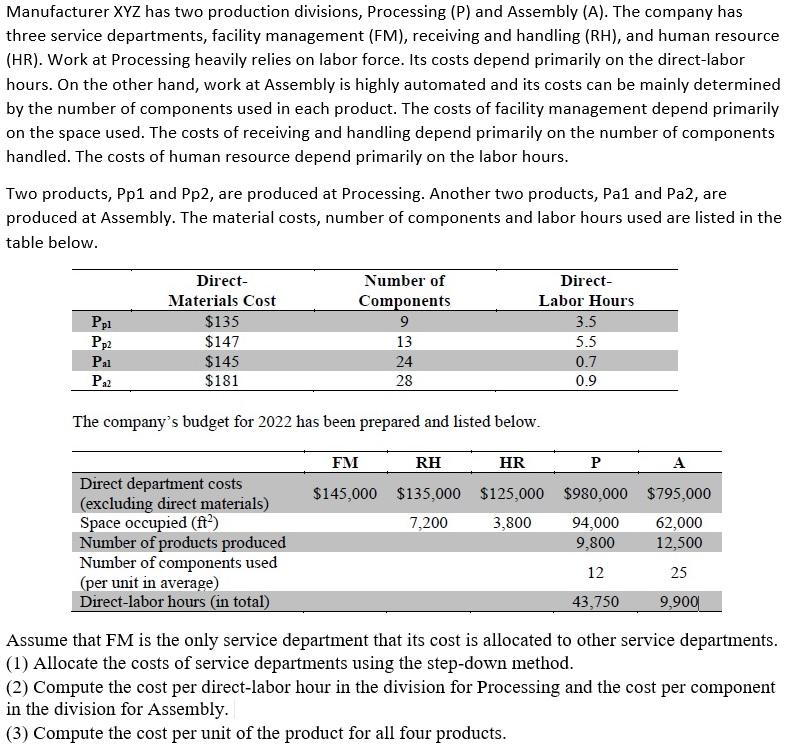

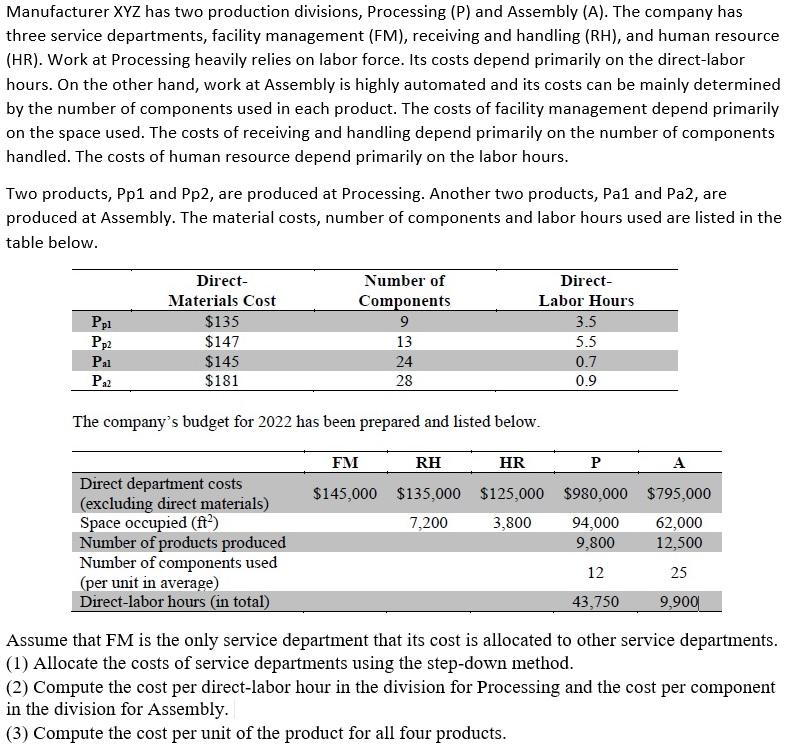

Manufacturer XYZ has two production divisions, Processing (P) and Assembly (A). The company has three service departments, facility management (FM), receiving and handling (RH), and human resource (HR). Work at Processing heavily relies on labor force. Its costs depend primarily on the direct-labor hours. On the other hand, work at Assembly is highly automated and its costs can be mainly determined by the number of components used in each product. The costs of facility management depend primarily on the space used. The costs of receiving and handling depend primarily on the number of components handled. The costs of human resource depend primarily on the labor hours. Two products, Pp1 and Pp2, are produced at Processing. Another two products, Pal and Pa2, are produced at Assembly. The material costs, number of components and labor hours used are listed in the table below. Direct- Labor Hours 3.5 Ppi Pp2 Pai P22 Direct- Materials Cost $135 $147 $145 $181 Number of Components 9 13 24 28 5.5 0.7 0.9 The company's budget for 2022 has been prepared and listed below. Direct department costs (excluding direct materials) Space occupied (ft) Number of products produced Number of components used (per unit in average) Direct-labor hours (in total) FM RH HR P A $145,000 $135,000 $125,000 $980,000 $795,000 7,200 3,800 94,000 62,000 9,800 12,500 12 25 43,750 9,900 Assume that FM is the only service department that its cost is allocated to other service departments. (1) Allocate the costs of service departments using the step-down method. (2) Compute the cost per direct-labor hour in the division for Processing and the cost per component in the division for Assembly. (3) Compute the cost per unit of the product for all four products. Manufacturer XYZ has two production divisions, Processing (P) and Assembly (A). The company has three service departments, facility management (FM), receiving and handling (RH), and human resource (HR). Work at Processing heavily relies on labor force. Its costs depend primarily on the direct-labor hours. On the other hand, work at Assembly is highly automated and its costs can be mainly determined by the number of components used in each product. The costs of facility management depend primarily on the space used. The costs of receiving and handling depend primarily on the number of components handled. The costs of human resource depend primarily on the labor hours. Two products, Pp1 and Pp2, are produced at Processing. Another two products, Pal and Pa2, are produced at Assembly. The material costs, number of components and labor hours used are listed in the table below. Direct- Labor Hours 3.5 Ppi Pp2 Pai P22 Direct- Materials Cost $135 $147 $145 $181 Number of Components 9 13 24 28 5.5 0.7 0.9 The company's budget for 2022 has been prepared and listed below. Direct department costs (excluding direct materials) Space occupied (ft) Number of products produced Number of components used (per unit in average) Direct-labor hours (in total) FM RH HR P A $145,000 $135,000 $125,000 $980,000 $795,000 7,200 3,800 94,000 62,000 9,800 12,500 12 25 43,750 9,900 Assume that FM is the only service department that its cost is allocated to other service departments. (1) Allocate the costs of service departments using the step-down method. (2) Compute the cost per direct-labor hour in the division for Processing and the cost per component in the division for Assembly. (3) Compute the cost per unit of the product for all four products