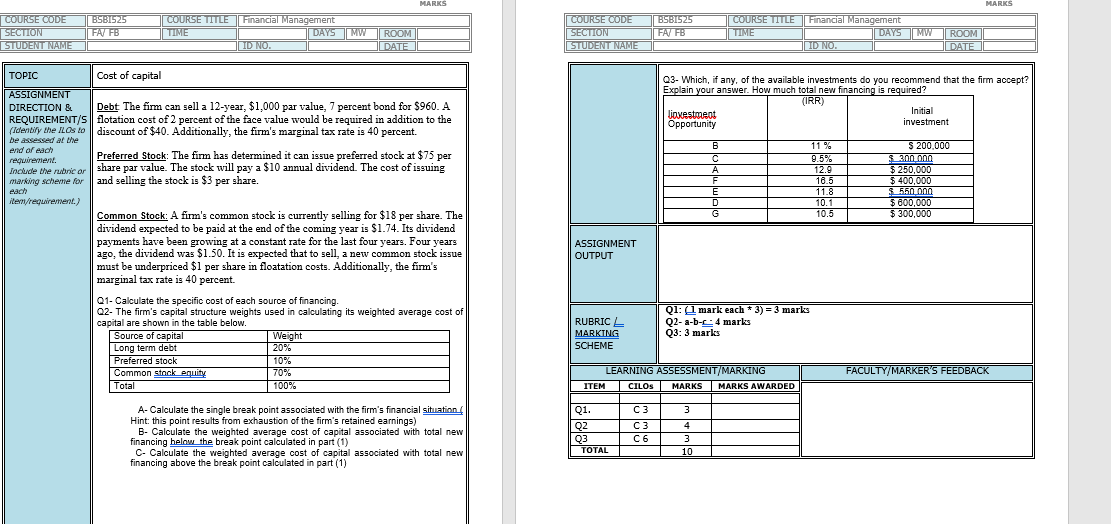

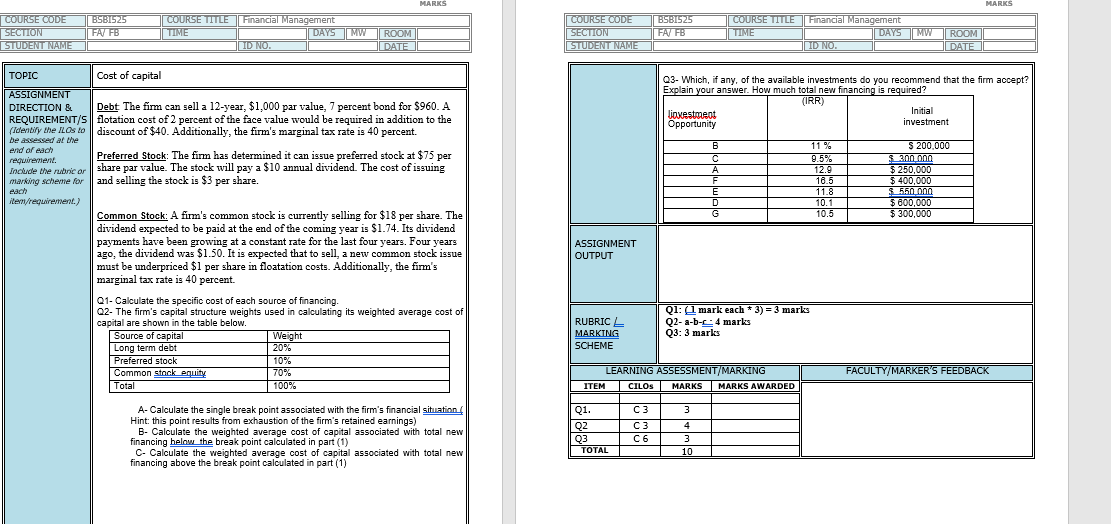

MARKS MARKS COURSE CODE SECTION STUDENT NAME BSBI525 FAY FB COURSE TITLE Financial Management TIME DAYS MW ROOM ID NO DATE COURSE CODE SECTION STUDENT NAME BSBI525 FAY FB COURSE TITLE Financial Management TIME DAYS MW ROOM ID NO. DATE TOPIC Cost of capital Q3. Which, if any, of the available investments do you recommend that the firm accept? Explain your answer. How much total new financing is required? (IRR) lovestmeot Initial Opportunity investment B 11 % $ 200,000 C 9.5% 300 na 12.9 $ 250,000 F 18.5 $ 400,000 E 11.8 550.00 10.1 $ 600,000 G 10.5 $ 300,000 D ASSIGNMENT DIRECTION & Debt The fimm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A REQUIREMENT/s flotation cost of 2 percent of the face value would be required in addition to the (identity the ILOS to discount of $40. Additionally, the firm's marginal tax rate is 40 percent. be assessed at the end of each requirement. Preferred Stock: The firm has determined it can issue preferred stock at $75 per include the rubric or share par value. The stock will pay a $10 annual dividend. The cost of issuing marking scheme for and selling the stock is $3 per share. each item/requirement.) Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent. Q1- Calculate the specific cost of each source of financing. 02- The firm's capital structure weights used in calculating its weighted average cost of capital are shown in the table below. Source of capital Weight Long term debt 20% Preferred stock 10% Common stock equity 70% Total 100% ASSIGNMENT OUTPUT RUBRIC MARKING SCHEME Q1: 4 mark each + 3) = 3 marks Q2-a-b-c4 marks Q3: 3 marks FACULTY/MARKER'S FEEDBACK LEARNING ASSESSMENT/MARKING ITEM CILOS MARKS MARKS AWARDED 3 A- Calculate the single break point associated with the firm's financial situation Hint: this point results from exhaustion of the firm's retained earnings) B- Calculate the weighted average cost of capital associated with total new financing below the break point calculated in part (1) C- Calculate the weighted average cost of capital associated with total new financing above the break point calculated in