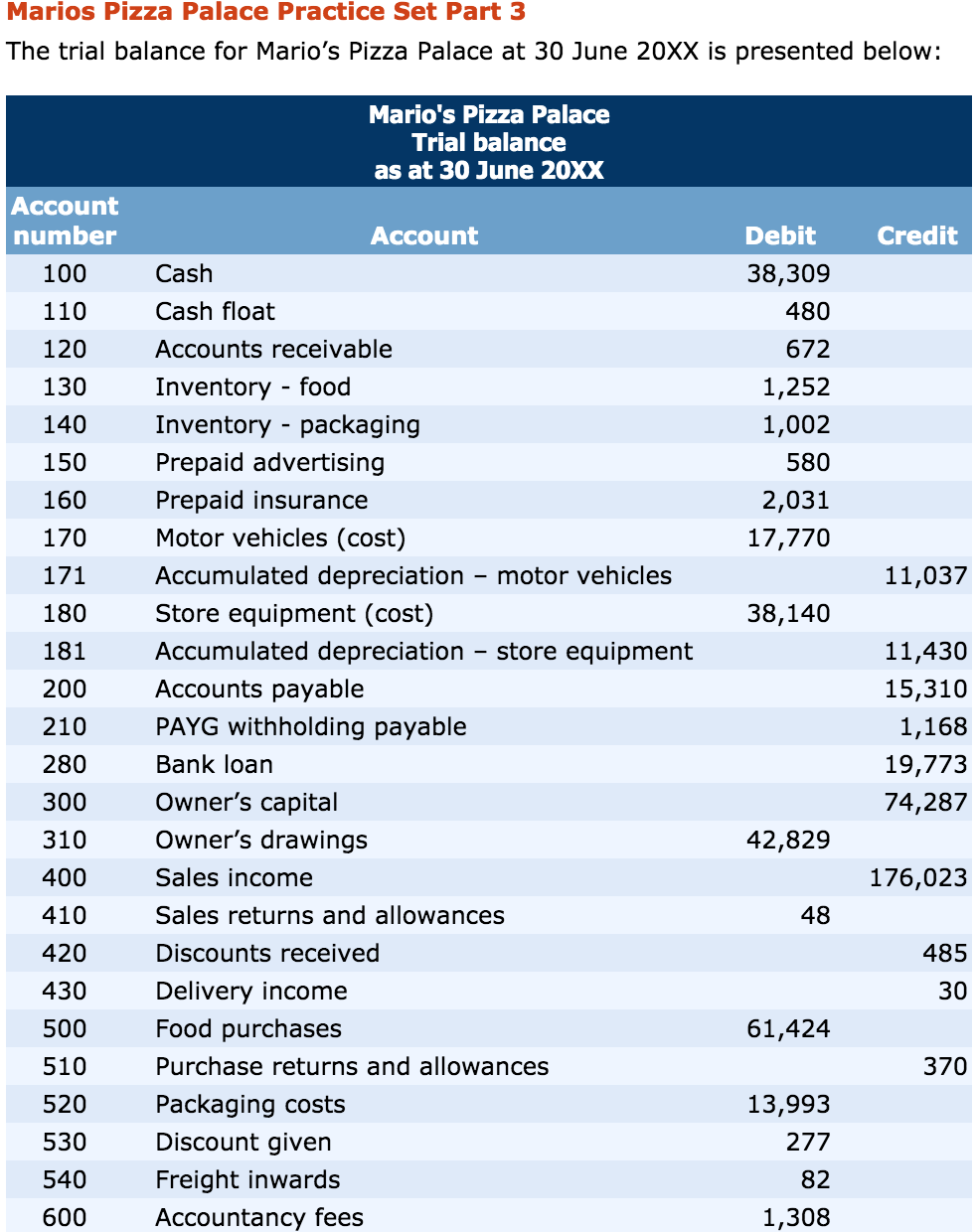

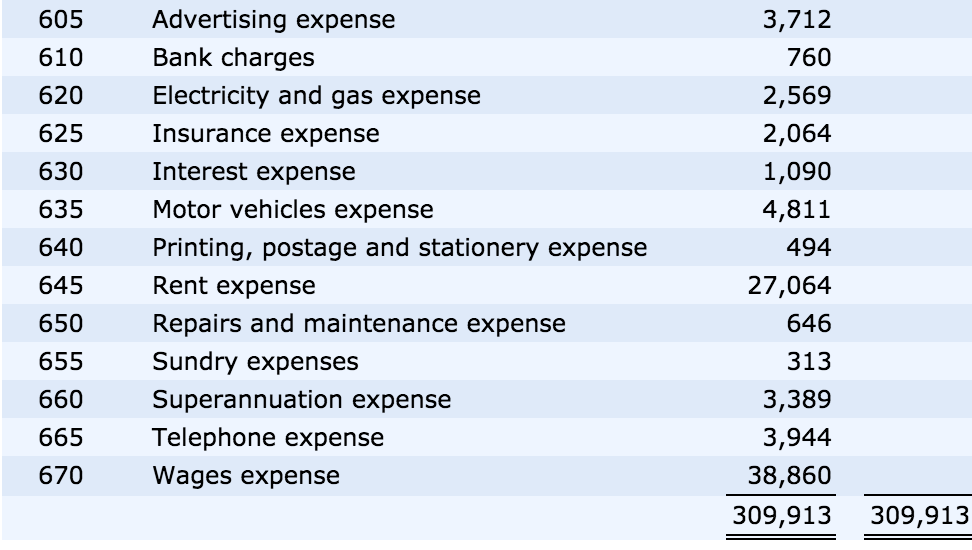

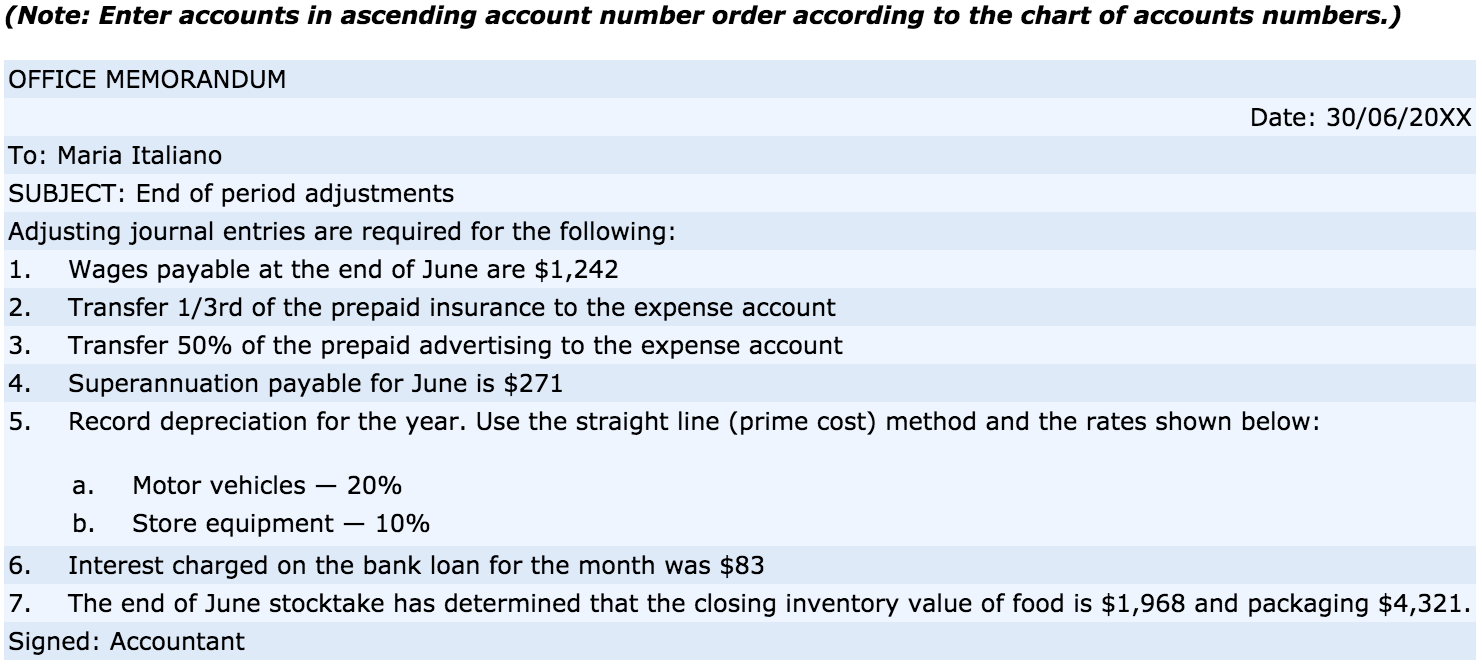

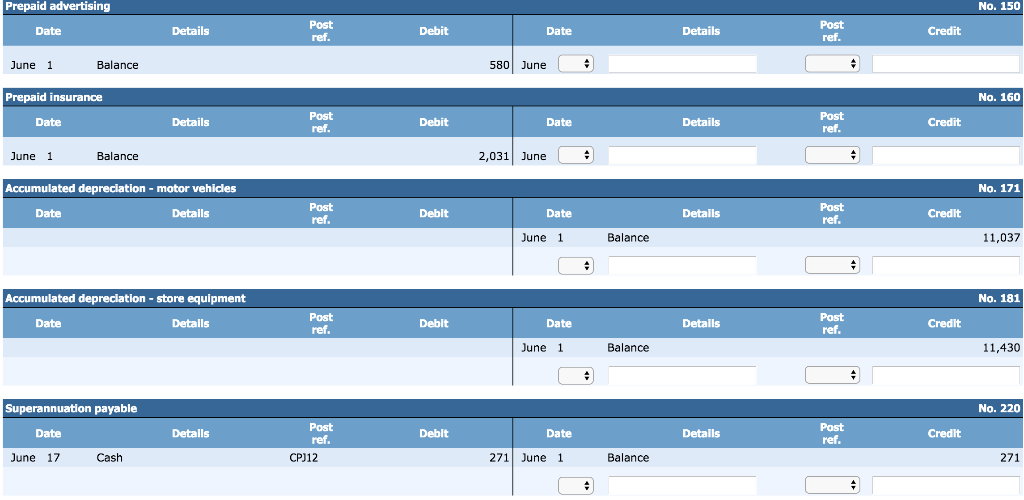

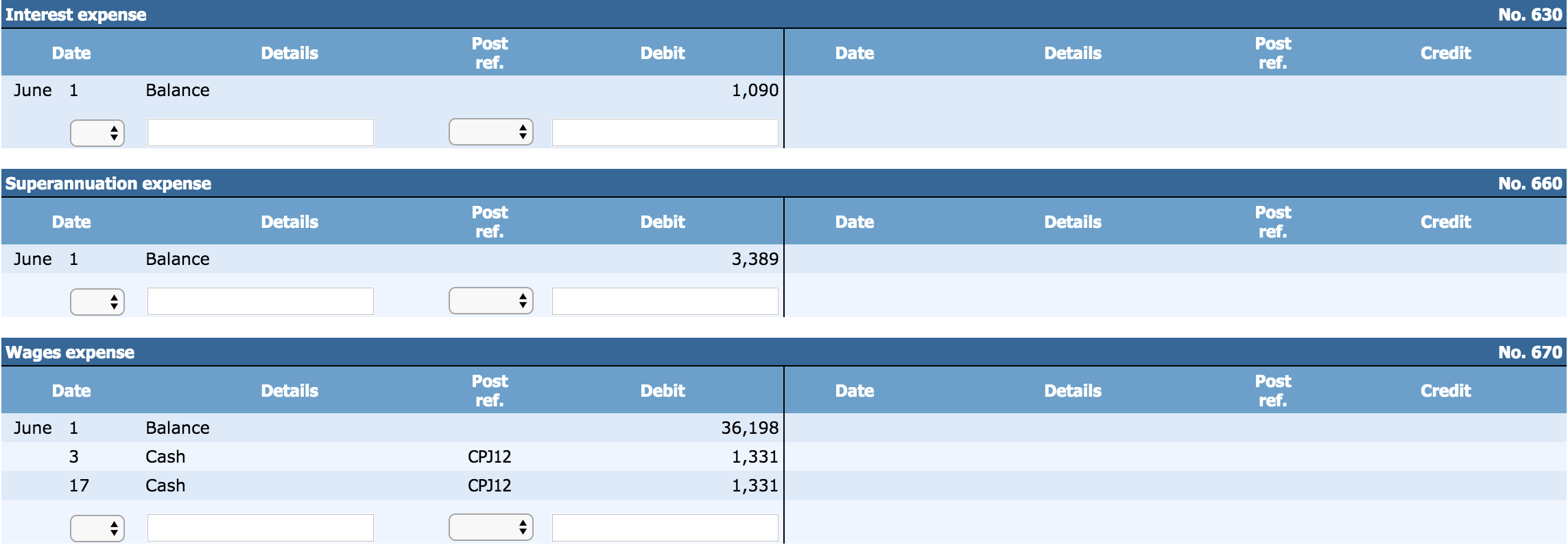

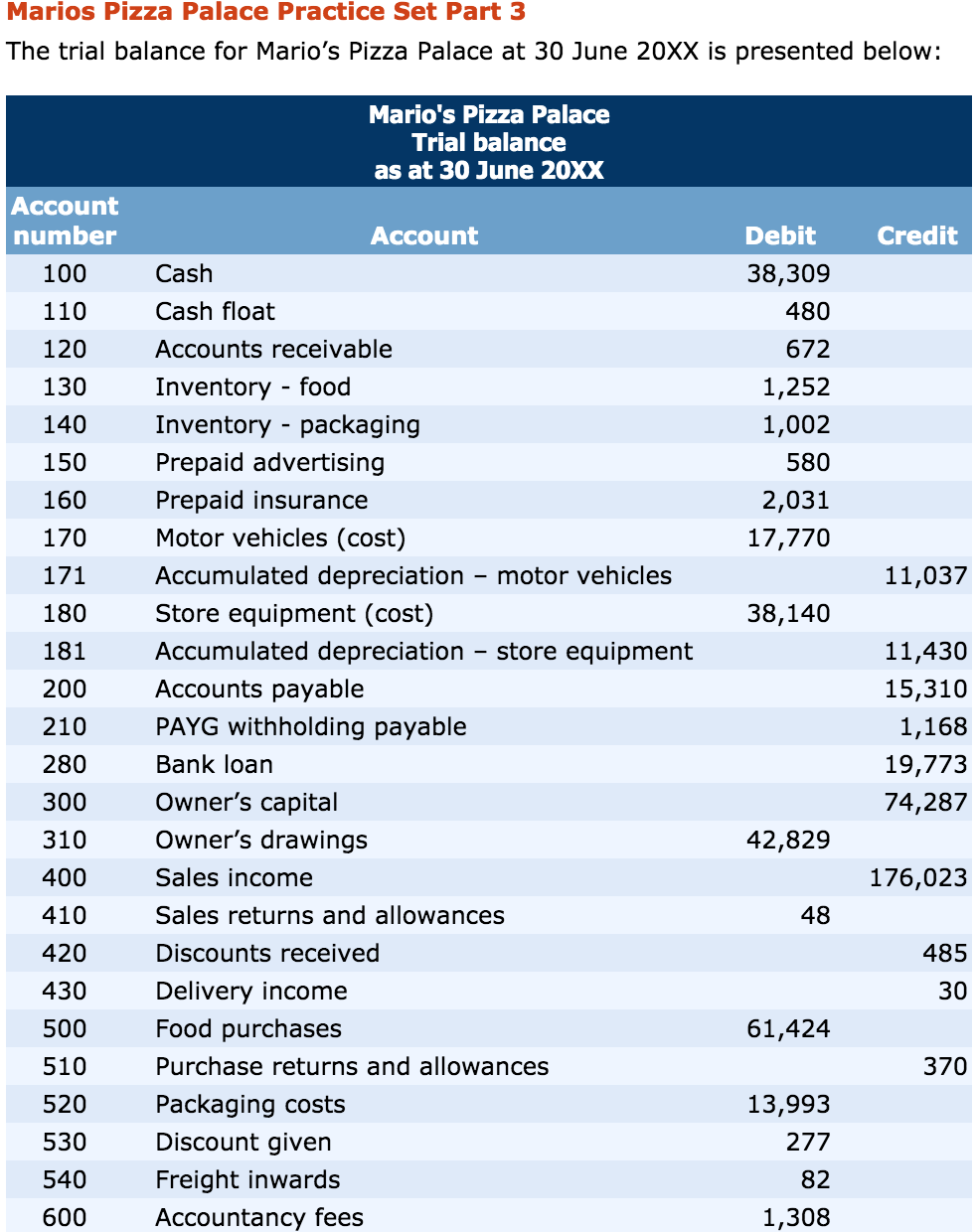

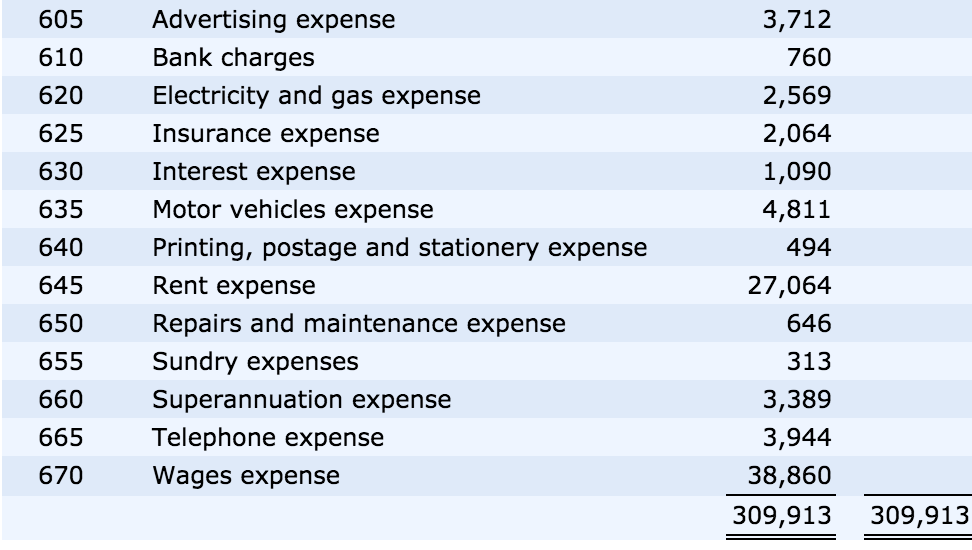

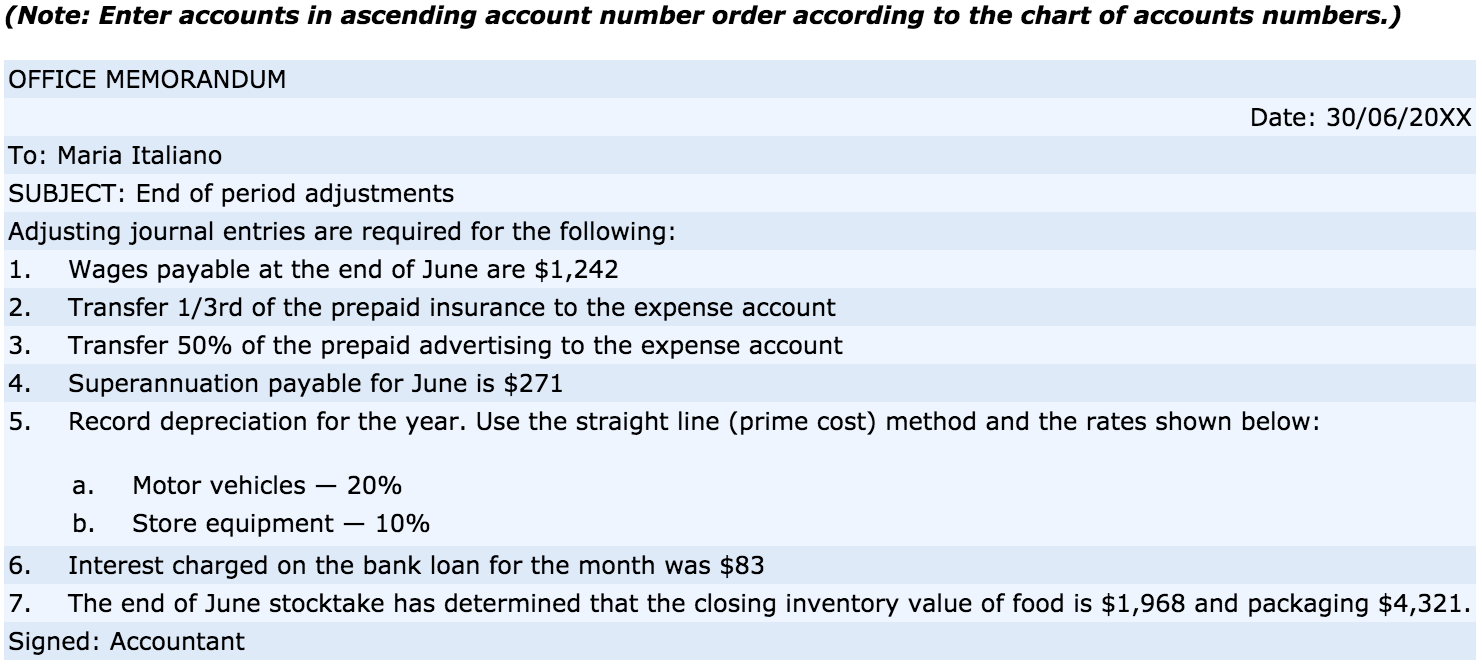

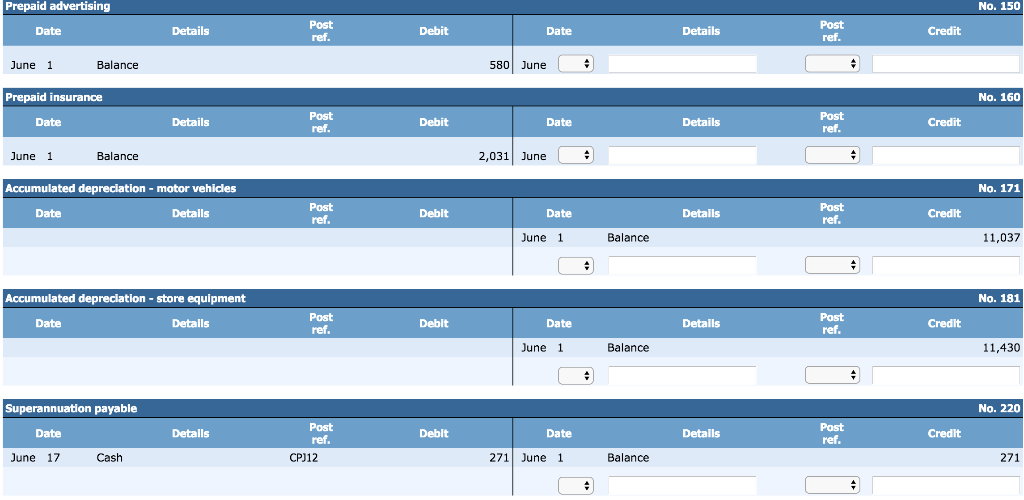

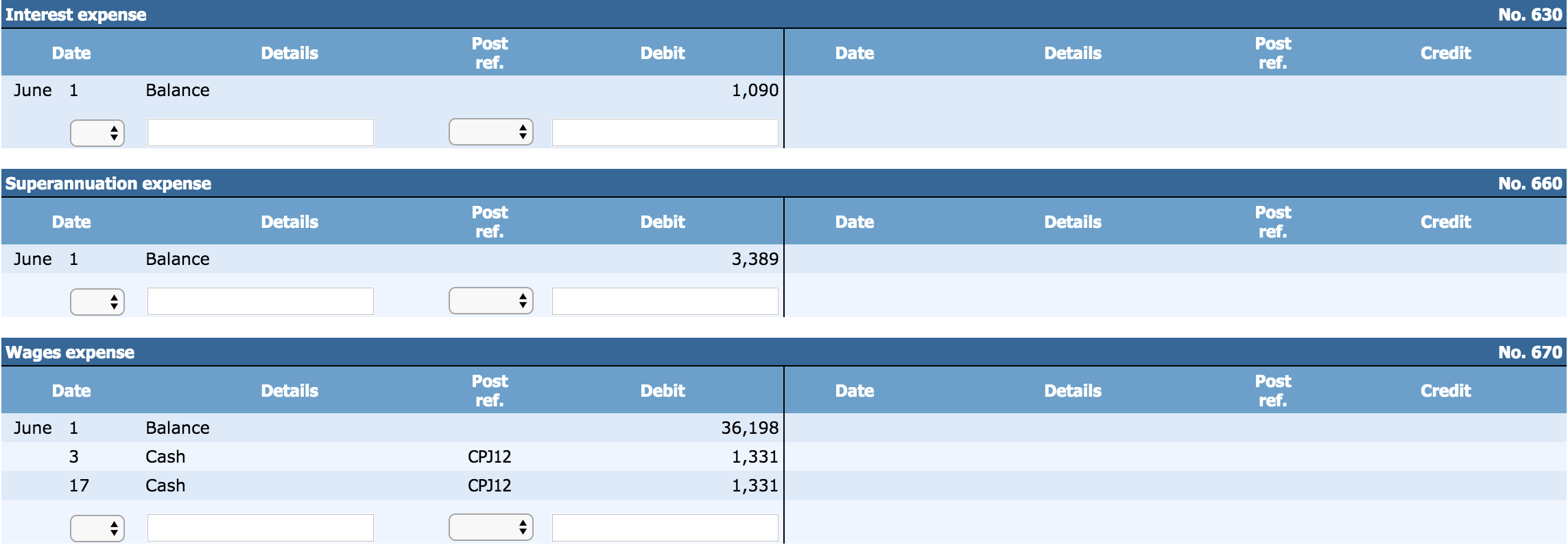

Marios Pizza Palace Practice Set Part 3 The trial balance for Mario's Pizza Palace at 30 June 20XX