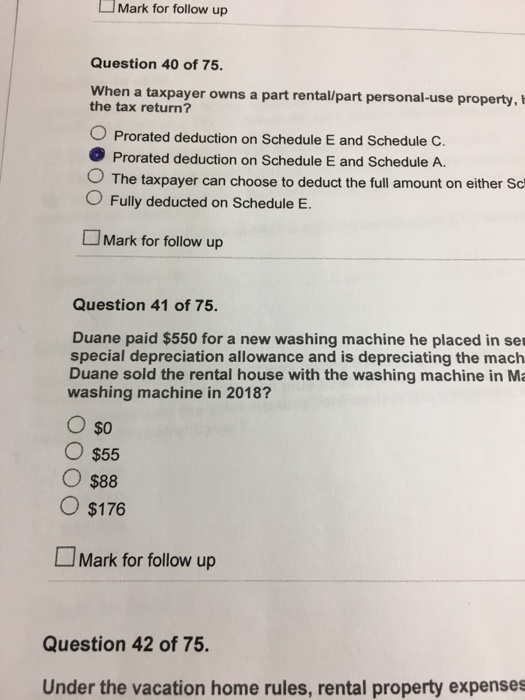

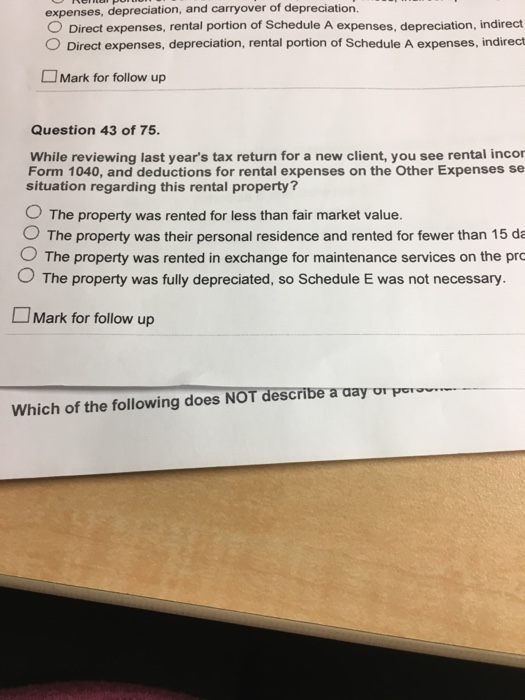

Mark for follow up Question 40 of 75. When a taxpayer owns a part rental/part personal use property, 1 the tax return? O Prorated deduction on Schedule E and Schedule C. Prorated deduction on Schedule E and Schedule A. The taxpayer can choose to deduct the full amount on either Sc O Fully deducted on Schedule E. Mark for follow up Question 41 of 75. Duane paid $550 for a new washing machine he placed in se special depreciation allowance and is depreciating the mach Duane sold the rental house with the washing machine in Ma washing machine in 2018? O $0 O $55 O $88 O $176 Mark for follow up Question 42 of 75. Under the vacation home rules, rental property expenses expenses, depreciation, and carryover of depreciation O Direct expenses, rental portion of Schedule A expenses, depreciation, indirect O Direct expenses, depreciation, rental portion of Schedule A expenses, indirect Mark for follow up Question 43 of 75. While reviewing last year's tax return for a new client, you see rental incor Form 1040, and deductions for rental expenses on the Other Expenses se situation regarding this rental property? The property was rented for less than fair market value. The property was their personal residence and rented for fewer than 15 da The property was rented in exchange for maintenance services on the pre The property was fully depreciated, so Schedule E was not necessary. Mark for follow up Which of the following does NOT describe a day or poro Mark for follow up Question 40 of 75. When a taxpayer owns a part rental/part personal use property, 1 the tax return? O Prorated deduction on Schedule E and Schedule C. Prorated deduction on Schedule E and Schedule A. The taxpayer can choose to deduct the full amount on either Sc O Fully deducted on Schedule E. Mark for follow up Question 41 of 75. Duane paid $550 for a new washing machine he placed in se special depreciation allowance and is depreciating the mach Duane sold the rental house with the washing machine in Ma washing machine in 2018? O $0 O $55 O $88 O $176 Mark for follow up Question 42 of 75. Under the vacation home rules, rental property expenses expenses, depreciation, and carryover of depreciation O Direct expenses, rental portion of Schedule A expenses, depreciation, indirect O Direct expenses, depreciation, rental portion of Schedule A expenses, indirect Mark for follow up Question 43 of 75. While reviewing last year's tax return for a new client, you see rental incor Form 1040, and deductions for rental expenses on the Other Expenses se situation regarding this rental property? The property was rented for less than fair market value. The property was their personal residence and rented for fewer than 15 da The property was rented in exchange for maintenance services on the pre The property was fully depreciated, so Schedule E was not necessary. Mark for follow up Which of the following does NOT describe a day or poro