Answered step by step

Verified Expert Solution

Question

1 Approved Answer

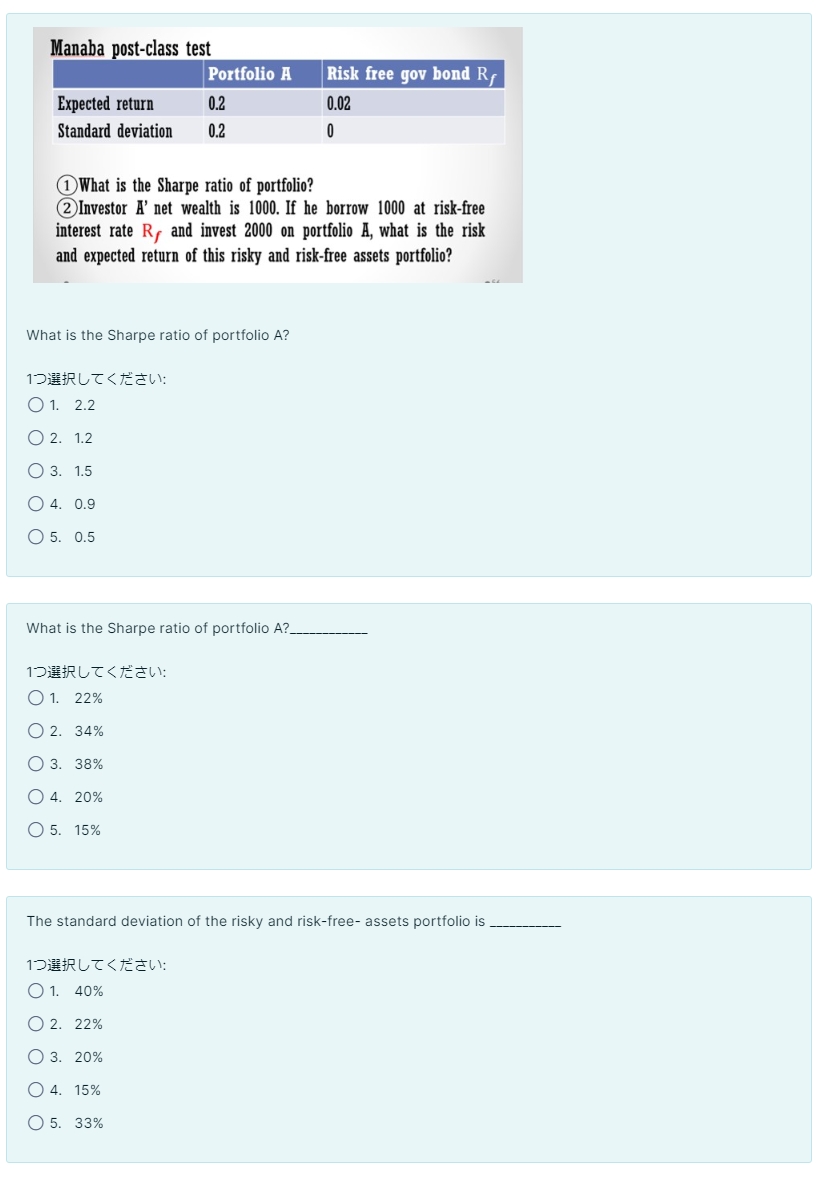

Manaba Dost-class test (1) What is the Sharpe ratio of portfolio? (2) Investor A' net wealth is 1000 . If he borrow 1000 at risk-free

