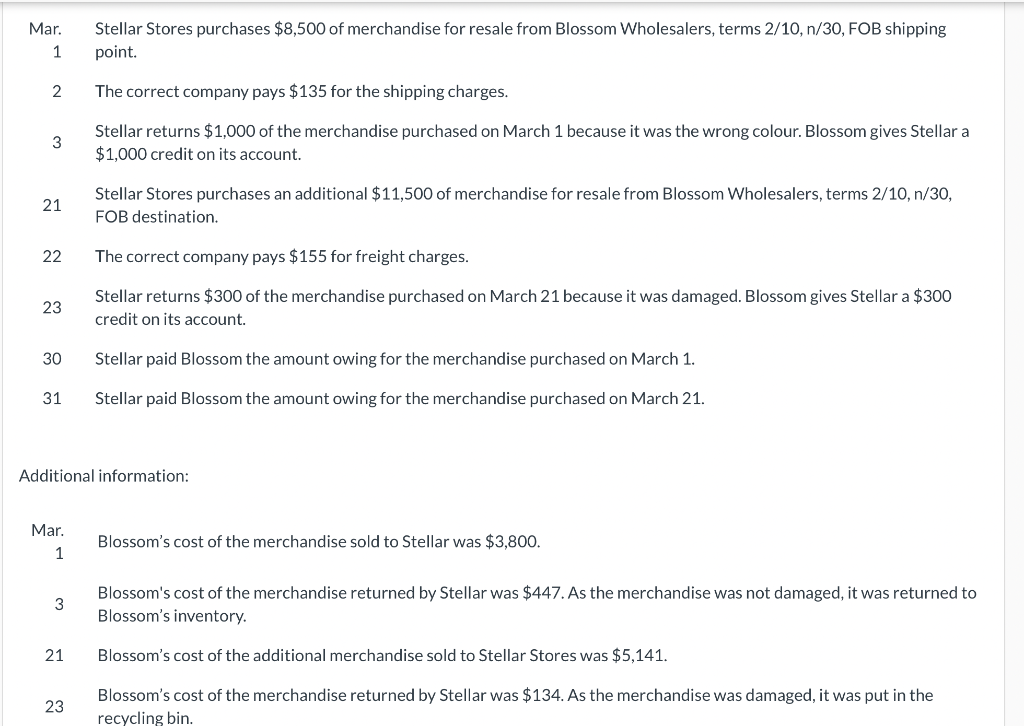

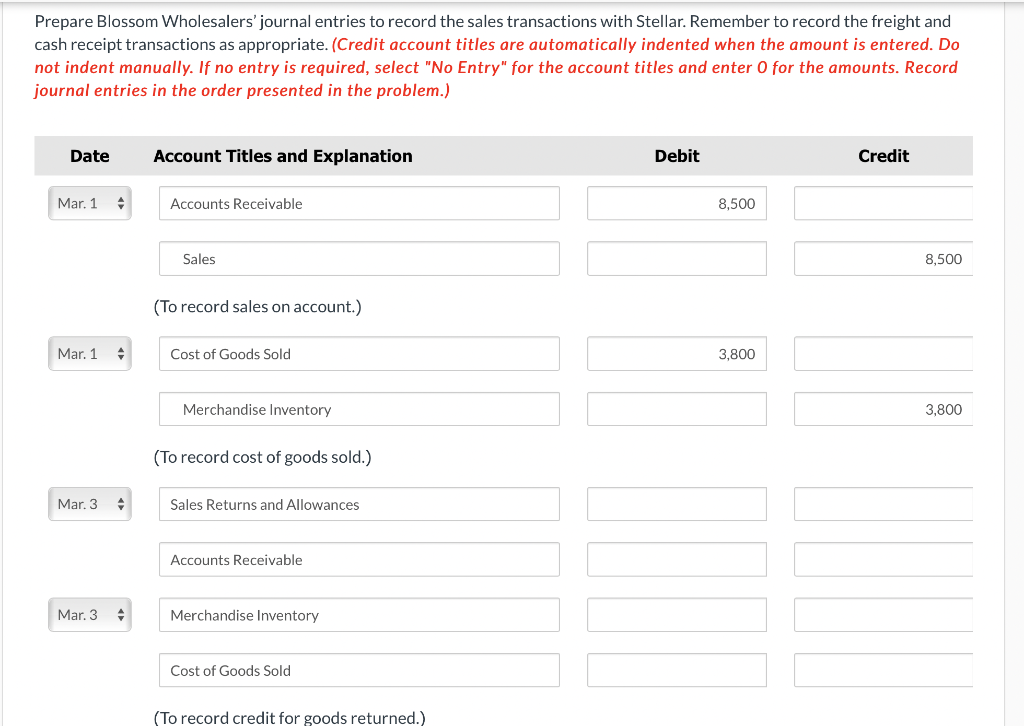

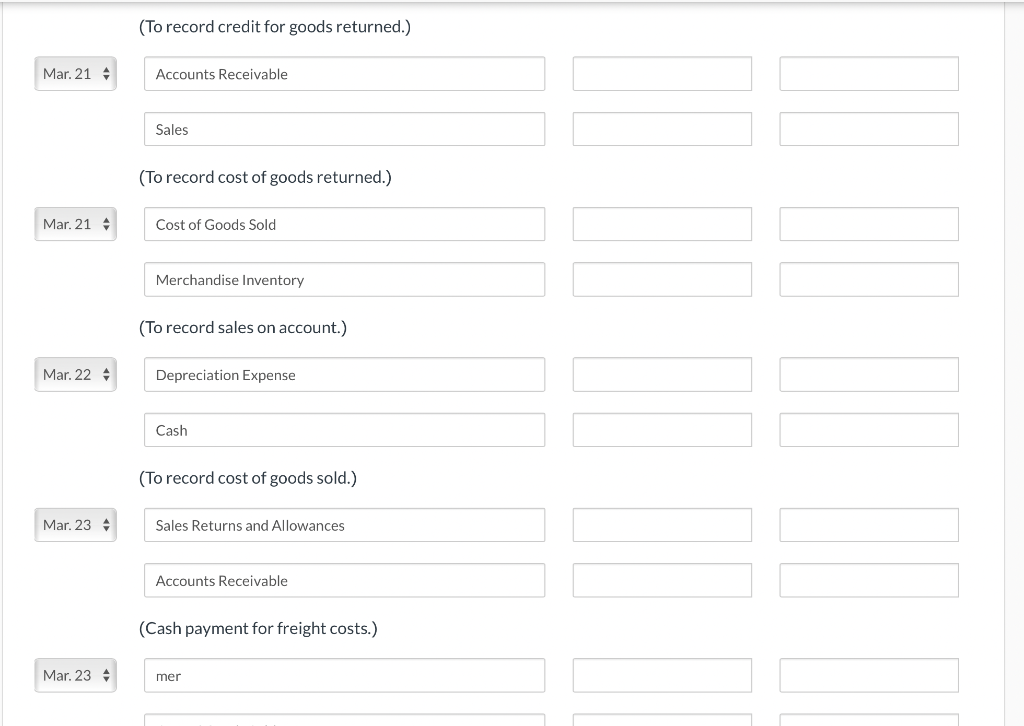

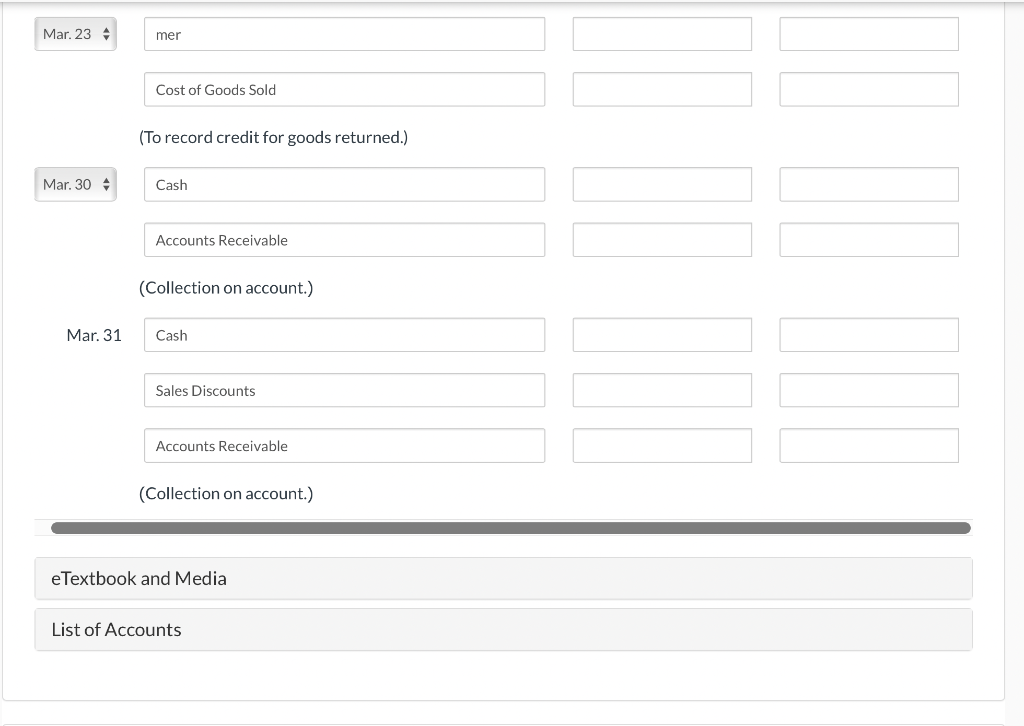

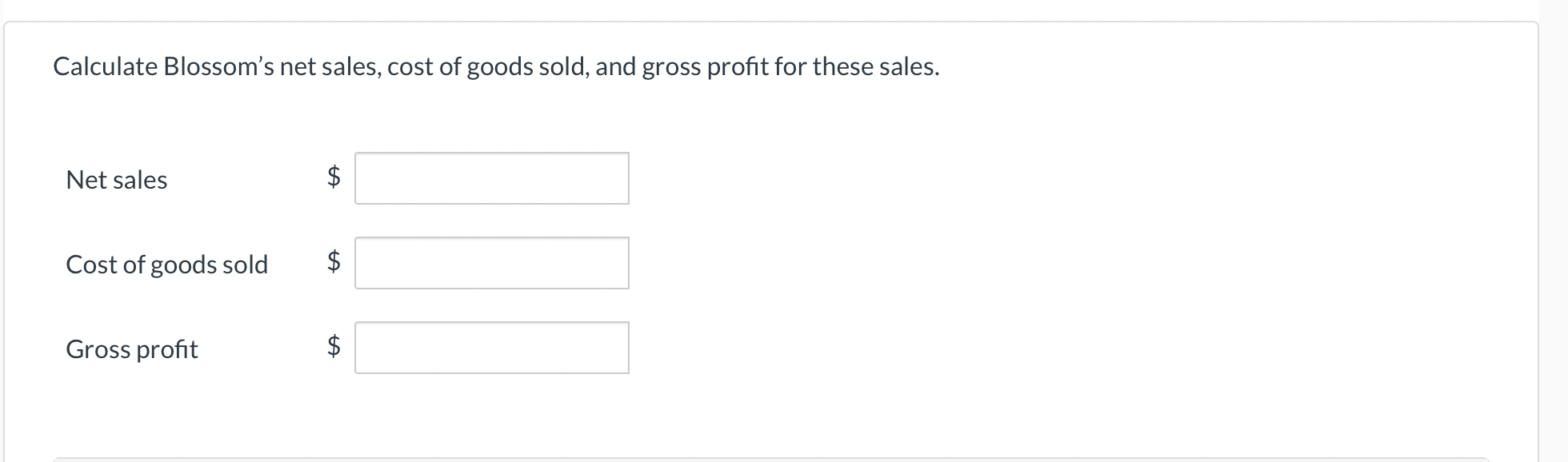

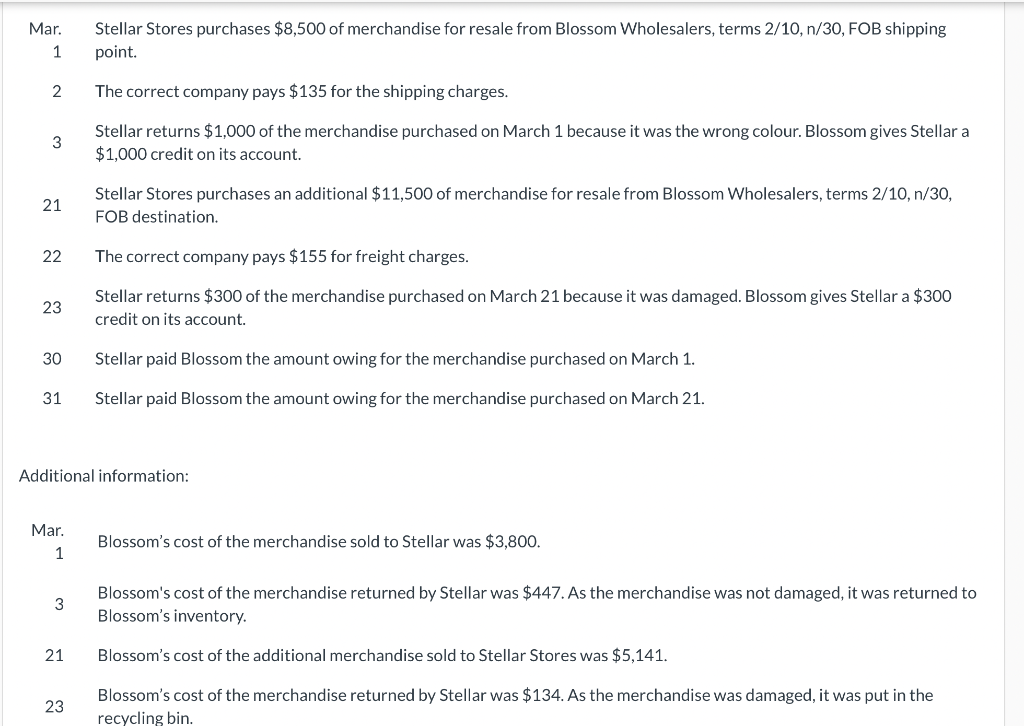

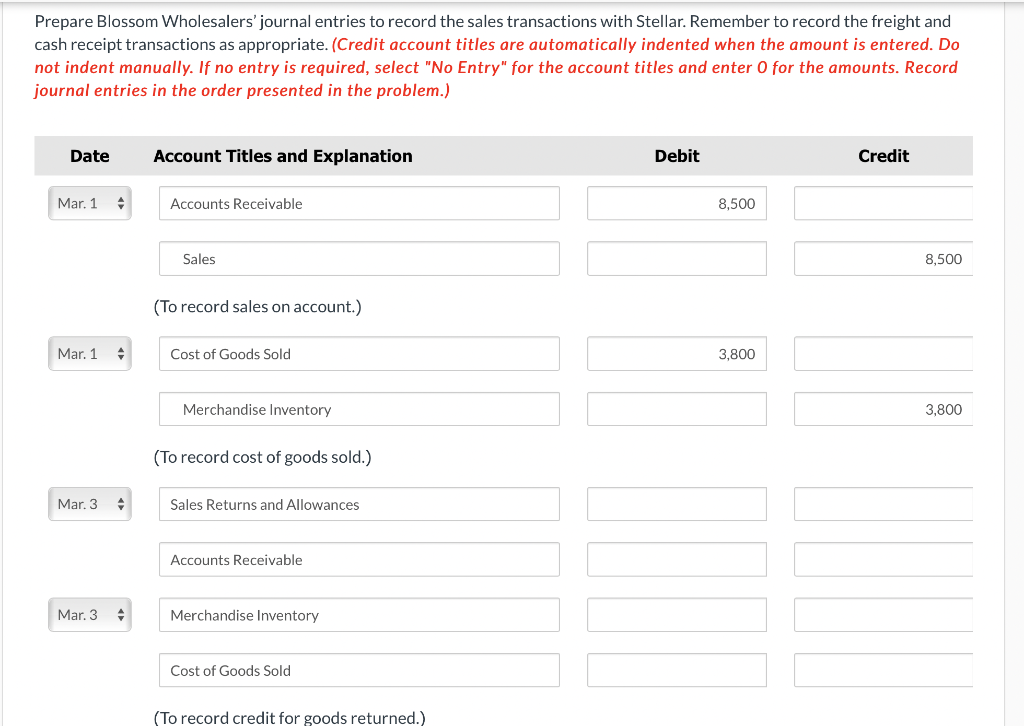

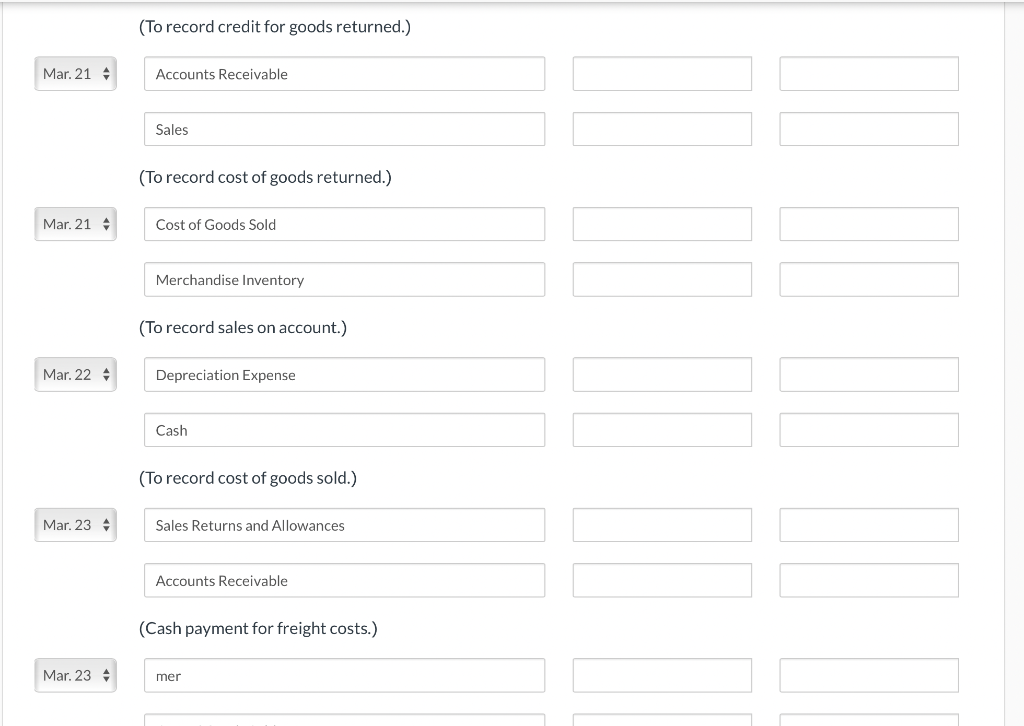

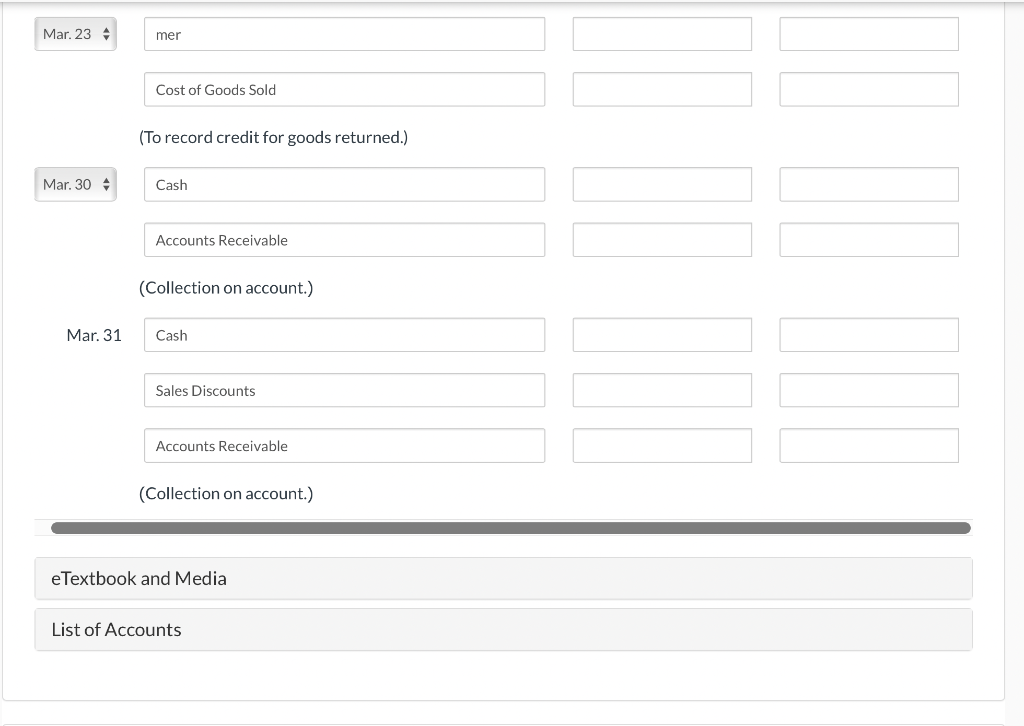

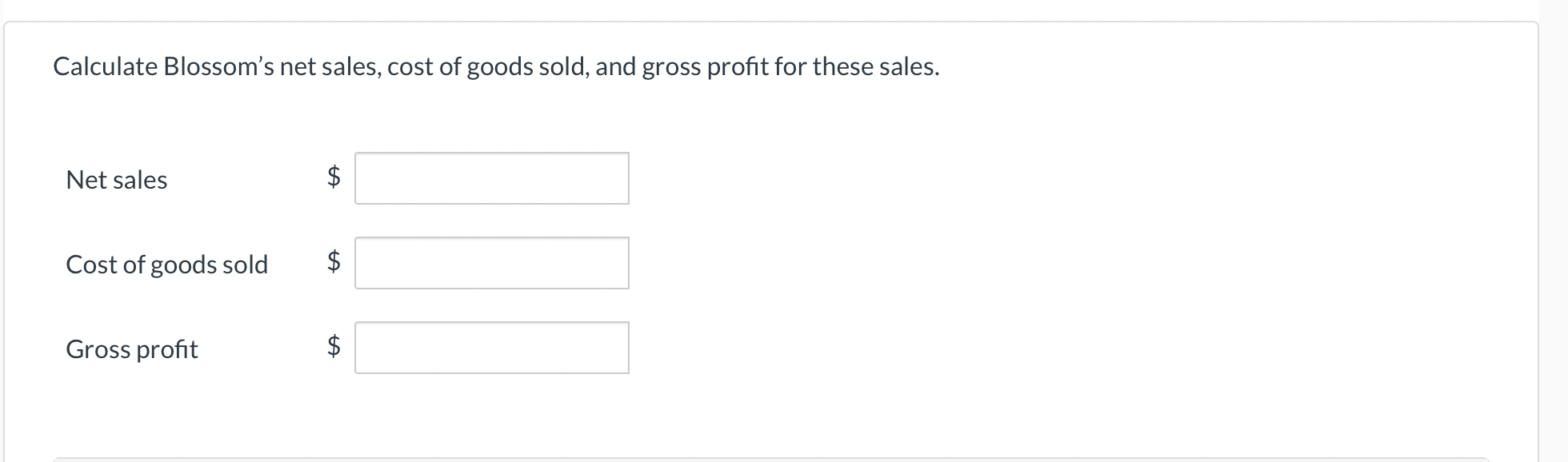

Mar. 1 Stellar Stores purchases $8,500 of merchandise for resale from Blossom Wholesalers, terms 2/10, n/30, FOB shipping point. 