Answered step by step

Verified Expert Solution

Question

1 Approved Answer

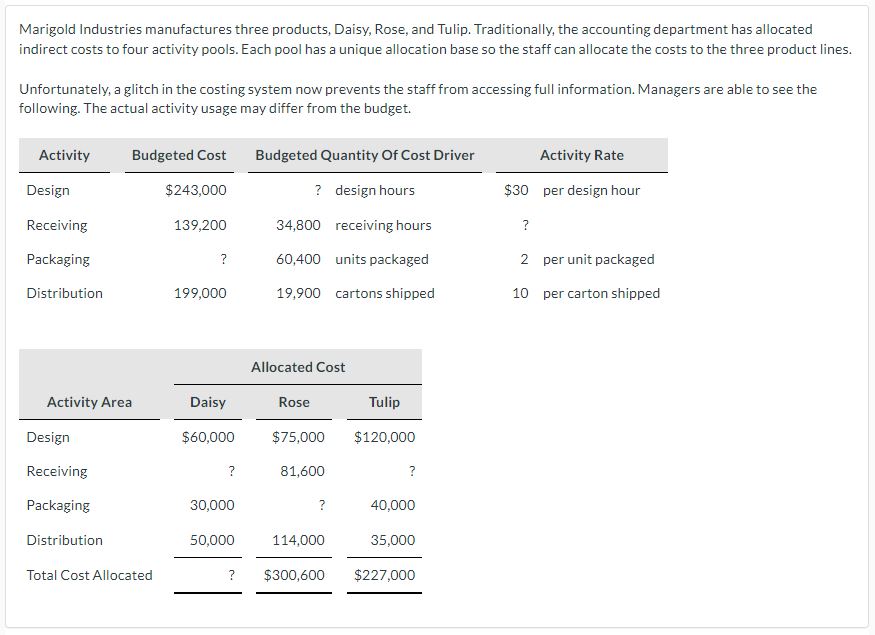

Marigold Industries manufactures three products, Daisy, Rose, and Tulip. Traditionally, the accounting department has allocated indirect costs to four activity pools. Each pool has

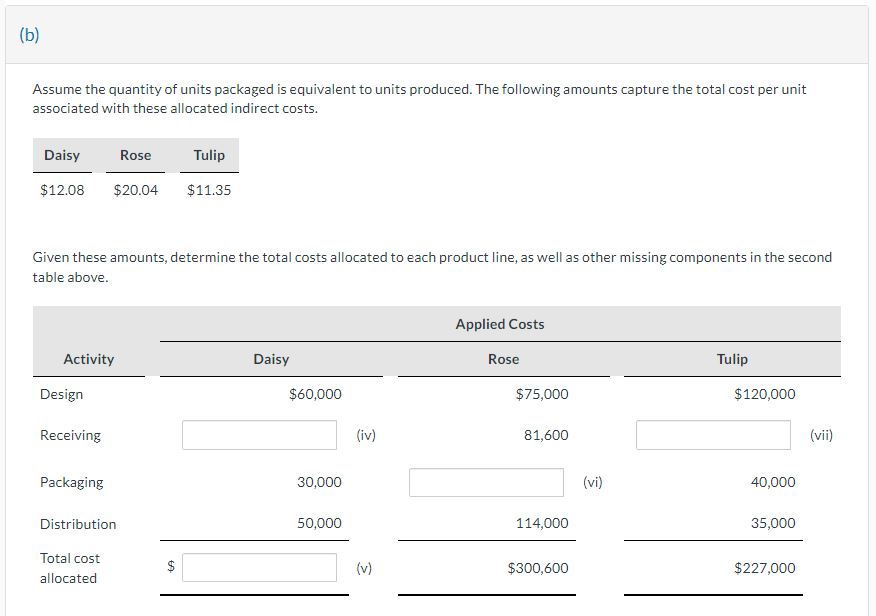

Marigold Industries manufactures three products, Daisy, Rose, and Tulip. Traditionally, the accounting department has allocated indirect costs to four activity pools. Each pool has a unique allocation base so the staff can allocate the costs to the three product lines. Unfortunately, a glitch in the costing system now prevents the staff from accessing full information. Managers are able to see the following. The actual activity usage may differ from the budget. Activity Design Receiving Packaging Distribution Budgeted Cost Activity Area Design Receiving Packaging Distribution Total Cost Allocated $243,000 139,200 ? 199,000 Daisy 60,000 ? 30,000 50,000 ? Budgeted Quantity Of Cost Driver ? design hours 34,800 receiving hours 60,400 units packaged 19,900 cartons shipped Allocated Cost Rose Tulip $75,000 $120,000 81,600 ? 114,000 ? 40,000 35,000 $300,600 $227,000 Activity Rate $30 per design hour ? 2 per unit packaged 10 per carton shipped (b) Assume the quantity of units packaged is equivalent to units produced. The following amounts capture the total cost per unit associated with these allocated indirect costs. Daisy Rose $12.08 $20.04 Given these amounts, determine the total costs allocated to each product line, as well as other missing components in the second table above. Activity Design Receiving Packaging Distribution Total cost allocated Tulip $11.35 $ Daisy $60,000 30,000 50,000 (iv) (v) Applied Costs Rose $75,000 81,600 114,000 $300,600 (vi) Tulip $120,000 40,000 35,000 $227,000 (vii)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine the missing components in the second table we need to calculate the allocated costs for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started