Freeline Limited, a South African-based brick manufacturing company, intends to expand its output capacity in order to meet the expected increase in demand from

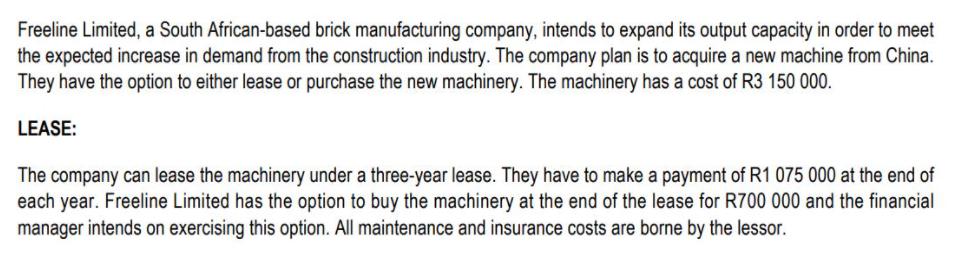

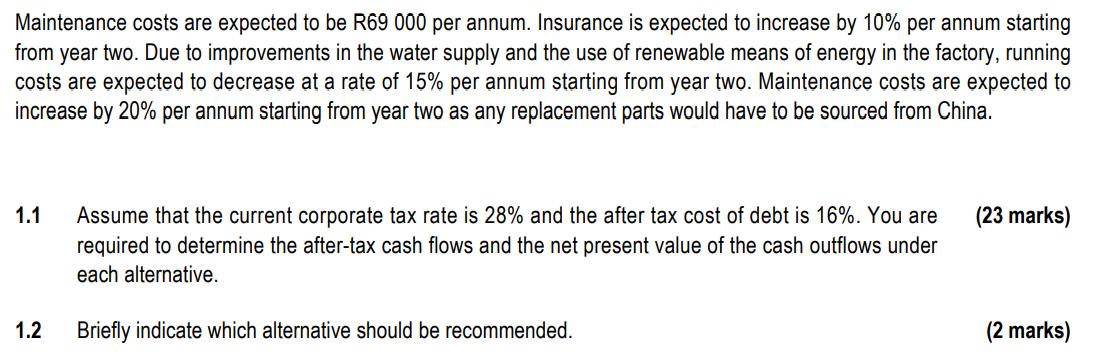

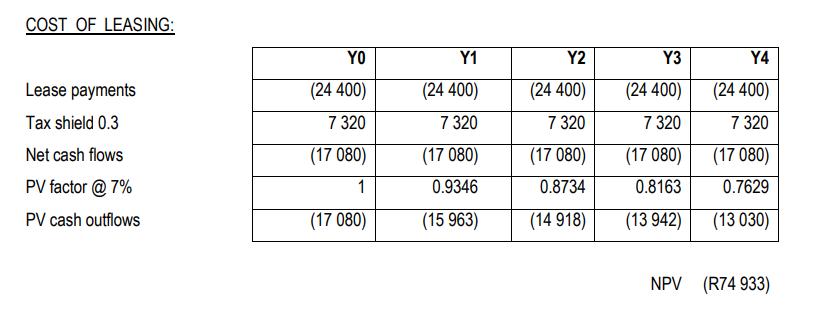

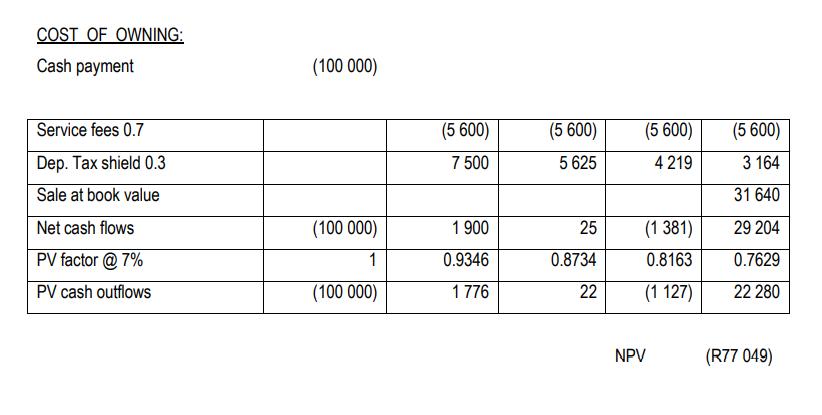

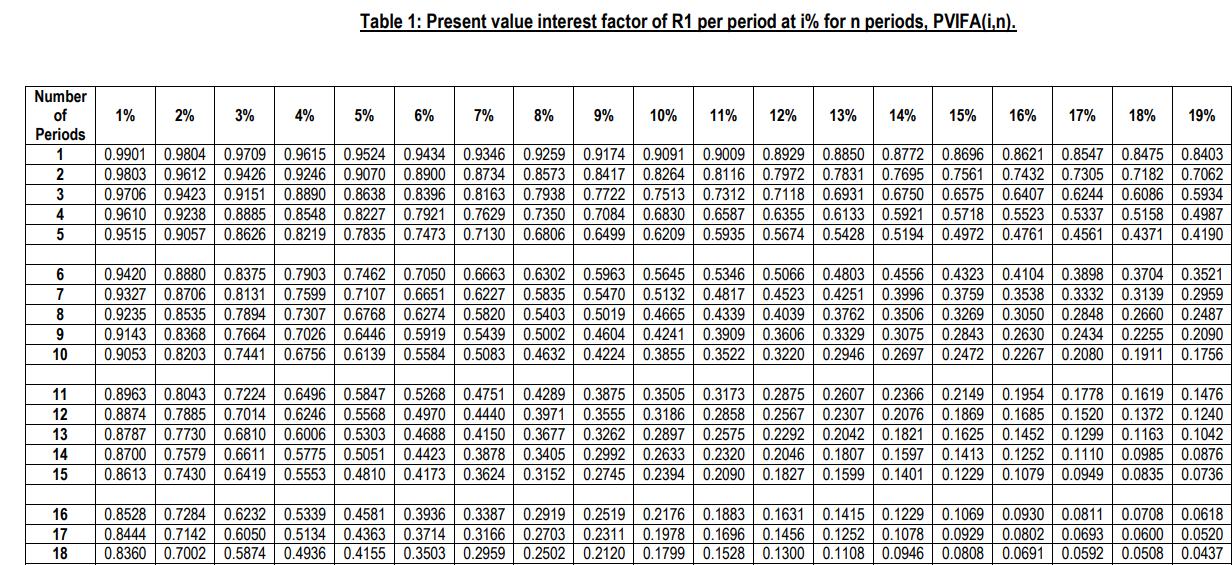

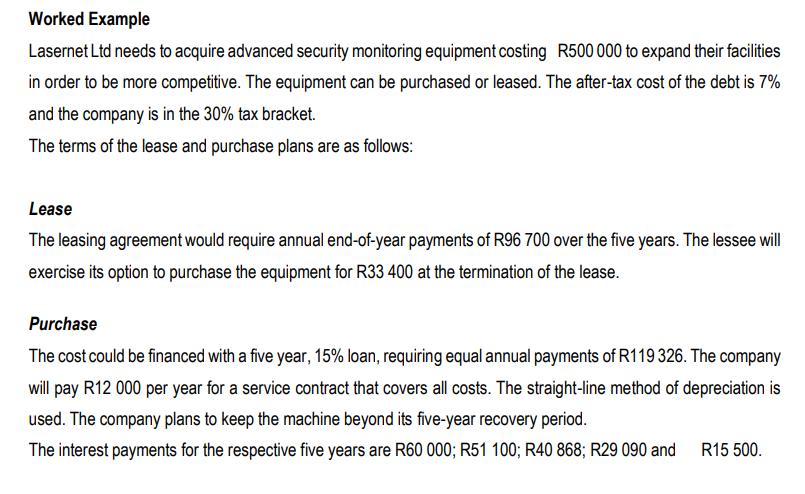

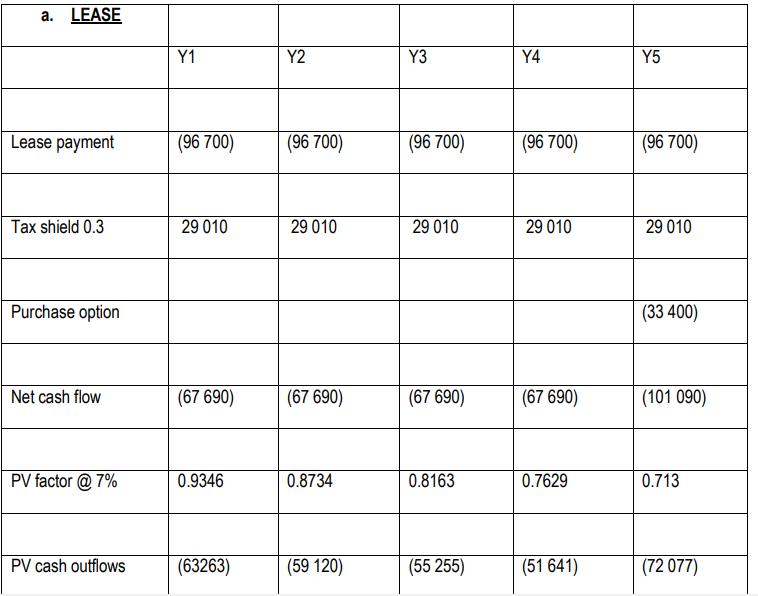

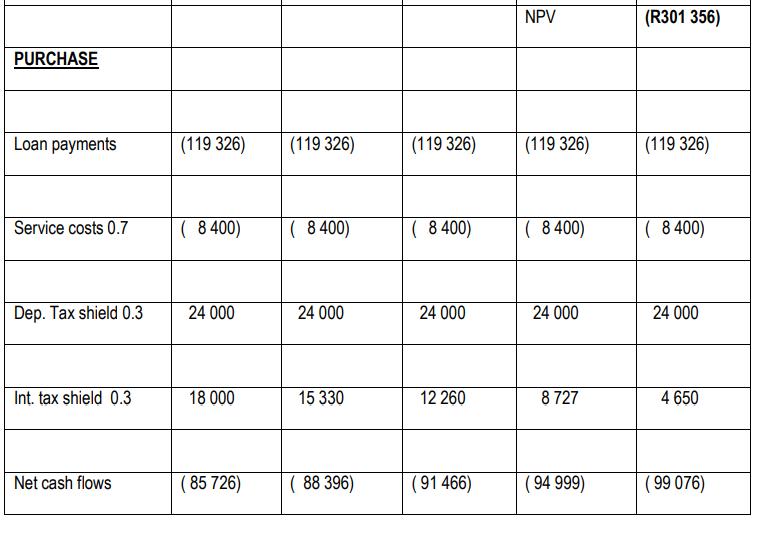

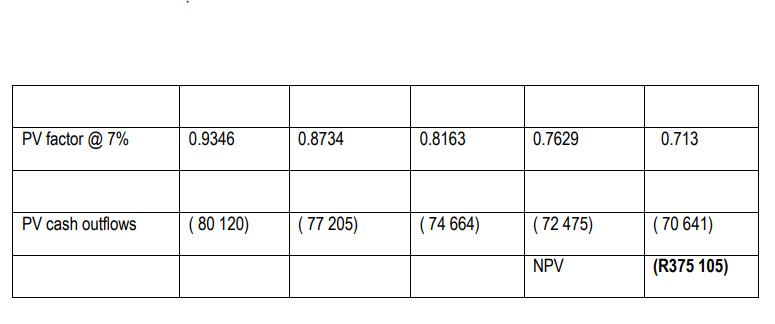

Freeline Limited, a South African-based brick manufacturing company, intends to expand its output capacity in order to meet the expected increase in demand from the construction industry. The company plan is to acquire a new machine from China. They have the option to either lease or purchase the new machinery. The machinery has a cost of R3 150 000. LEASE: The company can lease the machinery under a three-year lease. They have to make a payment of R1 075 000 at the end of each year. Freeline Limited has the option to buy the machinery at the end of the lease for R700 000 and the financial manager intends on exercising this option. All maintenance and insurance costs are borne by the lessor. Maintenance costs are expected to be R69 000 per annum. Insurance is expected to increase by 10% per annum starting from year two. Due to improvements in the water supply and the use of renewable means of energy in the factory, running costs are expected to decrease at a rate of 15% per annum starting from year two. Maintenance costs are expected to increase by 20% per annum starting from year two as any replacement parts would have to be sourced from China. 