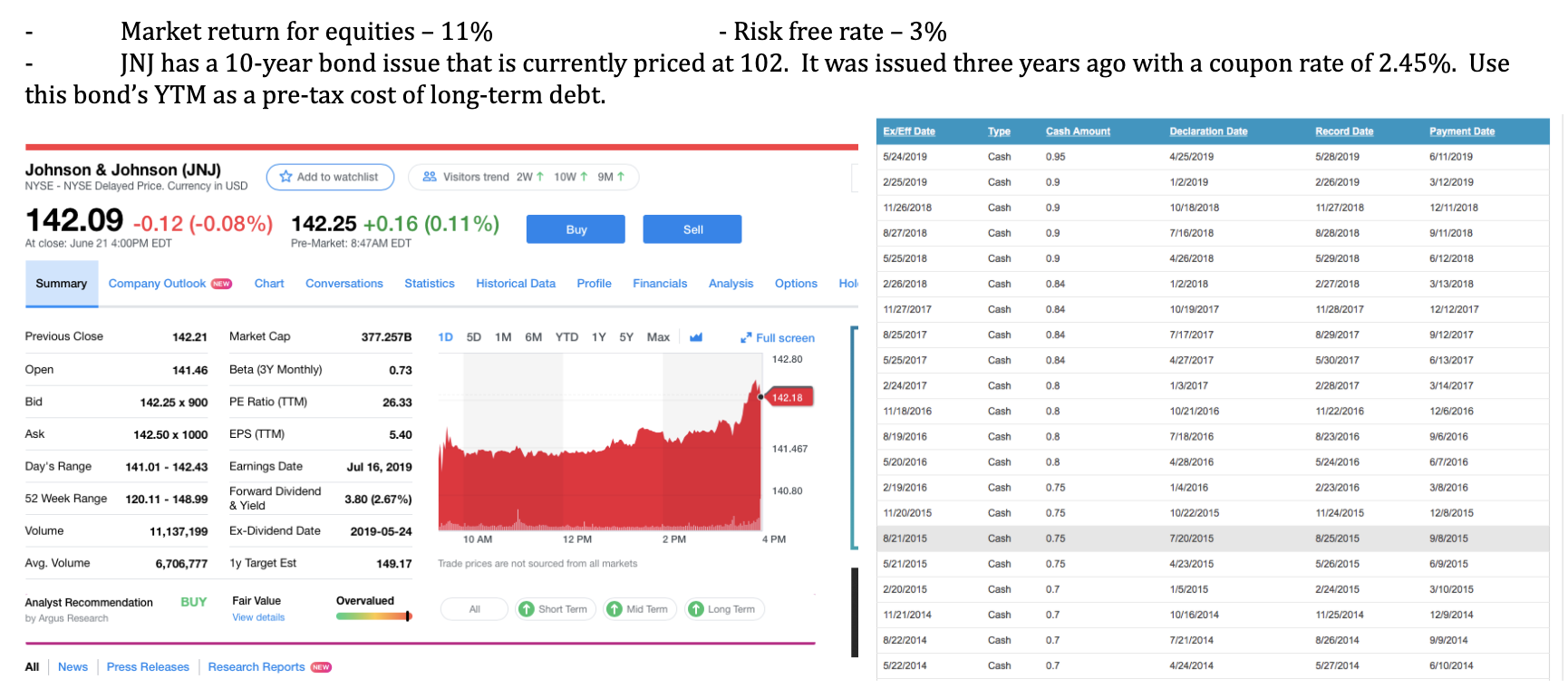

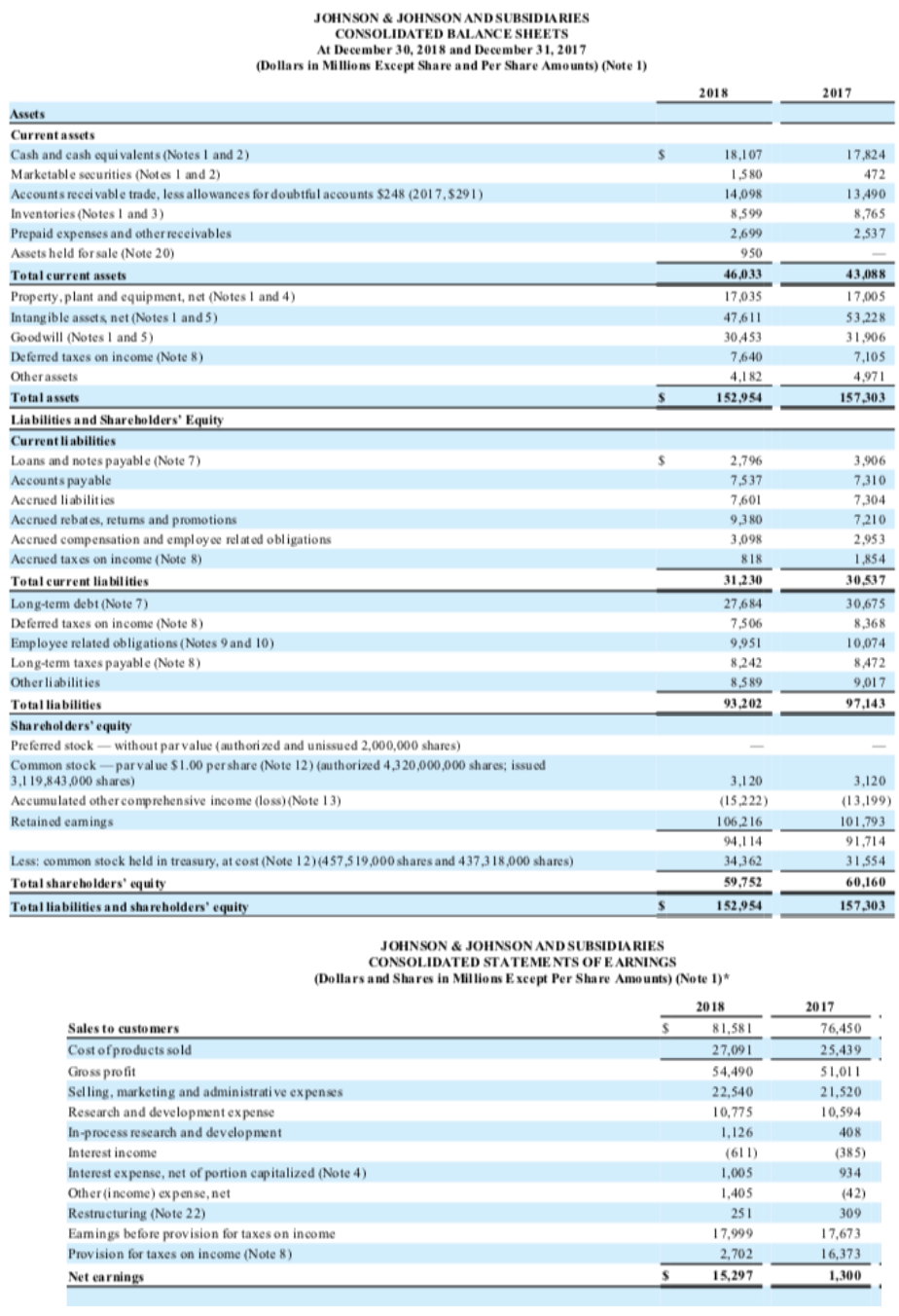

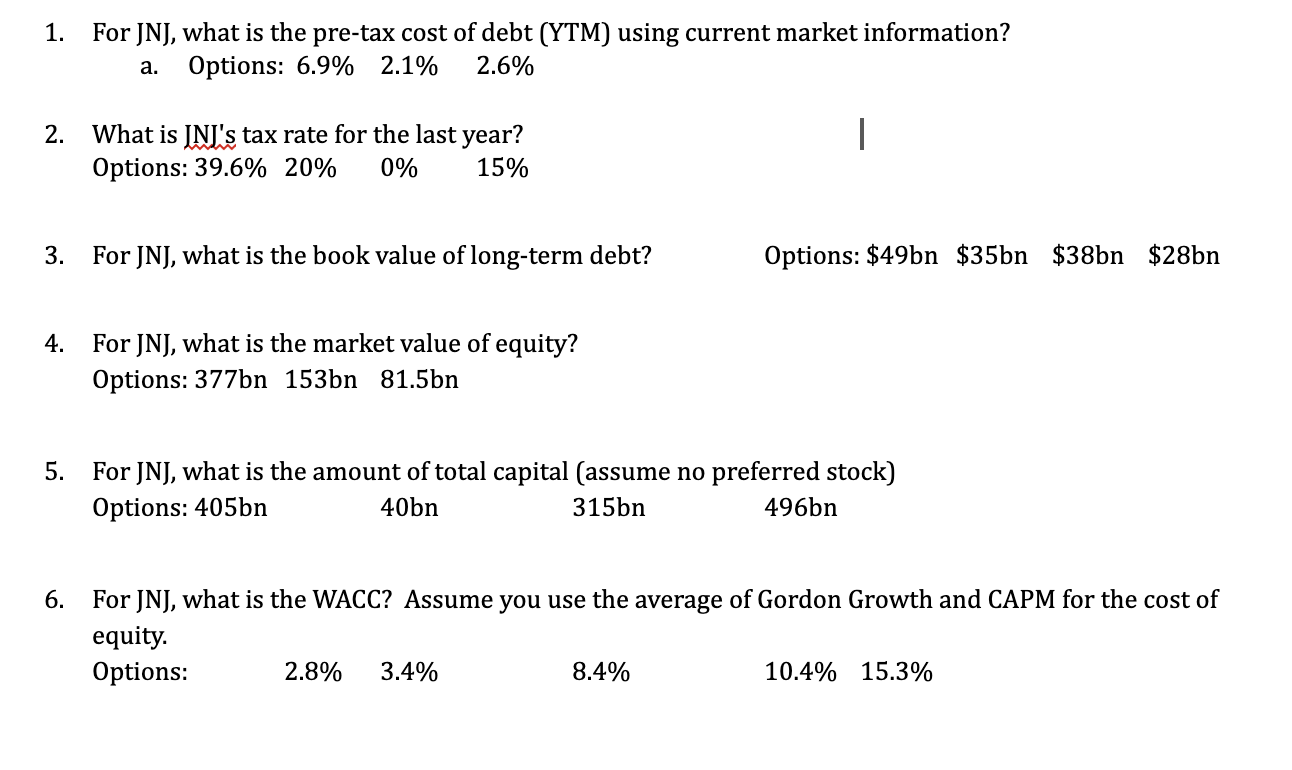

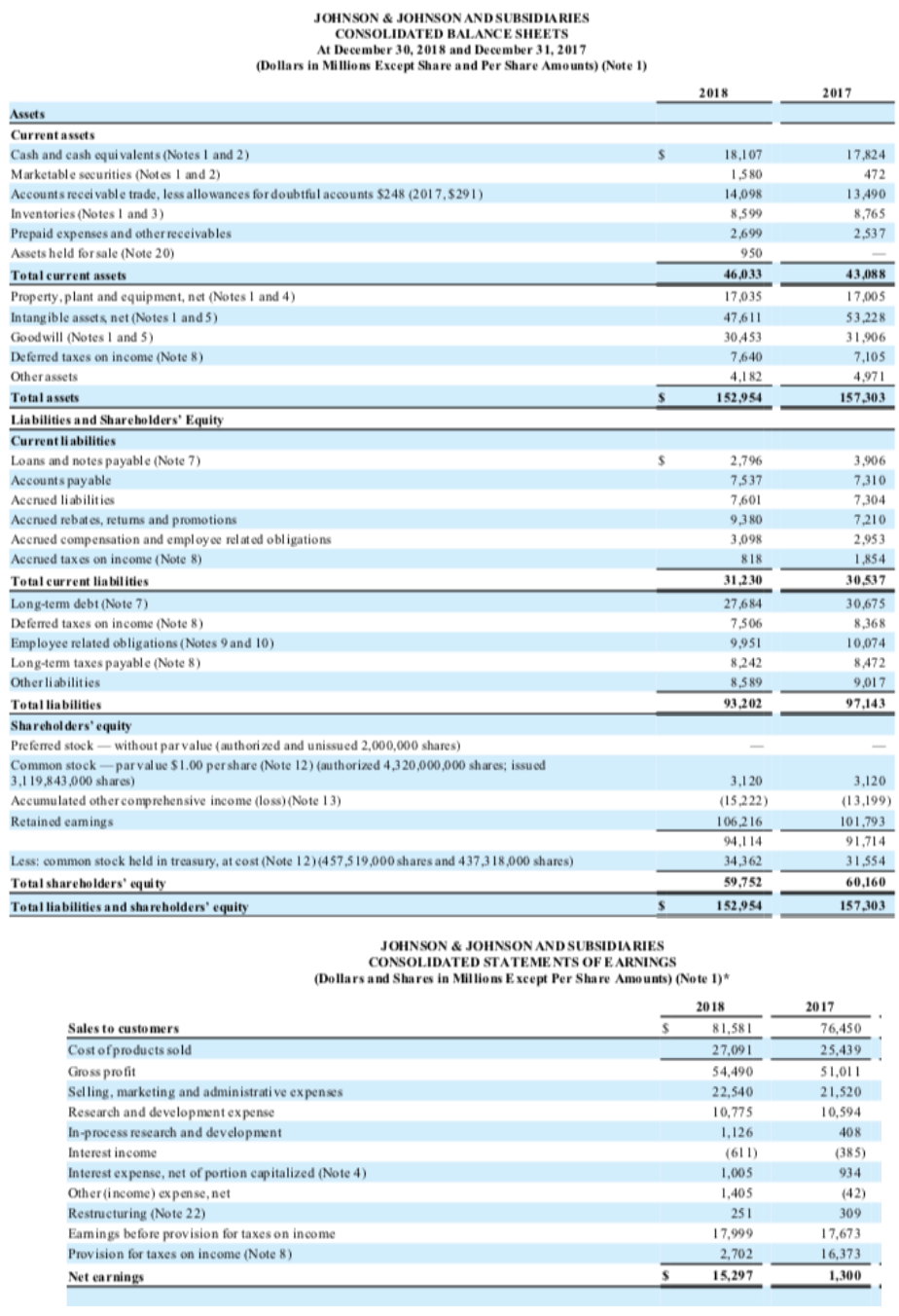

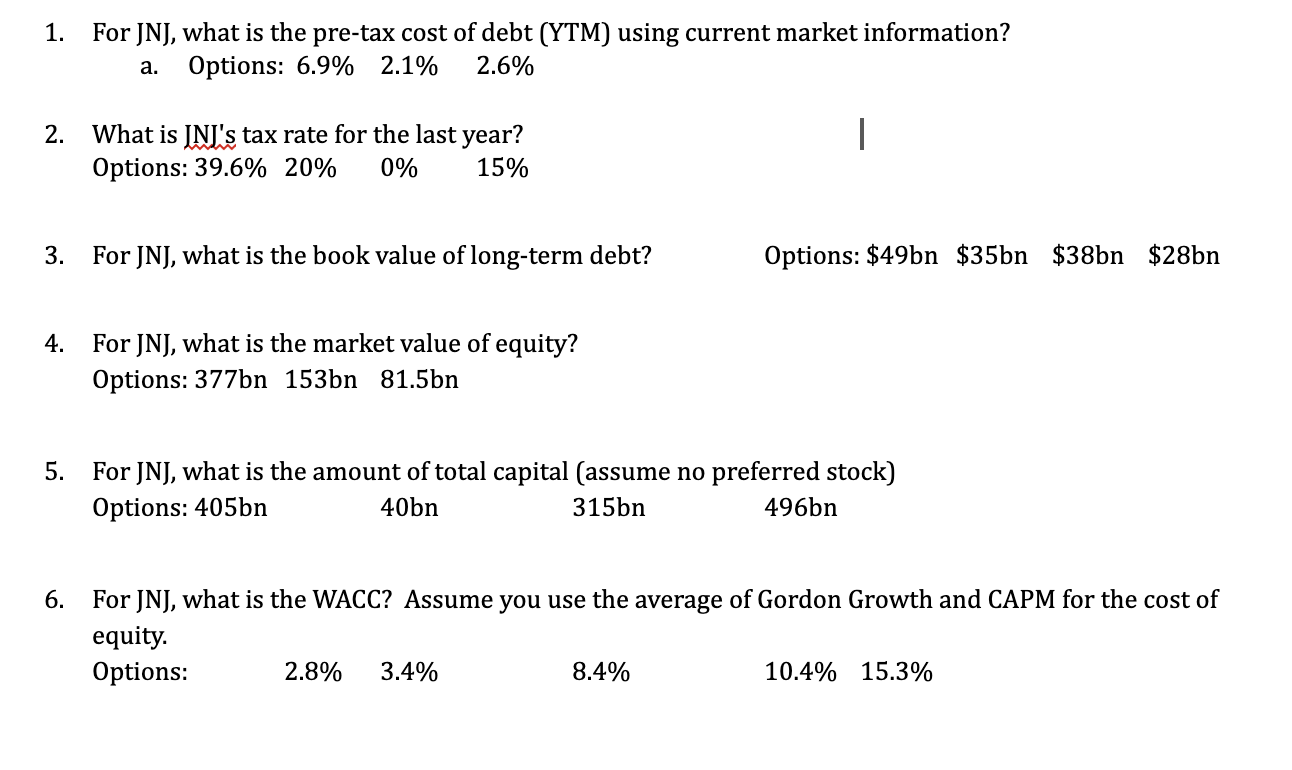

Market return for equities 11% - Risk free rate - 3% JNJ has a 10-year bond issue that is currently priced at 102. It was issued three years ago with a coupon rate of 2.45%. Use a this bond's YTM as a pre-tax cost of long-term debt. Ex/Eff Date Type Cash Amount Declaration Date Record Date Payment Date 5/24/2019 Cash 0.95 4/25/2019 5/28/2019 6/11/2019 Johnson & Johnson (JNJ) NYSE - NYSE Delayed Price. Currency in USD - Add to watchlist 29 Visitors trend 2W + 10W T 9M 1 2/25/2019 Cash 0.9 1/2/2019 2/26/2019 3/12/2019 11/26/2018 Cash 0.9 10/18/2018 11/27/2018 12/11/2018 142.09 -0.12 (-0.08%) 142.25 +0.16 0.11%) Buy Sell 8/27/2018 Cash 0.9 7/16/2018 8/28/2018 9/11/2018 At close: June 21 4:00PM EDT Pre-Market: 8:47AM EDT 5/25/2018 Cash 0.9 4/26/2018 5/29/2018 6/12/2018 Summary Company Outlook SEW Chart Conversations Statistics Historical Data Profile Financials Analysis Options Hol 2/26/2018 Cash 0.84 1/2/2018 2/27/2018 3/13/2018 11/27/2017 Cash 0.84 10/19/2017 11/28/2017 12/12/2017 Previous Close 142.21 Market Cap 377.257B 1D 5D 1M 6M YTD 1y5Y Max W * Full screen 8/25/2017 Cash 0.84 7/17/2017 8/29/2017 9/12/2017 142.80 5/25/2017 Cash 0.84 4/27/2017 5/30/2017 6/13/2017 Open 141.46 Beta (3Y Monthly) 0.73 2/24/2017 Cash 0.8 1/3/2017 2/28/2017 3/14/2017 Bid 142.25 x 900 PE Ratio (TTM) 26.33 142.18 11/18/2016 