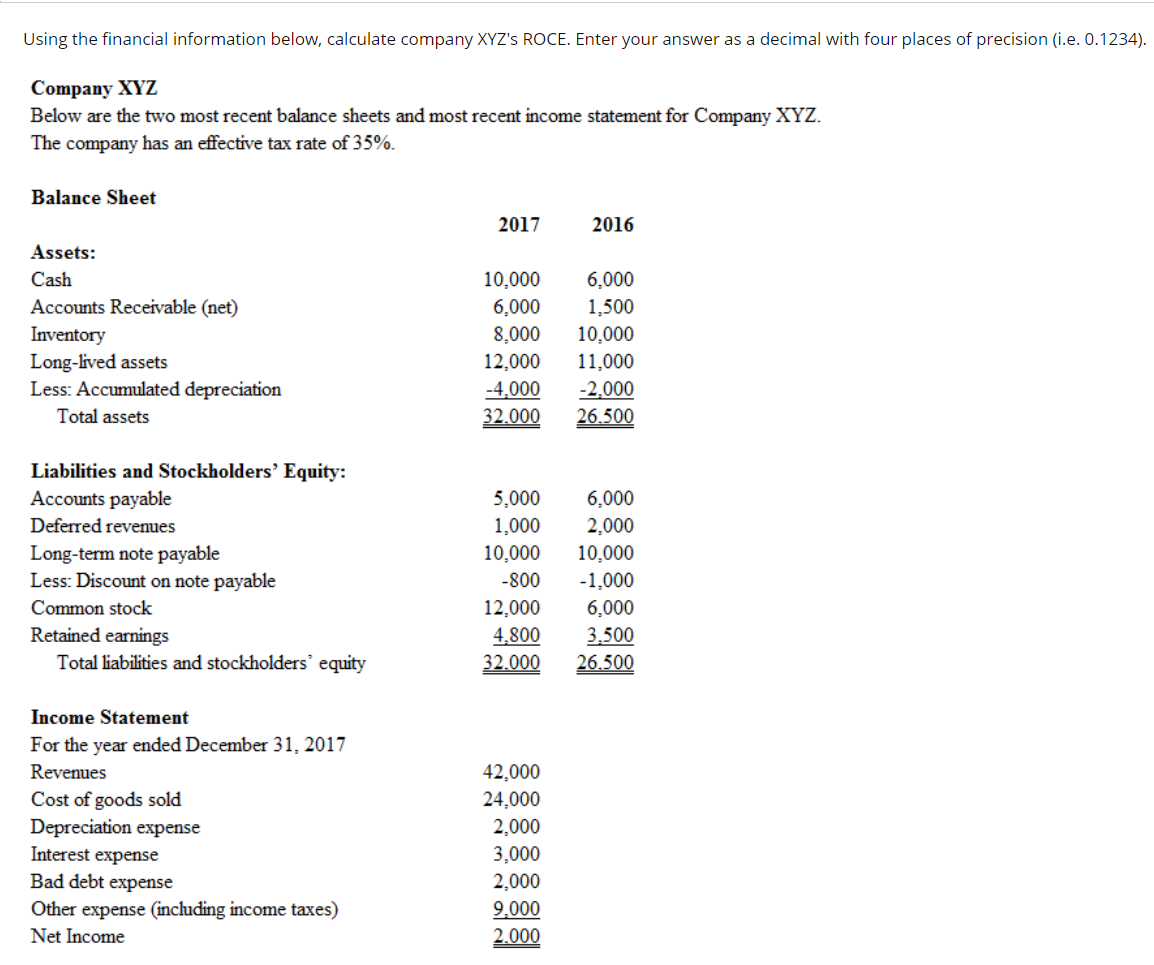

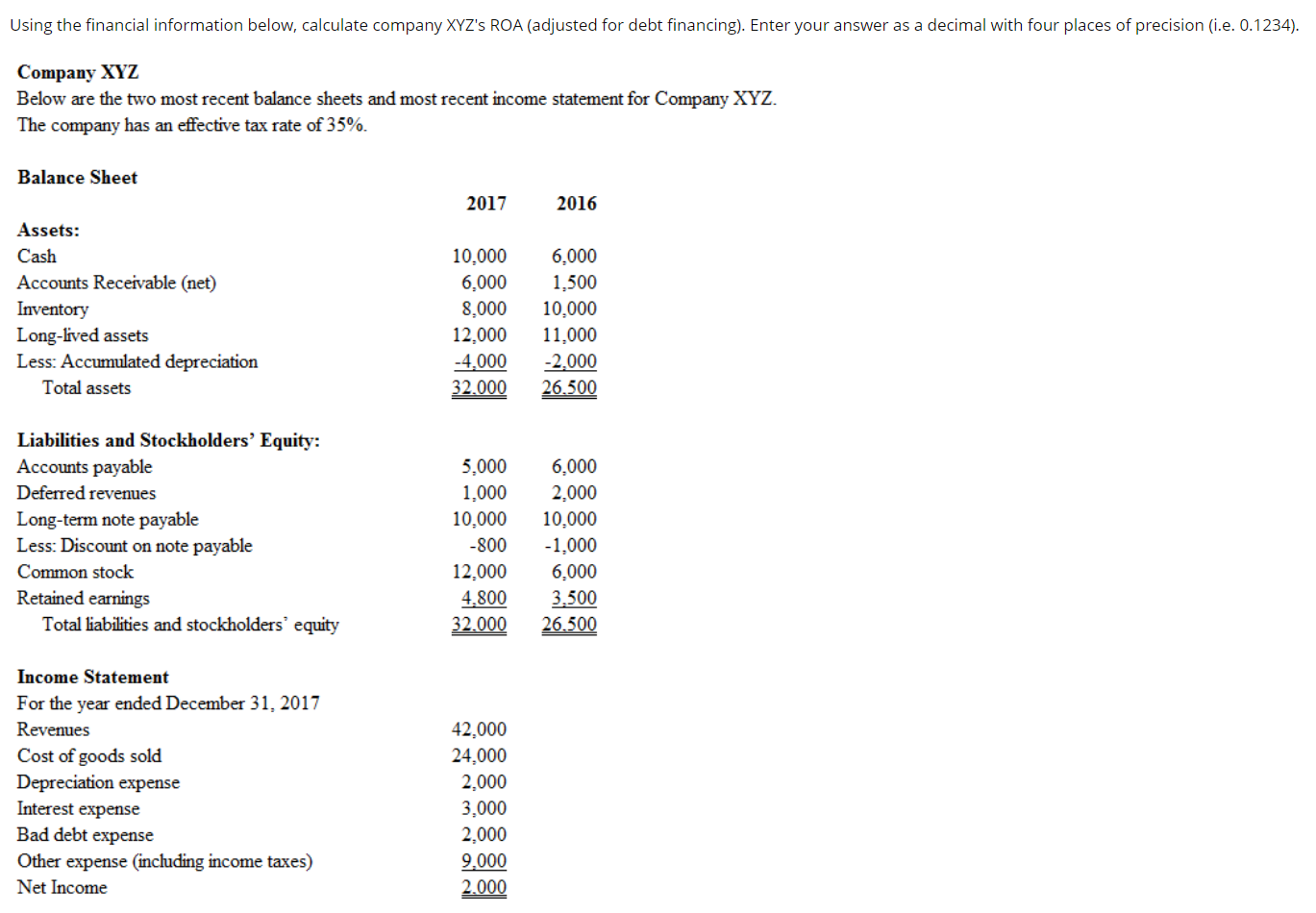

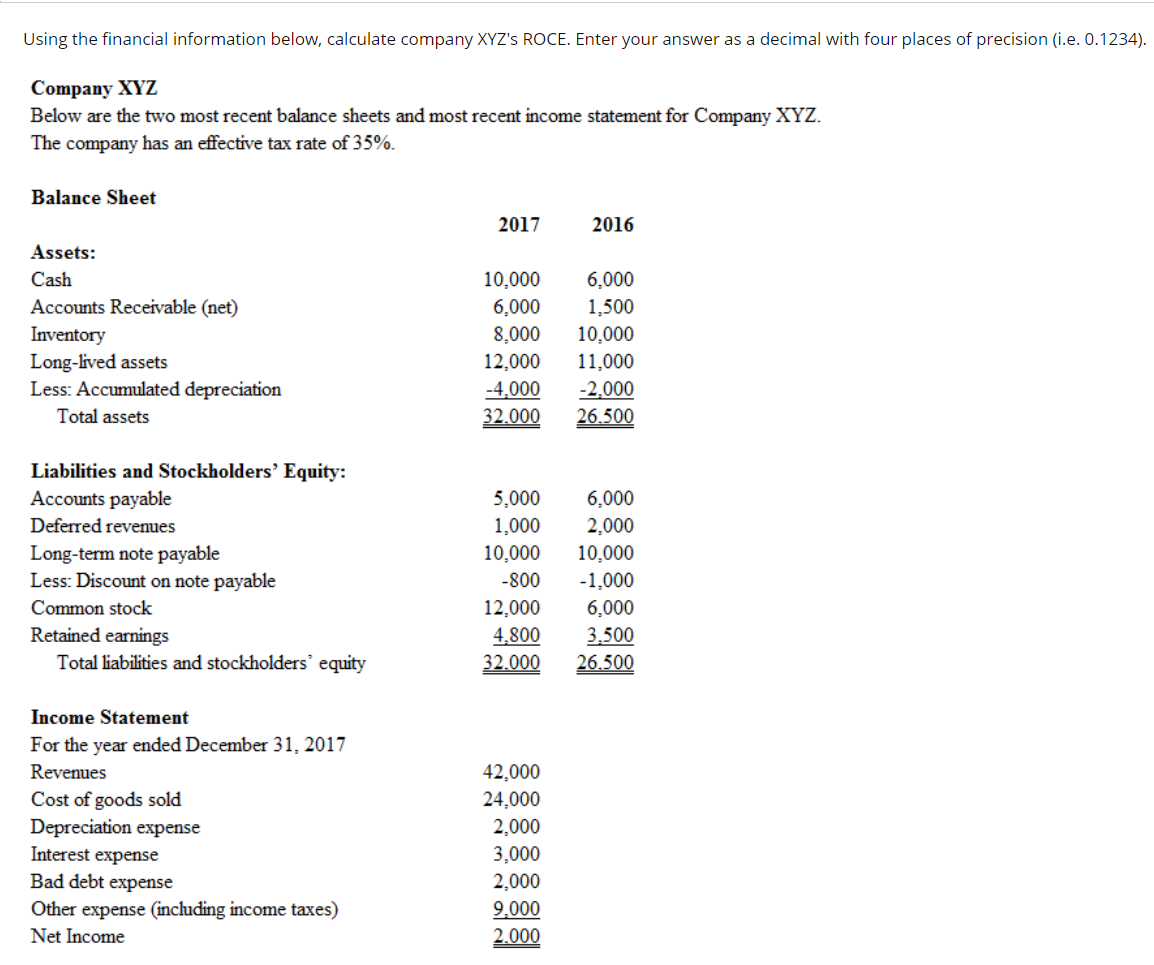

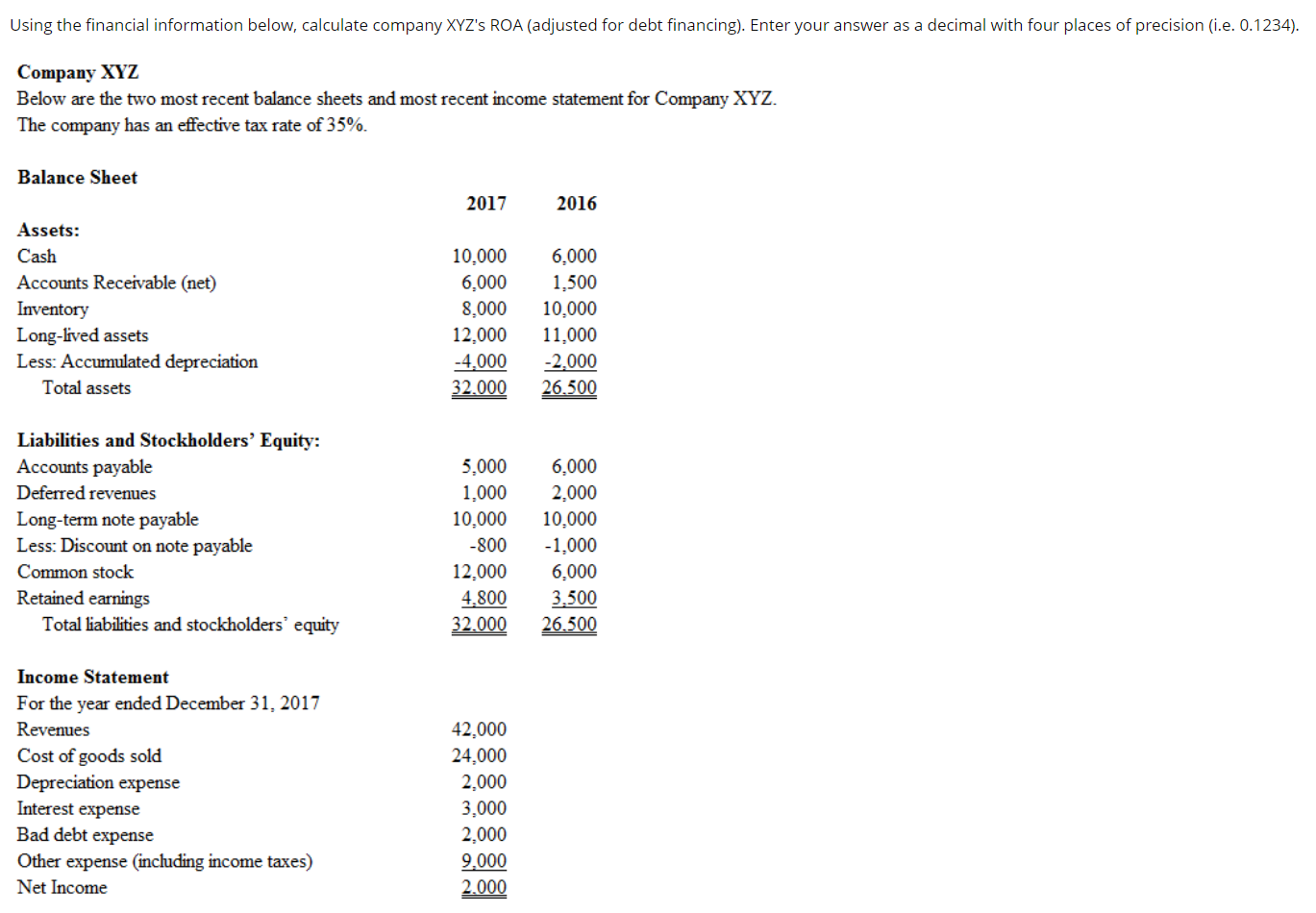

Managers at Funck Inc. provide you with the following data: Ending receivables balance: $450,000 Receivables, on average, can be converted to cash in 28 days Ending inventory balance: $375,000 Inventory, on average, can be liquidated in 43 days How many days will it take to convert the receivables and inventory to cash? Enter your answer as a number with two decimal places of precision (i.e. 1.34) Using the financial information below, calculate company XYZ'S ROCE. Enter your answer as a decimal with four places of precision (i.e. 0.1234). Company XYZ Below are the two most recent balance sheets and most recent income statement for Company XYZ. The company has an effective tax rate of 35%. Balance Sheet 2017 2016 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets 10,000 6,000 8.000 12.000 -4,000 32.000 6,000 1,500 10,000 11,000 -2,000 