Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marie needs to plan to fund the higher education of her daughter Liz. Liz is expected to begin her higher education 12 years from

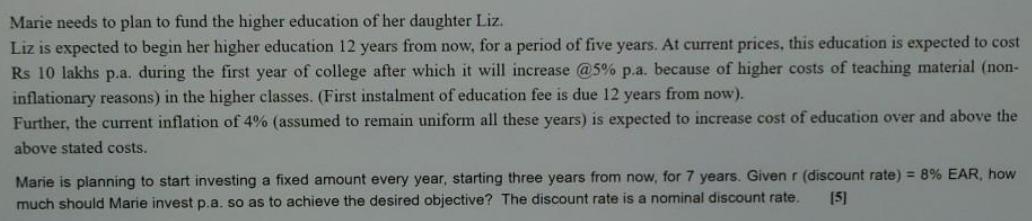

Marie needs to plan to fund the higher education of her daughter Liz. Liz is expected to begin her higher education 12 years from now, for a period of five years. At current prices, this education is expected to cost Rs 10 lakhs p.a. during the first year of college after which it will increase @5% p.a. because of higher costs of teaching material (non- inflationary reasons) in the higher classes. (First instalment of education fee is due 12 years from now). Further, the current inflation of 4% (assumed to remain uniform all these years) is expected to increase cost of education over and above the above stated costs. Marie is planning to start investing a fixed amount every year, starting three years from now, for 7 years. Given r (discount rate) = 8% EAR, how much should Marie invest p.a. so as to achieve the desired objective? The discount rate is a nominal discount rate. [5]

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

AS f given dato Cost q Collage 12 yeas fream now Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started