Answered step by step

Verified Expert Solution

Question

1 Approved Answer

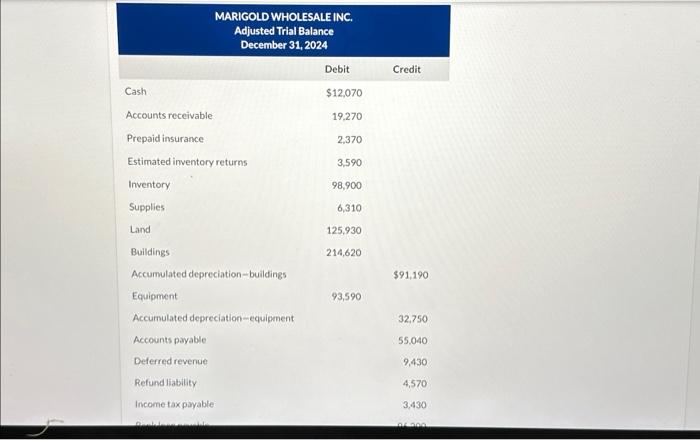

MARIGOLD WHOLESALE INC. Adjusted Trial Balance December 31, 2024 Debit Credit Cash $12,070 Accounts receivable 19,270 Prepaid insurance 2,370 Estimated inventory returns 3,590 Inventory

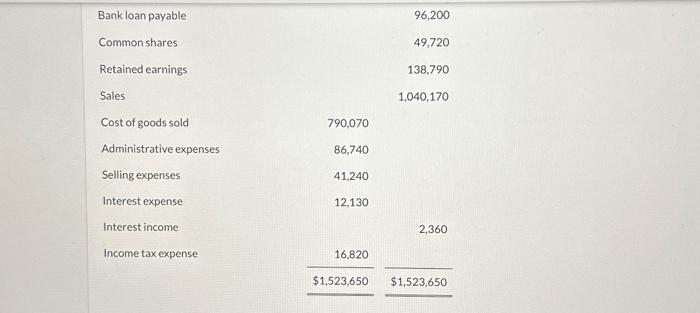

MARIGOLD WHOLESALE INC. Adjusted Trial Balance December 31, 2024 Debit Credit Cash $12,070 Accounts receivable 19,270 Prepaid insurance 2,370 Estimated inventory returns 3,590 Inventory 98,900 Supplies 6,310 Land 125,930 Buildings 214,620 Accumulated depreciation-buildings $91,190 Equipment 93,590 Accumulated depreciation-equipment 32,750 Accounts payable 55,040 Deferred revenue 9,430 Refund liability 4,570 Income tax payable 3,430 0000 Bank loan payable Common shares. Retained earnings 96,200 49,720 138,790 Sales 1,040,170 Cost of goods sold 790,070 Administrative expenses 86,740 Selling expenses 41,240 Interest expense 12,130 Interest income 2,360 Income tax expense 16,820 $1,523,650 $1,523,650 Prepare a single-step statement of income. MARIGOLD WHOLESALE INC. Statement of Income (Single-Step) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The single step statement of income is as follows MARIGOLD WHOLESALE INC State...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started