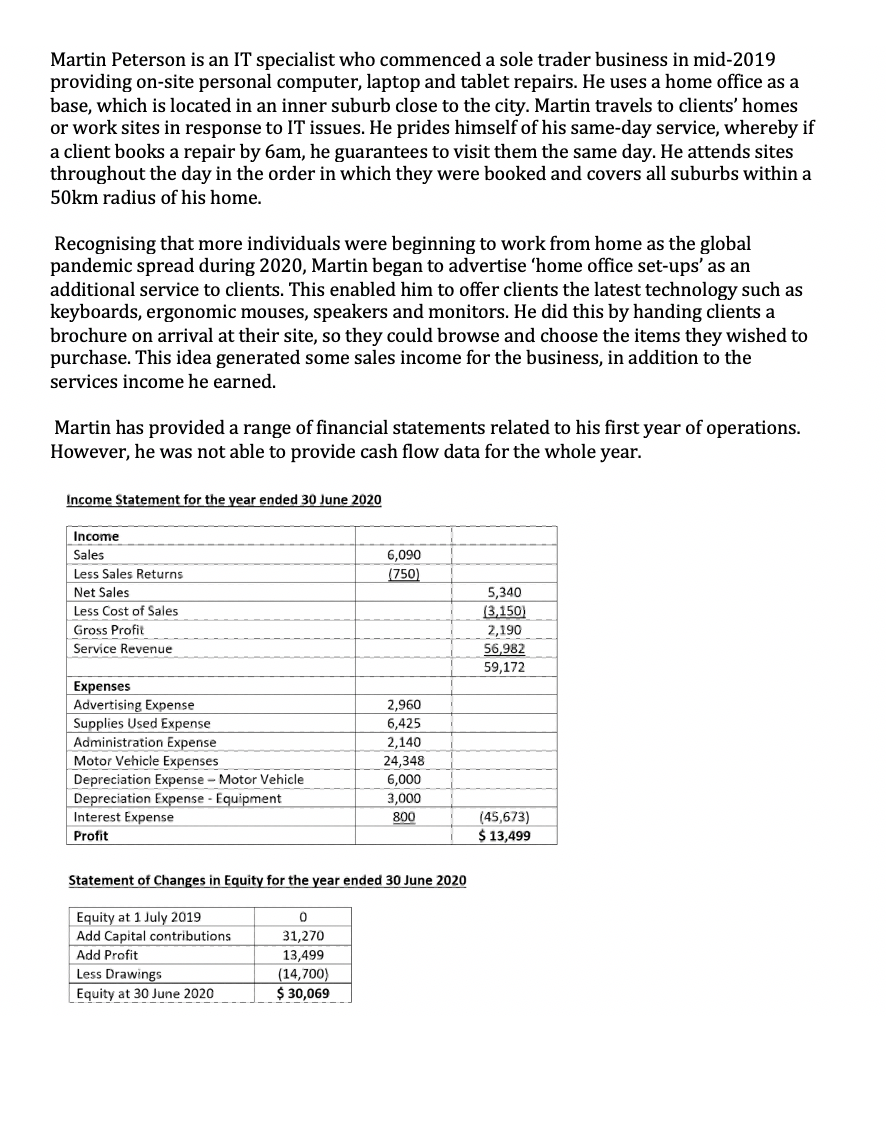

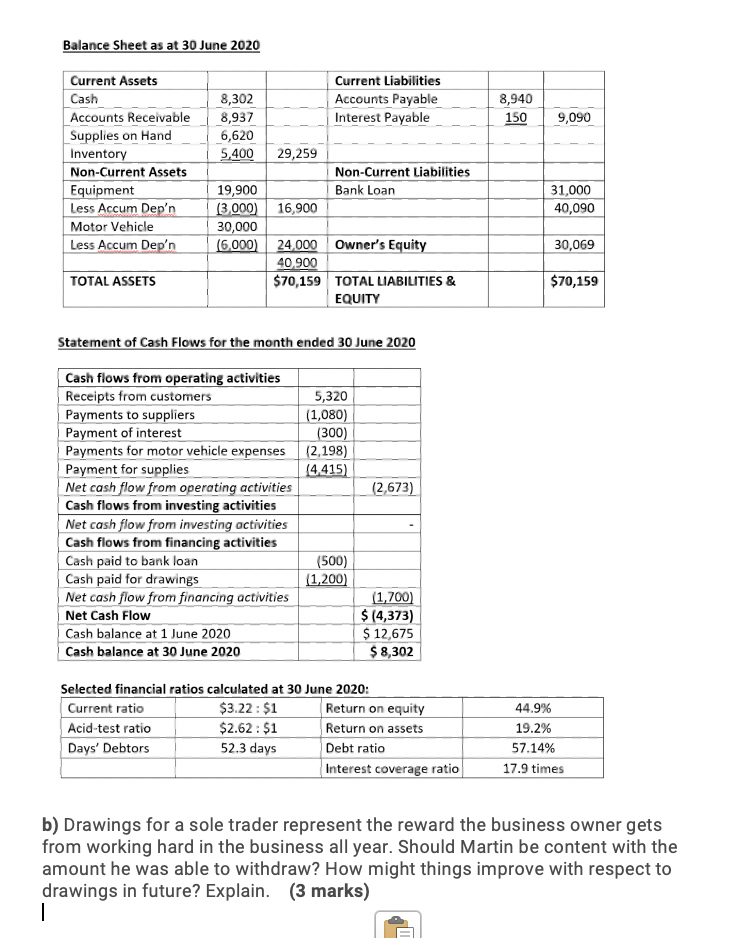

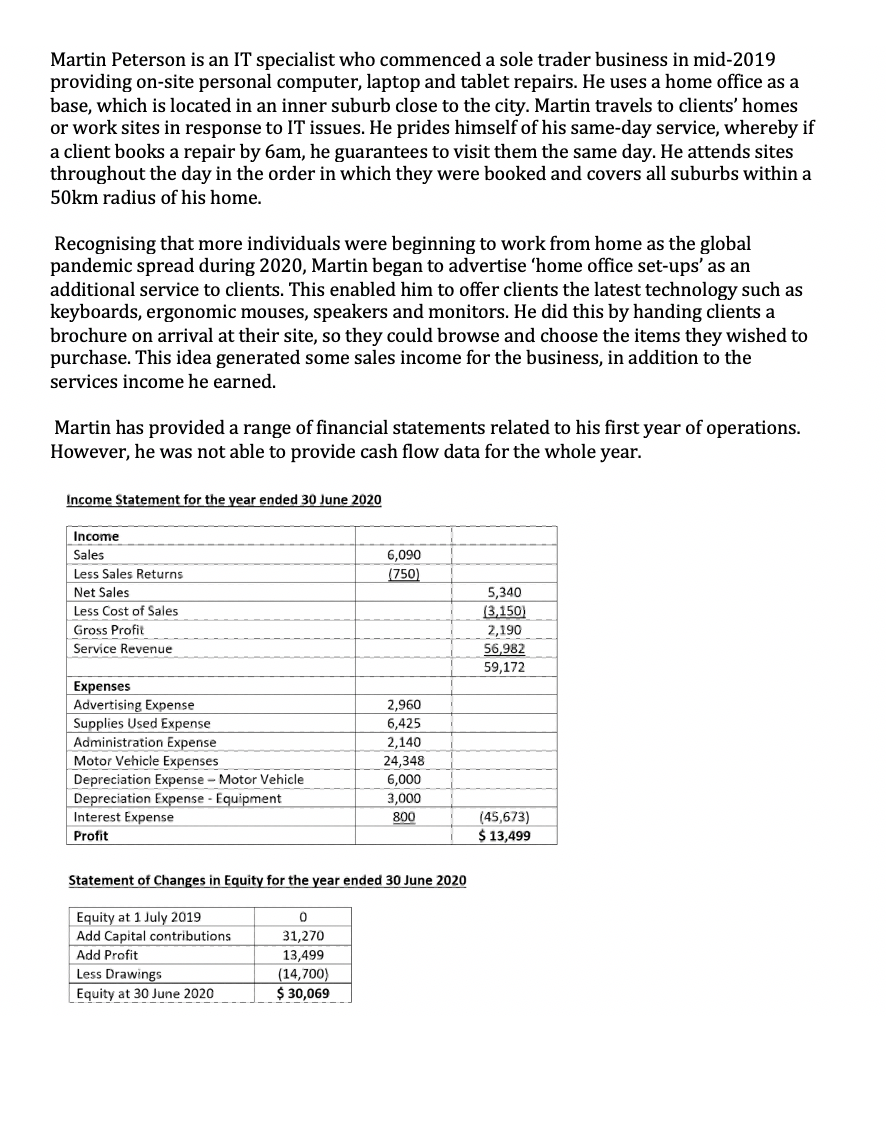

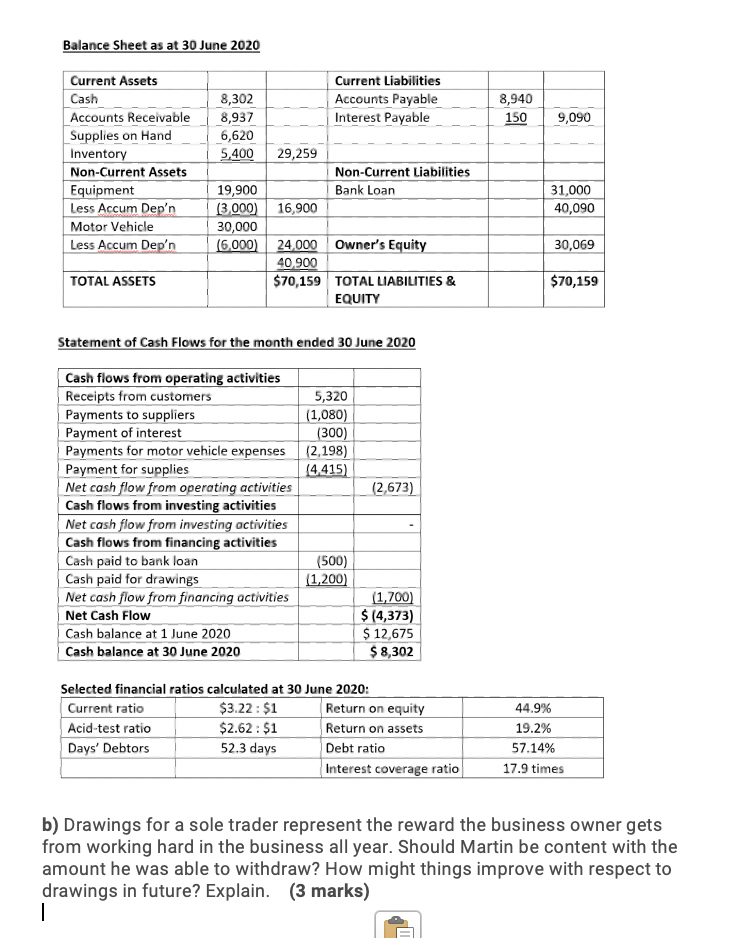

Martin Peterson is an IT specialist who commenced a sole trader business in mid-2019 providing on-site personal computer, laptop and tablet repairs. He uses a home office as a base, which is located in an inner suburb close to the city. Martin travels to clients' homes or work sites in response to IT issues. He prides himself of his same-day service, whereby if a client books a repair by 6am, he guarantees to visit them the same day. He attends sites throughout the day in the order in which they were booked and covers all suburbs within a 50km radius of his home. Recognising that more individuals were beginning to work from home as the global pandemic spread during 2020, Martin began to advertise 'home office set-ups' as an additional service to clients. This enabled him to offer clients the latest technology such as keyboards, ergonomic mouses, speakers and monitors. He did this by handing clients a brochure on arrival at their site, so they could browse and choose the items they wished to purchase. This idea generated some sales income for the business, in addition to the services income he earned. Martin has provided a range of financial statements related to his first year of operations. However, he was not able to provide cash flow data for the whole year. Income Statement for the year ended 30 June 2020 Income Sales 6,090 (750) Less Sales Returns Net Sales Less Cost of Sales Gross Profit 5,340 (3,150 2,190 56,982 59,172 Service Revenue Expenses Advertising Expense Supplies Used Expense Administration Expense Motor Vehicle Expenses Depreciation Expense - Motor Vehicle Depreciation