Answered step by step

Verified Expert Solution

Question

1 Approved Answer

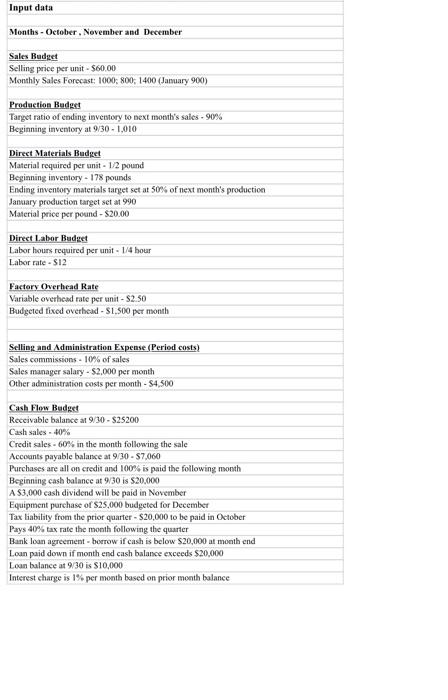

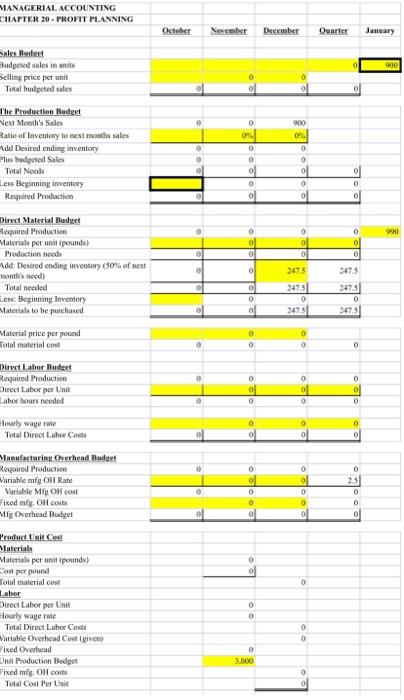

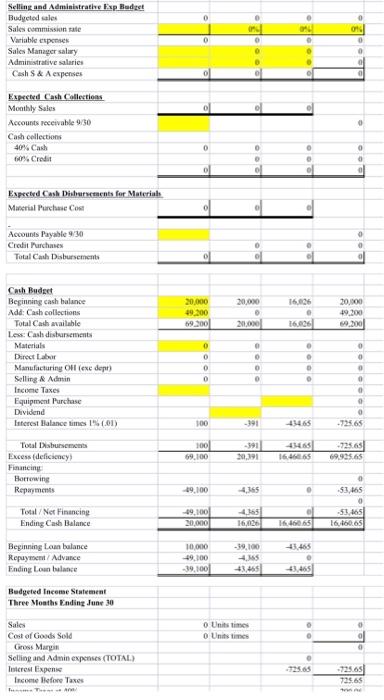

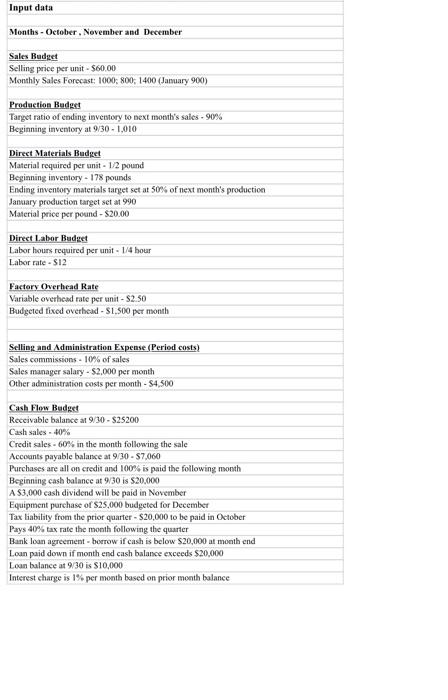

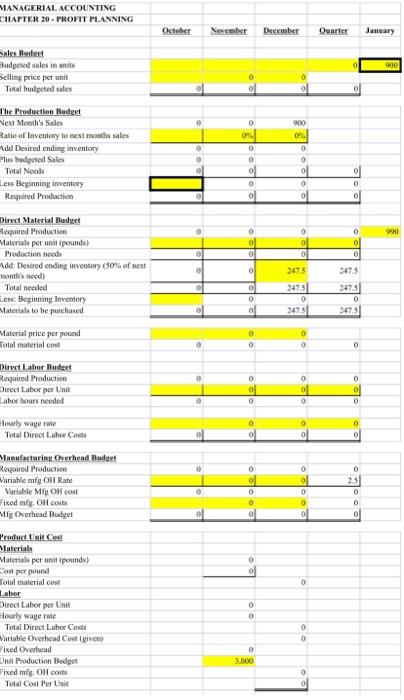

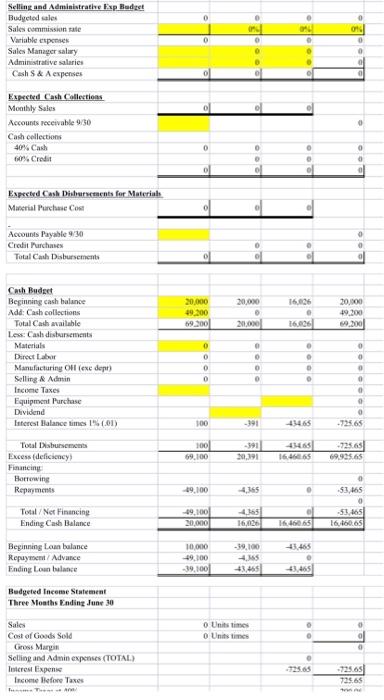

Managerial accounting Input data Months - October, November and December Sales Budget Selling price per unit - $60.00 Monthly Sales Forecast: 1000, 800, 1400 (January

