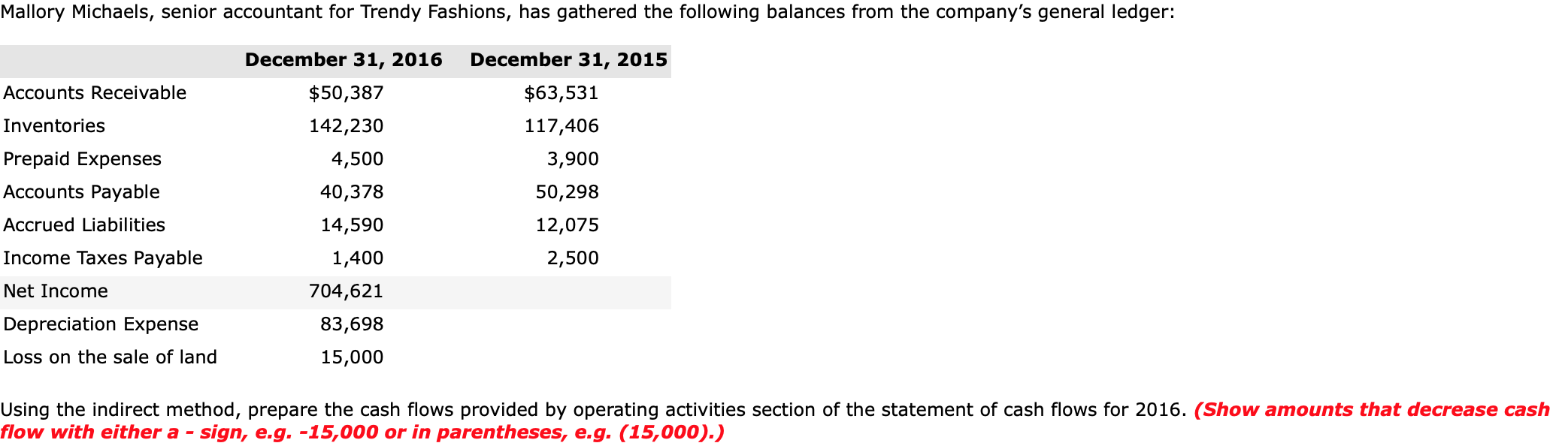

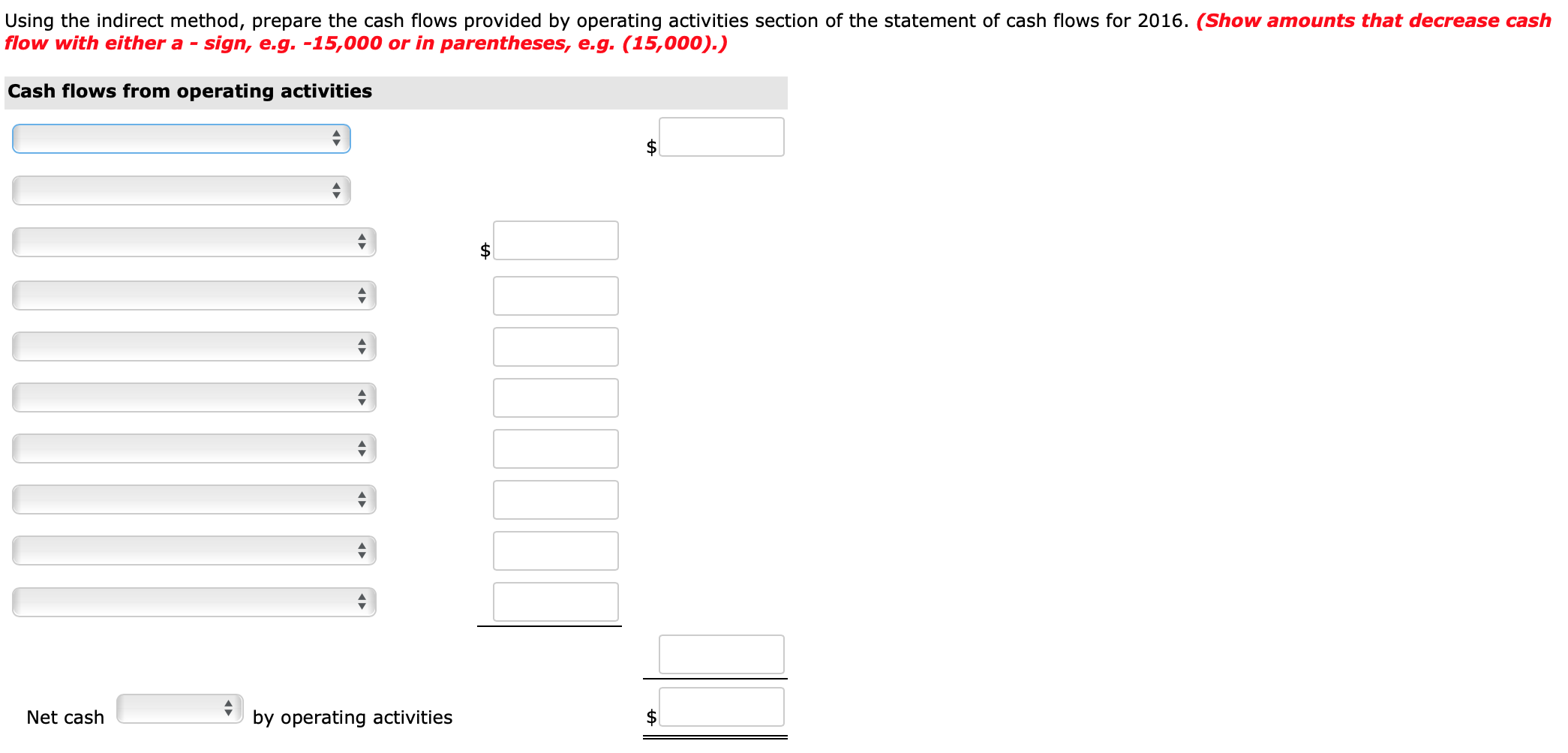

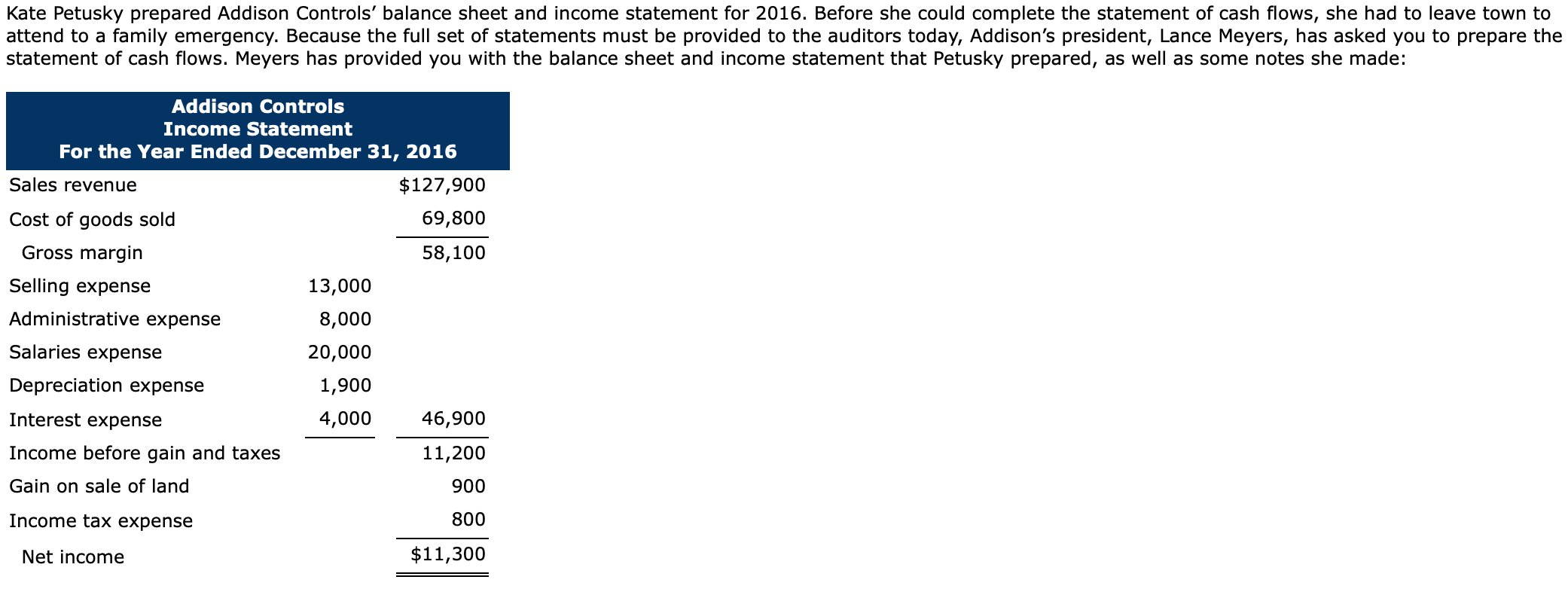

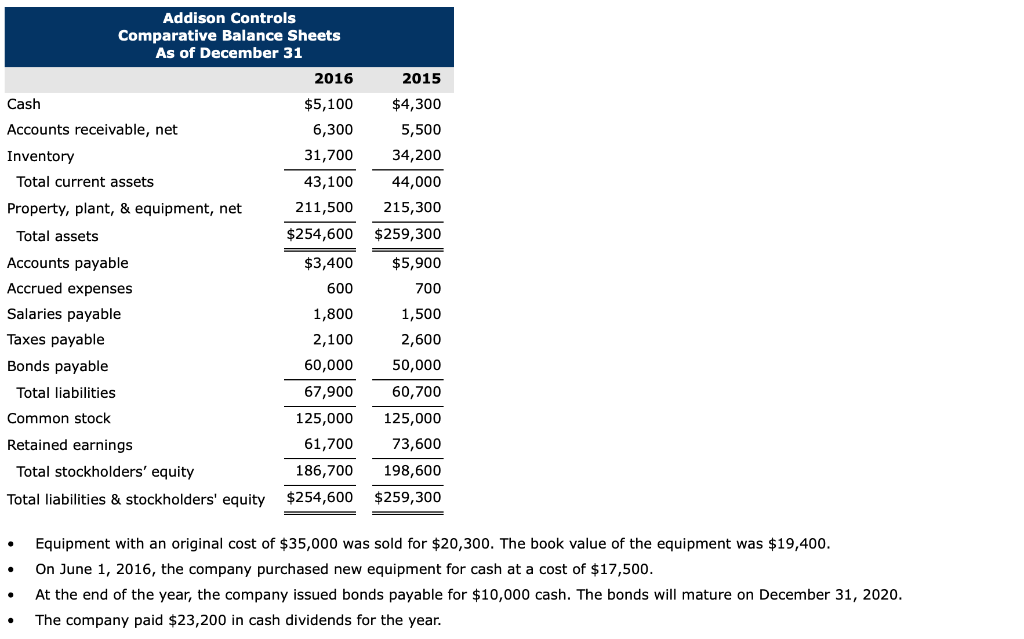

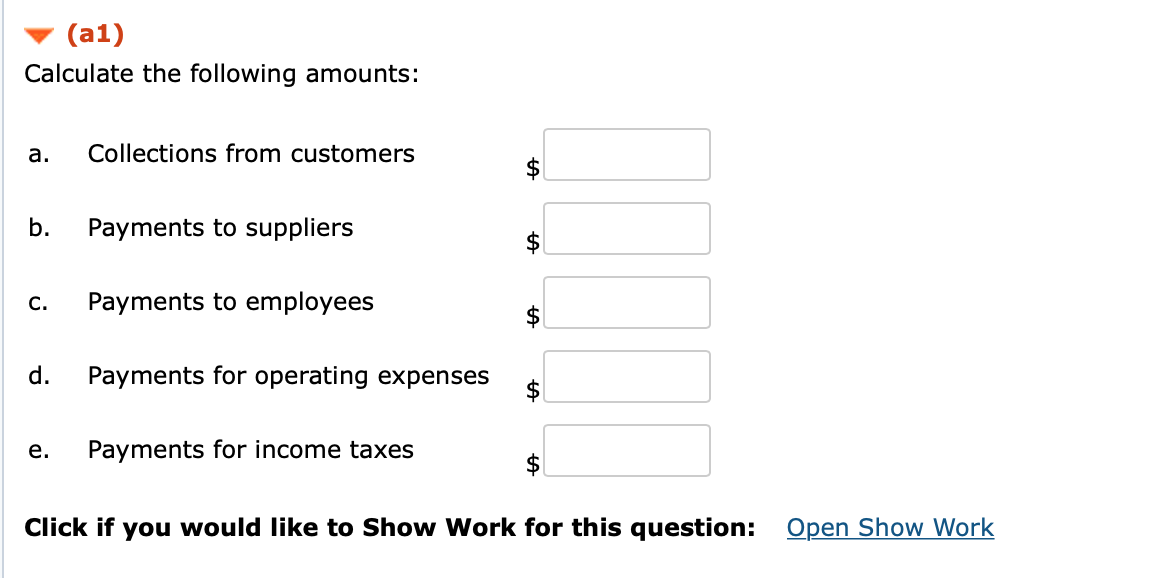

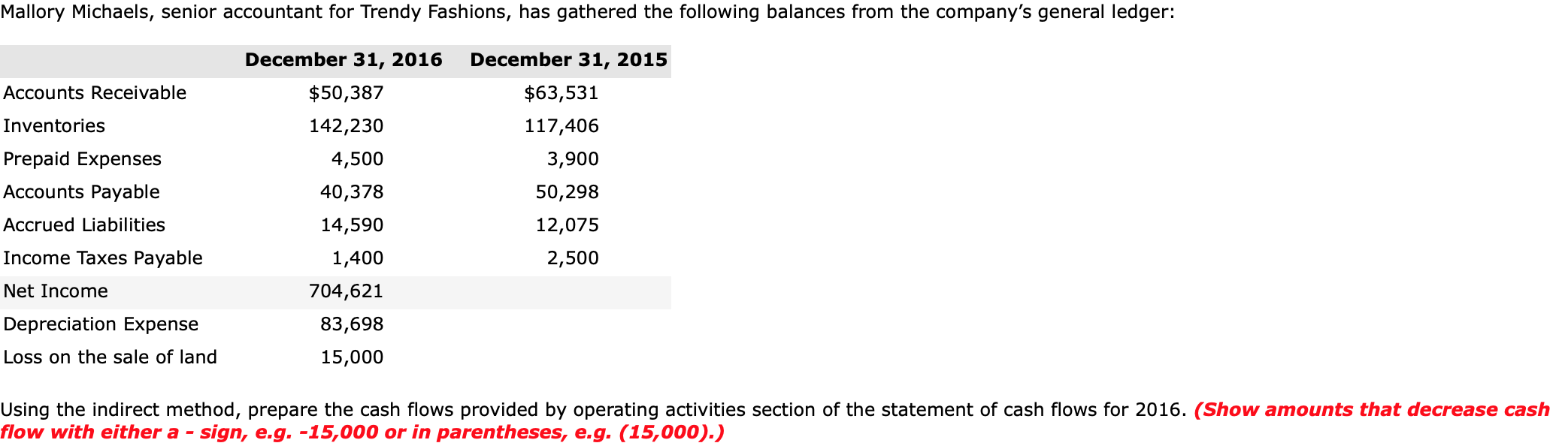

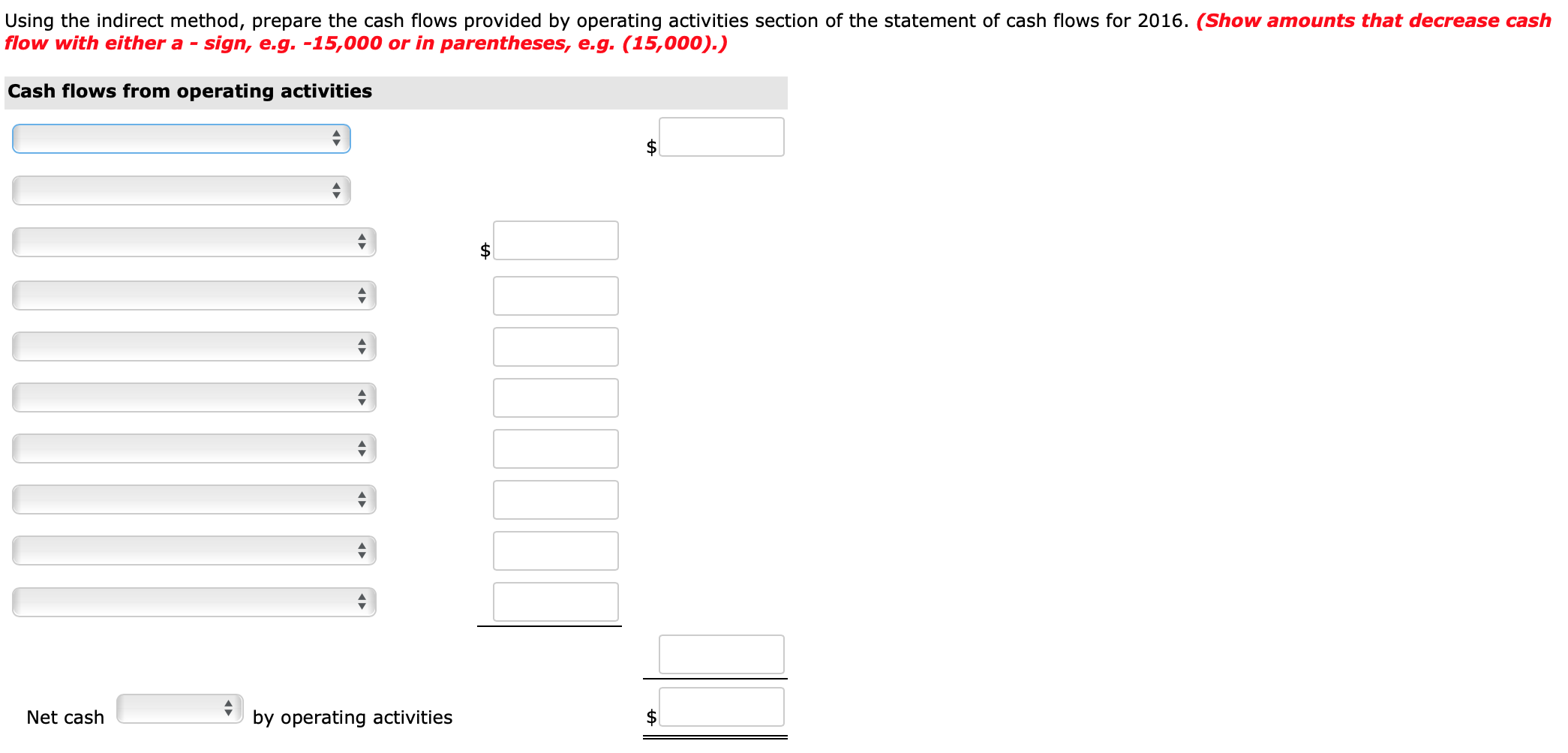

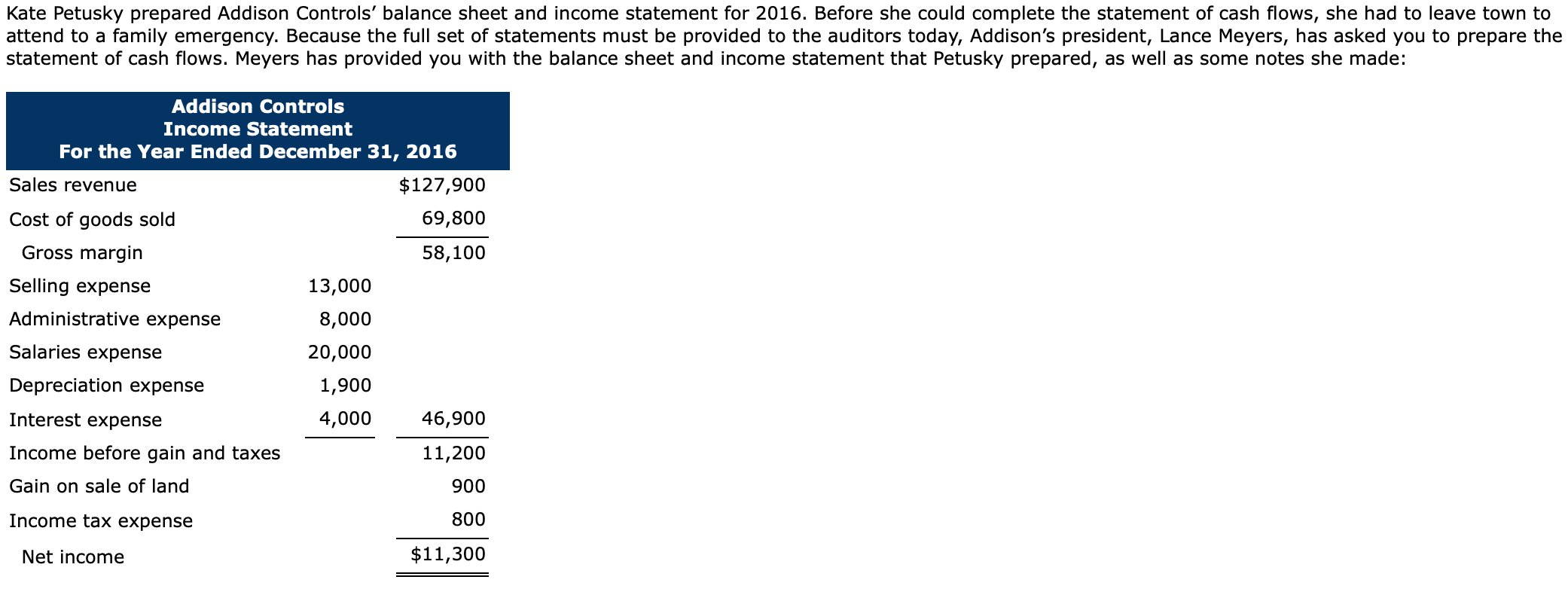

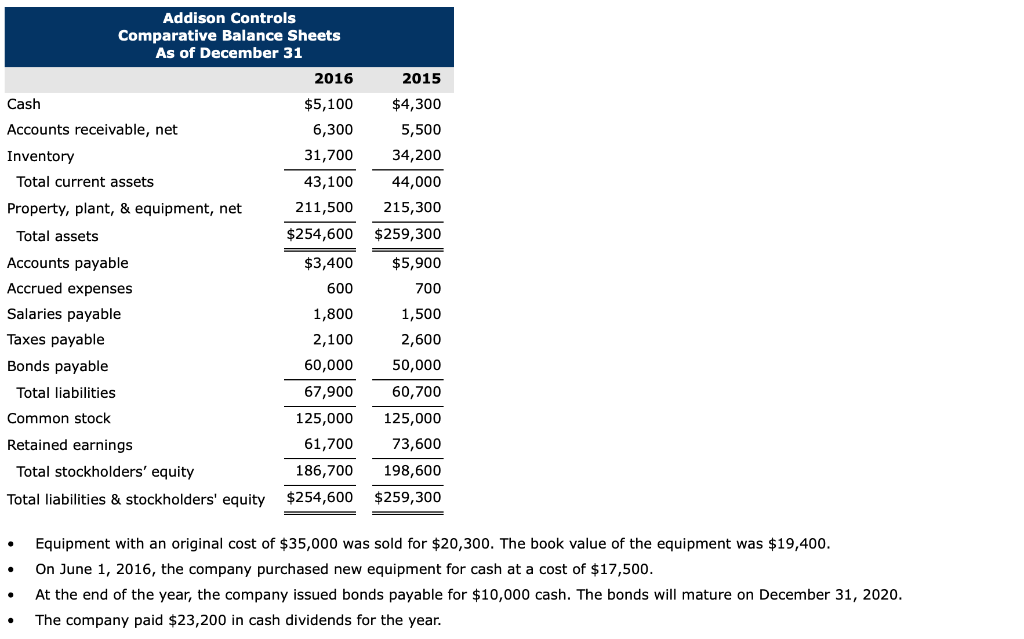

Mallory Michaels, senior accountant for Trendy Fashions, has gathered the