Cash 0.8 10/21/2016 11/22/2016 12/6/2016 Ask 142.50 x 1000 EPS (TTM) 5.40 8/19/2016 Cash 0.8 7/18/2016 8/23/2016 9/6/2016 141.467 Cash Day's Range 141.01 - 142.43 5/20/2016 0.8 Jul 16, 2019 4/28/2016 5/24/2016 6/7/2016 Earnings Date Forward Dividend & Yield 140.80 2/19/2016 0.75 Cash 1/4/2016 2/23/2016 3/8/2016 52 Week Range 120.11 - 148.99 3.80 (2.67%) 11/20/2015 Cash 0.75 10/22/2015 11/24/2015 12/8/2015 Volume 11,137,199 Ex-Dividend Date 2019-05-24 10 AM 12 PM 2 PM 4 4 PM 8/21/2015 Cash 0.75 7/20/2015 8/25/2015 9/8/2015 Avg. Volume 6,706,777 1y Target Est 149.17 Trade prices are not sourced from all markets 5/21/2015 Cash 0.75 4/23/2015 5/26/2015 6/9/2015 2/20/2015 Cash 0.7 1/5/2015 2/24/2015 3/10/2015 BUY Overvalued Analyst Recommendation by Argus Research Fair Value View details All Short Term Mid Term 1 Long Term 11/21/2014 Cash 0.7 10/16/2014 11/25/2014 12/9/2014 8/22/2014 Cash 0.7 7/21/2014 8/26/2014 9/9/2014 All News Press Releases Research Reports NEW 5/22/2014 Cash 0.7 4/24/2014 5/27/2014 6/10/2014 JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS At December 30, 2018 and December 31, 2017 (Dollars in Millions Except Share and Per Share Amounts) (Note 1) 2018 2017 17.824 472 13.490 8,765 2,537 18,107 1.580 14,098 8,599 2.699 950 46,033 17,035 47.611 30.453 7.640 4.182 152,954 43.088 17.005 53,228 31,906 7,105 4.971 157,303 Assets Current assets Cash and cash oquivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $248 (2017.5291) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 