Managerial accounting

Input data Months - October, November and December Sales Budget Selling price per unit - $60.00 Monthly Sales Forecast: 1000, 800, 1400 (January 9001) Production Budget Target ratio of ending inventory to next month's sales - 90% Beginning inventory at 9/30 . 1,010 Direct Materials Budget Material required per unit - 12 pound Beginning inventory - 178 pounds Ending inventory materials target set at 50% of next month's production January production target set at 990 Material price per pound - $20.00 Direct Labor Budget Labor hours required per unit - 1/4 hour Labor rate - S12 Factory Overhead Rate Variable overhead rate per unit - $2.50 Budgeted fixed overhead - $1.500 per month Selling and Administration Expense (Period costs) Sales commissions - 10% of sales Sales manager salary - $2.000 per month Other administration costs per month - S4,500 Cash Flow Budget Receivable balance at 9/30 - 525200 Cash sales. 40% Credit sales -60% in the month following the sale Accounts payable balance at 9/30 - 57,060 Purchases are all on credit and 100% is paid the following month Beginning cash balance at 930 is $20,000 A $3,000 cash dividend will be paid in November Equipment purchase of $25,000 budgeted for December Tax liability from the prior quarter - $20,000 to be paid in October Pays 40% tax rate the month following the quarter Bank loan agreement - borrow if cash is below 520,000 at month end Loan paid down if month end cash balance exceeds $20,000 Loan balance at 9/30 is $10,000 Interest charge is 1% per month based on prior month balance MANAGERIAL ACCOUNTING CHAPTER 20 -PROFIT PLANNING October November December Quarter January 900 Sales Badet Budgeted sales in its Selling price per unit Total budgeted sales 0 0 0 900 On 0 The Production Budget Next Month's Sales Ratio of Inventory to next months sales Add Desired ending inventory Plus budgeted Sales Total Needs Less Beginning inventory Required Production 0 0 O 0 0 D O 0 0 0 0 0 900 D o 0 0 0 D Direct Material Budget Required Production Materiale per unit (pounds) Production neede Add: Desired ending inventory (50% of next Tent's need Total needed Less Beginning Inventory Materials to be purchased O 2475 247.51 0 347.5 D 0 Material price per pound Total material con 0 0 0 0 0 0 Direct Labor Hudget Required Production Direct Labor per Unit Labor hours needed 0 ol 0 o 0 0 0 0 D 0 Hourly wage role Total Direct Laber Costs 0 O O 0 0 0 ol Manufacturing Cherhead Budget Required Production Variable mfg OH Rate Variable Me OH cost Fixed mig, OH costs Mig Overhead Budget O 0 0 0 O 0 D 0 0 0 0 Product UnitCest Materials Materials per unit (pounds) couper pound Total material cost Labor Direct Labor per Unit Hourly wage rate Total Direct Labor Costs Variable Overhead Cowgiven Fixed Overhead Unit Production Budget Fixed mig. Oll costs Total Cost Per Unit 0 0 0 0 0 SOO 0 Selling and Administratie Exp Badget Budgeted sales Sales missionate Variable expenses Sales Manager salary Administrative salaries Cash & expenses 0 0 0 O Expected Cash Collections Monthly Sales Accounts receivable 9/30 Cash collections 40% Cash 60%. Credit 0 0 ol Expected