1.1 (23 marks) Assume that the current corporate tax rate is 28% and the after tax cost of debt is 16%. You are required to determine the after-tax cash flows and the net present value of the cash outflows under each alternative. 1.2 Briefly indicate which alternative should be recommended. (2 marks) COST OF LEASING: YO Y1 Y2 Y3 Y4 Lease payments (24 400) (24 400) (24 400) (24 400) (24 400) Tax shield 0.3 7 320 7 320 7 320 7 320 7 320 Net cash flows (17 080) (17 080) (17 080) (17 080) (17 080) PV factor @ 7% 1 0.9346 0.8734 0.8163 0.7629 PV cash outflows (17 080) (15 963) (14 918) (13 942) (13 030) NPV (R74 933) COST OF OWNING: Cash payment (100 000) Service fees 0.7 (5 600) (5 600) (5 600) (5 600) Dep. Tax shield 0.3 7 500 5 625 4 219 3 164 Sale at book value 31 640 Net cash flows (100 000) 1 900 25 (1 381) 29 204 PV factor @ 7% 1 0.9346 0.8734 0.8163 0.7629 PV cash outflows (100 000) 1776 22 (1 127) 22 280 NPV (R77 049) Table 1: Present value interest factor of R1 per period at i% forn periods, PVIFA(i.n). Number of 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% Periods 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8573 0.8417 0.8264 0.8116 0.7722 0.7513 0.7312 0.6830 0.6587 0.8929 0.8850 0.8772 0.8696 0.8621 0.7972 0.7831 0.7695 0.7561 0.6931 0.8547 0.8475 0.8403 0.7432 0.7305 0.7182 0.7062 0.6575 0.6407 0.6244 0.6086 0.5934 0.5718 0.5523 | 0.5337 0.5158 0.4987 0.4561 0.4371 0.4190 1 0.9803 0.9612 0.9706 0.9423 0.9151 0.9426 0.9246 0.9070 0.8900 0.8890 0.8638 0.8396 0.9610 | 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.8626 0.8219 0.7835 0.7473 0.7130 2 0.8734 0.6750 0.6355 0.6133 0.5921 3 0.8163 0.7938 0.7118 4 0.9515 0.9057 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.4972 0.4761 0.9420 | 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.9327 0.8706 | 0.8131 0.5963 0.5645 