Question

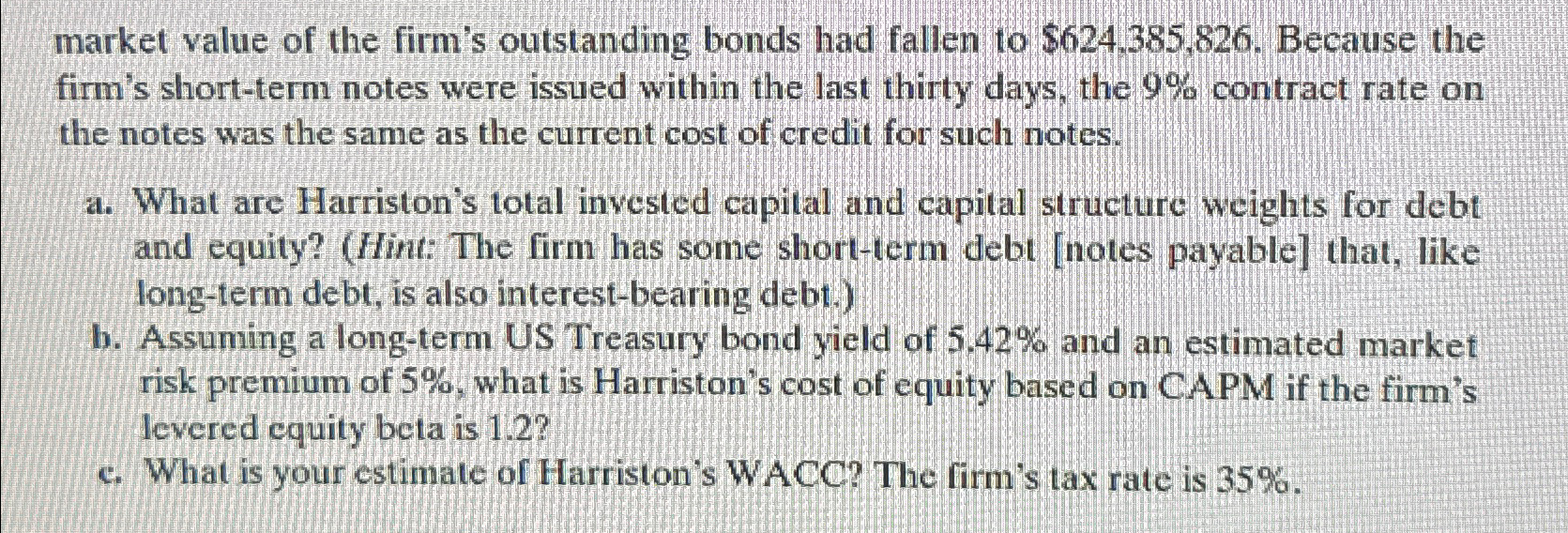

market value of the firm's outstanding bonds had fallen to $624,385,826 . Because the firm's short-term notes were issued within the last thirty days, the

market value of the firm's outstanding bonds had fallen to

$624,385,826. Because the firm's short-term notes were issued within the last thirty days, the

9%contract rate on the notes was the same as the current cost of credit for such notes.\ a. What are Harriston's total invested capital and capital structure weights for debt and equity? (Hint: The firm has some short-term debt [notes payable] that, like long-term debt, is also interest-bearing debt.)\ b. Assuming a long-term US Treasury bond yield of

5.42%and an estimated market risk premium of

5%, what is Harriston's cost of equity based on CAPM if the firm's levered equity beta is 1.2 ?\ c. What is your estimate of Harriston's WACC? The firm's tax rate is

35%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started