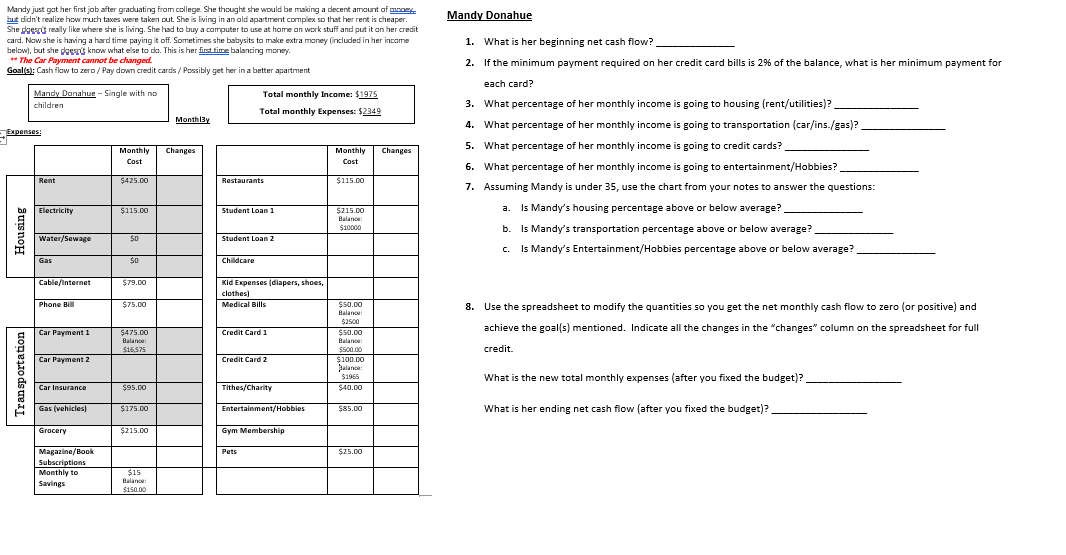

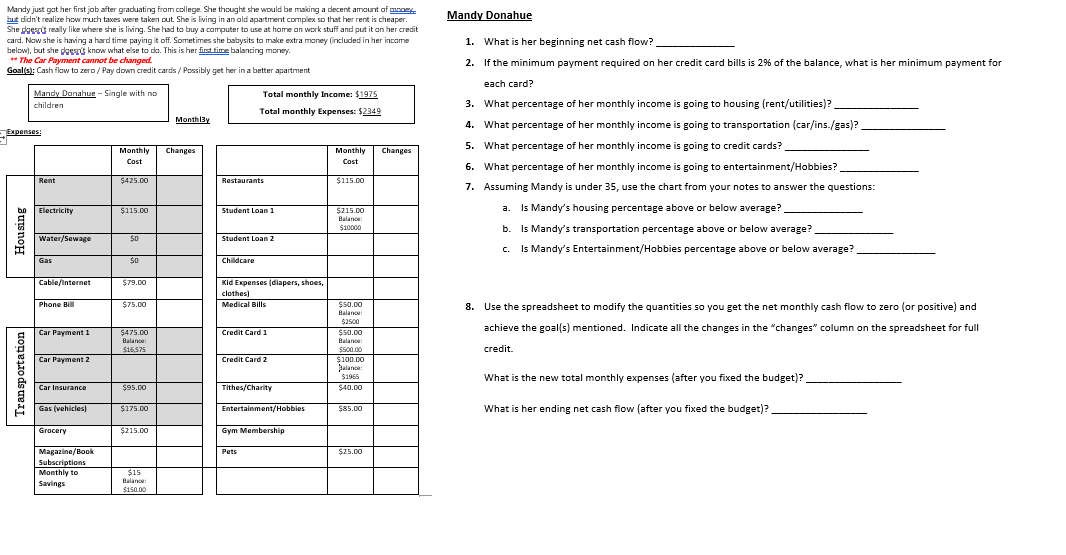

Mandy Donahue Mandy just gat her first job after graduating from college. She thought she would be maiting a decent amount of mone but didn't realize how much taxes were taken out. She is living in an old apartment complex so that her rent is cheaper. She post really like where she is living. She had to buy a computer to use at home an work stuff and put it on her credit card. Now she is having a hard time paying it off. Sometimes she babysits to make extra money included in her income below), but she doesnt know what else to do. This is her first time balancing money. ** The Car Payment cannot be changed. Goal(s): Cash flow to zero / Pay down credit cards / Possibly get her in a better apartment Mandy Danahue - Single with no children Total monthly Income: $1975 Total monthly Expenses: 52349 Monthly Expenses Changes Changes Monthly Cost Monthly Cost 1. What is her beginning net cash flow? 2. If the minimum payment required on her credit card bills is 2% of the balance, what is her minimum payment for each card? 3. What percentage of her monthly income is going to housing (rent/utilities)? 4. What percentage of her monthly income is going to transportation (car/ins./gas)? 5. What percentage of her monthly income is going to credit cards? 6. What percentage of her monthly income is going to entertainment/Hobbies? 7. Assuming Mandy is under 35, use the chart from your notes to answer the questions: Is Mandy's housing percentage above or below average? b. Is Mandy's transportation percentage above or below average? Is Mandy's Entertainment/Hobbies percentage above or below average? Rent $425.00 Restaurants $115.00 bo Electricity $115.00 Student Loan 1 a. Housing $215.00 Balance: $10000 Water/Sewage $0 Student Loan 2 C. Gas $0 Childcare Cable/Internet $79.00 Kid Expenses (diapers, shoes, clothes Medical Bills Phone Bill $75.00 8. Use the spreadsheet to modify the quantities so you get the net monthly cash flow to zero (or positive) and achieve the goal(s) mentioned. Indicate all the changes in the "changes" column on the spreadsheet for full Car Payment 1 Credit Card 1 $475.00 Balance $16,575 $50.00 Balance $2500 $50.00 Balance $500.00 $100.00 Balance $1965 $40.00 credit Car Payment 2 Credit Card 2 Transportation What is the new total monthly expenses (after you fixed the budget)? Car Insurance $95.00 Tithes/Charity Gas (vehicles $175.00 Entertainment/Hobbies $85.00 What is her ending net cash flow (after you fixed the budget)? Grocery $215.00 Gym Membership Pets $25.00 Magazine/Book Subscriptions