Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sea Horse Boats, Inc. Sea Horse is in the business of selling and servicing new and used pleasure boats. The business began on January 1

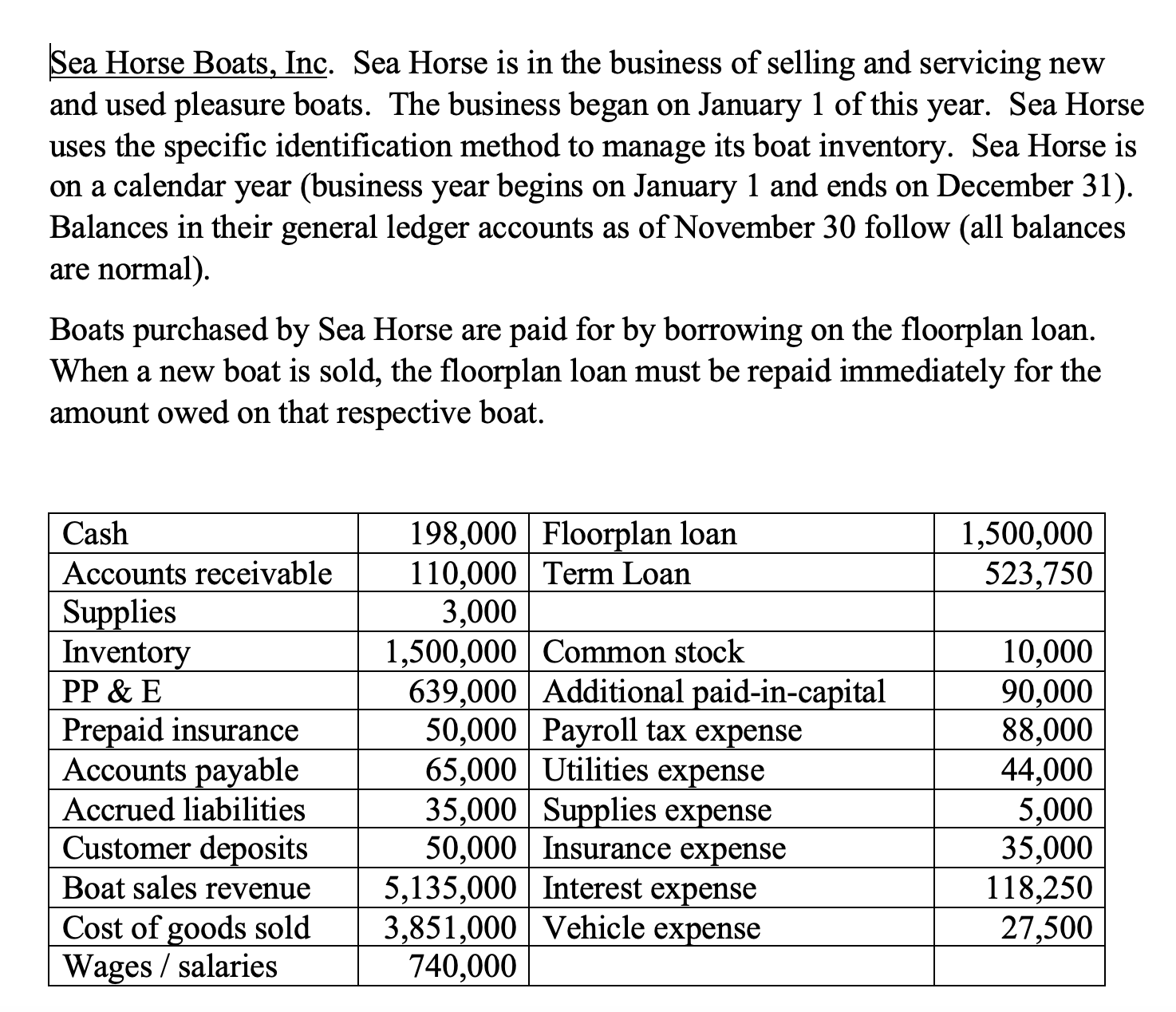

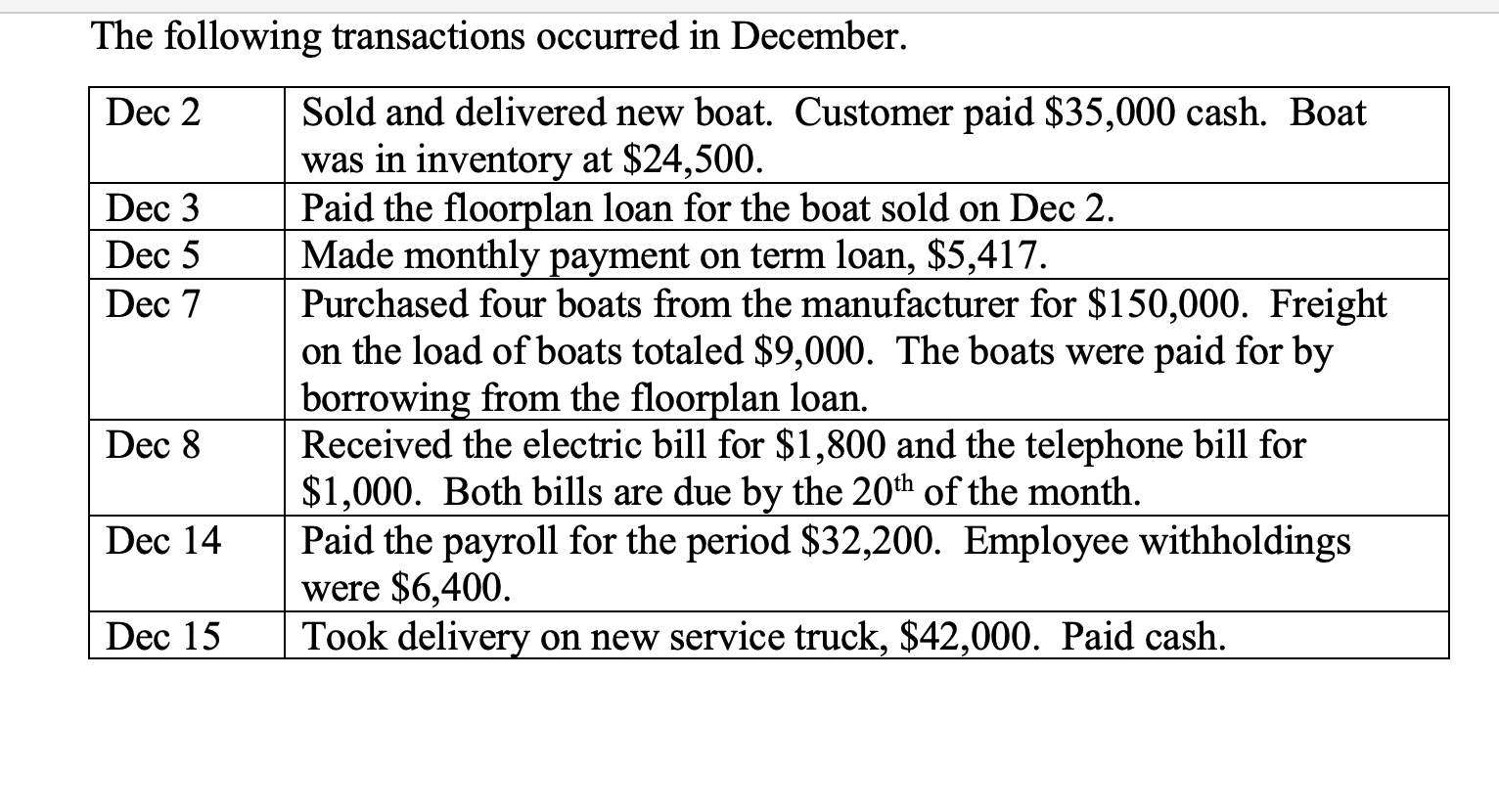

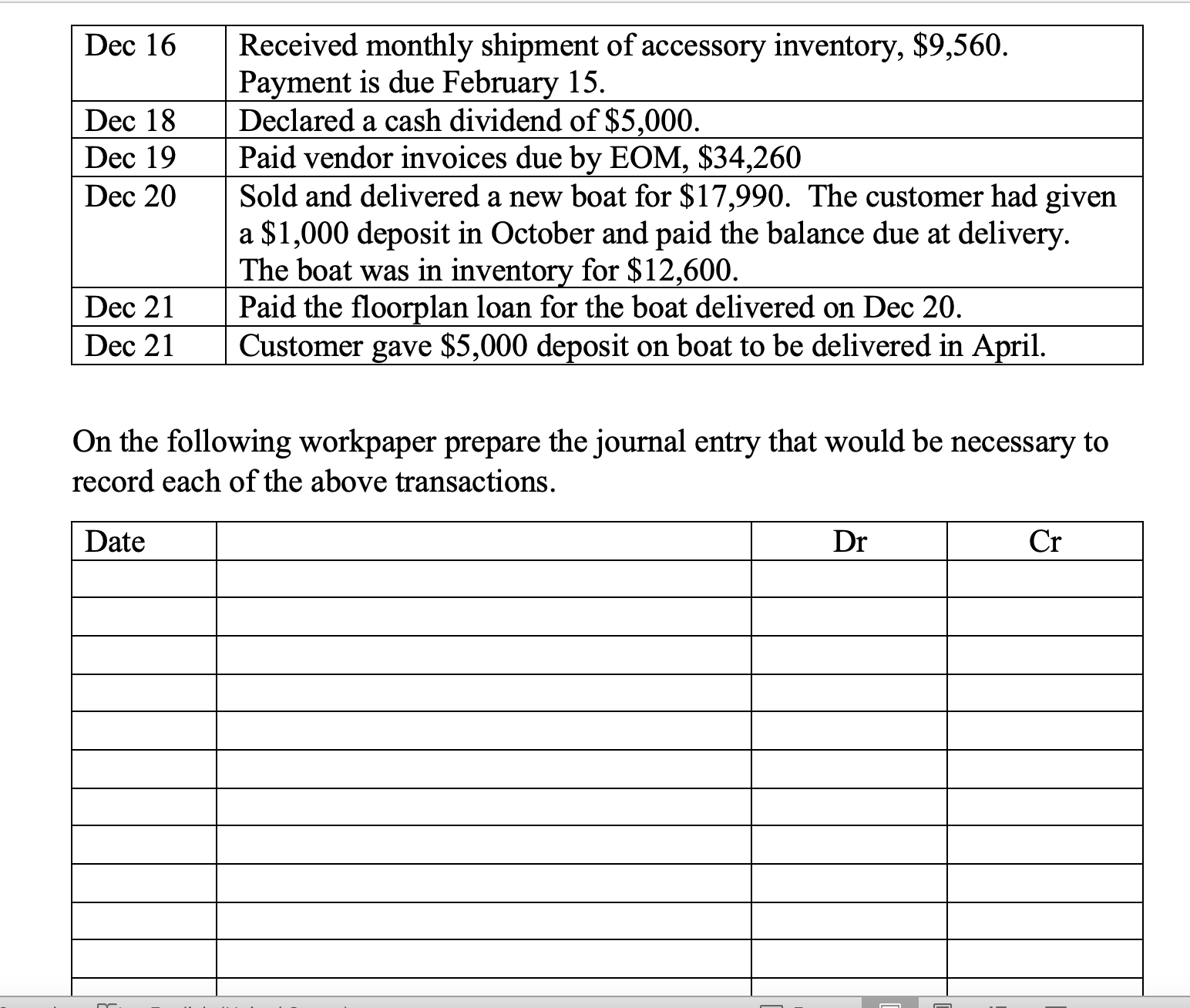

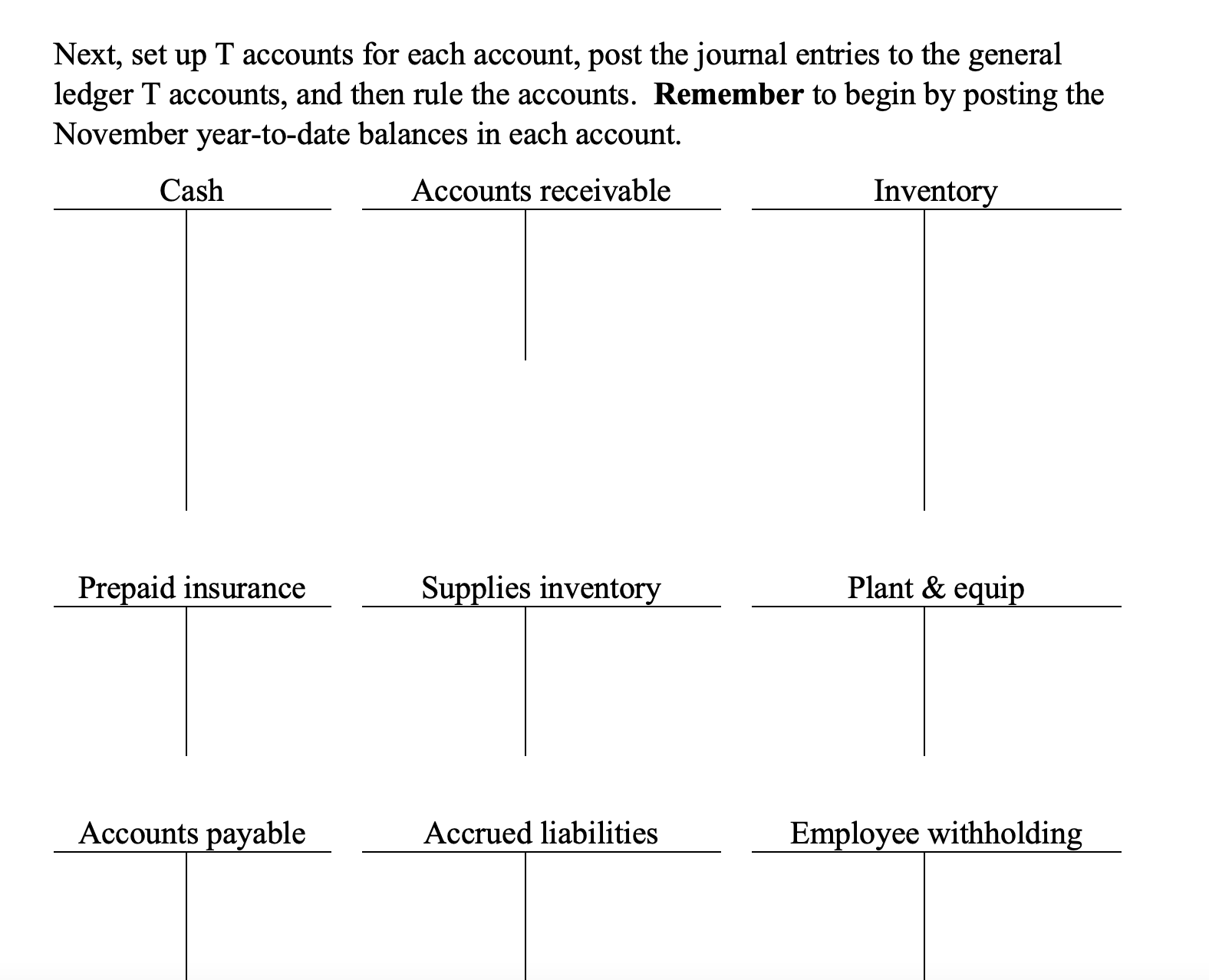

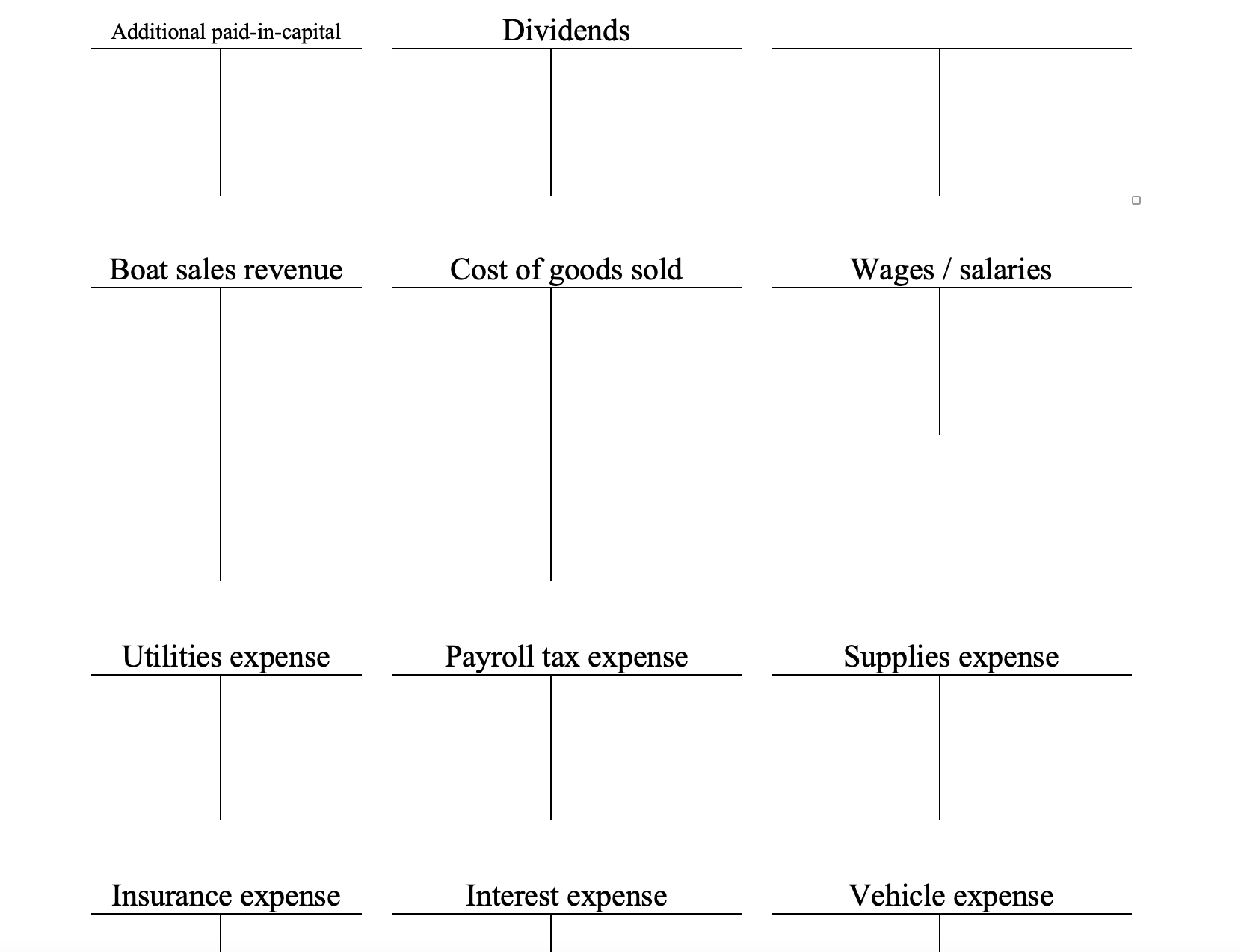

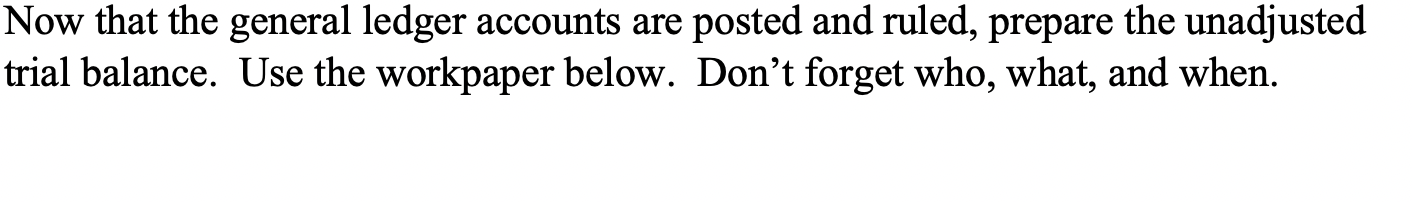

Sea Horse Boats, Inc. Sea Horse is in the business of selling and servicing new and used pleasure boats. The business began on January 1 of this year. Sea Horse uses the specific identification method to manage its boat inventory. Sea Horse is on a calendar year (business year begins on January 1 and ends on December 31). Balances in their general ledger accounts