0.5346 0.5132 0.4817 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3269 0.3050 0.2848 0.2660 0.2487 0.4803 0.4556 0.4323 0.4104 0.3898 0.3704 0.3521 0.3759 0.3538 0.3332 0.3139 0.2959 6 0.6302 0.5066 7 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.4523 0.4251 0.3996 8 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.9053 0.8203 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 0.2843 0.2630 0.2434 0.2255 0.2090 0.3522 0.3220 0.2946 | 0.2697 9 10 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.2472 0.2267 0.2080 0.1911 0.1756 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.8874 0.7885 0.8787 0.7730 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 0.2046 | 0.1807 0.1597 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1229 0.1079 0.0949 0.0835 0.0736 0.3505 0.3173 0.2875 0.2607 0.2366 0.2149 0.1954 0.1778 0.1619 0.1476 0.4289 0.3971 0.3555 0.3186| 0.2858 0.2567 0.2307 0.2076 0.1869 0.1685 0.1520 0.1372 0.1240 0.3677 0.3262 0.2897 0.2575 0.2292 11 0.4751 0.3875 0.7014 0.6246 0.5568 0.4970 0.4440 0.6810 | 0.6006 0.5303 0.4688 12 0.2042 0.1821 0.1625 0.1452 0.1299 0.1163 0.1413 0.1252 0.1110 0.0985 0.0876 13 0.4150 0.1042 14 15 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.0811 0.0708 0.0618 0.8528 0.7284 0.6232 0.5339 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.0693 0.0600 0.0520 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0808 0.0691 0.0592 0.0508 0.0437 16 17 18 Worked Example Lasernet Ltd needs to acquire advanced security monitoring equipment costing R500 000 to expand their facilities in order to be more competitive. The equipment can be purchased or leased. The after-tax cost of the debt is 7% and the company is in the 30% tax bracket. The terms of the lease and purchase