Question

Marin Inc. sells portable computer equipment with a two-year warranty contract that requires the corporation to replace defective parts and provide the necessary repair labour.

Marin Inc. sells portable computer equipment with a two-year warranty contract that requires the corporation to replace defective parts and provide the necessary repair labour. During 2020, the corporation sells for cash 380 computers at a unit price of $2,550. Ignore any cost of goods sold. Based on experience, the two-year warranty costs are estimated to be $166 for parts and $189 for labour per unit. (For simplicity, assume that all sales occurred on December 31, 2020.) The warranty is not sold separately from the equipment, and no portion of the sales price is allocated to warranty sales. Marin follows ASPE.

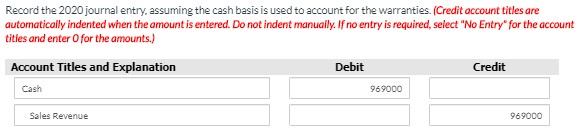

1. (Double-check if correct please)

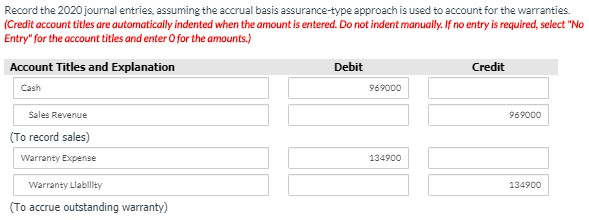

2. (Double-check if correct please)

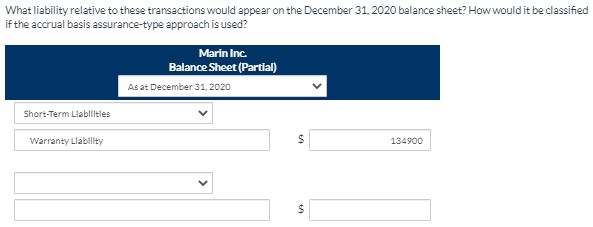

3. (I have the first part just need the second part)

4.

5.

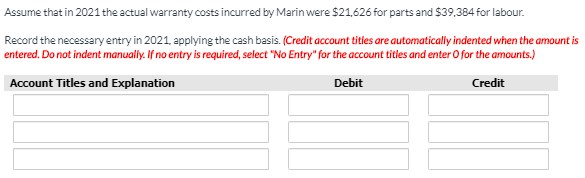

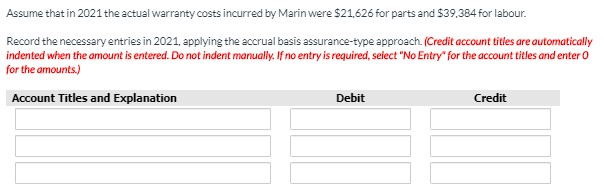

Record the 2020 journal entry, assuming the cash basis is used to account for the warranties. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter for the amounts.) Account Titles and Explanation Debit Credit Cash 969000 Sales Revenue 969000 Record the 2020 journal entries, assuming the accrual basis assurance-type approach is used to account for the warranties. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Cash 969000 969000 Sales Revenue (To record sales) Warranty Expense 134900 134900 Warranty Liability (To accrue outstanding warranty) What liability relative to these transactions would appear on the December 31, 2020 balance sheet? How would it be classified if the accrual basis assurance-type approach is used? Marin Inc Balance Sheet (Partial) As at December 31, 2020 Short-Term Llabilities $ Warranty Llability 134900 $ Assume that in 2021 the actual warranty costs incurred by Marin were $21,626 for parts and $39,384 for labour. Record the necessary entry in 2021, applying the cash basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Assume that in 2021 the actual warranty costs incurred by Marin were $21,626 for parts and $39,384 for labour. Record the necessary entries in 2021, applying the accrual basis assurance-type approach. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started