Answered step by step

Verified Expert Solution

Question

1 Approved Answer

make sure are 1000 words, that what i am looking for. Thanks You are required to submit an Academic Report with word count of 1000

make sure are 1000 words, that what i am looking for. Thanks

You are required to submit an Academic Report with word count of 1000 words this should be accompanied by an appendix showing all workings external from word count. Use graphs tables or charts within the body of the report for reference.

so please let me know what you didn't understand to make it clear. i just need to solve all questions and then present the report which includes 1000 words. i need the report that's all thanks.

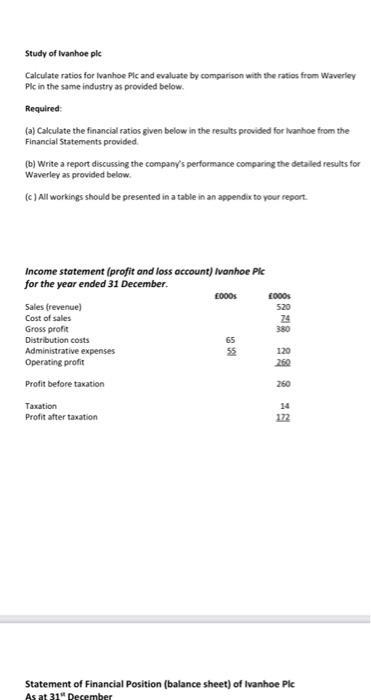

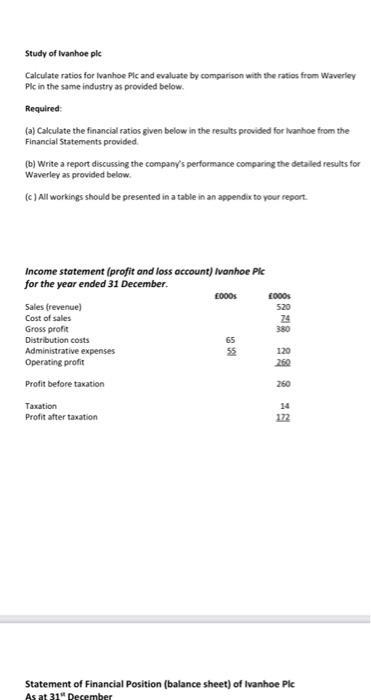

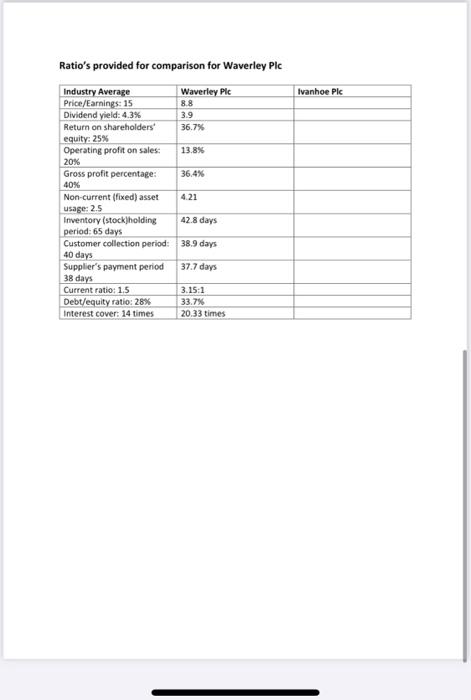

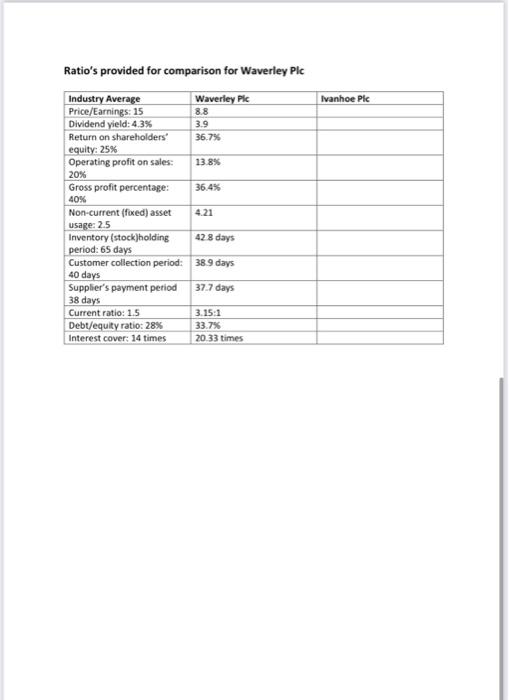

Study of Ivanhoe pl Calculate ratios for Ivanhoe Pic and evaluate by comparison with the ratios from Waverley Plc in the same industry as provided below. Required (a) Calculate the financial ratios given below in the results provided for Ivanhoe from the Financial Statements provided (b) Write a report discussing the company's performance comparing the detailed results for Waverley as provided below. (c) All workings should be presented in a table in an appendix to your report Income statement (profit and loss account) Ivanhoe pic for the year ended 31 December 2000 000 520 Sales frevenue) Cost of sales 24 380 Gross profit Distribution costs Administrative expenses Operating profit ss 120 250 Profit before taxation 260 14 Taxation Profit after taxation 172 Statement of Financial Position (balance sheet) of Ivanhoe Pic As at 31 Desember Ratio's provided for comparison for Waverley Pic Waverley Pic Ivanhoe Pic 8.8 3.9 36.7% Industry Average Price/Earnings: 15 Dividend yield: 4.3% Return on shareholders equity: 25% Operating profit on sales: 20% Gross profit percentage: 13.8% 36.4% 40% 4.21 Non-current (fixed) asset usage: 2.5 Inventory (stockholding 42.8 days period:65 days Customer collection period: 38.9 days 40 days Supplier's payment period 37.7 days 38 days Current ratio: 1.5 3.15:1 Debt/equity ratio: 28% 33.7% Interest cover: 14 times 20.33 times Ratio's provided for comparison for Waverley Plc Ivanhoe Pic Industry Average Waverley Pic Price/Earnings: 15 8.8 Dividend yield: 4.3% 3.9 Return on shareholders 36.7% equity: 25% Operating profit on sales: 13.8% 20% Gross profit percentage: 36.4% 40% Non-current (foxed) asset 4.21 usage: 25 Inventory (stock)holding 42 8 days period: 65 days Customer collection period: 38.9 days 40 days Supplier's payment period 37.7 days 38 days 3.15:1 Debt/equlty ratio: 28% 33.7% Interest cover: 14 times 20 33 times Current ratio: 1.5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started