Question

Margie Noverro is a junior analyst in the derivatives research division of an international securities firm. Noverro's supervisor, Stan Dardevian, asks her to conduct an

Margie Noverro is a junior analyst in the derivatives research division of an international securities firm. Noverro's supervisor, Stan Dardevian, asks her to conduct an analysis of various options trading strategies relating to shares of three companies: IZD, QWY, and XDF.

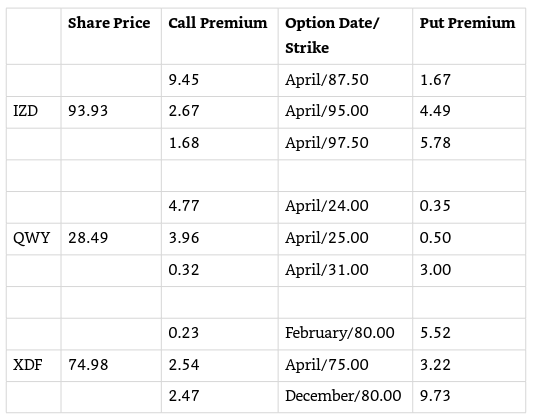

On 1 February, Noverro gathers selected option premium data on the companies, which is presented in Exhibit 1.

EXHIBIT 1 Share Price and Options Premiums as of 1 February (share prices and option premiums are in Euros

Noverro considers the following option strategies relating to IZD.

Strategy 1: Constructing a synthetic long put position in IZD

Strategy 2: Buying 100 shares of IZD and writing the April 95.00 strike call option on IZD

Strategy 3: Implementing a covered call position in IZD using the April 97.50 strike option

Noverro next reviews the following option strategies relating to QWY:

Strategy 4: Implementing a protective put position in QWY using the April 25.00 strike option

Strategy 5: Buying 100 shares of QWY, buying the April 24.00 strike put option, and writing the April 31.00 strike call option

Strategy 6: Implementing a bear spread in QWY using the April 25.00 and April 31.00 strike options.

Finally, Noverro considers two option strategies relating to XDF.

Strategy 7: Writing both the April 75.00 strike call option and the April 75.00 strike put option on XDF

Strategy 8: Writing the February 80.00 strike call option and buying the December 80.00 strike call option on XDF

Over the past few months, Noverro and Dardevian have followed news reports on a proposed merger between XDF and one of its competitors. A government antitrust committee is currently reviewing the potential merger. Dardevian expects the share price to move sharply up or down depending on whether the committee decides to approve or reject the merger next week. Dardevian asks Noverro to recommend an option trade that might allow the firm to benefit from a significant move in the XDF share price regardless of the direction of the move.

1.

Strategy 5 is best described as a:

| collar. | ||

| straddle. | ||

| bear spread. |

2.

Based on Exhibit 1, the maximum loss per share that would be incurred if Strategy 4 was implemented is:

| 2.99. | ||

| 3.99. | ||

| unlimited. |

3. Based on Exhibit 1, the breakeven share price for Strategy 6 is closest to:

| 22.50. | ||

| 28.50. | ||

| 33.50. |

4. Strategy 1 would require Noverro to buy ...

| shares of IZD. | ||

| a put option on IZD. | ||

| a call option on IZD. |

5. Based on Exhibit 1, the maximum gain per share that could be earned if Strategy 7 is implemented is:

| 5.74. | ||

| 5.76. | ||

| unlimited. |

6. The option trade that Noverro should recommend relating to the government committee's decision is a:

| collar. | ||

| bull spread. | ||

| long straddle. |

7. Based on Exhibit 1, Noverro should expect Strategy 2 to be least profitable if the share price of IZD at option expiration is:

| less than 91.26. | ||

| between 91.26 and 95.00. | ||

| more than 95.00. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started