following balances from the company's general ledger: Accounts Receivable Inventories Prepaid Expenses December 31, 2016 $50,387 142,230 4,500 40,378 14,590 1,400 704,621 83,698 15,000 December 31, 2015 $63,531 117,406 3,900 50,298 12,075 2,500 Accounts Payable Accrued Liabilities Income Taxes Payable Net Income Depreciation Expense Loss on the sale of land Using the indirect method, prepare the cash flows provided by operating activities section of the statement of cash flows for 2016. (Show amounts that decrease cash flow with either a - sign, e.g. -15,000 or in parentheses, e.g. (15,000).) Using the indirect method, prepare the cash flows provided by operating activities section of the statement of cash flows for 2016. (Show amounts that decrease cash flow with either a - sign, e.g. -15,000 or in parentheses, e.g. (15,000).) Cash flows from operating activities Net cash y operating activities Kate Petusky prepared Addison Controls' balance sheet and income statement for 2016. Before she could complete the statement of cash flows, she had to leave town to attend to a family emergency. Because the full set of statements must be provided to the auditors today, Addison's president, Lance Meyers, has asked you to prepare the statement of cash flows. Meyers has provided you with the balance sheet and income statement that Petusky prepared, as well as some notes she made: Addison Controls Income Statement For the Year Ended December 31, 2016 Sales revenue $127,900 Cost of goods sold 69,800 Gross margin 58,100 Selling expense 13,000 Administrative expense 8,000 Salaries expense 20,000 Depreciation expense 1,900 Interest expense 4,000 46,900 Income before gain and taxes 11,200 Gain on sale of land 900 Income tax expense 800 Net income $11,300 Addison Controls Comparative Balance Sheets As of December 31 2016 Cash $5,100 Accounts receivable, net 6,300 Inventory 31,700 Total current assets 43,100 Property, plant, & equipment, net 211,500 Total assets $254,600 Accounts payable $3,400 Accrued expenses 600 Salaries payable 1,800 Taxes payable 2,100 Bonds payable 60,000 Total liabilities 67,900 Common stock 125,000 Retained earnings 61,700 Total stockholders' equity 186,700 Total liabilities & stockholders' equity $254,600 2015 $4,300 5,500 34,200 44,000 215,300 $259,300 $5,900 700 1,500 2,600 50,000 60,700 125,000 73,600 198,600 $259,300 Equipment with an original cost of $35,000 was sold for $20,300. The book value of the equipment was $19,400. On June 1, 2016, the company purchased new equipment for cash at a cost of $17,500. At the end of the year, the company issued bonds payable for $10,000 cash. The bonds will mature on December 31, 2020. The company paid $23,200 in cash dividends for the year