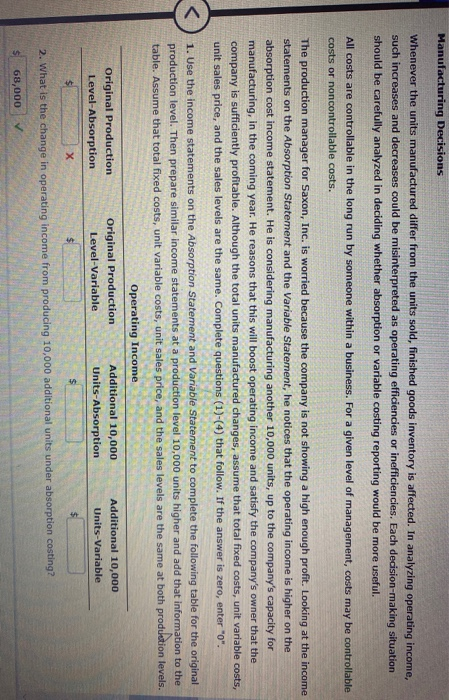

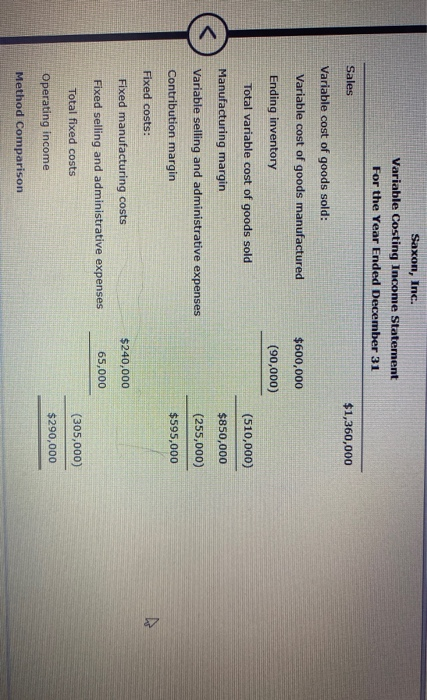

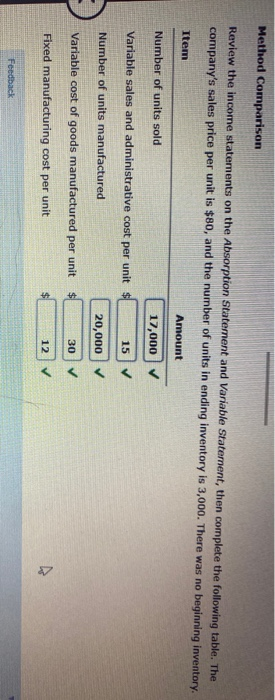

Manufacturing Decisions Whenever the units manufactured differ from the units sold, finished goods inventory is affected. In analyzing operating income, such increases and decreases could be misinterpreted as operating efficiencies or inefficiencies. Each decision-making situation should be carefully analyzed in deciding whether absorption or variable costing reporting would be more useful. All costs are controllable in the long run by someone within a business. For a given level of management, costs may be controllable costs or noncontrollable costs. The production manager for Saxon, Inc. is worried because the company is not showing a high enough profit. Looking at the income statements on the Absorption Statement and the Variable Statement, he notices that the operating income is higher on the absorption cost income statement. He is considering manufacturing another 10,000 units, up to the company's capacity for manufacturing, in the coming year. He reasons that this will boost operating income and satisfy the company's owner that the company is sufficiently profitable. Although the total units manufactured changes, assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same. Complete questions (1)-(4) that follow. If the answer is zero, enter "O". 1. Use the income statements on the Absorption Statement and Variable Statement to complete the following table for the original production level. Then prepare similar income statements at a production level 10,000 units higher and add that information to the table. Assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same at both production levels. Operating Income Original Production Original Production Additional 10,000 Additional 10,000 Level-Absorption Level-Variable Units-Absorption Units-Variable $ X 2. What is the change in operating income from producing 10,000 additional units under absorption costing? $ 68,000 Saxon, Inc. Variable Costing Income Statement For the Year Ended December 31 Sales Variable cost of goods sold: Variable cost of goods manufactured $600,000 Ending inventory (90,000) Total variable cost of goods sold (510,000) $850,000 Manufacturing margin Variable selling and administrative expenses (255,000) $595,000 Contribution margin Fixed costs: $240,000 Fixed manufacturing costs Fixed selling and administrative expenses 65,000 Total fixed costs (305,000) $290,000 Operating income Method Comparison Method Comparison Review the income statements on the Absorption Statement and Variable Statement, then complete the following table. The company's sales price per unit is $80, and the number of units in ending inventory is 3,000. There was no beginning inventory Item Amount Number of units sold 17,000 Variable sales and administrative cost per unit $ Number of units manufactured 15 20,000 30 12 Variable cost of goods manufactured per unit $ $ Fixed manufacturing cost per unit Feedback Manufacturing Decisions Whenever the units manufactured differ from the units sold, finished goods inventory is affected. In analyzing operating income, such increases and decreases could be misinterpreted as operating efficiencies or inefficiencies. Each decision-making situation should be carefully analyzed in deciding whether absorption or variable costing reporting would be more useful. All costs are controllable in the long run by someone within a business. For a given level of management, costs may be controllable costs or noncontrollable costs. The production manager for Saxon, Inc. is worried because the company is not showing a high enough profit. Looking at the income statements on the Absorption Statement and the Variable Statement, he notices that the operating income is higher on the absorption cost income statement. He is considering manufacturing another 10,000 units, up to the company's capacity for manufacturing, in the coming year. He reasons that this will boost operating income and satisfy the company's owner that the company is sufficiently profitable. Although the total units manufactured changes, assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same. Complete questions (1)-(4) that follow. If the answer is zero, enter "O". 1. Use the income statements on the Absorption Statement and Variable Statement to complete the following table for the original production level. Then prepare similar income statements at a production level 10,000 units higher and add that information to the table. Assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same at both production levels. Operating Income Original Production Original Production Additional 10,000 Additional 10,000 Level-Absorption Level-Variable Units-Absorption Units-Variable $ X 2. What is the change in operating income from producing 10,000 additional units under absorption costing? $ 68,000 Saxon, Inc. Variable Costing Income Statement For the Year Ended December 31 Sales Variable cost of goods sold: Variable cost of goods manufactured $600,000 Ending inventory (90,000) Total variable cost of goods sold (510,000) $850,000 Manufacturing margin Variable selling and administrative expenses (255,000) $595,000 Contribution margin Fixed costs: $240,000 Fixed manufacturing costs Fixed selling and administrative expenses 65,000 Total fixed costs (305,000) $290,000 Operating income Method Comparison Method Comparison Review the income statements on the Absorption Statement and Variable Statement, then complete the following table. The company's sales price per unit is $80, and the number of units in ending inventory is 3,000. There was no beginning inventory Item Amount Number of units sold 17,000 Variable sales and administrative cost per unit $ Number of units manufactured 15 20,000 30 12 Variable cost of goods manufactured per unit $ $ Fixed manufacturing cost per unit Feedback