as of November 30 follow (all balances are normal). Boats purchased by Sea Horse are paid for by borrowing on the floorplan loan. When a new boat is sold, the floorplan loan must be repaid immediately for the amount owed on that respective boat. The following transactions occurred in December. On the following workpaper prepare the journal entry that would be necessary to record each of the above transactions. Next, set up T accounts for each account, post the journal entries to the general ledger T accounts, and then rule the accounts. Remember to begin by posting the Additional paid-in-capital Dividends \begin{tabular}{c} Boat sales revenue \\ \hline \end{tabular} Utilities expense Cost of goods sold x Payroll tax expense Wages / salaries \begin{tabular}{l|l} \hline & \end{tabular} Insurance expense Interest expense Vehicle expense Now that the general ledger accounts are posted and ruled, prepare the unadjusted trial balance. Use the workpaper below. Don't forget who, what, and when. \begin{tabular}{|l|l|l|} \hline Cash & Dr & \\ \hline Accounts receivable & & \\ \hline Inventory & & \\ \hline Prepaid insurance & & \\ \hline Supplies inventory & & \\ \hline Plant \& equipment & & \\ \hline Accounts payable & & \\ \hline Accrued liabilities & & \\ \hline Employee withholding & & \\ \hline Term loan & & \\ \hline Customer deposits & & \\ \hline Dividend payable & & \\ \hline Floorplan loan & & \\ \hline Common stock & & \\ \hline Additional paid-in-capital & & \\ \hline Dividends & & \\ \hline Boat sales revenue & & \\ \hline Cost of goods sold & & \\ \hline Wages / salaries & & \\ \hline