Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mapolomoko Ltd is evaluating a proposal to purchase a new drill press to replace a less efficient machine presently in use. The cost of the

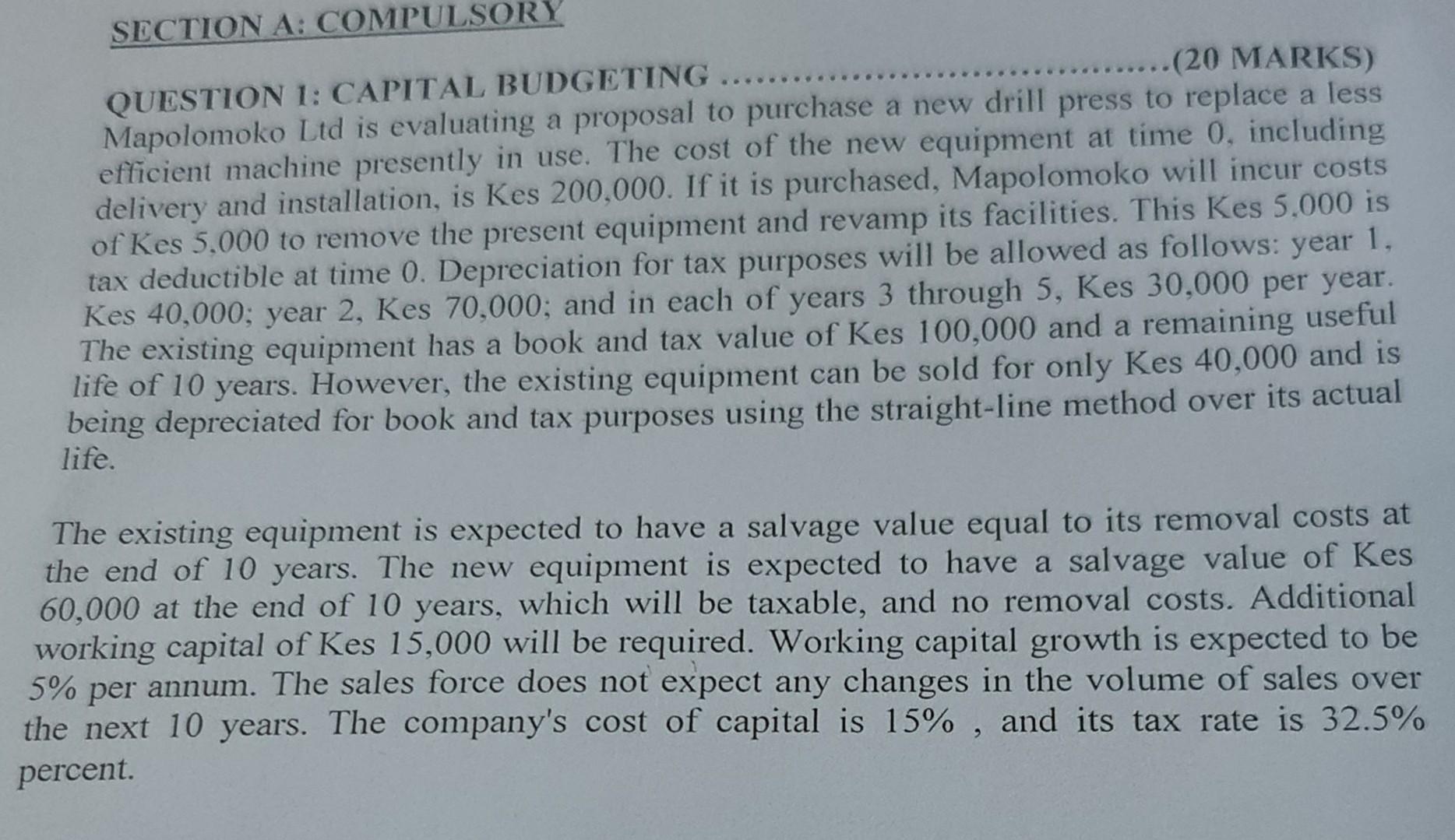

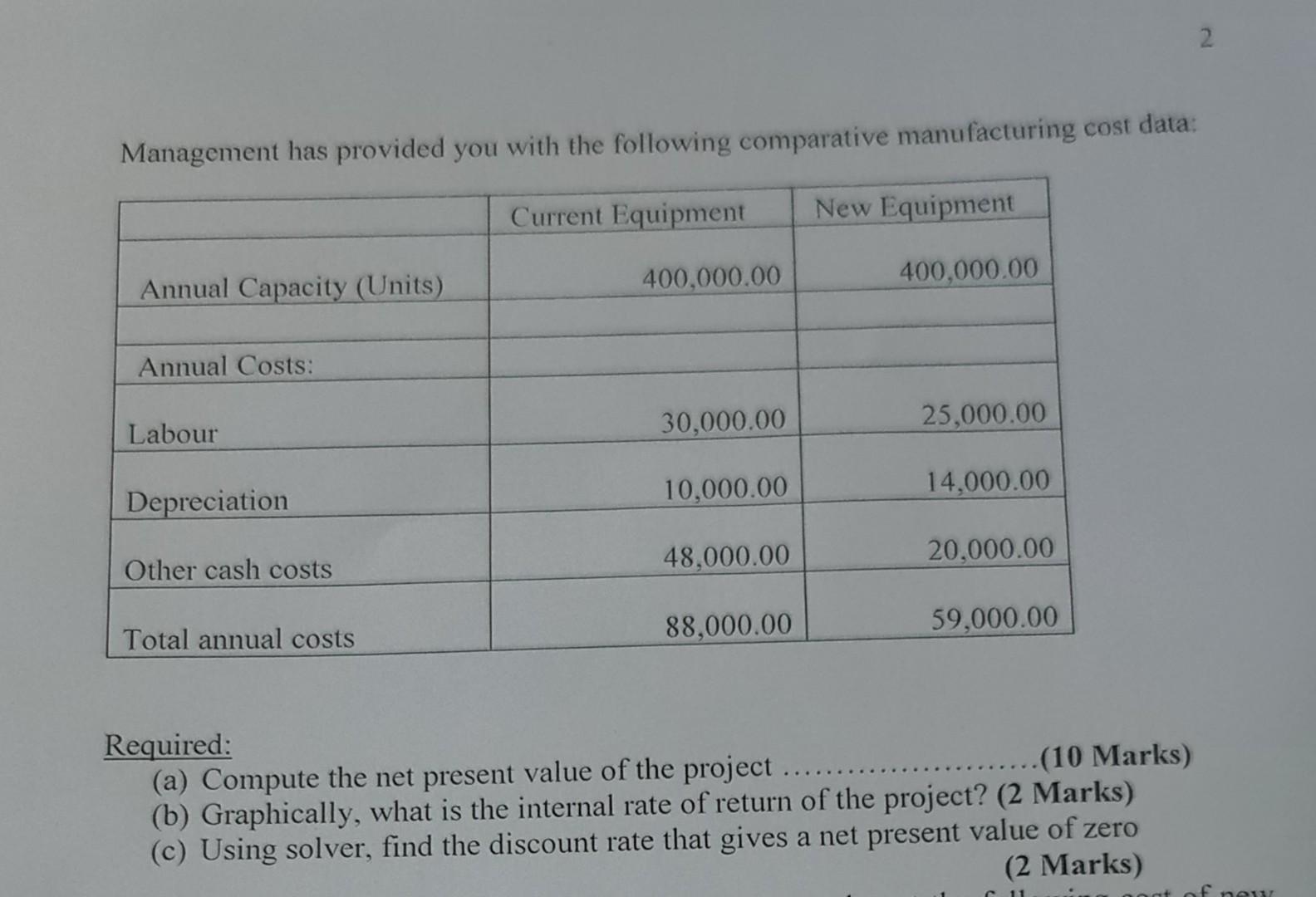

Mapolomoko Ltd is evaluating a proposal to purchase a new drill press to replace a less efficient machine presently in use. The cost of the new equipment at time 0 , including delivery and installation, is Kes 200,000. If it is purchased, Mapolomoko will incur costs of Kes 5,000 to remove the present equipment and revamp its facilities. This Kes 5,000 is tax deductible at time 0 . Depreciation for tax purposes will be allowed as follows: year 1 , The existing equipment has a book and tax value of Kes 100,000 and a remaining useful The of 10 years. However, the existing equipment can be sold for only Kes 40,000 and is being depreciated for book and tax purposes using the straight-line method over its actual life. The existing equipment is expected to have a salvage value equal to its removal costs at the end of 10 years. The new equipment is expected to have a salvage value of Kes 60,000 at the end of 10 years, which will be taxable, and no removal costs. Additional working capital of Kes 15,000 will be required. Working capital growth is expected to be 5% per annum. The sales force does not expect any changes in the volume of sales over the next 10 years. The company's cost of capital is 15%, and its tax rate is 32.5% percent. Management has provided you with the following comparative manufacturing cost data: Required: (a) Compute the net present value of the project (10 Marks) (b) Graphically, what is the internal rate of return of