Answered step by step

Verified Expert Solution

Question

1 Approved Answer

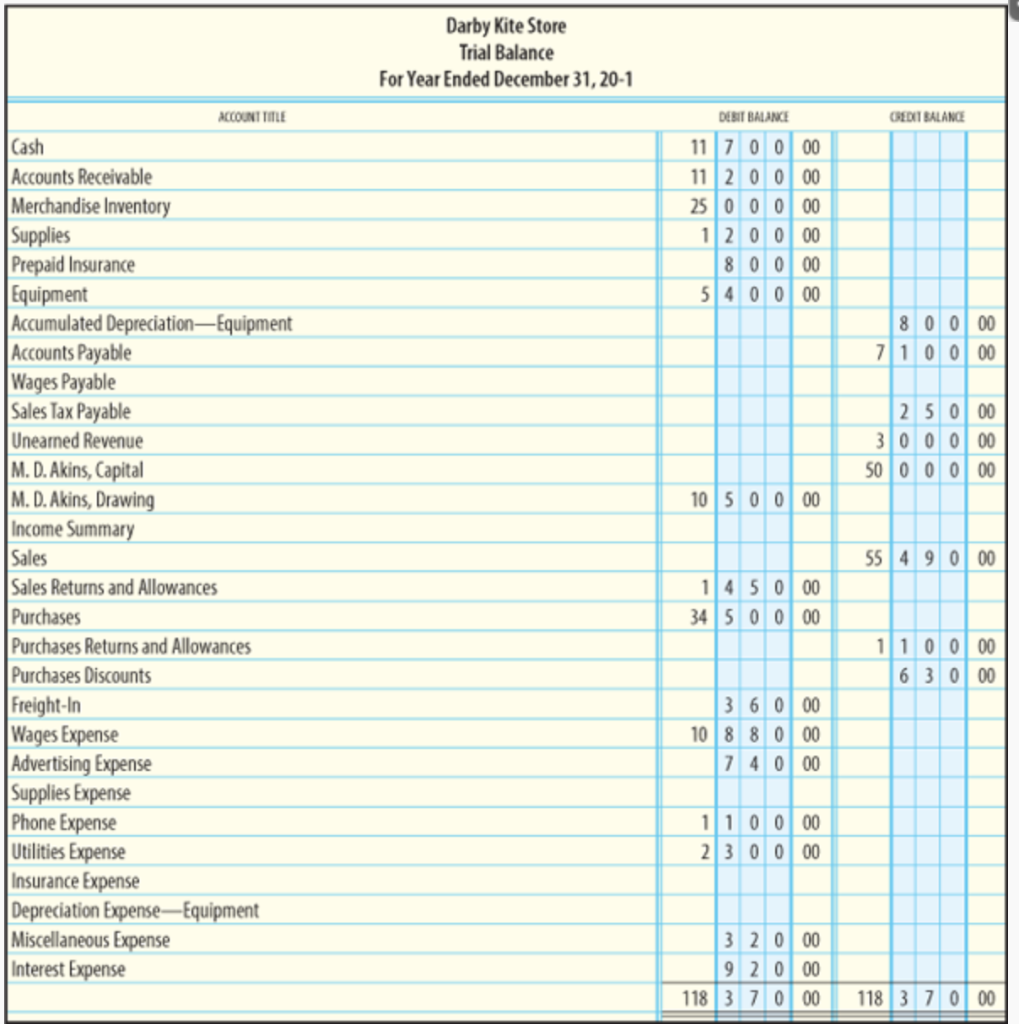

Make an income statement Darby Kite Store Trial Balance For Year Ended December 31,20-1 CCOUNT TITLE IT BALANCE REDIT BALANCE 11 7 0 0 00

