Question

Major Manufacturing has four manufacturing departments: extrusion, press, welding, and forging. Work in each department is finished at the fiscal year end for extensive cleaning

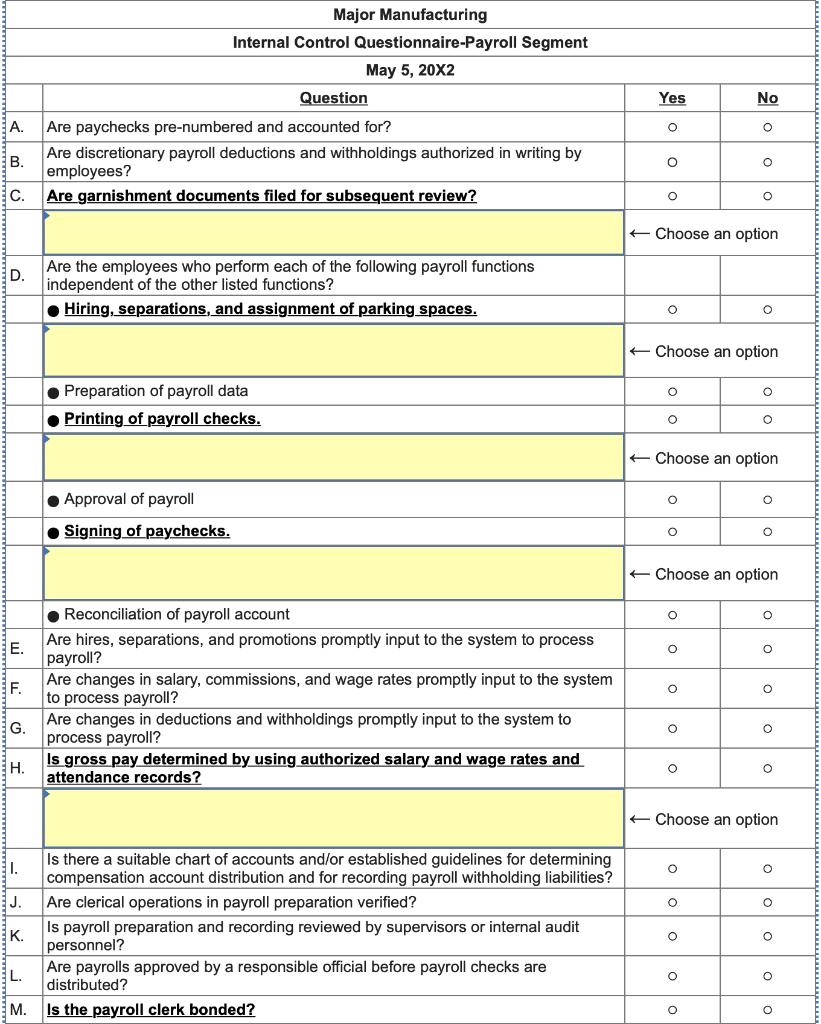

Major Manufacturing has four manufacturing departments: extrusion, press, welding, and forging. Work in each department is finished at the fiscal year end for extensive cleaning and repairs, so there is no work in process inventory at the fiscal year end. Materials move through only one manufacturing department. The year under audit is 20X2. This is the second year that Major has engaged Cutt, Paste & Semele, CPAs, to perform the annual audit of its financial statements. Major uses an in-house payroll department at its corporate headquarters to compute payroll data, and to prepare and distribute payroll checks to its 517 employees. Payroll for salaried, commissioned, and hourly employees is processed bi-weekly. Rates and working conditions for manufacturing hourly employees are negotiated during the union contract negotiations when renewing contracts, typically annually. Other employees typically have rate changes 90 days after their hire date and then once annually on June 30. The controller, Bob Clough, indicates that nothing has changed in payroll processing since the previous year's audit. Based on documentation from the previous year's audit, an intern, Irene Inverness, has prepared a draft of the payroll segment of an internal control questionnaire to assist in obtaining an understanding of Major's internal control and in assessing risk of material misstatement. Other segments of the questionnaire will address questions relating to cash payrolls, computer applications, employee benefits (pensions, health care, vacations, etc.), and payroll tax accruals other than withholding. Amend the questionnaire that Irene has drafted, as appropriate. To revise the document, navigate to the instances of underlined text below and click the dropdown immediately below it to select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original text]. If none of the statements are appropriate in the context of the document, select [Delete text].

Major Manufacturing Internal Control Questionnaire-Payroll Segment May 5, 20X2 Question Yes No A. Are paychecks pre-numbered and accounted for? B. Are discretionary payroll deductions and withholdings authorized in writing by employees? C. Are garnishment documents filed for subsequent review? Choose an option D. Are the employees who perform each of the following payroll functions independent of the other listed functions? Hiring, separations, and assignment of parking spaces. Preparation of payroll data Printing of payroll checks. Approval of payroll Signing of paychecks. Choose an option Choose an option Choose an option Reconciliation of payroll account E. Are hires, separations, and promotions promptly input to the system to process payroll? F. Are changes in salary, commissions, and wage rates promptly input to the system to process payroll? G. Are changes in deductions and withholdings promptly input to the system to process payroll? H. Is gross pay determined by using authorized salary and wage rates and attendance records? Choose an option I. J. Is there a suitable chart of accounts and/or established guidelines for determining compensation account distribution and for recording payroll withholding liabilities? Are clerical operations in payroll preparation verified? K. Is payroll preparation and recording reviewed by supervisors or internal audit personnel? L. Are payrolls approved by a responsible official before payroll checks are distributed? M. Is the payroll clerk bonded? 00 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems youve shared an internal control questionnaire and related information from an audit document To proceed with reviewing and amending the ques...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started