2 The correct company pays $135 for the shipping charges. 3 Stellar returns $1,000 of the merchandise purchased on March 1 because it was the wrong colour. Blossom gives Stellar a $1,000 credit on its account. 21 Stellar Stores purchases an additional $11,500 of merchandise for resale from Blossom Wholesalers, terms 2/10, n/30, FOB destination. 22 The correct company pays $155 for freight charges. 23 Stellar returns $300 of the merchandise purchased on March 21 because it was damaged. Blossom gives Stellar a $300 credit on its account. 30 Stellar paid Blossom the amount owing for the merchandise purchased on March 1. 31 Stellar paid Blossom the amount owing for the merchandise purchased on March 21. Additional information: Mar. 1 Blossom's cost of the merchandise sold to Stellar was $3,800. 3 Blossom's cost of the merchandise returned by Stellar was $447. As the merchandise was not damaged, it was returned to Blossom's inventory. 21 Blossom's cost of the additional merchandise sold to Stellar Stores was $5,141. 23 Blossom's cost of the merchandise returned by Stellar was $134. As the merchandise was damaged, it was put in the recycling bin. Prepare Blossom Wholesalers' journal entries to record the sales transactions with Stellar. Remember to record the freight and cash receipt transactions as appropriate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Mar. 1 Accounts Receivable 8,500 Sales 8,500 (To record sales on account.) Mar. 1 Cost of Goods Sold 3,800 Merchandise Inventory 3,800 (To record cost of goods sold.) Mar. 3 Sales Returns and Allowances Accounts Receivable Mar. 3 Merchandise Inventory Cost of Goods Sold (To record credit for goods returned.) (To record credit for goods returned.) Mar. 21 Accounts Receivable Sales (To record cost of goods returned.) Mar. 21 Cost of Goods Sold Merchandise Inventory (To record sales on account.) Mar. 224 Depreciation Expense Cash (To record cost of goods sold.) Mar. 23 Sales Returns and Allowances Accounts Receivable (Cash payment for freight costs.) Mar. 234 mer Mar. 234 mer Cost of Goods Sold (To record credit for goods returned.) Mar. 304 Cash Accounts Receivable (Collection on account.) Mar. 31 Cash Sales Discounts Accounts Receivable (Collection on account.) e Textbook and Media List of Accounts Calculate Blossom's net sales, cost of goods sold, and gross profit for these sales. Net sales $ Cost of goods sold $ ta Gross profit ta