20) Total current assets Property, plant and equipment, net (Notes and 4) Intangible assets net (Notes 1 and 5) Goodwill (Notes and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accried liabilities Accried rebates, retums and promotions Accrued compensation and employee related obligations Accrued taxes on income ( Note 8) Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-tem taxes payable (Note 8) Other liabilities Total liabilities Shareholders'equity Preferred stock - without par value authorized and unissued 2,000,000 shares) Common stock - par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3,119,843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earings 2,796 7.537 7.601 9,380 3.098 818 31.230 27,684 7,506 9.951 8,242 8.589 93,202 3,906 7,310 7,304 7.210 2.953 1.854 30.537 30,675 8,368 10.074 8.472 9.017 97.143 3.120 (15,222) 106,216 94.114 34,362 59,752 152,954 3.120 (13.199) 101.793 91.714 31,554 60.160 Less: common stock held in treasury, at cost (Note 12)(457,519,000 shares and 437,318,000 shares) Total shareholders' equity Total liabilities and shareholders' equity $ S 157,303 JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS (Dollars and Shares in Millions Except Per Share Amounts) (Note 1)* $ Sales to customers Cost of products sold Gross profit Selling, marketing and administrative expenses Research and development expense In-process research and development Interest income Interest expense, net of portion capitalized (Note 4) Other (income) expense, net Restructuring (Note 