Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Create an amortization schedule for a $649,600 mortgage being paid back in end of month payments, amortized over 25 years with interest at

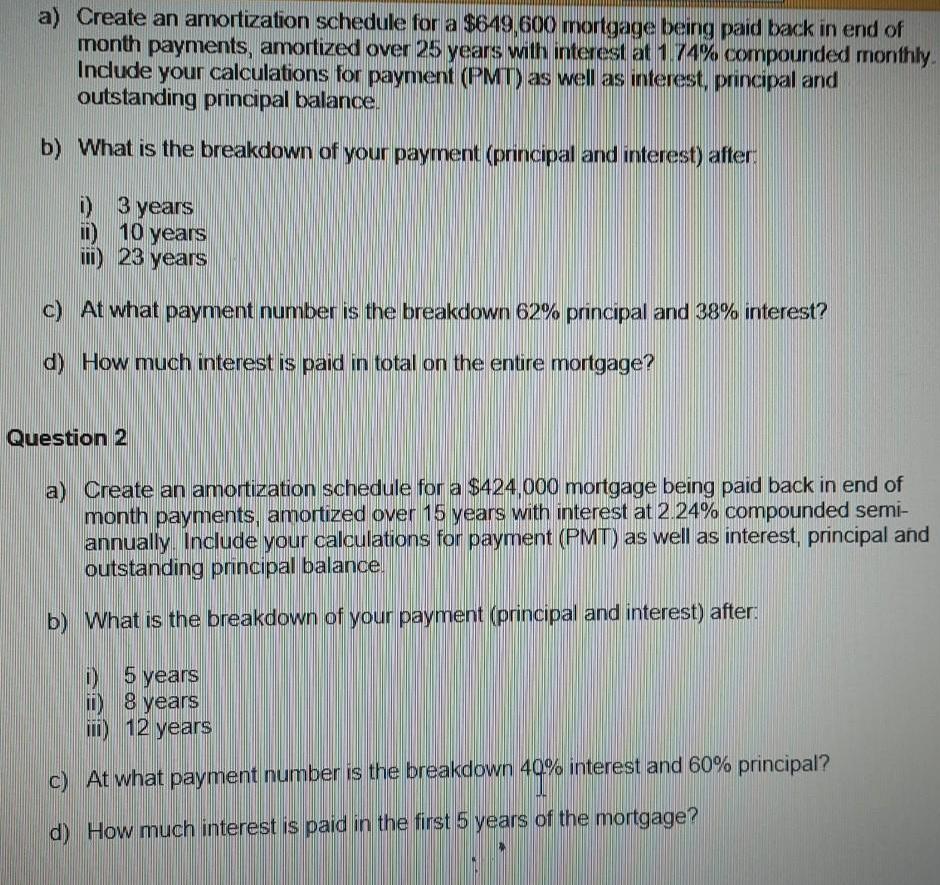

a) Create an amortization schedule for a $649,600 mortgage being paid back in end of month payments, amortized over 25 years with interest at 1.74% compounded monthly. Include your calculations for payment (PMT) as well as interest, principal and outstanding principal balance. b) What is the breakdown of your payment (principal and interest) after: i) 3 years ii) 10 years iII) 23 years c) At what payment number is the breakdown 62% principal and 38% interest? d) How much interest is paid in total on the entire mortgage? Question 2 a) Create an amortization schedule for a $424,000 mortgage being paid back in end of month payments, amortized over 15 years with interest at 2.24% compounded semi- annually. Include your calculations for payment (PMT) as well as interest, principal and outstanding principal balance. b) What is the breakdown of your payment (principal and interest) after: ) 5 years i) 8 years m) 12 years c) At what payment number is the breakdown 40% interest and 60% principal? d) How much interest is paid in the first 5 years of the mortgage?

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

20 Question 1 a Mortgage is 649600 Monitly Time is 25 Yrs Rate is 17460 69600x 12 month...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started