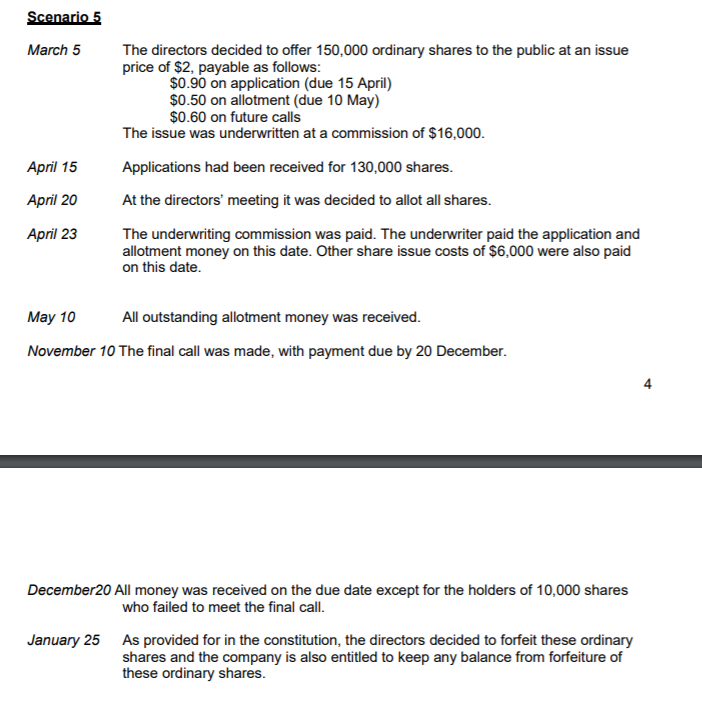

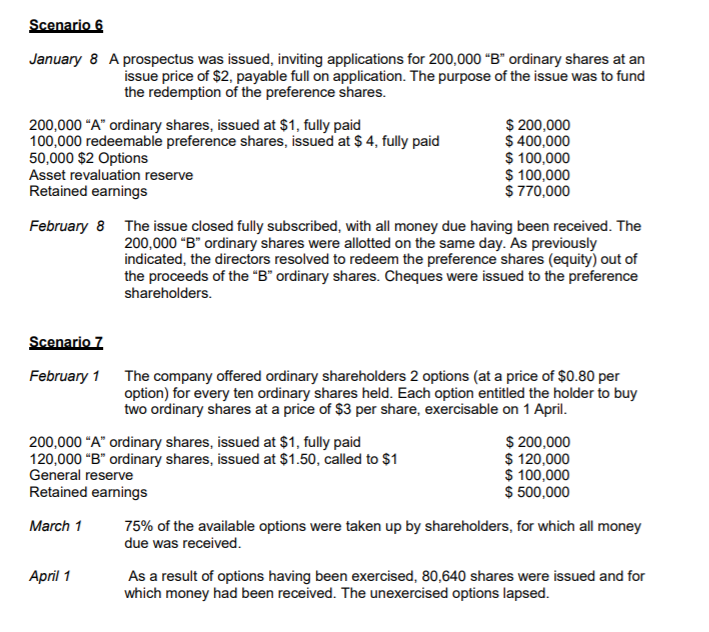

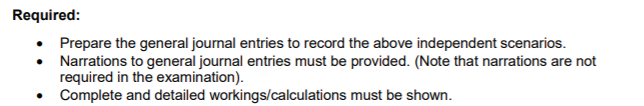

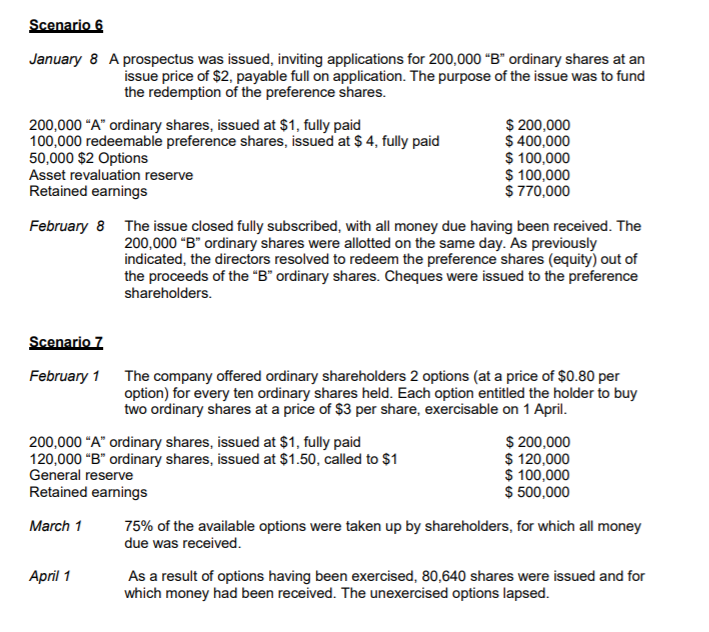

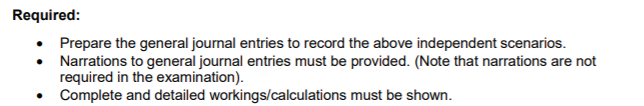

March 5 The directors decided to offer 150,000 ordinary shares to the public at an issue price of $2, payable as follows: $0.50 on allotment (due 10 May) $0.60 on future calls The issue was underwritten at a commission of $16,000. Applications had been received for 130,000 shares. At the directors' meeting it was decided to allot all shares. April 15 April 20 April 23 The underwriting commission was paid. The underwriter paid the application and allotment money on this date. Other share issue costs of $6,000 were also paid on this date May 10 All outstanding allotment money was received. November 10 The final call was made, with payment due by 20 December. 4 December20 All money was received on the due date except for the holders of 10,000 shares who failed to meet the final call January 25 As provided for in the constitution, the directors decided to forfeit these ordinary shares and the company is also entitled to keep any balance from forfeiture of these ordinary shares. January 8 A prospectus was issued, inviting applications for 200,000 "B ordinary shares at an issue price of $2, payable full on application. The purpose of the issue was to fund the redemption of the preference shares. 200,000 "A" ordinary shares, issued at $1, fully paid 100,000 redeemable preference shares, issued at S 4, fully paid 50,000 $2 Options Asset revaluation reserve Retained earnings $ 200,000 $ 400,000 $ 100,000 100,000 $ 770,000 February 8 The issue closed fully subscribed, with all money due having been received. The 200,000 "B" ordinary shares were allotted on the same day. As previously indicated, the directors resolved to redeem the preference shares (equity) out of the proceeds of the "B" ordinary shares. Cheques were issued to the preference shareholders. February 1 The company offered ordinary shareholders 2 options (at a price of $0.80 per option) for every ten ordinary shares held. Each option entitled the holder to buy two ordinary shares at a price of $3 per share, exercisable on 1 April 200,000 "A" ordinary shares, issued at $1, fully paid 120,000 "B" ordinary shares, issued at $1.50, called to $1 General reserve Retained earnings $ 200,000 120,000 $ 100,000 $ 500,000 March 1 75% of the available options were taken up by shareholders, for which all money due was received April 1 As a result of options having been exercised, 80,640 shares were issued and for which money had been received. The unexercised options lapsed. Required: the general journal entries to record the above Narrations to general journal entries must be provided. (Note that narrations are not required in the examination)