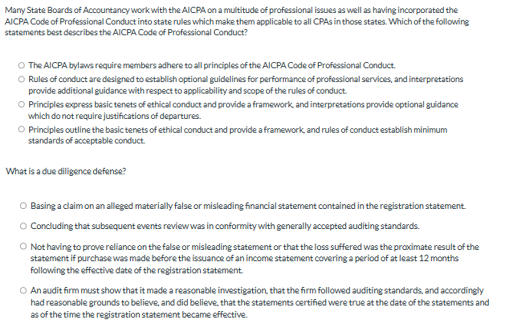

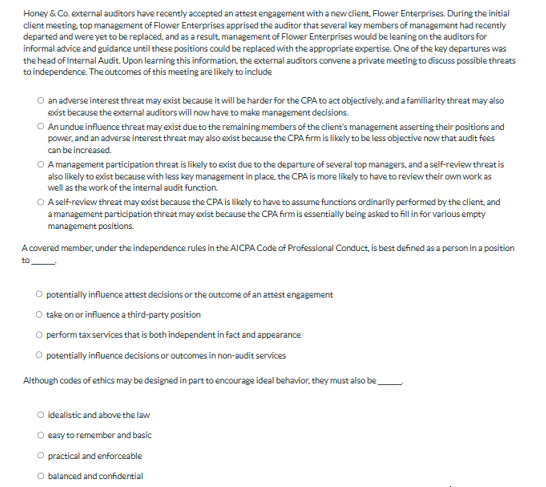

Marry State Boards of Accountancy work with the AUCPA on a multitude of professional issues as well as having incorporated the AICPA Code of Professional Conduct into state rules which make them applicable to all CPAs in those states. Which of the followine statements best describes the AICPA Code of Professional Conduct? The AICPA bylaws require members adhere to all principles of the AICPA Code of Professional Conduct. Rules of conduct are designed to establish optional guidelines for performance of professional services, and interpretations provide additional guidance with respect to applicability and scope of the rules of conduct. Principles express basic tenets of ethical conduct and provide a framework and interpretations provide optional guidance which do not require justifications of departures. Principles cutline the basic tenets of ethical conduct and provide a framework, and rules of conduct establish minimum standards of acceptable conduct. What is a due diligence defense? Basing a claim on an alleged materially false or misleading financial statement contained in the registration statement. Concluding that subsequent events review was in conformity with generally accepted auditing standards. Not having to prove reliance on the false or misleading statement or that the loss suffered was the proximate result of the statement if purchase was made before the issuance of an income statement covering a period of at least 12 months following the effective date of the registration statement. An audit firm must show that it made a reasonable inwestigation, that the firm followed auditing standards and accordingly had reasonable grounds to believe, and did believe, that the statements certified were true at the date of the statements and as of the time the registration statement became effective. Honey \& Co. ecternal auditors have recently accepted an attest engagement with a new client. Flower Enterprises. During the initial client meeting, top management of Flower Enterprises apprised the auditor that several key members of management had recently departed and were yet to be replaced, and as a result, management of Flower Enterprises would be learing on the auditors for informal advice and guidance until these positions could be replaced with the appropriate expertise. One of the key departures was the head of Internal Audit. Upon leaming this information, the external auditors corvene a private meeting to discuss possible threats to independence. The outcomes of this meeting are likely to include an adverse interest threat may exist because it will be harder for the CPA to act objectively, and a familiarity threat may also exist because the external auditors will now have to make management decisions. An undue influence threat may exist due to the remaining members of the client's management asserting thelr positions and power, and an adverse interest threat may also exist because the CPA firm is likely to be less objective now that audit fees can be increased. A management participation threat is likely to exist due to the departure of several top managers. and a self-review threat is also likely to e6ist because with less key management in place, the CPA is more likely to have to review their own work as well as the work of the intemal audit function A self-review threat may exist because the CPA is likely to have to assume functions ordinarily performed by the client, and a management participation threat may exist because the CPA firm is essentially being asked to fill in for various empty management positions. A covered member, under the independence rules in the AICPA Code of Professional Conduct, is best defined as a person in a position to potentially influence attest decisions or the cutcome of an attest engagement take on or influence a third-party position perform tax services that is both independent in fact and appearance potentially influence decisions or outcomes in non-audit services Although codes of ethics may be designed in part to encourage ideal behavior. they must also be Idealistic and above the law easy to remember and basic practical and enforceable belanced and confidential