Utilities expense & & \\ \hline Payroll tax expense & & \\ \hline Supplies expense & & \\ \hline Insurance expense & & \\ \hline Interest expense & & \\ \hline Vehicle expense & & \\ \hline \end{tabular}

Sea Horse Boats, Inc. Sea Horse is in the business of selling and servicing new and used pleasure boats. The business began on January 1 of this year. Sea Horse uses the specific identification method to manage its boat inventory. Sea Horse is on a calendar year (business year begins on January 1 and ends on December 31). Balances in their general ledger accounts as of November 30 follow (all balances are normal). Boats purchased by Sea Horse are paid for by borrowing on the floorplan loan. When a new boat is sold, the floorplan loan must be repaid immediately for the amount owed on that respective boat. The following transactions occurred in December. On the following workpaper prepare the journal entry that would be necessary to record each of the above transactions. Next, set up T accounts for each account, post the journal entries to the general ledger T accounts, and then rule the accounts. Remember to begin by posting the Additional paid-in-capital Dividends \begin{tabular}{c} Boat sales revenue \\ \hline \end{tabular} Utilities expense Cost of goods sold x Payroll tax expense Wages / salaries \begin{tabular}{l|l} \hline & \end{tabular} Insurance expense Interest expense Vehicle expense Now that the general ledger accounts are posted and ruled, prepare the unadjusted trial balance. Use the workpaper below. Don't forget who, what, and when. \begin{tabular}{|l|l|l|} \hline Cash & Dr & \\ \hline Accounts receivable & & \\ \hline Inventory & & \\ \hline Prepaid insurance & & \\ \hline Supplies inventory & & \\ \hline Plant \& equipment & & \\ \hline Accounts payable & & \\ \hline Accrued liabilities & & \\ \hline Employee withholding & & \\ \hline Term loan & & \\ \hline Customer deposits & & \\ \hline Dividend payable & & \\ \hline Floorplan loan & & \\ \hline Common stock & & \\ \hline Additional paid-in-capital & & \\ \hline Dividends & & \\ \hline Boat sales revenue & & \\ \hline Cost of goods sold & & \\ \hline Wages / salaries & & \\ \hline Utilities expense & & \\ \hline Payroll tax expense & & \\ \hline Supplies expense & & \\ \hline Insurance expense & & \\ \hline Interest expense & & \\ \hline Vehicle expense & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started