Expense - Equipment Interest Expense Profit 2,960 6,425 2,140 24,348 6,000 3,000 800 (45,673) $ 13,499 Statement of Changes in Equity for the year ended 30 June 2020 0 Equity at 1 July 2019 Add Capital contributions Add Profit Less Drawings Equity at 30 June 2020 31,270 13,499 (14,700) $ 30,069 Balance Sheet as at 30 June 2020 8,940 150 9,090 Current Assets Cash Accounts Receivable Supplies on Hand Inventory Non-Current Assets Equipment Less Accum Dep'n Motor Vehicle Less Accum Dep'n Current Liabilities 8,302 Accounts Payable 8,937 Interest Payable 6,620 5,400 29,259 Non-Current Liabilities 19,900 Bank Loan (3.000) 16,900 30,000 (6,000) 24.000 Owner's Equity 40.900 $70,159 TOTAL LIABILITIES & EQUITY 31,000 40,090 30,069 TOTAL ASSETS $70,159 Statement of Cash Flows for the month ended 30 June 2020 5,320 (1,080) (300) (2,198) 14.415) (2,673) Cash flows from operating activities Receipts from customers Payments to suppliers Payment of interest Payments for motor vehicle expenses Payment for supplies Net cash flow from operating activities Cash flows from investing activities Net cash flow from investing activities Cash flows from financing activities Cash paid to bank loan Cash paid for drawings Net cash flow from financing activities Net Cash Flow Cash balance at 1 June 2020 Cash balance at 30 June 2020 (500) (1,200) (1,700) $ (4,373) $ 12,675 $ 8,302 44.9% Selected financial ratios calculated at 30 June 2020: Current ratio $3.22: $1 Return on equity Acid-test ratio $2.62: $1 Return on assets Days' Debtors 52.3 days Debt ratio Interest coverage ratio 19.2% 57.14% 17.9 times b) Drawings for a sole trader represent the reward the business owner gets from working hard in the business all year. Should Martin be content with the amount he was able to withdraw? How