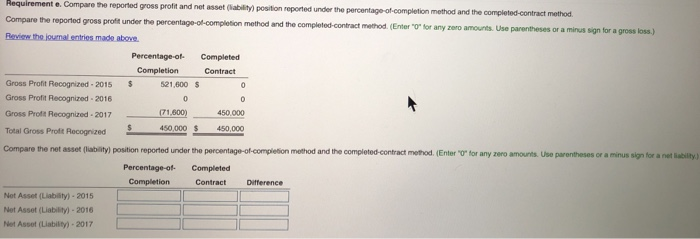

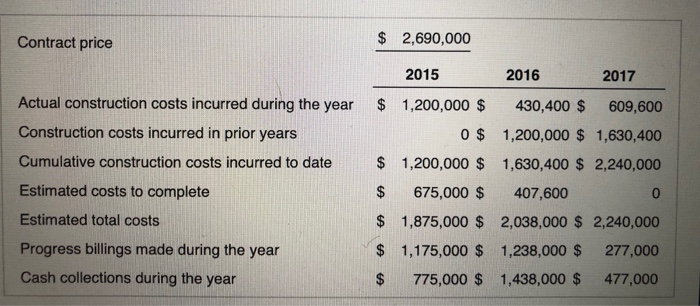

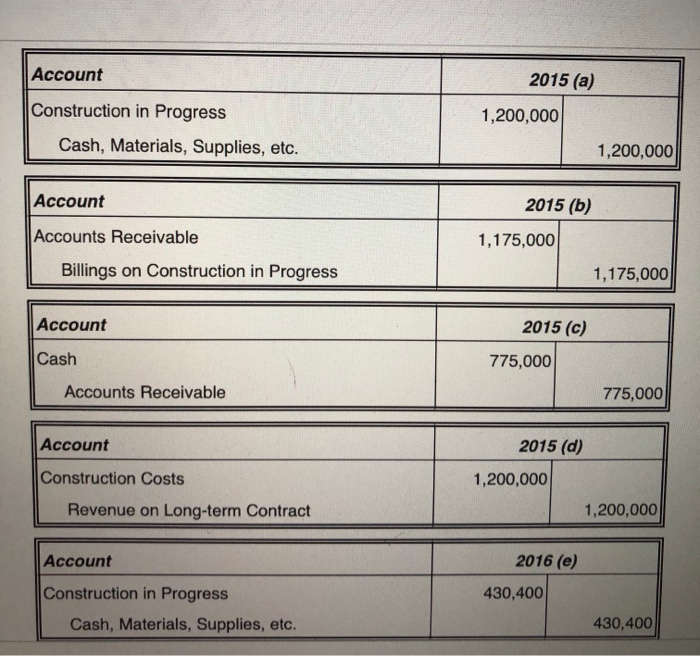

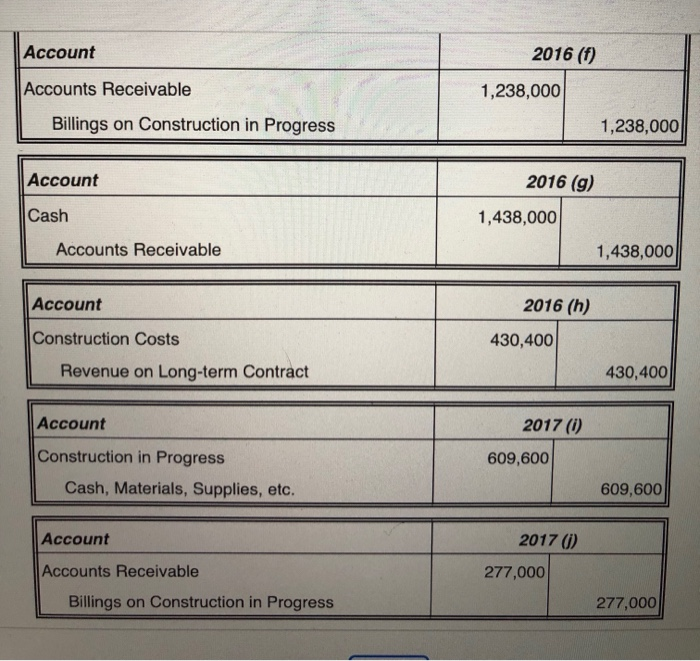

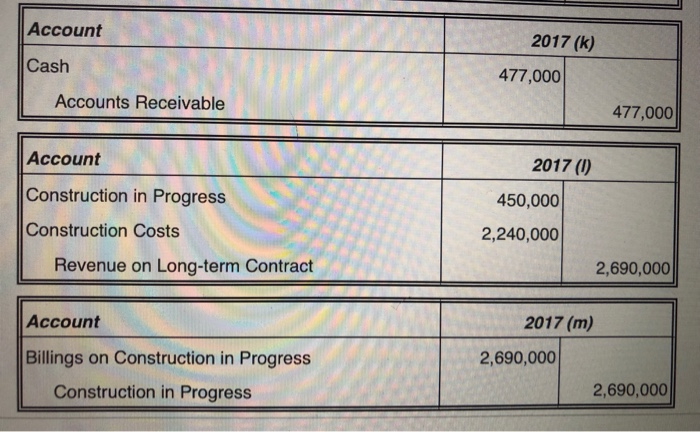

Requirement e. Compare the reported gross profit and net asset (iablity) position r reported under the percentage of-completion method and the completed-contract method t completed-contract method.(Enter "O for any zero amounts. Use parentheses or a minus sign for a gross loss.) Compare the reported gross profit under the percentage-of-completion method and the Percentage-of Completed Completion Contract Gross Profit Recognized-2015 21,600 Gross Profit Recognized 2016 Gross Profit Recognized-2017 71,600) Total Gross Prott Recognized Compare the net asset (liability) position reported under the percentage-of-compietion method and the completed-contract method. (Enter "0r for any zero amounts. Use parentheses or a minus sign for a net 450,000 450,000 450,000 liability ) Percentage-of. Completed Completion Contract Difference Not Asset (Liabilaity)-2015 Net Asset (Liability)-2016 Net Asset (Liability)-2017 Contract price $2,690,000 2015 2016 2017 Actual construction costs incurred during the year Construction costs incurred in prior years Cumulative construction costs incurred to date Estimated costs to complete Estimated total costs Progress billings