part (1) Q1. Q2 Q3 TOTAL C3 C3 C6 4 4 3 10 MARKS MARKS COURSE CODE SECTION STUDENT NAME BSBI525 FAY FB COURSE TITLE Financial Management TIME DAYS MW ROOM ID NO DATE COURSE CODE SECTION STUDENT NAME BSBI525 FAY FB COURSE TITLE Financial Management TIME DAYS MW ROOM ID NO. DATE TOPIC Cost of capital Q3. Which, if any, of the available investments do you recommend that the firm accept? Explain your answer. How much total new financing is required? (IRR) lovestmeot Initial Opportunity investment B 11 % $ 200,000 C 9.5% 300 na 12.9 $ 250,000 F 18.5 $ 400,000 E 11.8 550.00 10.1 $ 600,000 G 10.5 $ 300,000 D ASSIGNMENT DIRECTION & Debt The fimm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A REQUIREMENT/s flotation cost of 2 percent of the face value would be required in addition to the (identity the ILOS to discount of $40. Additionally, the firm's marginal tax rate is 40 percent. be assessed at the end of each requirement. Preferred Stock: The firm has determined it can issue preferred stock at $75 per include the rubric or share par value. The stock will pay a $10 annual dividend. The cost of issuing marking scheme for and selling the stock is $3 per share. each item/requirement.) Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent. Q1- Calculate the specific cost of each source of financing. 02- The firm's capital structure weights used in calculating its weighted average cost of capital are shown in the table below. Source of capital Weight Long term debt 20% Preferred stock 10% Common stock equity 70% Total 100% ASSIGNMENT OUTPUT RUBRIC MARKING SCHEME Q1: 4 mark each + 3) = 3 marks Q2-a-b-c4 marks Q3: 3 marks FACULTY/MARKER'S FEEDBACK LEARNING ASSESSMENT/MARKING ITEM CILOS MARKS MARKS AWARDED 3 A- Calculate the single break point associated with the firm's financial situation Hint: this point results from exhaustion of the firm's retained earnings) B- Calculate the weighted average cost of capital associated with total new financing below the break point calculated in part (1) C- Calculate the weighted average cost of capital associated with total new financing above the break point calculated in part (1) Q1. Q2 Q3 TOTAL C3 C3 C6 4 4 3 10