Question

Mark Company has $250,000 to pay dividends. The company has 25,000 shares of 8%, $50 par, preferred stock and 100,000 shares of $5 par

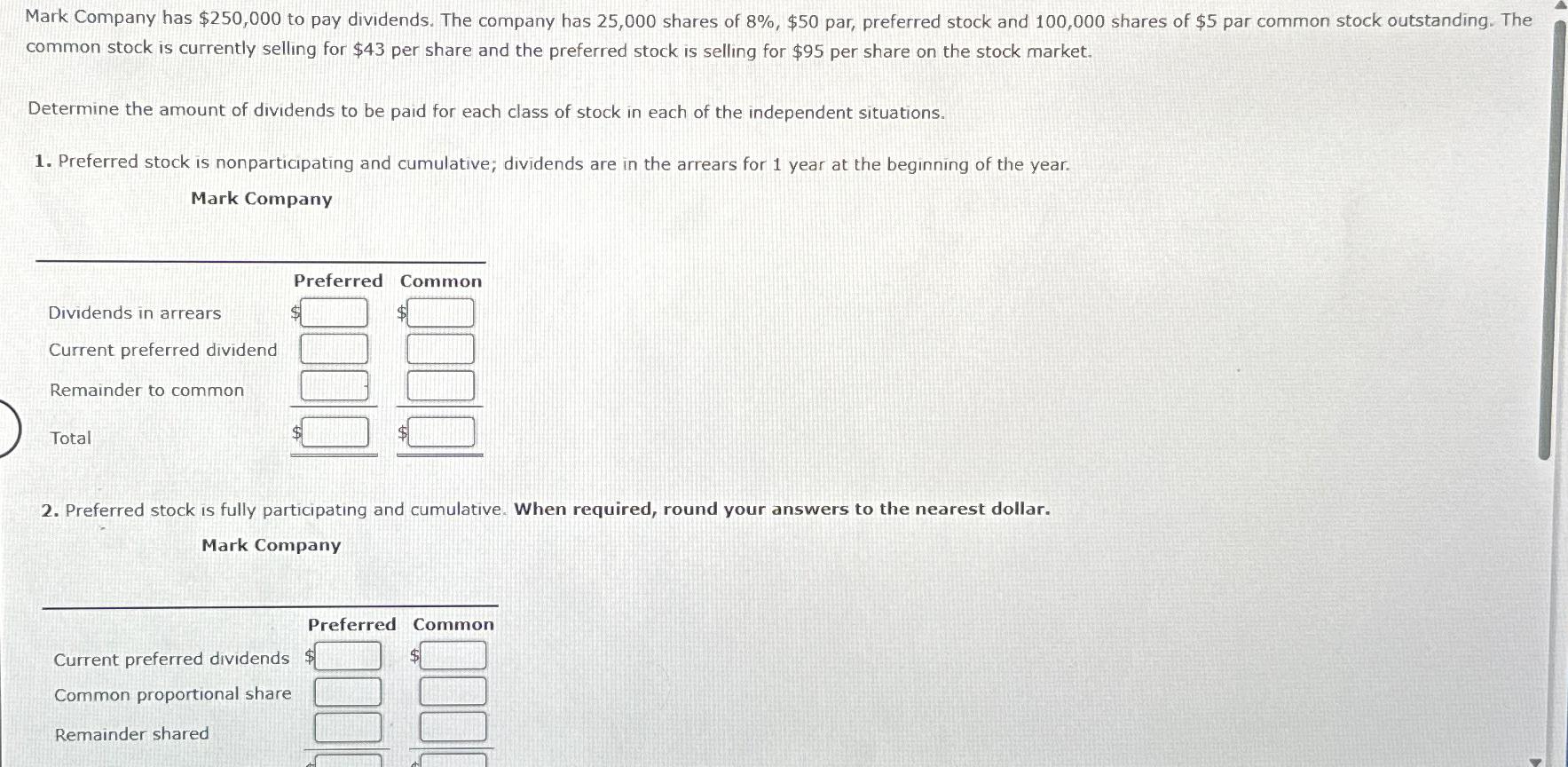

Mark Company has $250,000 to pay dividends. The company has 25,000 shares of 8%, $50 par, preferred stock and 100,000 shares of $5 par common stock outstanding. The common stock is currently selling for $43 per share and the preferred stock is selling for $95 per share on the stock market. Determine the amount of dividends to be paid for each class of stock in each of the independent situations. 1. Preferred stock is nonparticipating and cumulative; dividends are in the arrears for 1 year at the beginning of the year. Mark Company Dividends in arrears Current preferred dividend Remainder to common Total Preferred Common $ 2. Preferred stock is fully participating and cumulative. When required, round your answers to the nearest dollar. Mark Company Current preferred dividends Common proportional share Remainder shared Preferred Common

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

1st edition

1111822360, 978-1337116619, 1337116610, 978-1111822378, 1111822379, 978-1111822361

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App