Monthly to Savings $15 Balance: $150.00 Mandy Donahue Mandy just gat her first job after graduating from college. She thought she would be maiting a decent amount of mone but didn't realize how much taxes were taken out. She is living in an old apartment complex so that her rent is cheaper. She post really like where she is living. She had to buy a computer to use at home an work stuff and put it on her credit card. Now she is having a hard time paying it off. Sometimes she babysits to make extra money included in her income below), but she doesnt know what else to do. This is her first time balancing money. ** The Car Payment cannot be changed. Goal(s): Cash flow to zero / Pay down credit cards / Possibly get her in a better apartment Mandy Danahue - Single with no children Total monthly Income: $1975 Total monthly Expenses: 52349 Monthly Expenses Changes Changes Monthly Cost Monthly Cost 1. What is her beginning net cash flow? 2. If the minimum payment required on her credit card bills is 2% of the balance, what is her minimum payment for each card? 3. What percentage of her monthly income is going to housing (rent/utilities)? 4. What percentage of her monthly income is going to transportation (car/ins./gas)? 5. What percentage of her monthly income is going to credit cards? 6. What percentage of her monthly income is going to entertainment/Hobbies? 7. Assuming Mandy is under 35, use the chart from your notes to answer the questions: Is Mandy's housing percentage above or below average? b. Is Mandy's transportation percentage above or below average? Is Mandy's Entertainment/Hobbies percentage above or below average? Rent $425.00 Restaurants $115.00 bo Electricity $115.00 Student Loan 1 a. Housing $215.00 Balance: $10000 Water/Sewage $0 Student Loan 2 C. Gas $0 Childcare Cable/Internet $79.00 Kid Expenses (diapers, shoes, clothes Medical Bills Phone Bill $75.00 8. Use the spreadsheet to modify the quantities so you get the net monthly cash flow to zero (or positive) and achieve the goal(s) mentioned. Indicate all the changes in the "changes" column on the spreadsheet for full Car Payment 1 Credit Card 1 $475.00 Balance $16,575 $50.00 Balance $2500 $50.00 Balance $500.00 $100.00 Balance $1965 $40.00 credit Car Payment 2 Credit Card 2 Transportation What is the new total monthly expenses (after you fixed the budget)? Car Insurance $95.00 Tithes/Charity Gas (vehicles $175.00 Entertainment/Hobbies $85.00 What is her ending net cash flow (after you fixed the budget)? Grocery $215.00 Gym Membership Pets $25.00 Magazine/Book Subscriptions Monthly to Savings $15 Balance: $150.00