Cash Diberents for Material Material Purchase Cost Accounts Payable 9:30 Credit Purchase Total Cash Disbursement 0 20.000 15025) 20.000 29.200 9300 20,000 9.200 9.300 20.000 16.06 Cash Budget Beginning cash balance Add: Cash collections Total Cash available Less: Cash disbursements Materials Direct Labor Manufacturing On (exc depr) Selling Admin Income Taxes Equipment Purchase Dividend Interest Balance times 1% (01) 0 0 0 0 . D 0 0 0 0 0 0 o 100 -391 434.65 -725.65 100 69.100 -391 30.11 16.46665 69.925.65 Total Labursement Excess deficiency Financing Horrowing Repayments 19.100 4,165 0 53,165 0 -51.465 16.16665 Total / Net Financing Ending Cash Balance -19,100 20.000 4365 16,026 16.46065 43.465 Beginning Loun balance Repuyen/Advance Ending Loun balance 10,000 49.100 -39.1001 -4.5 43,465) Budgeted Income Statement Three Months Ending June 30 o Units times o Units times les Sales Cost of Goods Sold Gross Margin Selling and Admin expenses (TOTAL) Interest Expense Income Before Taxes -725.65 725.65 Income Before Taxes Income Taxes at 40% Net Income 725.65 290,06 435.59 Budgeted Balance Sheet Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Equipment Less Accumulated Depreciation Total Assets 60% Times o Times 0 Times 0 247.5 0 16,460.65 0 0 0 225,000 -40,500 200,960.65 100% Times 0 289.86 Liabilities and Equity Accounts Payable Income Taxes Payable Common Stock Retained Earnings Total Liab & Equity 150,000 43,305.59 193,305.59 193.595.45 Retained Earnings As of September 30 Quarter earnings Less: Dividend 42,870 435.59 0 43,305.59 Input data Months - October, November and December Sales Budget Selling price per unit - $60.00 Monthly Sales Forecast: 1000, 800, 1400 (January 9001) Production Budget Target ratio of ending inventory to next month's sales - 90% Beginning inventory at 9/30 . 1,010 Direct Materials Budget Material required per unit - 12 pound Beginning inventory - 178 pounds Ending inventory materials target set at 50% of next month's production January production target set at 990 Material price per pound - $20.00 Direct Labor Budget Labor hours required per unit - 1/4 hour Labor rate - S12 Factory Overhead Rate Variable overhead rate per unit - $2.50 Budgeted fixed overhead - $1.500 per month Selling and Administration Expense (Period costs) Sales commissions - 10% of sales Sales manager salary - $2.000 per month Other administration costs per month - S4,500 Cash Flow Budget Receivable balance at 9/30 - 525200 Cash sales. 40% Credit sales -60% in the month following the sale Accounts payable balance at 9/30 - 57,060 Purchases are all on credit and 100% is paid the following month Beginning cash balance at 930 is $20,000 A $3,000 cash dividend will be paid in November Equipment purchase of $25,000 budgeted for December Tax liability from the prior quarter - $20,000 to be paid in October Pays 40% tax rate the month following the quarter Bank loan agreement - borrow if cash is below 520,000 at month end Loan paid down if month end cash balance exceeds $20,000 Loan balance at 9/30 is $10,000 Interest charge is 1% per month based on prior month balance MANAGERIAL ACCOUNTING CHAPTER 20 -PROFIT PLANNING October November December Quarter January 900 Sales Badet Budgeted sales in its Selling price per unit Total budgeted sales 0 0 0 900 On 0 The Production Budget Next Month's Sales Ratio of Inventory to next months sales Add Desired ending inventory Plus budgeted Sales Total Needs Less Beginning inventory Required Production 0 0 O 0 0 D O 0 0 0 0 0 900 D o 0 0 0 D Direct Material Budget Required Production Materiale per unit (pounds) Production neede Add: Desired ending inventory (50% of next Tent's need Total needed Less Beginning Inventory Materials to be purchased O 2475 247.51 0 347.5 D 0 Material price per pound Total material con 0 0 0 0 0 0 Direct Labor Hudget Required Production Direct Labor per Unit Labor hours needed 0 ol 0 o 0 0 0 0 D 0 Hourly wage role Total Direct Laber Costs 0 O O 0 0 0 ol Manufacturing Cherhead Budget Required Production Variable mfg OH Rate Variable Me OH cost Fixed mig, OH costs Mig Overhead Budget O 0 0 0 O 0 D 0 0 0 0 Product UnitCest Materials Materials per unit (pounds) couper pound Total material cost Labor Direct Labor per Unit Hourly wage rate Total Direct Labor Costs Variable Overhead Cowgiven Fixed Overhead Unit Production Budget Fixed mig. Oll costs Total Cost Per Unit 0 0 0 0 0 SOO 0 Selling and Administratie Exp Badget Budgeted sales Sales missionate Variable expenses Sales Manager salary Administrative salaries Cash & expenses 0 0 0 O Expected Cash Collections Monthly Sales Accounts receivable 9/30 Cash collections 40% Cash 60%. Credit 0 0 ol Expected Cash Diberents for Material Material Purchase Cost Accounts Payable 9:30 Credit Purchase Total Cash Disbursement 0 20.000 15025) 20.000 29.200 9300 20,000 9.200 9.300 20.000 16.06 Cash Budget Beginning cash balance Add: Cash collections Total Cash available Less: Cash disbursements Materials Direct Labor Manufacturing On (exc depr) Selling Admin Income Taxes Equipment Purchase Dividend Interest Balance times 1% (01) 0 0 0 0 . D 0 0 0 0 0 0 o 100 -391 434.65 -725.65 100 69.100 -391 30.11 16.46665 69.925.65 Total Labursement Excess deficiency Financing Horrowing Repayments 19.100 4,165 0 53,165 0 -51.465 16.16665 Total / Net Financing Ending Cash Balance -19,100 20.000 4365 16,026 16.46065 43.465 Beginning Loun balance Repuyen/Advance Ending Loun balance 10,000 49.100 -39.1001 -4.5 43,465) Budgeted Income Statement Three Months Ending June 30 o Units times o Units times les Sales Cost of Goods Sold Gross Margin Selling and Admin expenses (TOTAL) Interest Expense Income Before Taxes -725.65 725.65 Income Before Taxes Income Taxes at 40% Net Income 725.65 290,06 435.59 Budgeted Balance Sheet Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Equipment Less Accumulated Depreciation Total Assets 60% Times o Times 0 Times 0 247.5 0 16,460.65 0 0 0 225,000 -40,500 200,960.65 100% Times 0 289.86 Liabilities and Equity Accounts Payable Income Taxes Payable Common Stock Retained Earnings Total Liab & Equity 150,000 43,305.59 193,305.59 193.595.45 Retained Earnings As of September 30 Quarter earnings Less: Dividend 42,870 435.59 0 43,305.59

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started