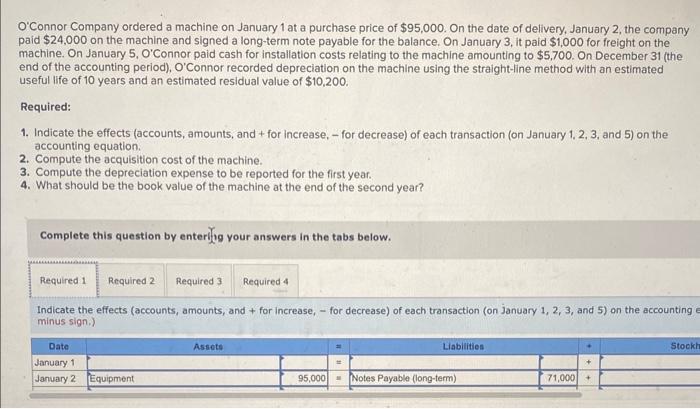

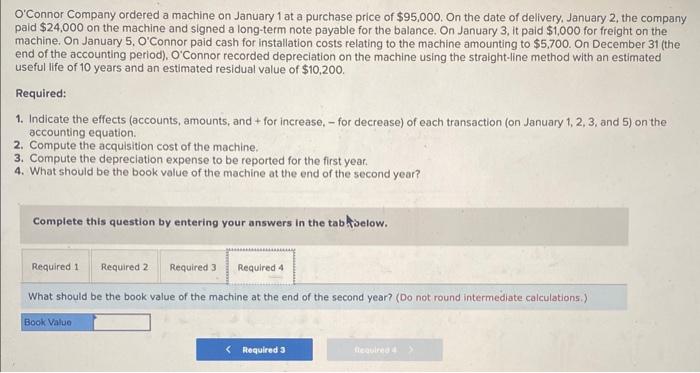

O'Connor Company ordered a machine on January 1 at a purchase price of $95,000. On the date of delivery. January 2 , the company paid $24,000 on the machine and signed a long-term note payable for the balance. On January 3 , it paid $1,000 for freight on the machine. On January 5, O'Connor paid cash for installation costs relating to the machine amounting to $5,700. On December 31 (the end of the accounting period), O'Connor recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $10,200. Required: 1. Indicate the effects (accounts, amounts, and + for increase, - for decrease) of each transaction (on January 1, 2, 3, and 5) on the accounting equation. 2. Compute the acquisition cost of the machine. 3. Compute the depreciation expense to be reported for the first year. 4. What should be the book value of the machine at the end of the second year? Complete this question by enteri.jg your answers in the tabs below. Indicate the effects (accounts, amounts, and + for increase, for decrease) of each transaction (on january 1,2,3, and 5) on the accounting minus sign.) O'Connor Company ordered a machine on January 1 at a purchase price of $95,000. On the date of delivery, January 2 , the company paid $24,000 on the machine and signed a long-term note payable for the balance. On January 3 , it paid $1,000 for freight on the machine. On January 5, O'Connor paid cash for installation costs relating to the machine amounting to $5,700. On December 31 (the end of the accounting period), O'Connor recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $10,200. Required: 1. Indicate the effects (accounts, amounts, and + for increase, - for decrease) of each transaction (on January 1, 2, 3, and 5) on the accounting equation. 2. Compute the acquisition cost of the machine. 3. Compute the depreciation expense to be reported for the first year. 4. What should be the book value of the machine at the end of the second year? Complete this question by entering your answers in the tablhbelow. What should be the book value of the machine at the end of the second year? (Do not round intermediate calculations.)