Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Management accounting 1B.clear and full answers best results plz Question 2 (34 marks) Windhoek Dairy Products ('WDP) processes milk to produce three products, Cheese (CS),

Management accounting 1B.clear and full answers best results plz

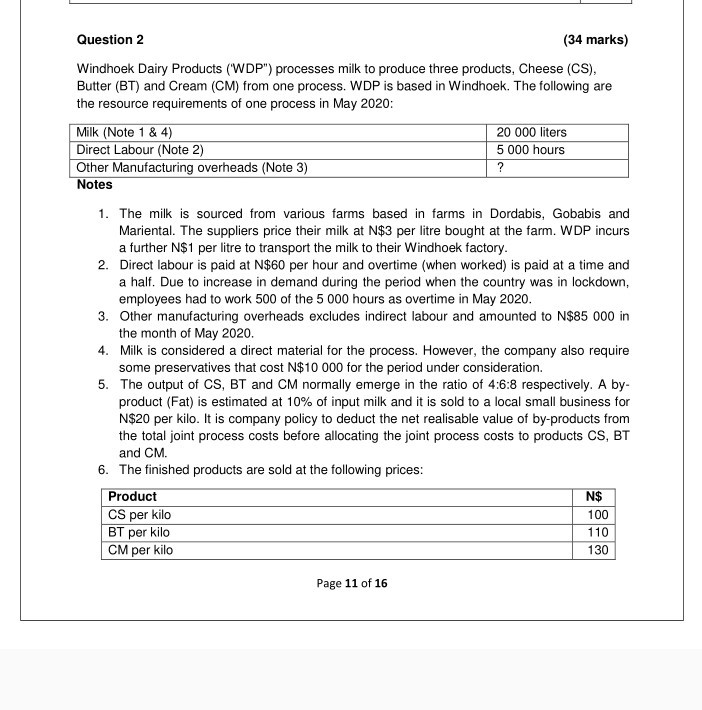

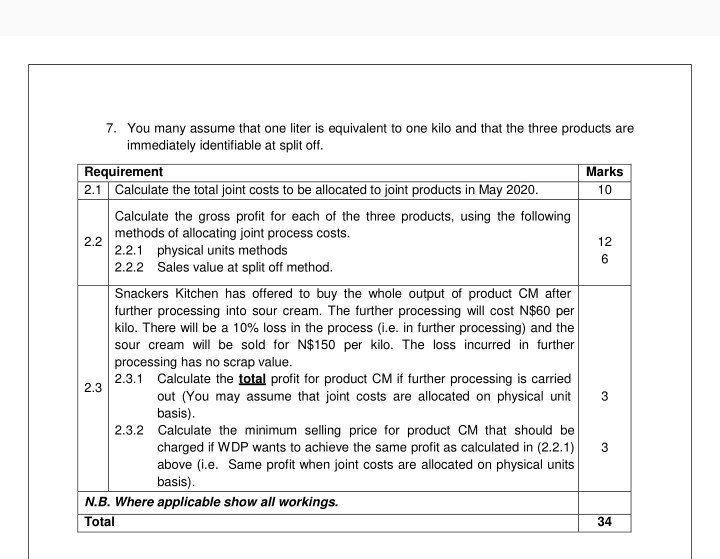

Question 2 (34 marks) Windhoek Dairy Products ('WDP") processes milk to produce three products, Cheese (CS), Butter (BT) and Cream (CM) from one process. WDP is based in Windhoek. The following are the resource requirements of one process in May 2020: Milk (Note 1 & 4) 20 000 liters Direct Labour (Note 2) 5 000 hours Other Manufacturing overheads (Note 3) ? Notes 1. The milk is sourced from various farms based in farms in Dordabis, Gobabis and Mariental. The suppliers price their milk at N$3 per litre bought at the farm. WDP incurs a further N$1 per litre to transport the milk to their Windhoek factory. 2. Direct labour is paid at N$60 per hour and overtime (when worked) is paid at a time and a half. Due to increase in demand during the period when the country was in lockdown, employees had to work 500 of the 5 000 hours as overtime in May 2020. 3. Other manufacturing overheads excludes indirect labour and amounted to N$85 000 in the month of May 2020. 4. Milk is considered a direct material for the process. However, the company also require some preservatives that cost N$10 000 for the period under consideration. 5. The output of CS, BT and CM normally emerge in the ratio of 4:6:8 respectively. A by- product (Fat) is estimated at 10% of input milk and it is sold to a local small business for N$20 per kilo. It is company policy to deduct the net realisable value of by-products from the total joint process costs before allocating the joint process costs to products CS, BT and CM. 6. The finished products are sold at the following prices: Product N$ CS per kilo 100 BT per kilo 110 CM per kilo 130 Page 11 of 16 12 6 7. You many assume that one liter is equivalent to one kilo and that the three products are immediately identifiable at split off. Requirement Marks 2.1 Calculate the total joint costs to be allocated to joint products in May 2020. 10 Calculate the gross profit for each of the three products, using the following methods of allocating joint process costs. 2.2 2.2.1 physical units methods 2.2.2 Sales value at split off method. Snackers Kitchen has offered to buy the whole output of product CM after further processing into sour cream. The further processing will cost N$60 per kilo. There will be a 10% loss in the process (i.e. in further processing) and the sour cream will be sold for N$150 per kilo. The loss incurred in further processing has no scrap value. 2.3.1 Calculate the total profit for product CM if further processing is carried out (You may assume that joint costs are allocated on physical unit 3 basis). 2.3.2 Calculate the minimum selling price for product CM that should be charged if WDP wants to achieve the same profit as calculated in (2.2.1) above (i.e. Same profit when joint costs are allocated on physical units basis). N.B. Where applicable show all workings. Total 2.3 3 34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started