plans are as follows: Lease The leasing agreement would require annual end-of-year payments of R96 700 over the five years. The lessee will exercise its option to purchase the equipment for R33 400 at the termination of the lease. Purchase The cost could be financed with a five year, 15% loan, requiring equal annual payments of R119 326. The company will pay R12 000 per year for a service contract that covers all costs. The straight-line method of depreciation is used. The company plans to keep the machine beyond its five-year recovery period. The interest payments for the respective five years are R60 000; R51 100; R40 868; R29 090 and R15 500. a. LEASE Y1 Y2 Y3 Y4 Y5 Lease payment (96 700) (96 700) (96 700) (96 700) (96 700) Tax shield 0.3 29 010 29 010 29 010 29 010 29 010 Purchase option (33 400) Net cash flow (67 690) (67 690) (67 690) (67 690) (101 090) PV factor @ 7% 0.9346 0.8734 0.8163 0.7629 0.713 PV cash outflows (63263) (59 120) (55 255) (51 641) (72 077) NPV (R301 356) PURCHASE Loan payments (119 326) (119 326) (119 326) (119 326) (119 326) Service costs 0.7 ( 8400) ( 8400) ( 8 400) ( 8400) ( 8400) Dep. Tax shield 0.3 24 000 24 000 24 000 24 000 24 000 Int. tax shield 0.3 18 000 15 330 12 260 8 727 4 650 Net cash flows ( 85 726) ( 88 396) (91 466) ( 94 999) (99 076) PV factor @ 7% 0.9346 0.8734 0.8163 0.7629 0.713 PV cash outflows ( 80 120) ( 77 205) ( 74 664) ( 72 475) ( 70 641) NPV (R375 105)

Step by Step Solution

3.58 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer The company shall choose the LEASE alternative as the cost of leasing it at their present value is only 218689338 compared to the cost of purchase which is 25228543 The company can save33596092 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started