Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mario the Saviour Ltd. manufactures backpacks and portable tables for tourists in three production departments: Cutting Room, Backpacks and Portable Tables. The whole process

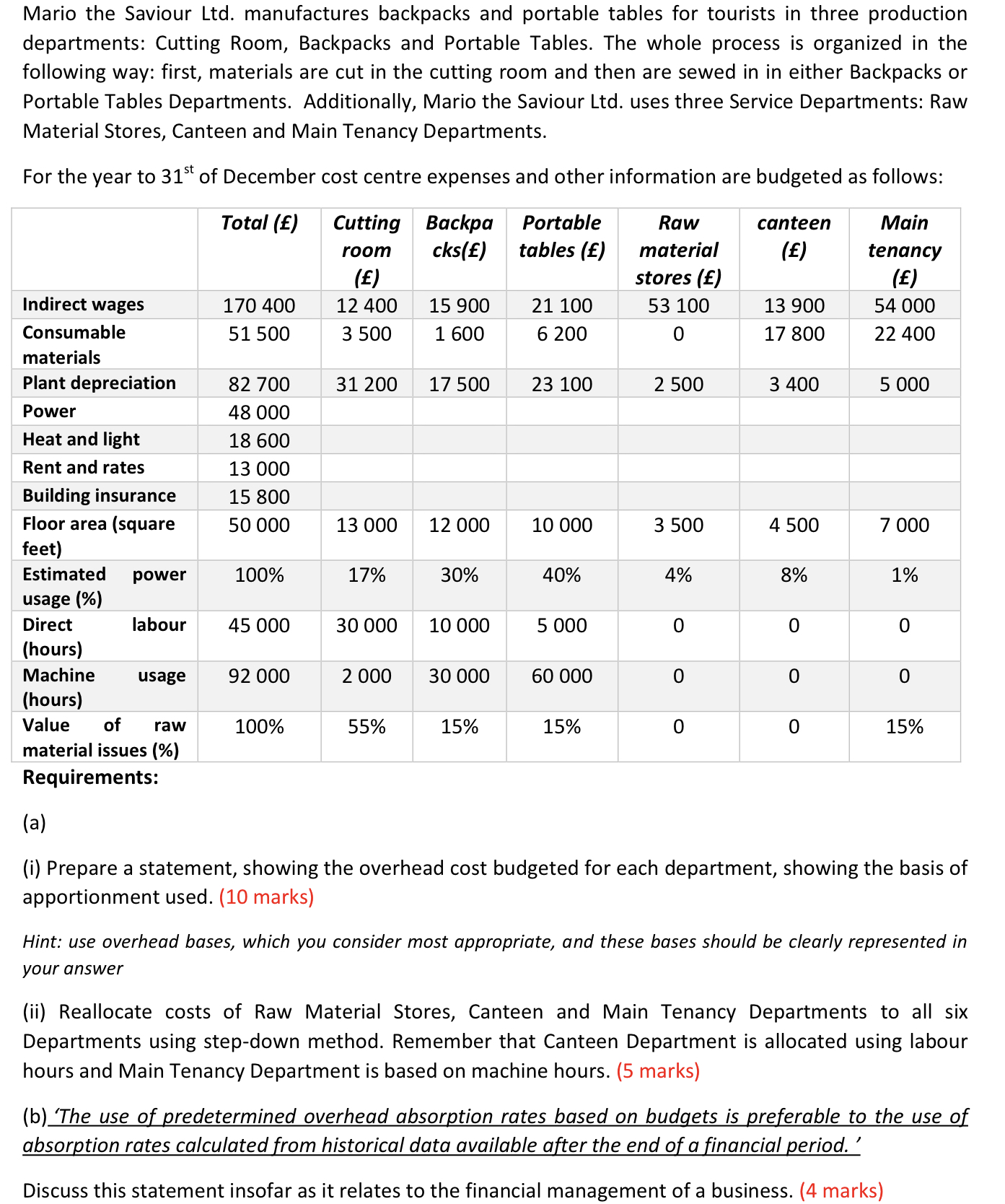

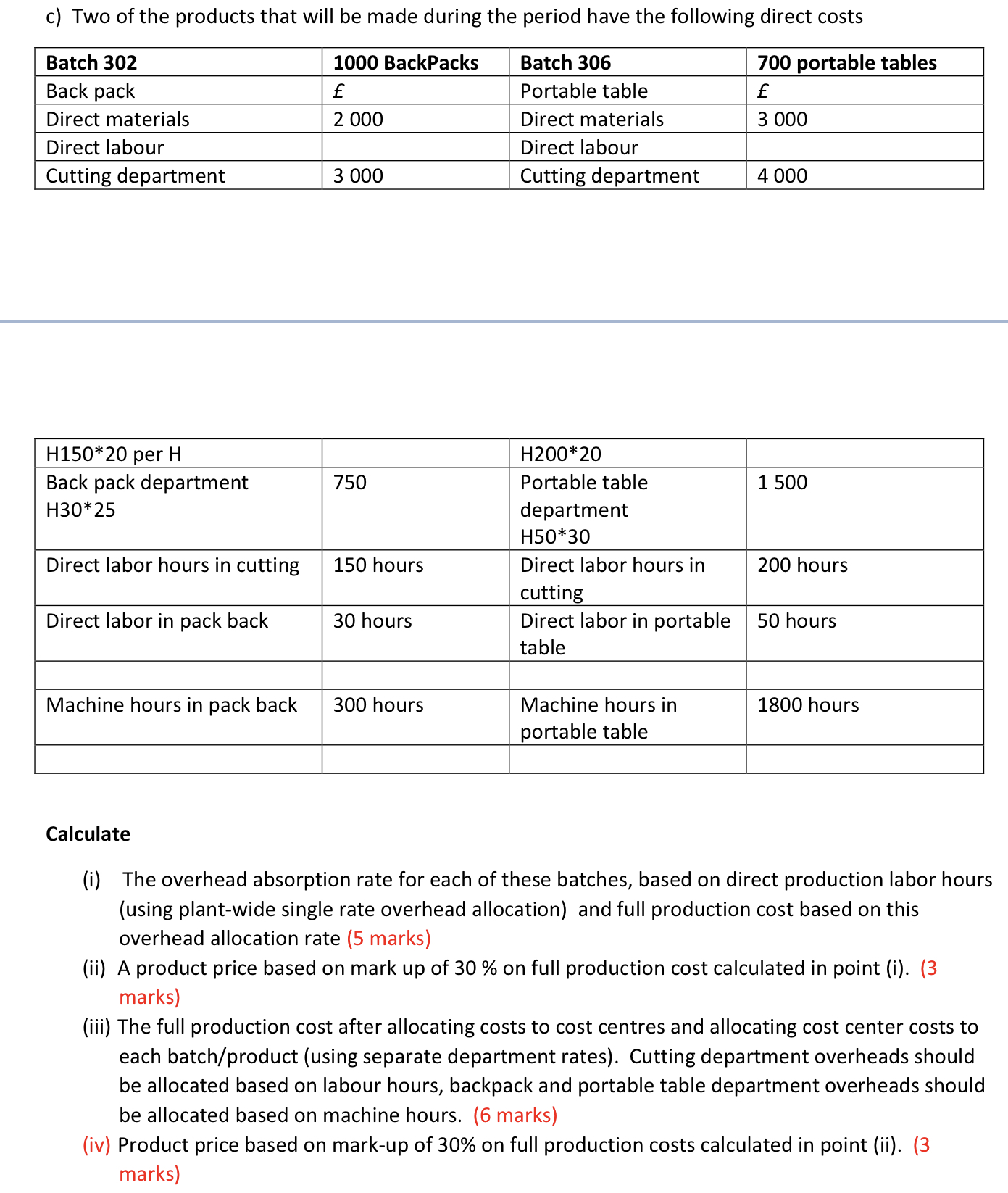

Mario the Saviour Ltd. manufactures backpacks and portable tables for tourists in three production departments: Cutting Room, Backpacks and Portable Tables. The whole process is organized in the following way: first, materials are cut in the cutting room and then are sewed in in either Backpacks or Portable Tables Departments. Additionally, Mario the Saviour Ltd. uses three Service Departments: Raw Material Stores, Canteen and Main Tenancy Departments. For the year to 31st of December cost centre expenses and other information are budgeted as follows: Total () Cutting Backpa room cks() Main tenancy () 54 000 () 12 400 3 500 22 400 Indirect wages Consumable materials Plant depreciation Power Heat and light Rent and rates Building insurance Floor area (square feet) Estimated usage (%) Direct (hours) Machine (hours) Value power labour usage of raw material issues (%) Requirements: 170 400 51 500 82 700 48 000 18 600 13 000 15 800 50 000 100% 45 000 92 000 100% 31 200 13 000 17% 30 000 2 000 55% 15 900 1 600 17 500 12 000 30% 10 000 30 000 15% Portable tables () 21 100 6 200 23 100 10 000 40% 5 000 60 000 15% Raw material stores () 53 100 0 2 500 3 500 4% 0 0 0 canteen () 13 900 17 800 3 400 4 500 8% 0 0 O 5 000 7 000 1% 0 15% (a) (i) Prepare a statement, showing the overhead cost budgeted for each department, showing the basis of apportionment used. (10 marks) Hint: use overhead bases, which you consider most appropriate, and these bases should be clearly represented in your answer (ii) Reallocate costs of Raw Material Stores, Canteen and Main Tenancy Departments to all six Departments using step-down method. Remember that Canteen Department is allocated using labour hours and Main Tenancy Department is