22) Eamings before provision for taxes on income Provision for taxes on income (Note 8) Net earnings 2018 81,581 27.091 54,490 22,540 10.775 1,126 (611) 1,005 1,405 251 17,999 2,702 15,297 2017 76,450 25,439 51,011 21,520 10,594 408 (385) 934 (42) 309 17,673 16,373 1,300 1. For JNJ, what is the pre-tax cost of debt (YTM) using current market information? Options: 6.9% 2.1% 2.6% a. 2. What is INI's tax rate for the last year? Options: 39.6% 20% 0% 15% 3. For JNJ, what is the book value of long-term debt? Options: $49bn $35bn $38bn $28bn 4. For JNJ, what is the market value of equity? Options: 377bn 153bn 81.5bn 5. For JNJ, what is the amount of total capital (assume no preferred stock) Options: 405bn 40bn 315bn 496bn 6. For JNJ, what is the WACC? Assume you use the average of Gordon Growth and CAPM for the cost of equity. Options: 2.8% 3.4% 8.4% 10.4% 15.3% Market return for equities 11% - Risk free rate - 3% JNJ has a 10-year bond issue that is currently priced at 102. It was issued three years ago with a coupon rate of 2.45%. Use a this bond's YTM as a pre-tax cost of long-term debt. Ex/Eff Date Type Cash Amount Declaration Date Record Date Payment Date 5/24/2019 Cash 0.95 4/25/2019 5/28/2019 6/11/2019 Johnson & Johnson (JNJ) NYSE - NYSE Delayed Price. Currency in USD - Add to watchlist 29 Visitors trend 2W + 10W T 9M 1 2/25/2019 Cash 0.9 1/2/2019 2/26/2019 3/12/2019 11/26/2018 Cash 0.9 10/18/2018 11/27/2018 12/11/2018 142.09 -0.12 (-0.08%) 142.25 +0.16 0.11%) Buy Sell 8/27/2018 Cash 0.9 7/16/2018 