managerial accounting EX. Chapter 8

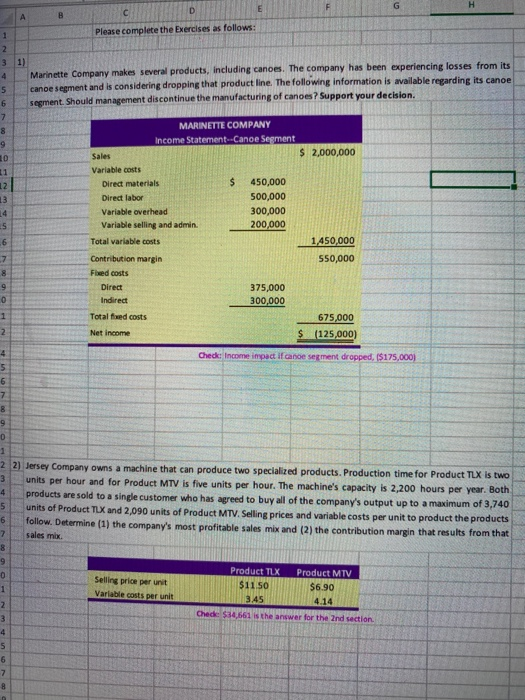

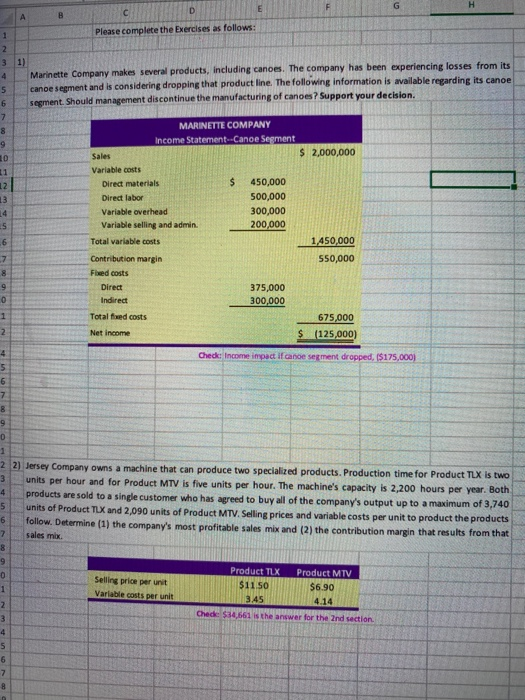

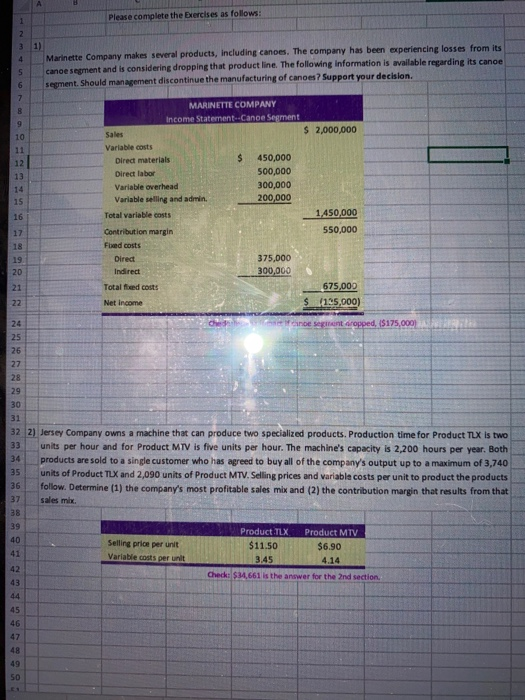

Please complete the Exercises as follows: 31) Marinette Company makes several products, including cances. The company has been experiencing losses from its cance segment and is considering dropping that product line. The following information is available regarding its canoe segment. Should management discontinue the manufacturing of cances ? Support your decision. 600 MARINETTE COMPANY Income Statement-Canoe Segment Sales $ 2,000,000 Variable costs Direct materials 450,000 Direct labor 500,000 Variable overhead 300,000 Variable selling and admin 200,000 Total variable costs 1,450,000 Contribution margin 550,000 Feed costs Direct 375,000 Indirect 300,000 Totalfred costs 675,000 Net Income $ (125,000) 0 0 Check: Income impact if canoe segment dropped, ($175,000) O 00 + 22) Jersey Company owns a machine that can produce two specialized products. Production time for Product TLX is two units per hour and for Product MTV is five units per hour. The machine's capacity is 2,200 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 3,740 units of Product TLX and 2,090 units of Product MTV. Selling prices and variable costs per unit to product the products follow. Determine (1) the company's most profitable sales mix and (2) the contribution margin that results from that sales mix 0 0 Selling price per unit Variable costs per unit Product TLX Product MTV $1150 $6.90 3.45 4.14 Chede $34.661 is the answer for the 2nd section NMD Please complete the Exercises as follows: Marinette Company makes several products, including cances. The company has been experiencing losses from its cance segment and is considering dropping that product line. The following information is available regarding its cange segment. Should management discontinue the manufacturing of canoes? Support your decision. MARINETTE COMPANY Income Statement Cance Segment Sales $ 2,000,000 Variable costs Direct materials 450,000 Direct labor 500,000 Variable overhead 300,000 Variable selling and admin. 200,000 Total variable costs 1,450,000 Contribution margin 550,000 Fixed costs Direct 375,000 Indirect 300,000 Total feed costs 675,000 Net Income $ 105,000) ne segment cropped. ($175,000 322) Jersey Company owns a machine that can produce two specialized products. Production time for Product TLX is two 33 units per hour and for Product MTV is five units per hour. The machine's capacity is 2,200 hours per year. Both 34 p roducts are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 3,740 units of Product TLX and 2,090 units of Product MTV. Selling prices and variable costs per unit to product the products Follow. Determine (1) the company's most profitable sales mix and (2) the contribution margin that results from that sales mix Selling price per unit Variable costs per unit Product TLX Product MTV $11.50 $6.90 3.45 14 Check: $34,661 is the answer for the 2nd