Question

Mallory is very excited as she has just found the perfect condo! She feels confident that the bank will provide her with a mortgage as

Mallory is very excited as she has just found the perfect condo! She feels confident that the bank will provide her with a mortgage as she received a pre-approval certificate. Mallory has worked hard to get her credit score up (currently at 720). Mallory is ready to make an offer on the condo which is listed at $435,000. She has savings for a 10% down payment which she knows would require mortgage loan insurance. Mallory believes that she meets Canada Mortgage and Housing Corporation (CMHC) requirements to qualify for mortgage loan insurance:

a) Mallory has been having a rough time with the bank and is no longer sure as to what a pre- approval certificate means as they now need more information on her finances to run through some ratios. Explain to Mallory what a pre-approval certificate is.

b) Mallory is meeting with CIBC to discuss her potential mortgage with them and the ratios that they require. Mallory’s gross annual income is $118,000. The condo would result in monthly heating costs of $575, condo fees of $1,800 per year, while her annual municipal property and school taxes would be $4,730. Her only debt is a car loan of $865 per month. Calculate her Total Debt Service (TDS) ratio using a monthly mortgage payment of $2,600.

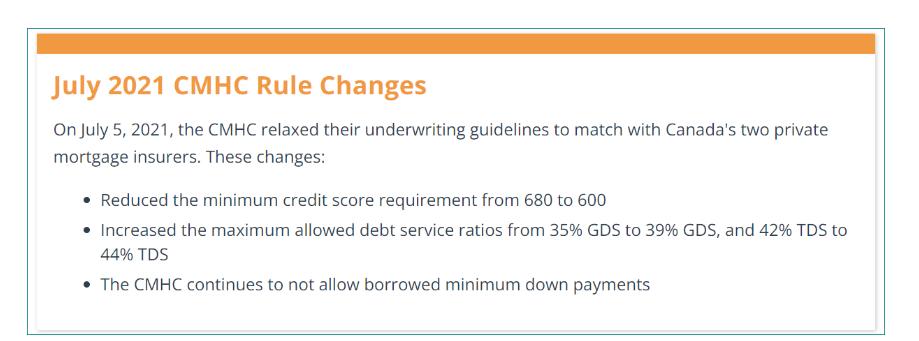

c) Does Mallory meet the TDS ratio requirement for CMHC default insurance based on their new underwriting guidelines from July 1, 2021? Yes or No

d) Calculate her Gross Debt Service (GDS) ratio.

e) Does Mallory meet the GDS ratio requirement for CMHC default insurance based on their new underwriting guidelines from July 1, 2021? Yes or No

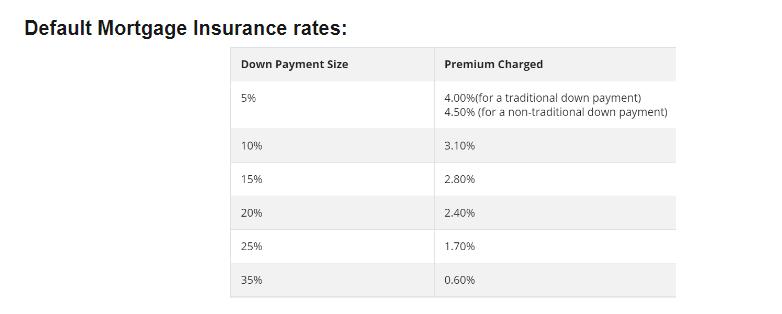

f) Calculate Mallory’s mortgage default insurance using the above table Default Mortgage Insurance rates.

Default Mortgage Insurance rates: Down Payment Size 5% Premium Charged 4.00% (for a traditional down payment) 4.50% (for a non-traditional down payment) 10% 3.10% 15% 2.80% 20% 2.40% 25% 1.70% 35% 0.60%

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to Mallorys questions a A preapproval certificate means that a lender has revie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started