8/28/2018 9/11/2018 At close: June 21 4:00PM EDT Pre-Market: 8:47AM EDT 5/25/2018 Cash 0.9 4/26/2018 5/29/2018 6/12/2018 Summary Company Outlook SEW Chart Conversations Statistics Historical Data Profile Financials Analysis Options Hol 2/26/2018 Cash 0.84 1/2/2018 2/27/2018 3/13/2018 11/27/2017 Cash 0.84 10/19/2017 11/28/2017 12/12/2017 Previous Close 142.21 Market Cap 377.257B 1D 5D 1M 6M YTD 1y5Y Max W * Full screen 8/25/2017 Cash 0.84 7/17/2017 8/29/2017 9/12/2017 142.80 5/25/2017 Cash 0.84 4/27/2017 5/30/2017 6/13/2017 Open 141.46 Beta (3Y Monthly) 0.73 2/24/2017 Cash 0.8 1/3/2017 2/28/2017 3/14/2017 Bid 142.25 x 900 PE Ratio (TTM) 26.33 142.18 11/18/2016 Cash 0.8 10/21/2016 11/22/2016 12/6/2016 Ask 142.50 x 1000 EPS (TTM) 5.40 8/19/2016 Cash 0.8 7/18/2016 8/23/2016 9/6/2016 141.467 Cash Day's Range 141.01 - 142.43 5/20/2016 0.8 Jul 16, 2019 4/28/2016 5/24/2016 6/7/2016 Earnings Date Forward Dividend & Yield 140.80 2/19/2016 0.75 Cash 1/4/2016 2/23/2016 3/8/2016 52 Week Range 120.11 - 148.99 3.80 (2.67%) 11/20/2015 Cash 0.75 10/22/2015 11/24/2015 12/8/2015 Volume 11,137,199 Ex-Dividend Date 2019-05-24 10 AM 12 PM 2 PM 4 4 PM 8/21/2015 Cash 0.75 7/20/2015 8/25/2015 9/8/2015 Avg. Volume 6,706,777 1y Target Est 149.17 Trade prices are not sourced from all markets 5/21/2015 Cash 0.75 4/23/2015 5/26/2015 6/9/2015 2/20/2015 Cash 0.7 1/5/2015 2/24/2015 3/10/2015 BUY Overvalued Analyst Recommendation by Argus Research Fair Value View details All Short Term Mid Term 1 Long Term 11/21/2014 Cash 0.7 10/16/2014 11/25/2014 