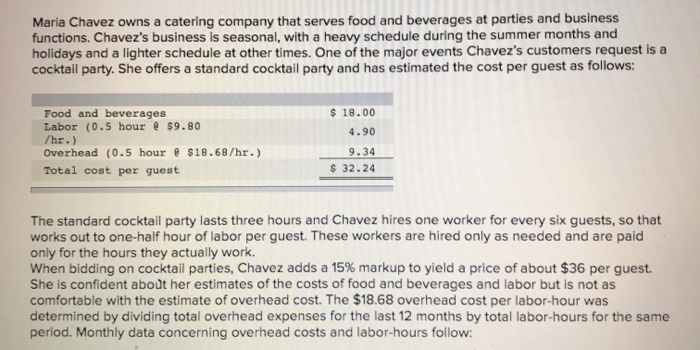

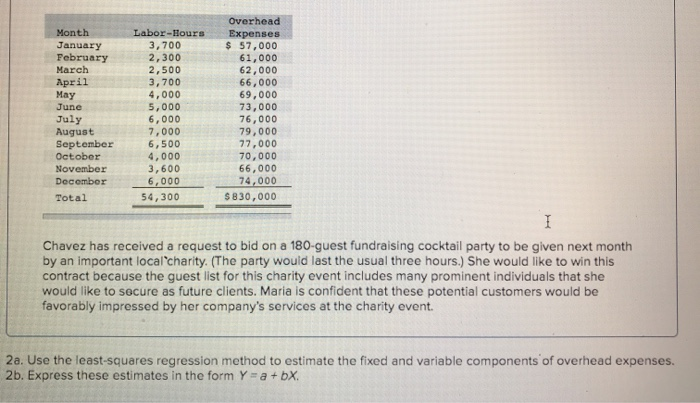

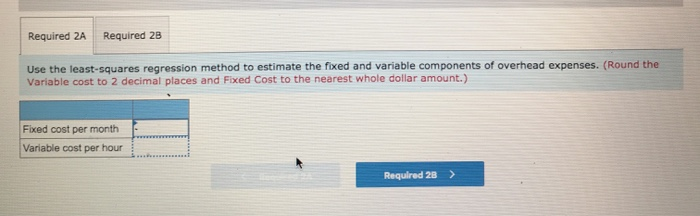

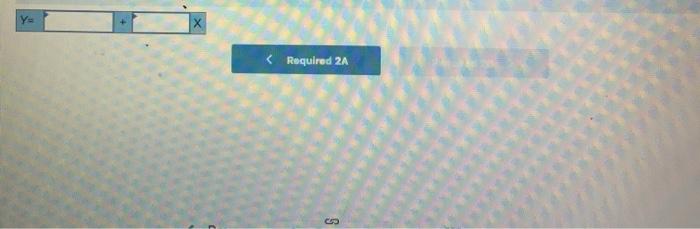

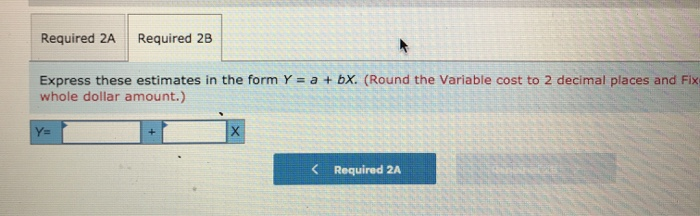

Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez's business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times. One of the major events Chavez's customers request is a cocktail party. She offers a standard cocktail party and has estimated the cost per guest as follows: Food and beverages Labor (0.5 hour $9.80 /hr.) Overhead (0.5 hour $18.68/hr.) $ 18.00 4.90 9.34 32.24 Total cost per guest The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one-half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work. When bidding on cocktail parties, Chavez adds a 15% markup to yield a price of about $36 per guest. She is confident about her estimates of the costs of food and beverages and labor but is not as comfortable with the estimate of overhead cost. The $18.68 overhead cost per labor-hour was determined by divid ing total overhead expenses for the last 12 months by total labor-hours for the sa period. Monthly data concerning overhead costs and labor-hours follow: me Overhead Month Labor-Hours Expenses $ 57,000 61,000 62,000 January 3,700 February 2,300 2,500 3,700 March April May 66,000 69,000 73,000 76,000 79,000 4,000 5,000 6,000 7,000 6,500 4,000 3,600 6,000 June July August September October 77,000 70,000 November December 66,000 74,000 54,300 $830,000 Total Chavez has received a request to bid on a 180-guest fundraising cocktail party to be given next month by an important local'charity. (The party would last the usual three hours.) She would like to win this contract because the guest list for this charity event includes many prominent individuals that she would like to secure as future clients. Maria is confident that these potential customers would be favorably impressed by her company's services at the charity event. 2a. Use the least-squares regression method to estimate the fixed and variable components of overhead expenses. 2b. Express these estimates in the form Y a+ bX Required 2A Required 2B Use the least-squares regression method to estimate the fixed and variable components of overhead expenses. (Round the Variable cost to 2 decimal places and Fixed Cost to the nearest whole dollar amount.) Fixed cost per month Variable cost per hour Required 2B Required 2A C2 Required 2A Required 2B Express these estimates in the form Y = a + bX. (Round the Variable cost to 2 decimal places and Fix whole dollar amount.) Y-