based on machine hours. (5 marks) (b) 'The use of predetermined overhead absorption rates based on budgets is preferable to the use of absorption rates calculated from historical data available after the end of a financial period. ' Discuss this statement insofar as it relates to the financial management of a business. (4 marks) c) Two of the products that will be made during the period have the following direct costs Batch 302 1000 Backpacks Batch 306 700 portable tables Back pack Portable table Direct materials Direct materials 2 000 3 000 Direct labour Direct labour Cutting department Cutting department H150*20 per H Back pack department H30*25 Direct labor hours in cutting Direct labor in pack back Machine hours in pack back 3 000 750 150 hours 30 hours 300 hours H200*20 Portable table department H50*30 Direct labor hours in cutting Direct labor in portable table Machine hours in portable table 4 000 1 500 200 hours 50 hours 1800 hours Calculate (i) The overhead absorption rate for each of these batches, based on direct production labor hours (using plant-wide single rate overhead allocation) and full production cost based on this overhead allocation rate (5 marks) (ii) A product price based on mark up of 30 % on full production cost calculated in point (i). (3 marks) (iii) The full production cost after allocating costs to cost centres and allocating cost center costs to each batch/product (using separate department rates). Cutting department overheads should be allocated based on labour hours, backpack and portable table department overheads should be allocated based on machine hours. (6 marks) (iv) Product price based on mark-up of 30% on full production costs calculated in point (ii). (3 marks)

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a i Statement showing overhead cost budgeted for each department Department Overhead Cost Cutting Room 92000 200030000 613333 Backpacks 92000 6000030000 18400000 Portable Tables 92000 6000030000 18400...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started