Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark opens his own company and completes the following transactions in May: 5/1 Mark invests $14,000 into the business. 5/3 Purchased $3,800 of equipment

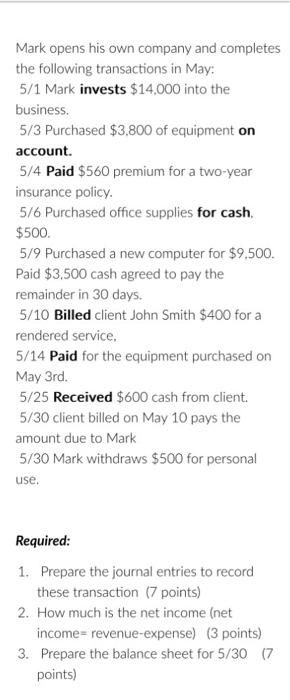

Mark opens his own company and completes the following transactions in May: 5/1 Mark invests $14,000 into the business. 5/3 Purchased $3,800 of equipment on account. 5/4 Paid $560 premium for a two-year insurance policy. 5/6 Purchased office supplies for cash. $500. 5/9 Purchased a new computer for $9,500. Paid $3,500 cash agreed to pay the remainder in 30 days. 5/10 Billed client John Smith $400 for a rendered service, 5/14 Paid for the equipment purchased on May 3rd. 5/25 Received $600 cash from client. 5/30 client billed on May 10 pays the amount due to Mark 5/30 Mark withdraws $500 for personal use. Required: 1. Prepare the journal entries to record these transaction (7 points) 2. How much is the net income (net income- revenue-expense) (3 points) 3. Prepare the balance sheet for 5/30 (7 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Journal Entries Date Account Debit Credit 51 Cash 14000 Owners Equity 14000 53 Equipment 38...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started