Make an income statement

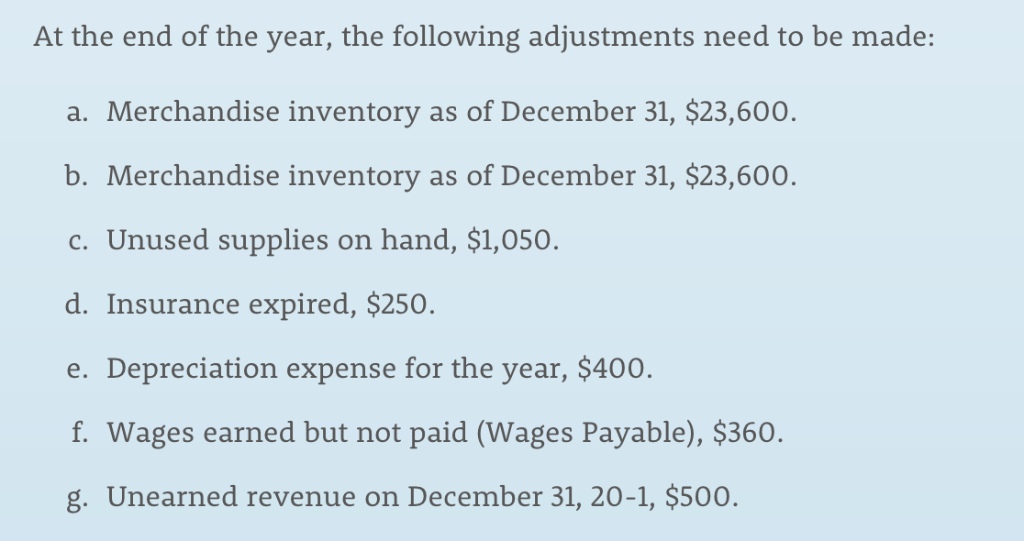

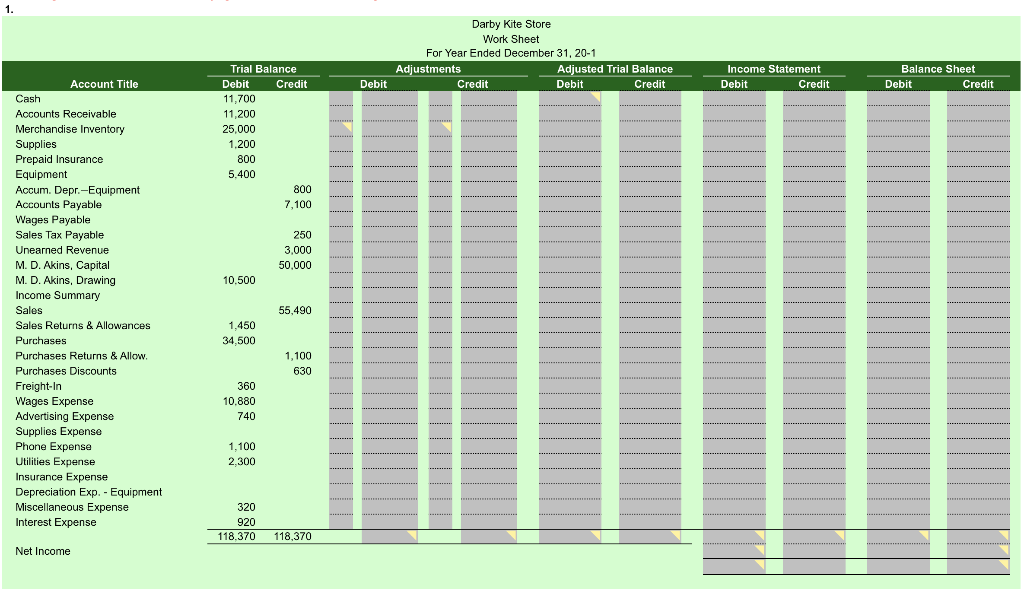

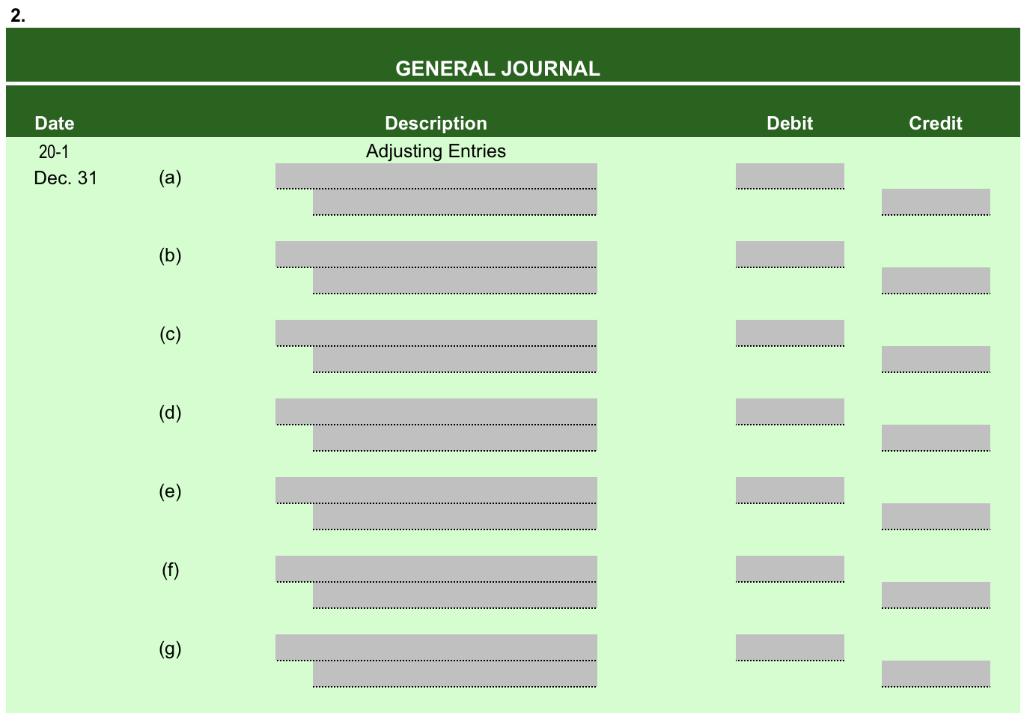

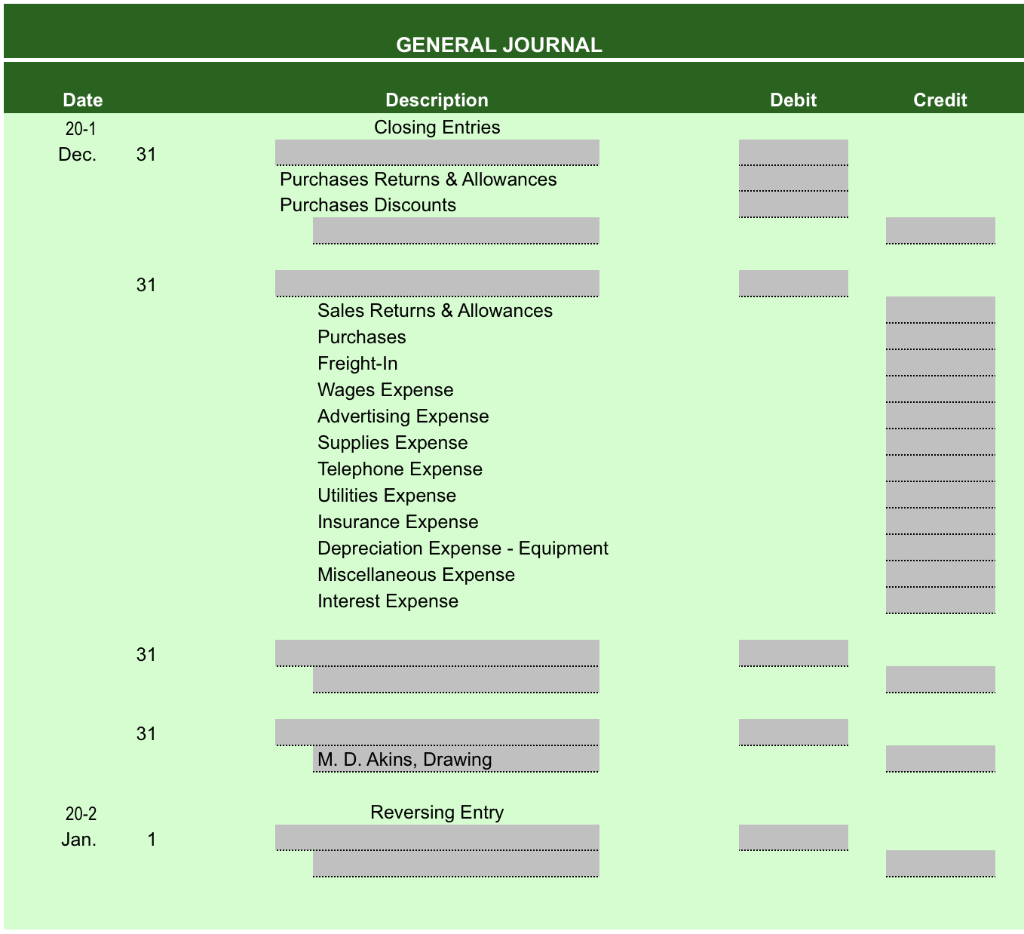

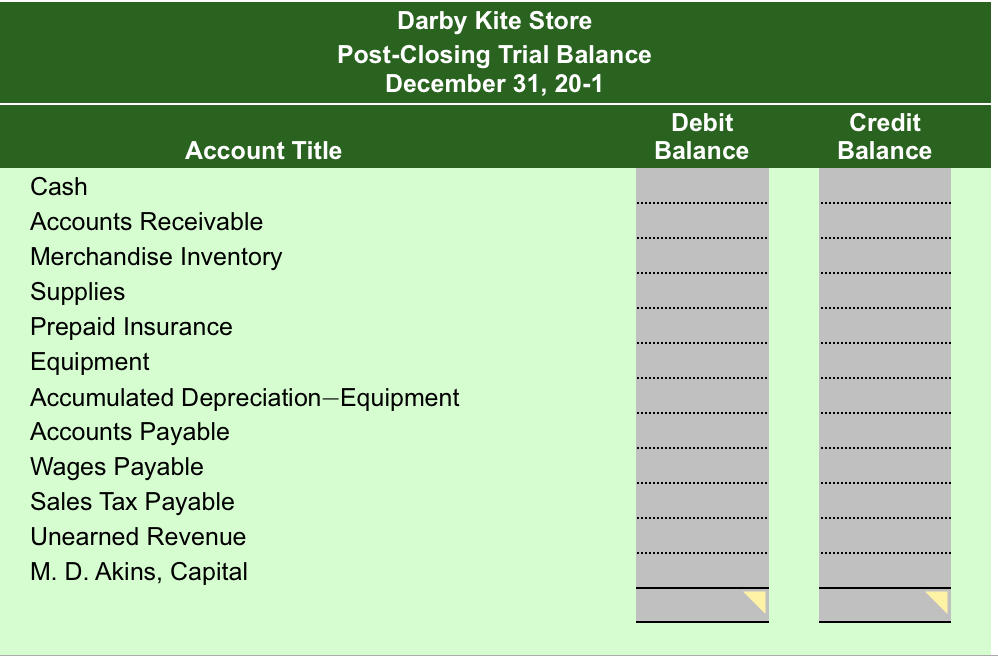

Darby Kite Store Trial Balance For Year Ended December 31,20-1 CCOUNT TITLE IT BALANCE REDIT BALANCE 11 7 0 0 00 11 2 0 0 00 25 0 0 000 12 0 0 0 800 00 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated DepreciationEquipment Accounts Payable Wages Payable Sales Tax Payable Unearned Revenue M.D. Akins, Capital M.D. Akins, Drawing Income Summar Sales Sales Returns and Allowances Purchases Purchases Returns and Allowance Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Phone Expense Utilities Expense nsurance Expense 80 000 7 1 0 000 25 0 00 50 0 0 0 00 0 5 00 00 5549 0 00 14 5 0 00 345 0 0 00 11 0 0 00 6 3 000 3 6 0 00 10 8 8 0 00 7 4 0 00 11 0 0 00 2 3 0 0 00 Equipment eciation Miscellaneous Expense Interest Expense 3 