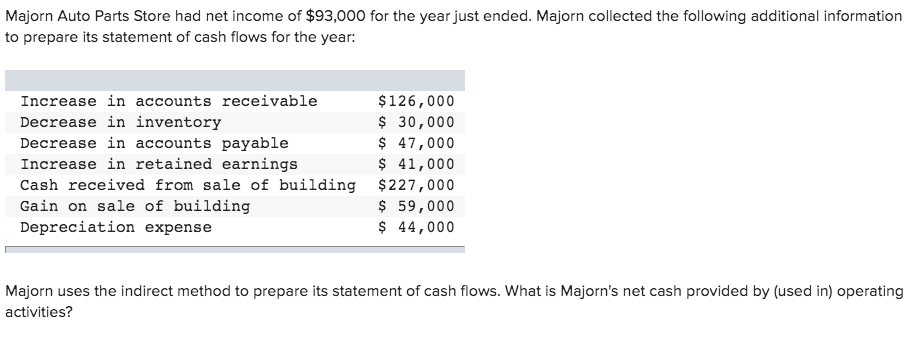

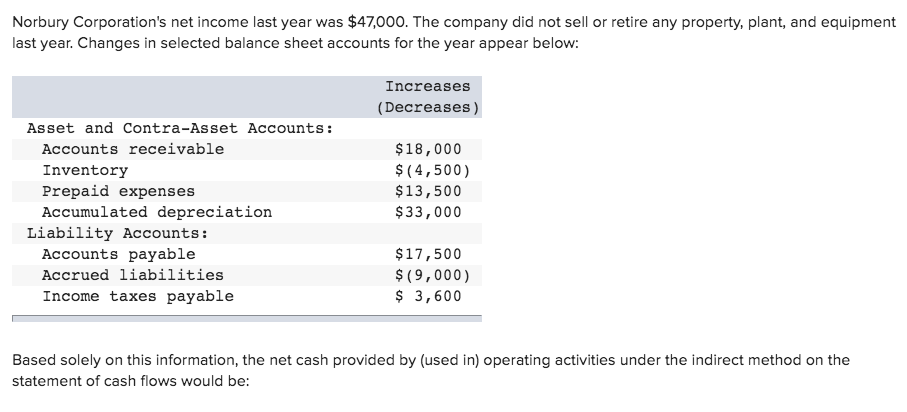

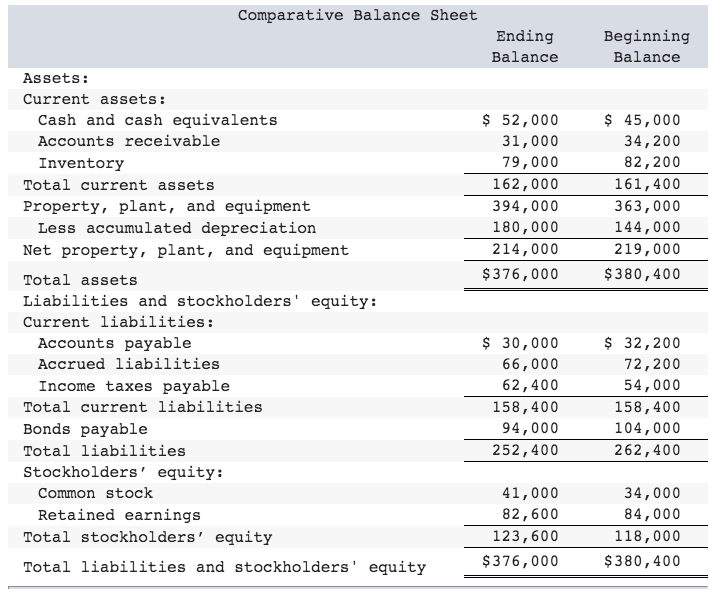

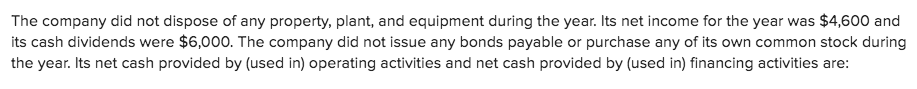

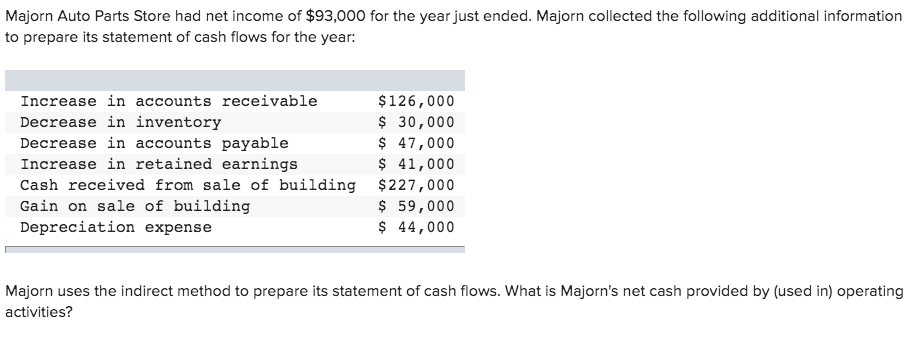

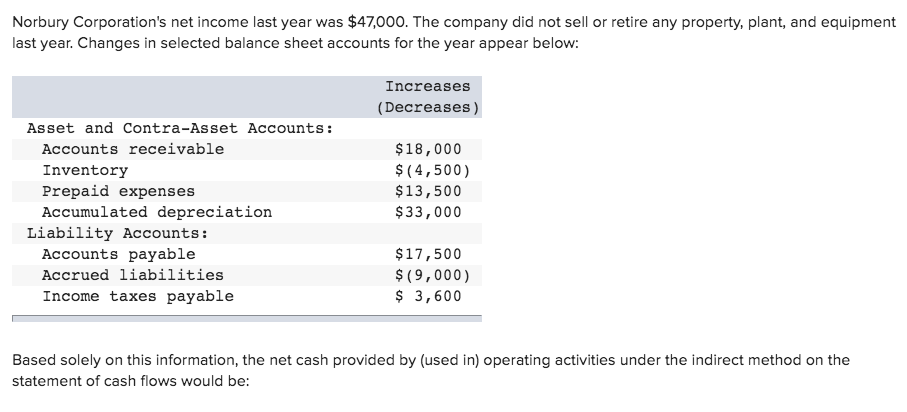

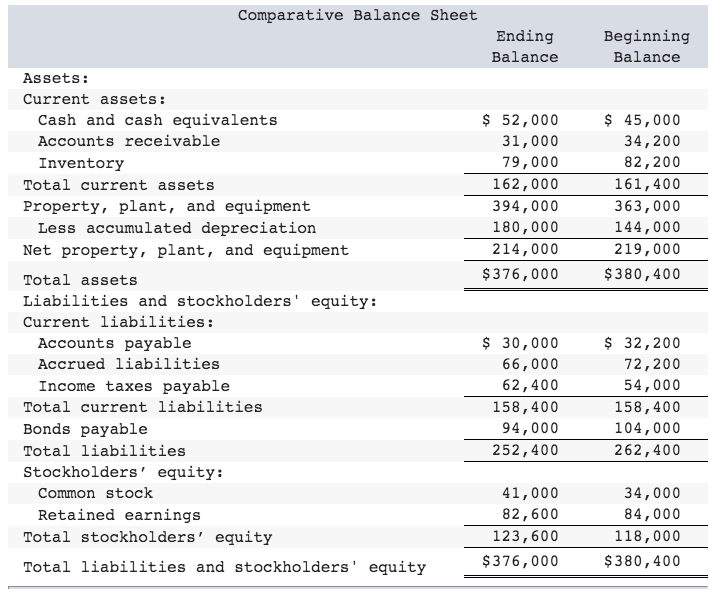

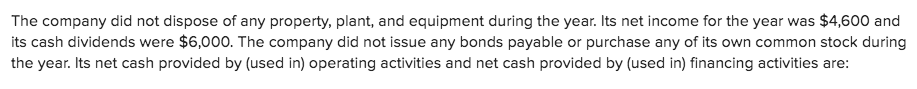

Majorn Auto Parts Store had net income of $93,000 for the year just ended. Majorn collected the following additional information to prepare its statement of cash flows for the year: Increase in accounts receivable Decrease in inventory Decrease in accounts payable Increase in retained earnings Cash received from sale of building Gain on sale of building Depreciation expense $ 126,000 $ 30,000 $ 47,000 $ 41,000 $227,000 $ 59,000 $ 44,000 Majorn uses the indirect method to prepare its statement of cash flows. What is Majorn's net cash provided by (used in) operating activities? Norbury Corporation's net income last year was $47,000. The company did not sell or retire any property, plant, and equipment last year. Changes in selected balance sheet accounts for the year appear below: Increases (Decreases) Asset and Contra-Asset Accounts: Accounts receivable Inventory Prepaid expenses Accumulated depreciation Liability Accounts: Accounts payable Accrued liabilities Income taxes payable $18,000 $(4,500) $13,500 $33,000 $ 17,500 $(9,000) $ 3,600 Based solely on this information, the net cash provided by (used in) operating activities under the indirect method on the statement of cash flows would be: Comparative Balance Sheet Ending Balance Beginning Balance $ 52,000 31,000 79,000 162,000 394,000 180,000 214,000 $376,000 $ 45,000 34,200 82,200 161,400 363,000 144,000 219,000 $380,400 Assets: Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and stockholders' equity: Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 30,000 66,000 62,400 158,400 94,000 252,400 $ 32,200 72,200 54,000 158,400 104,000 262,400 41,000 82,600 123,600 $376,000 34,000 84,000 118,000 $380,400 The company did not dispose of any property, plant, and equipment during the year. Its net income for the year was $4,600 and its cash dividends were $6,000. The company did not issue any bonds payable or purchase any of its own common stock during the year. Its net cash provided by (used in) operating activities and net cash provided by (used in) financing activities are