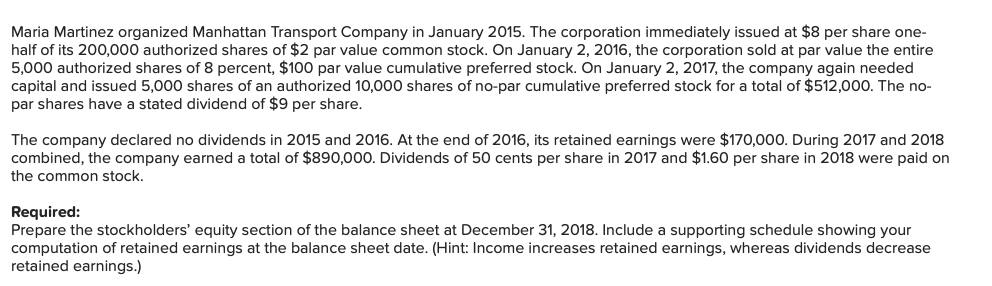

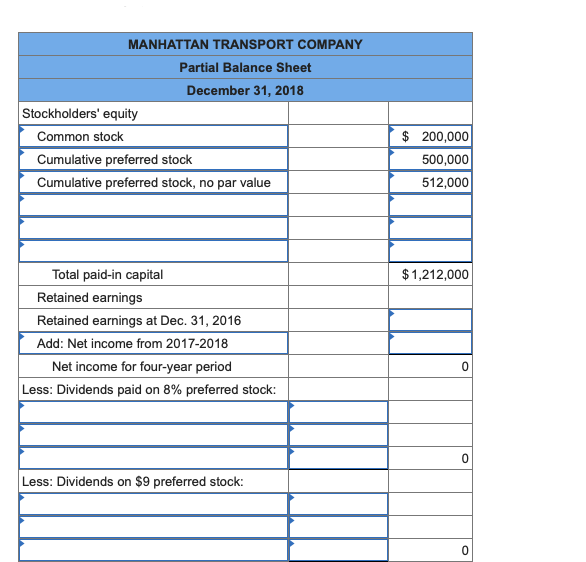

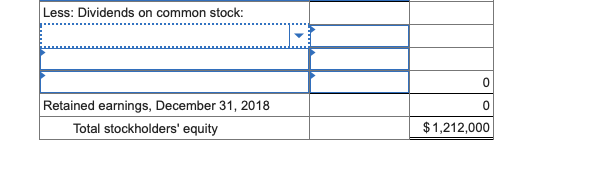

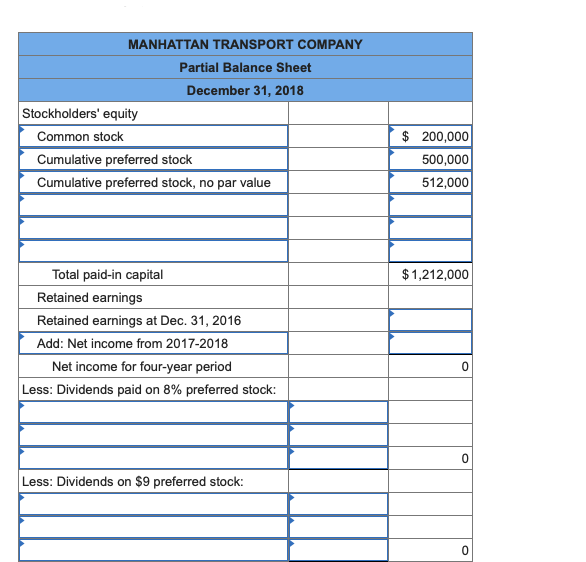

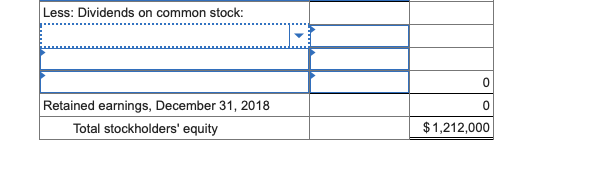

Maria Martinez organized Manhattan Transport Company in January 2015. The corporation immediately issued at $8 per share one- half of its 200,000 authorized shares of $2 par value common stock. On January 2, 2016, the corporation sold at par value the entire 5,000 authorized shares of 8 percent, $100 par value cumulative preferred stock. On January 2, 2017, the company again needed capital and issued 5,000 shares of an authorized 10,000 shares of no-par cumulative preferred stock for a total of $512,000. The no- par shares have a stated dividend of $9 per share. The company declared no dividends in 2015 and 2016. At the end of 2016, its retained earnings were $170,000. During 2017 and 2018 combined, the company earned a total of $890,000. Dividends of 50 cents per share in 2017 and $1.60 per share in 2018 were paid on the common stock. Required: Prepare the stockholders' equity section of the balance sheet at December 31, 2018. Include a supporting schedule showing your computation of retained earnings at the balance sheet date. (Hint: Income increases retained earnings, whereas dividends decrease retained earnings.) MANHATTAN TRANSPORT COMPANY Partial Balance Sheet December 31, 2018 Stockholders' equity 200,000 500,000 Common stock Cumulative preferred stock Cumulative preferred stock, no par value 512,000 Total paid-in capital $1,212,000 Retained earnings Retained earnings at Dec. 31, 2016 Add: Net income from 2017-2018 Net income for four-year period 0 Less: Dividends paid on 8% preferred stock: 0 Less: Dividends on $9 preferrred stock: 0 Less: Dividends on common stock: C Retained earnings, December 31, 2018 0 $1,212,000 Total stockholders' equity Maria Martinez organized Manhattan Transport Company in January 2015. The corporation immediately issued at $8 per share one- half of its 200,000 authorized shares of $2 par value common stock. On January 2, 2016, the corporation sold at par value the entire 5,000 authorized shares of 8 percent, $100 par value cumulative preferred stock. On January 2, 2017, the company again needed capital and issued 5,000 shares of an authorized 10,000 shares of no-par cumulative preferred stock for a total of $512,000. The no- par shares have a stated dividend of $9 per share. The company declared no dividends in 2015 and 2016. At the end of 2016, its retained earnings were $170,000. During 2017 and 2018 combined, the company earned a total of $890,000. Dividends of 50 cents per share in 2017 and $1.60 per share in 2018 were paid on the common stock. Required: Prepare the stockholders' equity section of the balance sheet at December 31, 2018. Include a supporting schedule showing your computation of retained earnings at the balance sheet date. (Hint: Income increases retained earnings, whereas dividends decrease retained earnings.) MANHATTAN TRANSPORT COMPANY Partial Balance Sheet December 31, 2018 Stockholders' equity 200,000 500,000 Common stock Cumulative preferred stock Cumulative preferred stock, no par value 512,000 Total paid-in capital $1,212,000 Retained earnings Retained earnings at Dec. 31, 2016 Add: Net income from 2017-2018 Net income for four-year period 0 Less: Dividends paid on 8% preferred stock: 0 Less: Dividends on $9 preferrred stock: 0 Less: Dividends on common stock: C Retained earnings, December 31, 2018 0 $1,212,000 Total stockholders' equity