26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity 5,000 1,000 10,000 -800 12,000 4.800 32.000 6,000 2,000 10,000 -1,000 6,000 3,500 26.500 Income Statement For the year ended December 31, 2017 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net Income 42,000 24,000 2.000 3,000 2.000 9,000 2.000 Using the financial information below, calculate company XYZ'S ROA (adjusted for debt financing). Enter your answer as a decimal with four places of precision (i.e. 0.1234). Company XYZ Below are the two most recent balance sheets and most recent income statement for Company XYZ. The company has an effective tax rate of 35%. Balance Sheet 2017 2016 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets 10,000 6,000 8,000 12,000 -4,000 32.000 6,000 1,500 10,000 11,000 -2,000 26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity 5,000 1,000 10,000 -800 12,000 4.800 32.000 6,000 2,000 10,000 -1,000 6,000 3.500 26.500 Income Statement For the year ended December 31, 2017 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net Income 42.000 24,000 2,000 3,000 2,000 9,000 2.000 Managers at Funck Inc. provide you with the following data: Ending receivables balance: $450,000 Receivables, on average, can be converted to cash in 28 days Ending inventory balance: $375,000 Inventory, on average, can be liquidated in 43 days How many days will it take to convert the receivables and inventory to cash? Enter your answer as a number with two decimal places of precision (i.e. 1.34) Using the financial information below, calculate company XYZ'S ROCE. Enter your answer as a decimal with four places of precision (i.e. 0.1234). Company XYZ Below are the two most recent balance sheets and most recent income statement for Company XYZ. The company has an effective tax rate of 35%. Balance Sheet 2017 2016 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets 10,000 6,000 8.000 12.000 -4,000 32.000 6,000 1,500 10,000 11,000 -2,000 26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity 5,000 1,000 10,000 -800 12,000 4.800 32.000 6,000 2,000 10,000 -1,000 6,000 3,500 26.500 Income Statement For the year ended December 31, 2017 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net Income 42,000 24,000 2.000 3,000 2.000 9,000 2.000 Using the financial information below, calculate company XYZ'S ROA (adjusted for debt financing). Enter your answer as a decimal with four places of precision (i.e. 0.1234). Company XYZ Below are the two most recent balance sheets and most recent income statement for Company XYZ. The company has an effective tax rate of 35%. Balance Sheet 2017 2016 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets 10,000 6,000 8,000 12,000 -4,000 32.000 6,000 1,500 10,000 11,000 -2,000 26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity 5,000 1,000 10,000 -800 12,000 4.800 32.000 6,000 2,000 10,000 -1,000 6,000 3.500 26.500 Income Statement For the year ended December 31, 2017 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net Income 42.000 24,000 2,000 3,000 2,000 9,000 2.000