2 000 At the end of the year, the following adjustments need to be made: a. Merchandise inventory as of December 31, $23,600 b. Merchandise inventory as of December 31, $23,600 c. Unused supplies on hand, $1,050 d. Insurance expired, $250 e. Depreciation expense for the year, $400. f. Wages earned but not paid (Wages Payable), $360. g. Unearned revenue on December 31, 20-1, $500. Darby Kite Store Work Sheet For Year Ended December 31, 20-1 Trial Balance Debit Adjustments Adjusted Trial Balance Debit Income Statement Debit Balance Sheet Account Title Credit Debit Credit Credit Credit Debit Credit Cash 11,700 11,200 25,000 1.200 800 5.400 Merchandise Inventory Supplies Prepaid Insurance Equipment Accum. Depr.-Equipment Accounts Payable Wages Payable Sales Tax Payable Unearned Revenue M. D. Akins, Capital M. D. Akins, Drawing Income Summary Sales Sales Returns & Allowances Purchases Purchases Returns& Allow Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Phone Expense Utilities Expense Insurance Expense Depreciaion Exp.-Equipment Miscellaneous Expense Interest Expense 7,100 3,000 50,000 10.500 55,490 1.450 34,500 1,100 630 10.880 1.100 2,300 118.370 118,370 Net Income 2 GENERAL JOURNAL Date 20-1 Dec. 31 Debit Description Adjusting Entries Credit GENERAL JOURNAL Date 20-1 Dec Description Closing Entries Debit Credit 31 Purchases Returns& Allowances Purchases Discounts 31 Sales Returns &Allowances Purchases Freight-In Wages Expense Advertising Expense Supplies Expense Telephone Expense Utilities Expense Insurance Expense Depreciation Expense - Equipment Miscellaneous Expense Interest Expense 31 M. D. Akins, Drawing 20-2 Jan Reversing Entry Darby Kite Store Post-Closing Trial Balance December 31, 20-1 Debit Balance Credit Balance Account Title Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Wages Payable Sales Tax Payable Unearned Revenue M. D. Akins, CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started