Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marsh Motors has to choose between Machine 1 and Machine 2 . Machine 1 costs $180,000, has a 3-year life and EBIT of $108,750 per

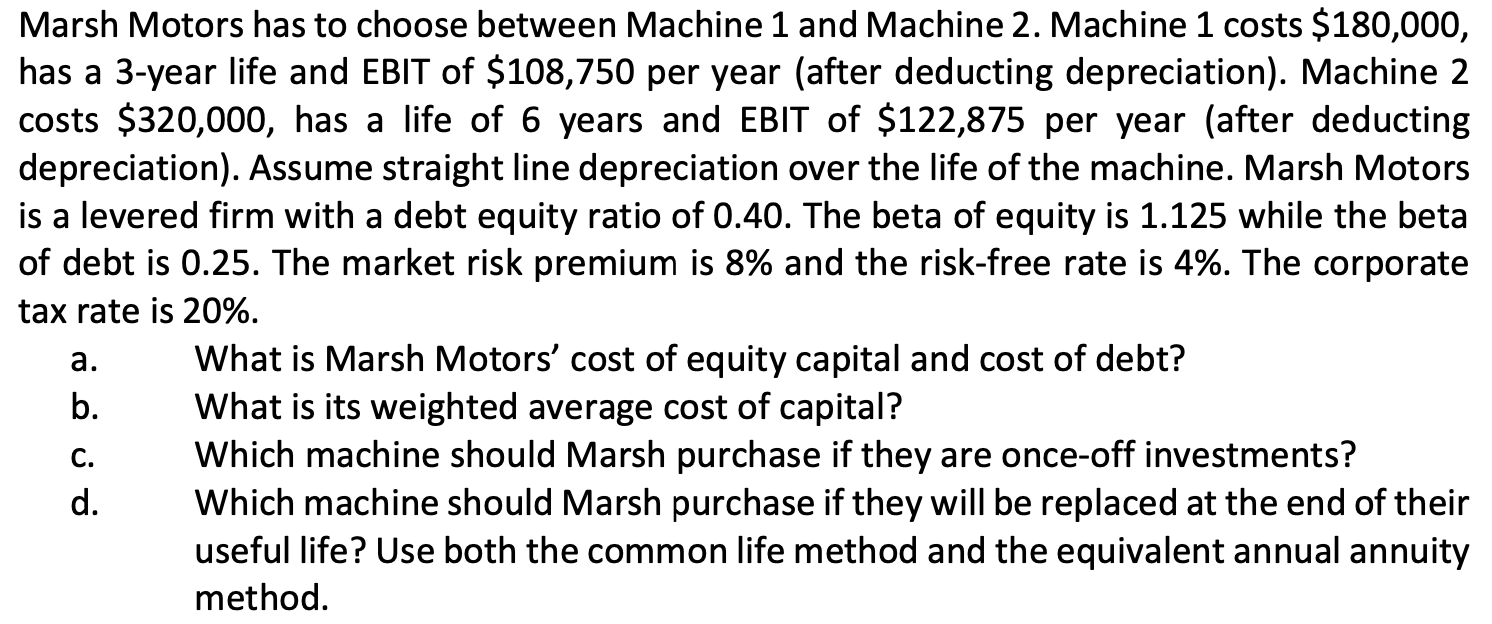

Marsh Motors has to choose between Machine 1 and Machine 2 . Machine 1 costs $180,000, has a 3-year life and EBIT of $108,750 per year (after deducting depreciation). Machine 2 costs $320,000, has a life of 6 years and EBIT of $122,875 per year (after deducting depreciation). Assume straight line depreciation over the life of the machine. Marsh Motors is a levered firm with a debt equity ratio of 0.40 . The beta of equity is 1.125 while the beta of debt is 0.25 . The market risk premium is 8% and the risk-free rate is 4%. The corporate tax rate is 20%. a. What is Marsh Motors' cost of equity capital and cost of debt? b. What is its weighted average cost of capital? c. Which machine should Marsh purchase if they are once-off investments? d. Which machine should Marsh purchase if they will be replaced at the end of their useful life? Use both the common life method and the equivalent annual annuity method. Marsh Motors has to choose between Machine 1 and Machine 2 . Machine 1 costs $180,000, has a 3-year life and EBIT of $108,750 per year (after deducting depreciation). Machine 2 costs $320,000, has a life of 6 years and EBIT of $122,875 per year (after deducting depreciation). Assume straight line depreciation over the life of the machine. Marsh Motors is a levered firm with a debt equity ratio of 0.40 . The beta of equity is 1.125 while the beta of debt is 0.25 . The market risk premium is 8% and the risk-free rate is 4%. The corporate tax rate is 20%. a. What is Marsh Motors' cost of equity capital and cost of debt? b. What is its weighted average cost of capital? c. Which machine should Marsh purchase if they are once-off investments? d. Which machine should Marsh purchase if they will be replaced at the end of their useful life? Use both the common life method and the equivalent annual annuity method

Marsh Motors has to choose between Machine 1 and Machine 2 . Machine 1 costs $180,000, has a 3-year life and EBIT of $108,750 per year (after deducting depreciation). Machine 2 costs $320,000, has a life of 6 years and EBIT of $122,875 per year (after deducting depreciation). Assume straight line depreciation over the life of the machine. Marsh Motors is a levered firm with a debt equity ratio of 0.40 . The beta of equity is 1.125 while the beta of debt is 0.25 . The market risk premium is 8% and the risk-free rate is 4%. The corporate tax rate is 20%. a. What is Marsh Motors' cost of equity capital and cost of debt? b. What is its weighted average cost of capital? c. Which machine should Marsh purchase if they are once-off investments? d. Which machine should Marsh purchase if they will be replaced at the end of their useful life? Use both the common life method and the equivalent annual annuity method. Marsh Motors has to choose between Machine 1 and Machine 2 . Machine 1 costs $180,000, has a 3-year life and EBIT of $108,750 per year (after deducting depreciation). Machine 2 costs $320,000, has a life of 6 years and EBIT of $122,875 per year (after deducting depreciation). Assume straight line depreciation over the life of the machine. Marsh Motors is a levered firm with a debt equity ratio of 0.40 . The beta of equity is 1.125 while the beta of debt is 0.25 . The market risk premium is 8% and the risk-free rate is 4%. The corporate tax rate is 20%. a. What is Marsh Motors' cost of equity capital and cost of debt? b. What is its weighted average cost of capital? c. Which machine should Marsh purchase if they are once-off investments? d. Which machine should Marsh purchase if they will be replaced at the end of their useful life? Use both the common life method and the equivalent annual annuity method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started