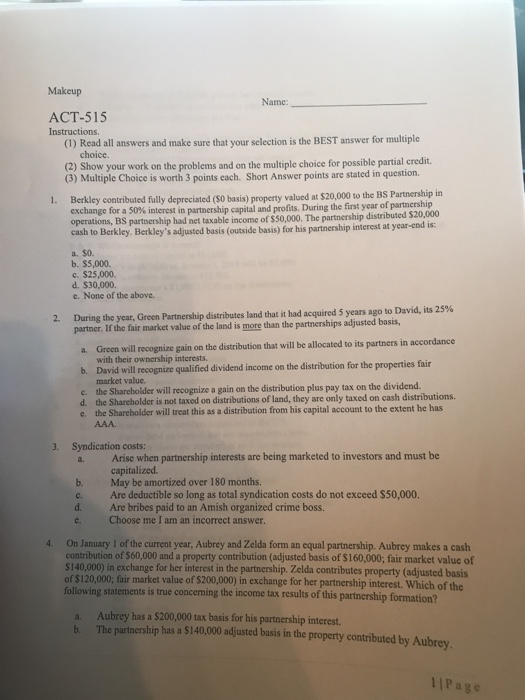

Makeup Name: ACT-515 Instructions. (1) Read all answers and make sure that your selection is the BEST answer for multiple choice. (2) Show your work on the problems and on the multiple choice for possible partial credit. (3) Multiple Choice is worth 3 points each. Short Answer points are stated in question contributed fully depreciated (S0 basis) property valued at $20,000 to the BS Partnership in for a 50% interest in partnership capital and profits. During the first year of partnership 1. Berkley exchange operations, Bs partnership had net taxable income of $$0,000. The partnership distributed $20,000 cash to Berkley. Berkley's adjusted basis (outside basis) for his partnership interest at year-end is: a. $0. b. $5,000. c. $25,000. d. $30,000. e. None of the above. During the year, Green Partnership distributes land that it had acquired 5 years ago to David, its 25% partner, If the fair market value of the land is more than the partnerships adjusted basis, 2. Green will recognize gain on the distribution that will be allocated with their ownership interests. Dav to its partners in accordance a. b. id will recognize qualified dividend income on the distribution for the properties fair market value. c. the Shareholder will recognize a gain on the distribution plus pay tax on the dividend. d. the Shareholder is not taxed on distributions of land, they are only taxed on cash distributions. e. the Shareholder will treat this as a distribution from his capital account to the extent he has 3. Syndication costs: Arise when partnership interests are being marketed to investors and must be capitalized a. b. May be amortized over 180 months Are deductible so long as total syndication costs do not exceed S50,000. Are bribes paid to an Amish organized crime boss. c. d. e. Choose me I am an incorrect answer 4 On January 1 of the current year, Aubrey and Zelda form an equal partnership. Aubrey makes a cash contribution of $60,000 and a property contribution (adjusted basis of $160,000; fair market value of $140,000) in exchange for her interest in the partnership. Zelda contributes property (adjusted basis of $120,000, fair market value of $200,000) in exchange for her partnership interest. Which of the following statements is true concerming the income tax results of this partnership formation? a. Aubrey has a $200,000 tax basis for his partnership interest. b. The partnership has a $140,000 adjusted basis in the property contributed by Aubrey 1IPage