Answered step by step

Verified Expert Solution

Question

1 Approved Answer

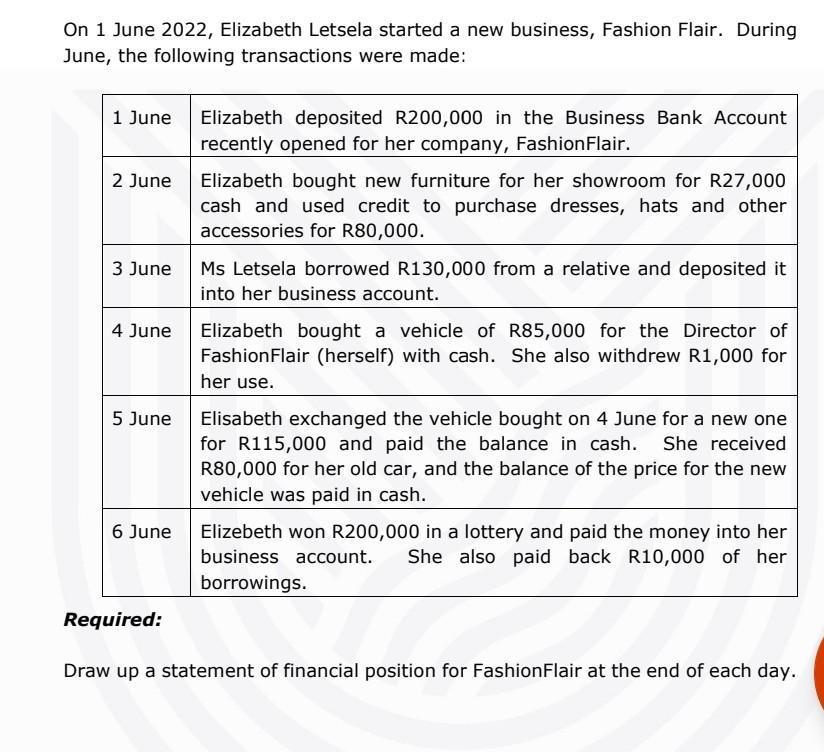

On 1 June 2022, Elizabeth Letsela started a new business, Fashion Flair. During June, the following transactions were made: 1 June 2 June 3

On 1 June 2022, Elizabeth Letsela started a new business, Fashion Flair. During June, the following transactions were made: 1 June 2 June 3 June 4 June 5 June 6 June Elizabeth deposited R200,000 in the Business Bank Account recently opened for her company, Fashion Flair. Elizabeth bought new furniture for her showroom for R27,000 cash and used credit to purchase dresses, hats and other accessories for R80,000. Ms Letsela borrowed R130,000 from a relative and deposited it into her business account. Elizabeth bought a vehicle of R85,000 for the Director of FashionFlair (herself) with cash. She also withdrew R1,000 for her use. Elisabeth exchanged the vehicle bought on 4 June for a new one for R115,000 and paid the balance in cash. She received R80,000 for her old car, and the balance of the price for the new vehicle was paid in cash. Elizebeth won R200,000 in a lottery and paid the money into her business account. She also paid back R10,000 of her borrowings. Required: Draw up a statement of financial position for FashionFlair at the end of each day.

Step by Step Solution

★★★★★

3.25 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the statements of financial position for Fashion Flair for each day in June Fashion Flair S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started