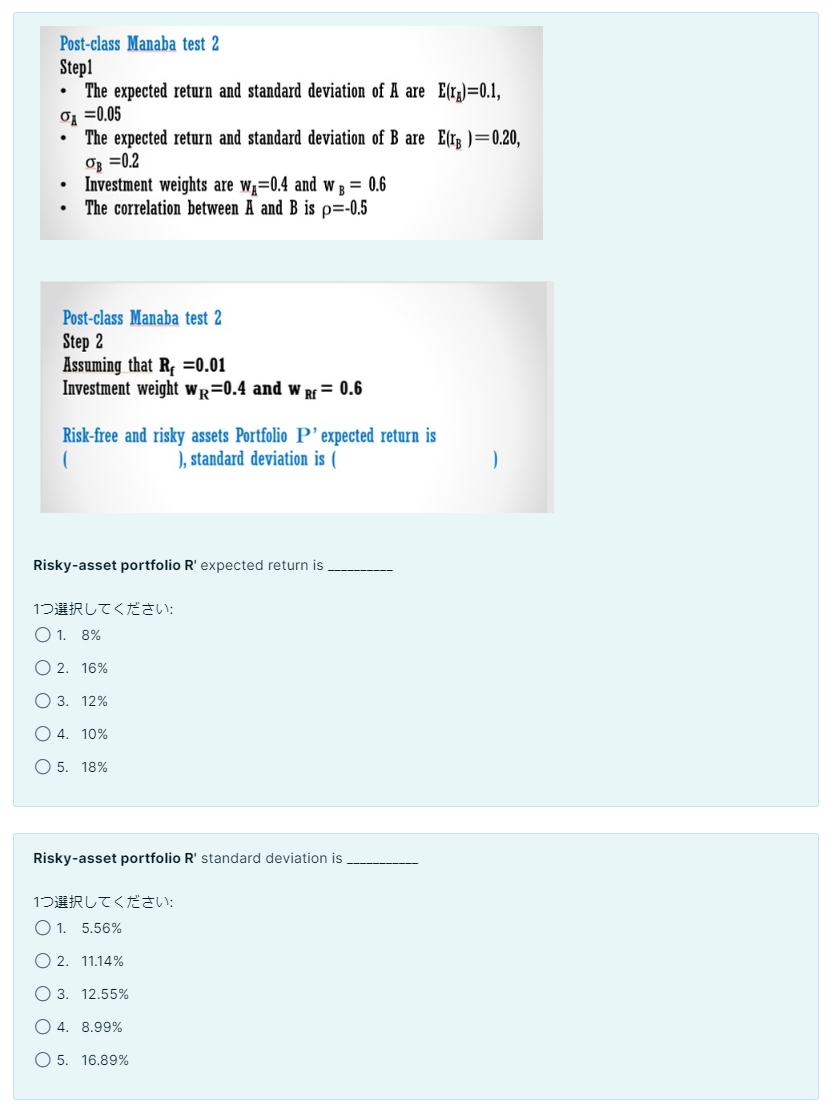

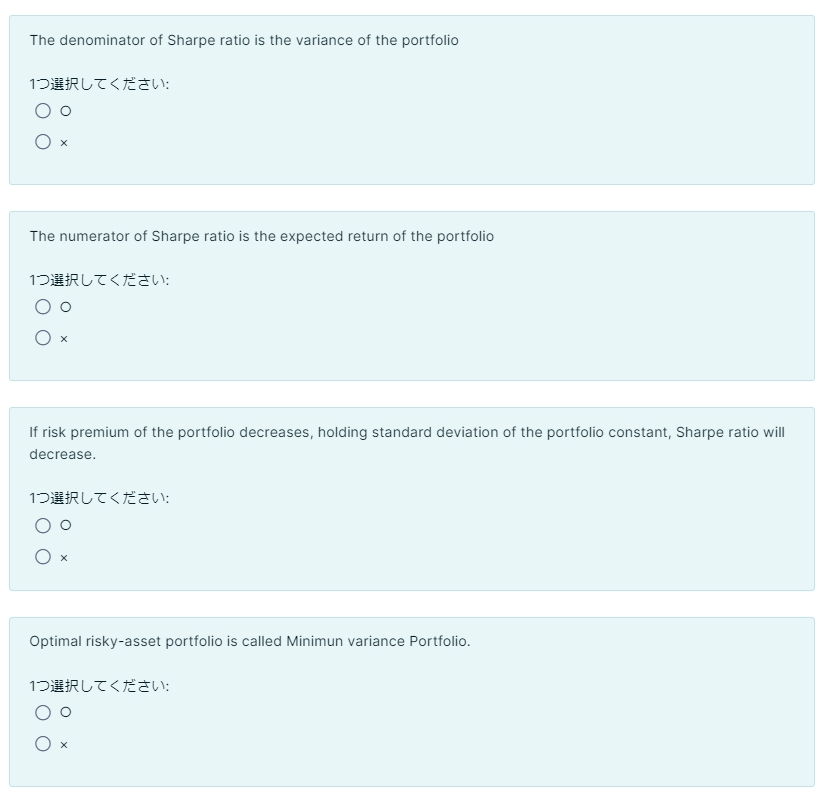

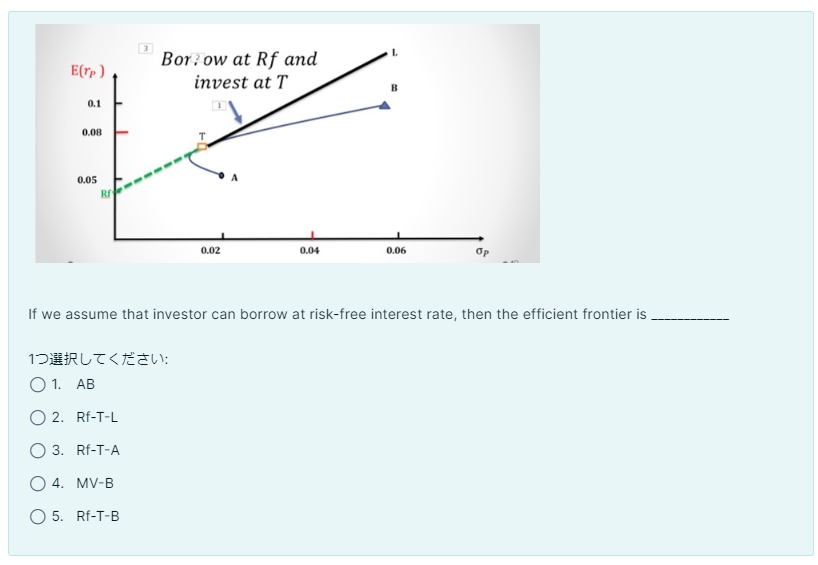

Manaba Dost-class test (1) What is the Sharpe ratio of portfolio? (2) Investor A' net wealth is 1000 . If he borrow 1000 at risk-free interest rate Rf and invest 2000 on portfolio A, what is the risk and expected return of this risky and risk-free assets portfolio? What is the Sharpe ratio of portfolio A? 1: 1. 2.2 2. 1.2 3. 1.5 4. 0.9 5. 0.5 What is the Sharpe ratio of portfolio A? 1: 1. 22% 2. 34% 3. 38% 4. 20% 5. 15% The standard deviation of the risky and risk-free- assets portfolio is 1: 1. 40% 2. 22% 3. 20% 4. 15% 5. 33% Post-class Manaba test 2 Stepl 1=0.05 - The expected return and standard deviation of B are E(rB)=0.20, B=0.2 - Investment weights are wA=0.4 and wB=0.6 - The correlation between A and B is =0.5 Post-class Manaba test 2 Step 2 Assuming that Rf=0.01 Investment weight wR=0.4 and wRf=0.6 Risk-free and risky assets Portfolio P expected return is ), standard deviation is ( Risky-asset portfolio R expected return is 1: 1. 8% 2. 16% 3. 12% 4. 10% 5. 18% Risky-asset portfolio R standard deviation is 1: 1. 5.56% 2. 11.14% 3. 12.55% 4. 8.99% 5. 16.89% Risky- and risk-free-asset portfolio P expected return is 1: 1. 22% 2. 12% 3. 18% 4. 15% 5. 7% Risky- and risk-free-asset portfolio P standard deviation is 1: 1. 4.45% 2. 1.89% 3. 9.45% 4. 2.55% 5. 4.88% The denominator of Sharpe ratio is the variance of the portfolio 1: 0 x The numerator of Sharpe ratio is the expected return of the portfolio 1: If risk premium of the portfolio decreases, holding standard deviation of the portfolio constant, Sharpe ratio will decrease. 1: 0 x Optimal risky-asset portfolio is called Minimun variance Portfolio. 1: 0 If we assume that investor can borrow at risk-free interest rate, then the efficient frontier is 1: 1. AB 2. RfTL 3. RfTA 4. MVB 5. RfTB