made during the year Cash collections during the year 1,200,000 $ 430,400 $ 609,600 0 $ 1,200,000 $ 1,630,400 1,200,000 $ 1,630,400 $ 2,240,000 0 $ 1,875,000 $ 2,038,000 $ 2,240,000 $ 1,175,000 $ 1,238,000 277,000 775,000 $ 1,438,000 477,000 $675,000$407,600 Account 2015 (a) Construction in Progress 1,200,000 Cash, Materials, Supplies, etc. Account Accounts Receivable 1,200,000 2015 (b) 1,175,000 Billings on Construction in Progress Account Cash 1,175,000 2015 (c) 775,000 Accounts Receivable 775,000 Account 2015 (d) Construction Costs 1,200,000 Revenue on Long-term Contract 1,200,000 Account 2016 (e) Construction in Progress 430,400 Cash, Materials, Supplies, etc 430,400 Account 2016 (t) Accounts Receivable 1,238,000 Billings on Construction in Progress 1,238,000 Account 2016 (g) Cash 1,438,000 Accounts Receivable 1,438,000 Account 2016 (h) Construction Costs 430,400 Revenue on Long-term Contract Account Construction in Progress 430,400 2017 () 609,600 Cash, Materials, Supplies, etc. 609,600 Account 2017 () Accounts Receivable 277,000 Billings on Construction in Progress 277,000 Account 2017 (k) Cash 477,000 Accounts Receivable 477,000 Account Construction in Progress Construction Costs 2017 (l) 450,000 2,240,000 Revenue on Long-term Contract 2,690,000 Account 2017 (m) Billings on Construction in Progress 2,690,000 Construction in Progress 2,690,000