Answered step by step

Verified Expert Solution

Question

1 Approved Answer

management accounting SV Sdn Bhd is considering to buy a giant machine which is expected to increase its factory production output and profits over an

management accounting

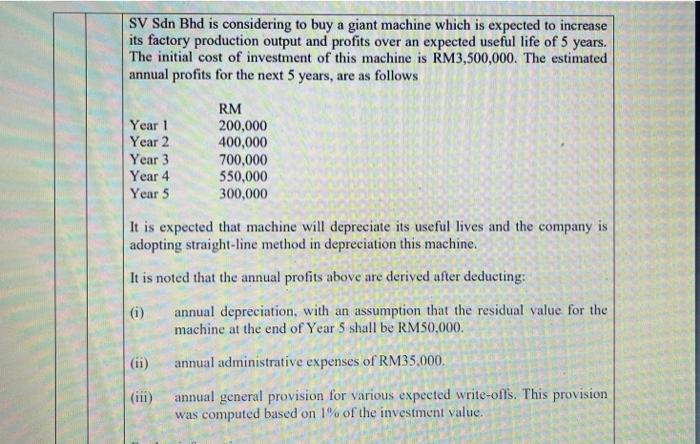

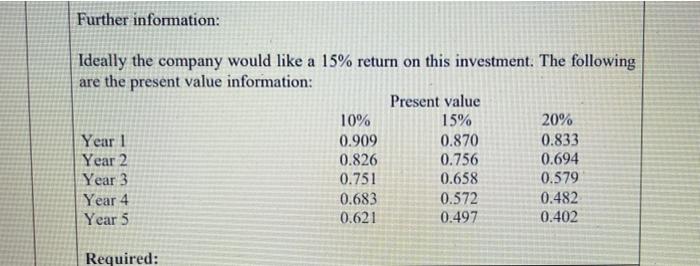

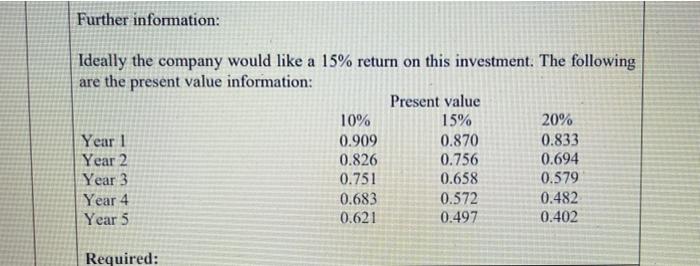

SV Sdn Bhd is considering to buy a giant machine which is expected to increase its factory production output and profits over an expected useful life of 5 years. The initial cost of investment of this machine is RM3,500,000. The estimated annual profits for the next 5 years, are as follows Year 1 Year 2 Year 3 Year 4 Year 5 RM 200,000 400,000 700,000 550,000 300,000 It is expected that machine will depreciate its useful lives and the company is adopting straight-line method in depreciation this machine. It is noted that the annual profits above are derived after deducting (i) annual depreciation, with an assumption that the residual value for the machine at the end of Year 5 shall be RM50,000. annual administrative expenses of RM35,000. (iii) annual general provision for various expected write-offs. This provision was computed based on 1% of the investment value. Further infornation: a Ideally the company would like a 15% return on this investment. The following are the present value information: Present value 10% 15% 20% Year 1 0.909 0.870 0.833 Year 2 0.826 0.756 0.694 Year 3 0.751 0.658 0.579 Year 4 0.683 0.572 0.482 Year 5 0.621 0.497 0.402 Required: b. Critically evaluate the importance of negotiated transfer pricing that the companies can use when transferring goods and services

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started