is presented below: Mario's Pizza Palace Trial balance as at 30 June 20XX Credit Account number 100 110 120 130 140 150 160 170 171 180 181 200 Debit 38,309 480 672 1,252 1,002 580 2,031 17,770 11,037 38,140 210 Account Cash Cash float Accounts receivable Inventory - food Inventory - packaging Prepaid advertising Prepaid insurance Motor vehicles (cost) Accumulated depreciation - motor vehicles Store equipment (cost) Accumulated depreciation - store equipment Accounts payable PAYG withholding payable Bank loan Owner's capital Owner's drawings Sales income Sales returns and allowances Discounts received Delivery income Food purchases Purchase returns and allowances Packaging costs Discount given Freight inwards Accountancy fees 11,430 15,310 1,168 19,773 74,287 42,829 176,023 48 485 280 300 310 400 410 420 430 500 510 520 530 540 600 30 61,424 370 13,993 277 82 1,308 605 610 620 625 630 635 640 645 650 655 660 665 670 Advertising expense Bank charges Electricity and gas expense Insurance expense Interest expense Motor vehicles expense Printing, postage and stationery expense Rent expense Repairs and maintenance expense Sundry expenses Superannuation expense Telephone expense Wages expense 3,712 760 2,569 2,064 1,090 4,811 494 27,064 646 313 3,389 3,944 38,860 309,913 309,913 (Note: Enter accounts in ascending account number order according to the chart of accounts numbers.) OFFICE MEMORANDUM Date: 30/06/20XX To: Maria Italiano SUBJECT: End of period adjustments Adjusting journal entries are required for the following: 1. Wages