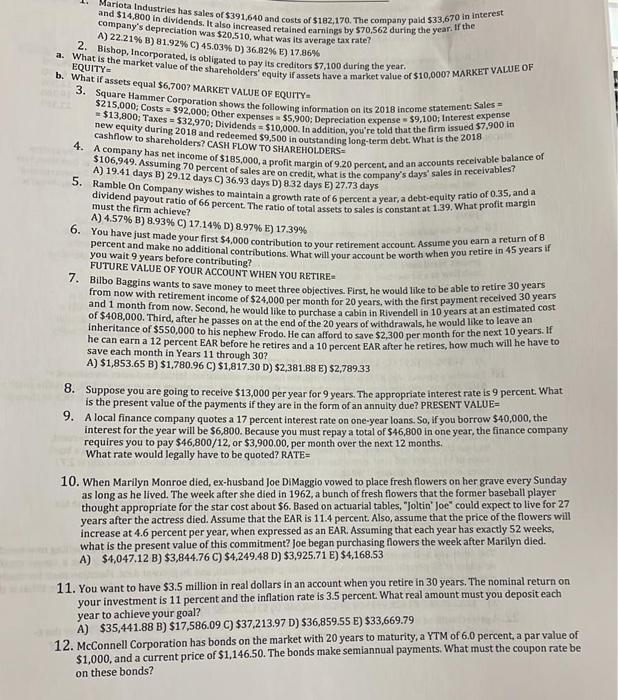

Mariota Industries has sales of $391,640 and costs of $182,170. The company paid $33,670 in interest and $14,800 in dividends. It also increased retained earnings by $70,562 during the year. If the company's depreciation was $20,510, what was its average tax rate? A) 22.21% B) 81.92 % C) 45.03 % D) 36.82% E) 17.86% 2. Bishop, Incorporated, is obligated to pay its creditors $7,100 during the year a. What is the market value of the shareholders' equity if assets have a market value of $10,000? MARKET VALUE OF EQUITY= b. What if assets equal $6,7007 MARKET VALUE OF EQUITY= 3. Square Hammer Corporation shows the following information on its 2018 income statement: Sales = $215,000; Costs $92,000; Other expenses $5,900; Depreciation expense $9,100; Interest expense $13,800; Taxes = $32,970; Dividends = $10,000. In addition, you're told that the firm issued $7,900 in new equity during 2018 and redeemed $9,500 in outstanding long-term debt. What is the 2018 cashflow to shareholders? CASH FLOW TO SHAREHOLDERS 4. A company has net income of $185,000, a profit margin of 9.20 percent, and an accounts receivable balance of $106,949. Assuming 70 percent of sales are on credit, what is the company's days' sales in receivables? A) 19.41 days B) 29.12 days C) 36.93 days D) 8.32 days E) 27.73 days 5. Ramble On Company wishes to maintain a growth rate of 6 percent a year, a debt-equity ratio of 0.35, and a dividend payout ratio of 66 percent. The ratio of total assets to sales is constant at 1.39. What profit margin must the firm achieve? A) 4.57% B) 8.93% C) 17.14% D) 8.97% E) 17.39% 6. You have just made your first $4,000 contribution to your retirement account. Assume you earn a return of 8 percent and make no additional contributions. What will your account be worth when you retire in 45 years if you wait 9 years before contributing? FUTURE VALUE OF YOUR ACCOUNT WHEN YOU RETIRE 7. Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $24,000 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $408,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $550,000 to his nephew Frodo. He can afford to save $2,300 per month for the next 10 years. If he can earn a 12 percent EAR before he retires and a 10 percent EAR after he retires, how much will he have to save each month in Years 11 through 30? A) $1,853.65 B) $1,780.96 C) $1,817.30 D) $2,381.88 E) $2,789.33 8. Suppose you are going to receive $13,000 per year for 9 years. The appropriate interest rate is 9 percent. What is the present value of the payments if they are in the form of an annuity due? PRESENT VALUE= 9. A local finance company quotes a 17 percent interest rate on one-year loans. So, if you borrow $40,000, the interest for the year will be $6,800. Because you must repay a total of $46,800 in one year, the finance company requires you to pay $46,800/12, or $3,900.00, per month over the next 12 months. What rate would legally have to be quoted? RATE= 10. When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former baseball player thought appropriate for the star cost about $6. Based on actuarial tables, "Joltin" Joe" could expect to live for 27 years after the actress died. Assume that the EAR is 11.4 percent. Also, assume that the price of the flowers will increase at 4.6 percent per year, when expressed as an EAR. Assuming that each year has exactly 52 weeks, what is the present value of this commitment? Joe began purchasing flowers the week after Marilyn died. A) $4,047.12 B) $3,844.76 C) $4,249.48 D) $3,925.71 E) $4,168.53 11. You want to have $3.5 million in real dollars in an account when you retire in 30 years. The nominal return on your investment is 11 percent and the inflation rate is 3.5 percent. What real amount must you deposit each year to achieve your goal? A) $35,441.88 B) $17,586.09 C) $37,213.97 D) $36,859.55 E) $33,669.79 12. McConnell Corporation has bonds on the market with 20 years to maturity, a YTM of 6.0 percent, a par value of $1,000, and a current price of $1,146.50. The bonds make semiannual payments. What must the coupon rate be on these bonds