Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Manhattan Partners provides management consulting services to government and corporate clients. Manhattan has two support departmentsadministrative services (AS) and information systems (IS)and two operating departmentsgovernment

Manhattan

Partners provides management consulting services to government and corporate clients.

Manhattan

has two support

departmentsadministrative

services (AS) and information systems

(IS)and

two operating

departmentsgovernment

consulting (GOVT) and corporate consulting (CORP). For the first quarter of

2020,

Manhattan's

cost records indicate the following:

please answer ALL parts

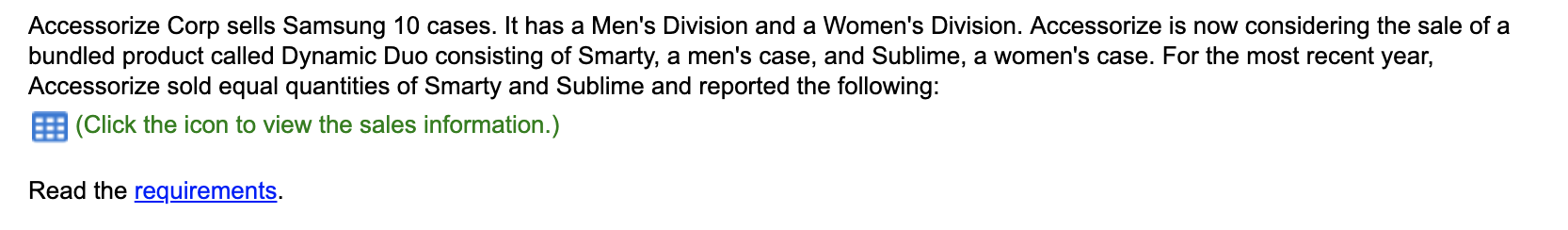

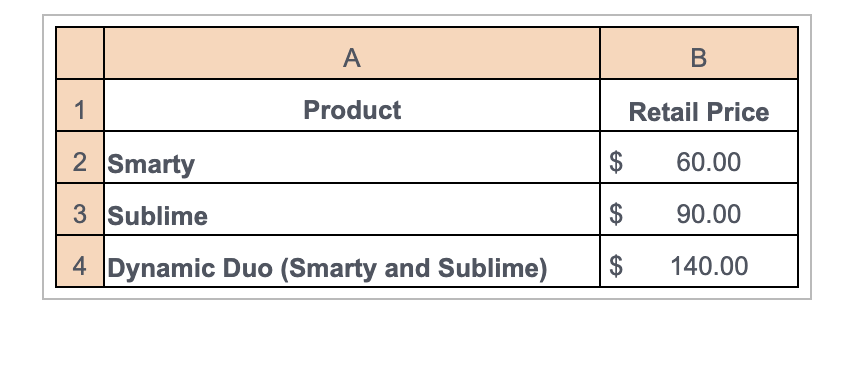

Accessorize Corp sells Samsung 10 cases. It has a Men's Division and a Women's Division. Accessorize is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men's case, and Sublime, a women's case. For the most recent year, Accessorize sold equal quantities of Smarty and Sublime and reported the following: (Click the icon to view the sales information.) Read the \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & Product & Retail Price \\ \hline 2 & Smarty & $60.00 \\ \hline 3 & Sublime & $90.00 \\ \hline 4 & Dynamic Duo (Smarty and Sublime) & 140.00 \\ \hline \end{tabular} 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1 , which one would you recommend for allocating Accessorize's revenues to Smarty and Sublime? Explain. Accessorize Corp sells Samsung 10 cases. It has a Men's Division and a Women's Division. Accessorize is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men's case, and Sublime, a women's case. For the most recent year, Accessorize sold equal quantities of Smarty and Sublime and reported the following: (Click the icon to view the sales information.) Read the \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & Product & Retail Price \\ \hline 2 & Smarty & $60.00 \\ \hline 3 & Sublime & $90.00 \\ \hline 4 & Dynamic Duo (Smarty and Sublime) & 140.00 \\ \hline \end{tabular} 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1 , which one would you recommend for allocating Accessorize's revenues to Smarty and Sublime? Explain

Accessorize Corp sells Samsung 10 cases. It has a Men's Division and a Women's Division. Accessorize is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men's case, and Sublime, a women's case. For the most recent year, Accessorize sold equal quantities of Smarty and Sublime and reported the following: (Click the icon to view the sales information.) Read the \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & Product & Retail Price \\ \hline 2 & Smarty & $60.00 \\ \hline 3 & Sublime & $90.00 \\ \hline 4 & Dynamic Duo (Smarty and Sublime) & 140.00 \\ \hline \end{tabular} 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1 , which one would you recommend for allocating Accessorize's revenues to Smarty and Sublime? Explain. Accessorize Corp sells Samsung 10 cases. It has a Men's Division and a Women's Division. Accessorize is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men's case, and Sublime, a women's case. For the most recent year, Accessorize sold equal quantities of Smarty and Sublime and reported the following: (Click the icon to view the sales information.) Read the \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline 1 & Product & Retail Price \\ \hline 2 & Smarty & $60.00 \\ \hline 3 & Sublime & $90.00 \\ \hline 4 & Dynamic Duo (Smarty and Sublime) & 140.00 \\ \hline \end{tabular} 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1 , which one would you recommend for allocating Accessorize's revenues to Smarty and Sublime? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started