payable at the end of June are $1,242 2. Transfer 1/3rd of the prepaid insurance to the expense account 3. Transfer 50% of the prepaid advertising to the expense account 4. Superannuation payable for June is $271 5. Record depreciation for the year. Use the straight line (prime cost) method and the rates shown below: a. Motor vehicles 20% b. Store equipment 10% 6. Interest charged on the bank loan for the month was $83 7. The end of June stocktake has determined that the closing inventory value of food is $1,968 and packaging $4,321. Signed: Accountant Prepaid advertising No. 150 Date Details Post ref. Debit Date Details Post ref. Credit June 1 Balance 580 June Prepaid insurance No. 160 Date - Details Post Debit Date Details Pest Credit June 1 Balance 2,031 June No. 171 Accumulated depreciation - motor vehicles Date Details Post ref. Debit Date Details Post ref. Credit June 1 Balance 11,037 No. 181 Accumulated depreciation - store equipment Date Details Post Debit Date June 1 Details Post Credit Balance 11,430 Superannuation payable No. 220 Details Post Debit Date Details Post ref. Credit Date June 17 Cash CPJ12 271 June 1 Balance 271 Interest expense No. 630 Date Details Post ref. Post Debit Debit Date Date Details Post ref. Credit June 1 Balance 1,090 Superannuation expense No. 660 Details Post ref. - Balance Post Debit Date Date Details . 3,389 Details Post ref. Date June 1 Post Credit Wages expense No. 670 Date Details Post ref. Debit Date Details Post Credit ref. June 1 1 Balance Cash Cash CP312 CP312 36,198 1,331 1,331 17