Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marlene has a life insurance policy with ABC Insurance. The policy has a 30-day grace period and a death benefit of $250,000. Marlene's husband,

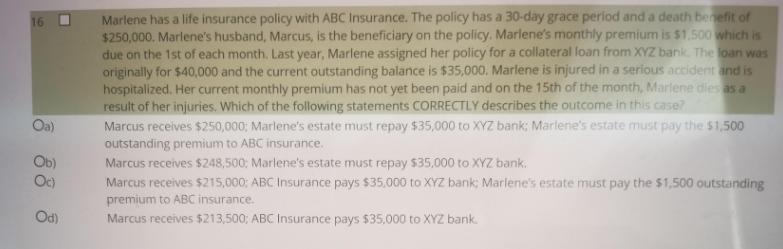

Marlene has a life insurance policy with ABC Insurance. The policy has a 30-day grace period and a death benefit of $250,000. Marlene's husband, Marcus, is the beneficiary on the policy. Marlene's monthly premium is $1.500 which is due on the 1st of each month. Last year, Marlene assigned her policy for a collateral loan from XYZ bank. The loan was originally for $40,000 and the current outstanding balance is $35,000, Marlene is injured in a serious accident and is hospitalized. Her current monthly premium has not yet been paid and on the 15th of the month, Marlene dies as a result of her injuries. Which of the following statements CORRECTLY describes the outcome in this case? Marcus receives $250,000; Marlene's estate must repay $35,000 to XYZ bank; Marlene's estate must pay the $1,500 outstanding premium to ABC insurance. Marcus receives $248,500; Marlene's estate must repay $35,000 to XYZ bank. Marcus receives $215,000: ABC Insurance pays $35,000 to XYZ bank: Marlene's estate must pay the $1,500 outstanding premium to ABC insurance. 16 L Oa) Ob) Oc) Od) Marcus receives $213,500; ABC Insurance pays $35,000 to XYZ bank.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Option D is correct 21350000 Marcus will receive and ABC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started