Manaba Dost-class test (1) What is the Sharpe ratio of portfolio? (2) Investor A' net wealth is 1000 . If he borrow 1000 at risk-free interest rate Rf and invest 2000 on portfolio A, what is the risk and expected return of this risky and risk-free assets portfolio? What is the Sharpe ratio of portfolio A? 1: 1. 2.2 2. 1.2 3. 1.5 4. 0.9 5. 0.5 What is the Sharpe ratio of portfolio A? 1: 1. 22% 2. 34% 3. 38% 4. 20% 5. 15% The standard deviation of the risky and risk-free- assets portfolio is 1: 1. 40% 2. 22% 3. 20% 4. 15% 5. 33% Post-class Manaba test 2 Stepl 1=0.05 - The expected return and standard deviation of B are E(rB)=0.20, B=0.2 - Investment weights are wA=0.4 and wB=0.6 - The correlation between A and B is =0.5 Post-class Manaba test 2 Step 2 Assuming that Rf=0.01 Investment weight wR=0.4 and wRf=0.6 Risk-free and risky assets Portfolio P expected return is ), standard deviation is ( Risky-asset portfolio R expected return is 1: 1. 8% 2. 16% 3. 12% 4. 10% 5. 18% Risky-asset portfolio R standard deviation is 1: 1. 5.56% 2. 11.14% 3. 12.55% 4. 8.99% 5. 16.89% Risky- and risk-free-asset portfolio P expected return is 1: 1. 22% 2. 12% 3. 18% 4. 15% 5. 7% Risky- and risk-free-asset portfolio P standard deviation is 1: 1. 4.45% 2. 1.89% 3. 9.45% 4. 2.55% 5. 4.88% The denominator of Sharpe ratio is the variance of the portfolio 1: 0 x The numerator of Sharpe ratio is the expected return of the portfolio 1: If risk premium of the portfolio decreases, holding standard deviation of the portfolio constant, Sharpe ratio will decrease. 1: 0 x Optimal risky-asset portfolio is called Minimun variance Portfolio. 1: 0 If we assume that investor can borrow at risk-free interest rate, then the efficient frontier is 1: 1. AB 2. RfTL 3. RfTA 4. MVB 5. RfTB Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started