might things improve with respect to drawings in future? Explain. (3 marks) | Martin Peterson is an IT specialist who commenced a sole trader business in mid-2019 providing on-site personal computer, laptop and tablet repairs. He uses a home office as a base, which is located in an inner suburb close to the city. Martin travels to clients' homes or work sites in response to IT issues. He prides himself of his same-day service, whereby if a client books a repair by 6am, he guarantees to visit them the same day. He attends sites throughout the day in the order in which they were booked and covers all suburbs within a 50km radius of his home. Recognising that more individuals were beginning to work from home as the global pandemic spread during 2020, Martin began to advertise 'home office set-ups' as an additional service to clients. This enabled him to offer clients the latest technology such as keyboards, ergonomic mouses, speakers and monitors. He did this by handing clients a brochure on arrival at their site, so they could browse and choose the items they wished to purchase. This idea generated some sales income for the business, in addition to the services income he earned. Martin has provided a range of financial statements related to his first year of operations. However, he was not able to provide cash flow data for the whole year. Income Statement for the year ended 30 June 2020 Income Sales 6,090 (750) Less Sales Returns Net Sales Less Cost of Sales Gross Profit 5,340 (3,150 2,190 56,982 59,172 Service Revenue Expenses Advertising Expense Supplies Used Expense Administration Expense Motor Vehicle Expenses Depreciation Expense - Motor Vehicle Depreciation Expense - Equipment Interest Expense Profit 2,960 6,425 2,140 24,348 6,000 3,000 800 (45,673) $ 13,499 Statement of Changes in Equity for the year ended 30 June 2020 0 Equity at 1 July 2019 Add Capital contributions Add Profit Less Drawings Equity at 30 June 2020 31,270 13,499 (14,700) $ 30,069 Balance Sheet as at 30 June 2020 8,940 150 9,090 Current Assets Cash Accounts Receivable Supplies on Hand Inventory Non-Current Assets Equipment Less Accum Dep'n Motor Vehicle Less Accum Dep'n Current Liabilities 8,302 Accounts Payable 8,937 Interest Payable 6,620 5,400 29,259 Non-Current Liabilities 19,900 Bank Loan (3.000) 16,900 30,000 (6,000) 24.000 Owner's Equity 40.900 $70,159 TOTAL LIABILITIES & EQUITY 31,000 40,090 30,069 TOTAL ASSETS $70,159 Statement of Cash Flows for the month ended 30 June 2020 5,320 (1,080) (300) (2,198) 14.415) (2,673) Cash flows from operating activities Receipts from customers Payments to suppliers Payment of interest Payments for motor vehicle expenses Payment for supplies Net cash flow from operating activities Cash flows from investing activities Net cash flow from investing activities Cash flows from financing activities Cash paid to bank loan Cash paid for drawings Net cash flow from financing activities Net Cash Flow Cash balance at 1 June 2020 Cash balance at 30 June 2020 (500) (1,200) (1,700) $ (4,373) $ 12,675 $ 8,302 44.9% Selected financial ratios calculated at 30 June 2020: Current ratio $3.22: $1 Return on equity Acid-test ratio $2.62: $1 Return on assets Days' Debtors 52.3 days Debt ratio Interest coverage ratio 19.2% 57.14% 17.9 times b) Drawings for a sole trader represent the reward the business owner gets from working hard in the business all year. Should Martin be content with the amount he was able to withdraw? How might things improve with respect to drawings in future? Explain. (3 marks) |