12/9/2014 8/22/2014 Cash 0.7 7/21/2014 8/26/2014 9/9/2014 All News Press Releases Research Reports NEW 5/22/2014 Cash 0.7 4/24/2014 5/27/2014 6/10/2014 JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS At December 30, 2018 and December 31, 2017 (Dollars in Millions Except Share and Per Share Amounts) (Note 1) 2018 2017 17.824 472 13.490 8,765 2,537 18,107 1.580 14,098 8,599 2.699 950 46,033 17,035 47.611 30.453 7.640 4.182 152,954 43.088 17.005 53,228 31,906 7,105 4.971 157,303 Assets Current assets Cash and cash oquivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $248 (2017.5291) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 20) Total current assets Property, plant and equipment, net (Notes and 4) Intangible assets net (Notes 1 and 5) Goodwill (Notes and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accried liabilities Accried rebates, retums and promotions Accrued compensation and employee related obligations Accrued taxes on income ( Note 8) Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-tem taxes payable (Note 8) Other liabilities Total liabilities Shareholders'equity Preferred stock - without par value authorized and unissued 2,000,000 shares) Common stock - par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3,119,843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earings 2,796 7.537 7.601 9,380 3.098 818 31.230 27,684 7,506 9.951 8,242 8.589 93,202 3,906 7,310 7,304 7.210 2.953 1.854 30.537 30,675 8,368 10.074 8.472 9.017 97.143 3.120 (15,222) 106,216 94.114 