Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Makoto Satou manages the Tanaka Global Fund, a Japan-based investment fund, which has USD900 million invested in the U.S. and EUR 700 million invested in

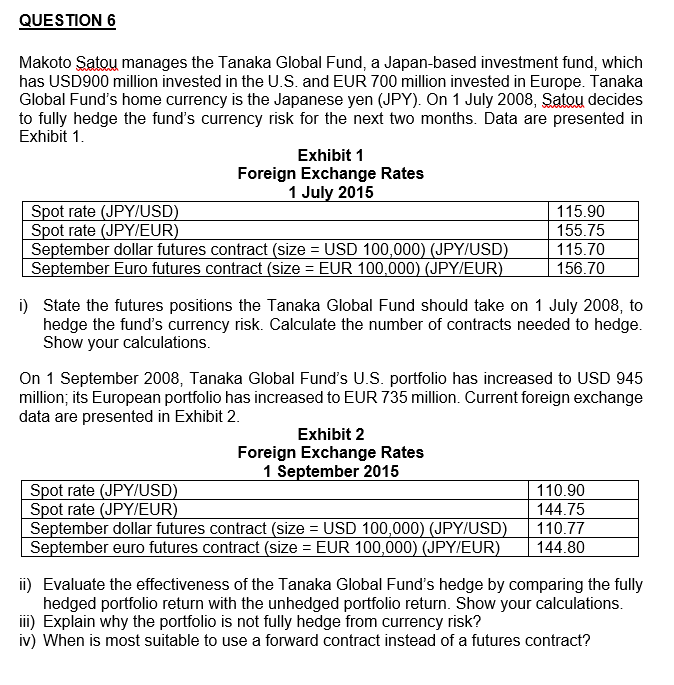

Makoto Satou manages the Tanaka Global Fund, a Japan-based investment fund, which has USD900 million invested in the U.S. and EUR 700 million invested in Europe. Tanaka Global Fund's home currency is the Japanese yen (JPY). On 1 July 2008, Satou decides to fully hedge the fund's currency risk for the next two months. Data are presented in Exhibit 1. Exhibit 1 Foreign Exchange Rates 1 liul 2nT i) State the futures positions the Tanaka Global Fund should take on 1 July 2008, to hedge the fund's currency risk. Calculate the number of contracts needed to hedge. Show your calculations. On 1 September 2008, Tanaka Global Fund's U.S. portfolio has increased to USD 945 million; its European portfolio has increased to EUR 735 million. Current foreign exchange data are presented in Exhibit 2. Exhibit 2 Foreign Exchange Rates 1 September 2015 ii) Evaluate the effectiveness of the Tanaka Global Fund's hedge by comparing the fully hedged portfolio return with the unhedged portfolio return. Show your calculations. iii) Explain why the portfolio is not fully hedge from currency risk? iv) When is most suitable to use a forward contract instead of a futures contract

Makoto Satou manages the Tanaka Global Fund, a Japan-based investment fund, which has USD900 million invested in the U.S. and EUR 700 million invested in Europe. Tanaka Global Fund's home currency is the Japanese yen (JPY). On 1 July 2008, Satou decides to fully hedge the fund's currency risk for the next two months. Data are presented in Exhibit 1. Exhibit 1 Foreign Exchange Rates 1 liul 2nT i) State the futures positions the Tanaka Global Fund should take on 1 July 2008, to hedge the fund's currency risk. Calculate the number of contracts needed to hedge. Show your calculations. On 1 September 2008, Tanaka Global Fund's U.S. portfolio has increased to USD 945 million; its European portfolio has increased to EUR 735 million. Current foreign exchange data are presented in Exhibit 2. Exhibit 2 Foreign Exchange Rates 1 September 2015 ii) Evaluate the effectiveness of the Tanaka Global Fund's hedge by comparing the fully hedged portfolio return with the unhedged portfolio return. Show your calculations. iii) Explain why the portfolio is not fully hedge from currency risk? iv) When is most suitable to use a forward contract instead of a futures contract Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started