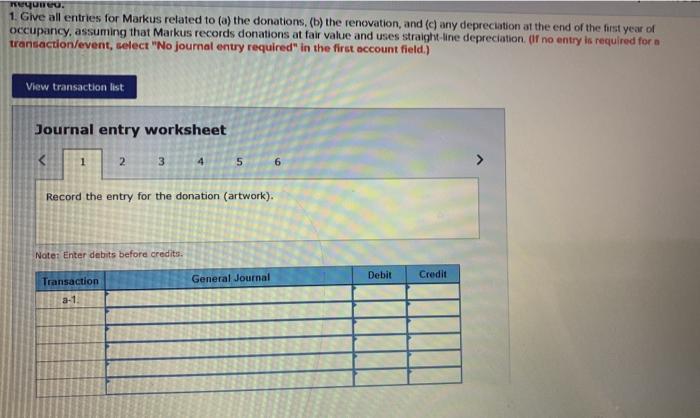

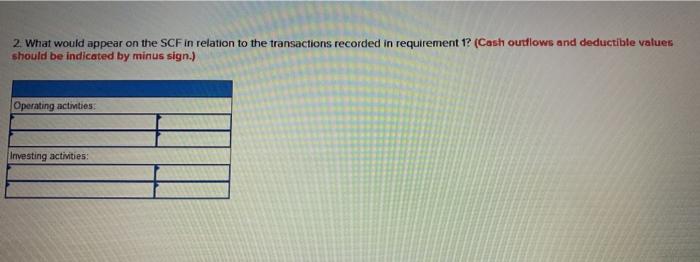

Markus Company received two donations during the year. A long-term client donated a piece of artwork from his personal art collection to display in the company's entrance way as a thank you for all of the years the company had completed work for him immediately. The artwork was appraised at $90,000. Markus also received a vacant building as a donation from the municipality, who no longer wanted to be responsible for operating costs. The building has a 20 year estimated remaining useful life ($38,000 residual value), which was recognized in the donation agreement Transfer costs of $37,500 were paid by the company. The building originally cost $1,450,000. 10 years earlier. The building was recently appraised at $782,500 market value by the municipality's tax assessor Anticipating occupancy within the next 10 days, the company spent $275,000 for repairs and internal rearrangements, and is expected to have value for 8 years. There are no unresolved contingencies about the building and Markus's permanent occupancy Required: 1. Give all entries for Markus related to (a) the donations, (b) the renovation, and (c) any depreciation at the end of the first year of occupancy, assuming that Markus records donations at fair value and uses straight-line depreciation (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 Record the entry for the donation (artwork). Net Friterhit hande Prey 1 of 3 Next > search O . ques. 1. Give all entries for Markus related to (a) the donations. (b) the renovation, and (c) any depreciation at the end of the first year of occupancy, assuming that Markus records donations at fair value and uses straight line depreciation (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 Record the entry for the donation (artwork). Note: Enter debits before credits. Debit General Journal Transaction Credit 8-1 2 What would appear on the SCF in relation to the transactions recorded in requirement 1? (Cash outflows and deductible values should be indicated by minus sign.) Operating activities: Investing activities