34,362 59,752 152,954 3.120 (13.199) 101.793 91.714 31,554 60.160 Less: common stock held in treasury, at cost (Note 12)(457,519,000 shares and 437,318,000 shares) Total shareholders' equity Total liabilities and shareholders' equity $ S 157,303 JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS (Dollars and Shares in Millions Except Per Share Amounts) (Note 1)* $ Sales to customers Cost of products sold Gross profit Selling, marketing and administrative expenses Research and development expense In-process research and development Interest income Interest expense, net of portion capitalized (Note 4) Other (income) expense, net Restructuring (Note 22) Eamings before provision for taxes on income Provision for taxes on income (Note 8) Net earnings 2018 81,581 27.091 54,490 22,540 10.775 1,126 (611) 1,005 1,405 251 17,999 2,702 15,297 2017 76,450 25,439 51,011 21,520 10,594 408 (385) 934 (42) 309 17,673 16,373 1,300 1. For JNJ, what is the pre-tax cost of debt (YTM) using current market information? Options: 6.9% 2.1% 2.6% a. 2. What is INI's tax rate for the last year? Options: 39.6% 20% 0% 15% 3. For JNJ, what is the book value of long-term debt? Options: $49bn $35bn $38bn $28bn 4. For JNJ, what is the market value of equity? Options: 377bn 153bn 81.5bn 5. For JNJ, what is the amount of total capital (assume no preferred stock) Options: 405bn 40bn 315bn 496bn 6. For JNJ, what is the WACC? Assume you use the average of Gordon Growth and CAPM for the cost of equity. Options: 2.8% 3.4% 8.4% 10.4% 15.3%