the project? (2 Marks) (c) Using solver, find the discount rate that gives a net present value of zero (2 Marks) Mapolomoko Ltd is evaluating a proposal to purchase a new drill press to replace a less efficient machine presently in use. The cost of the new equipment at time 0 , including delivery and installation, is Kes 200,000. If it is purchased, Mapolomoko will incur costs of Kes 5,000 to remove the present equipment and revamp its facilities. This Kes 5,000 is tax deductible at time 0 . Depreciation for tax purposes will be allowed as follows: year 1 , The existing equipment has a book and tax value of Kes 100,000 and a remaining useful The of 10 years. However, the existing equipment can be sold for only Kes 40,000 and is being depreciated for book and tax purposes using the straight-line method over its actual life. The existing equipment is expected to have a salvage value equal to its removal costs at the end of 10 years. The new equipment is expected to have a salvage value of Kes 60,000 at the end of 10 years, which will be taxable, and no removal costs. Additional working capital of Kes 15,000 will be required. Working capital growth is expected to be 5% per annum. The sales force does not expect any changes in the volume of sales over the next 10 years. The company's cost of capital is 15%, and its tax rate is 32.5% percent. Management has provided you with the following comparative manufacturing cost data: Required: (a) Compute the net present value of the project (10 Marks) (b) Graphically, what is the internal rate of return of the project? (2 Marks) (c) Using solver, find the discount rate that gives a net present value of zero (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started