Question

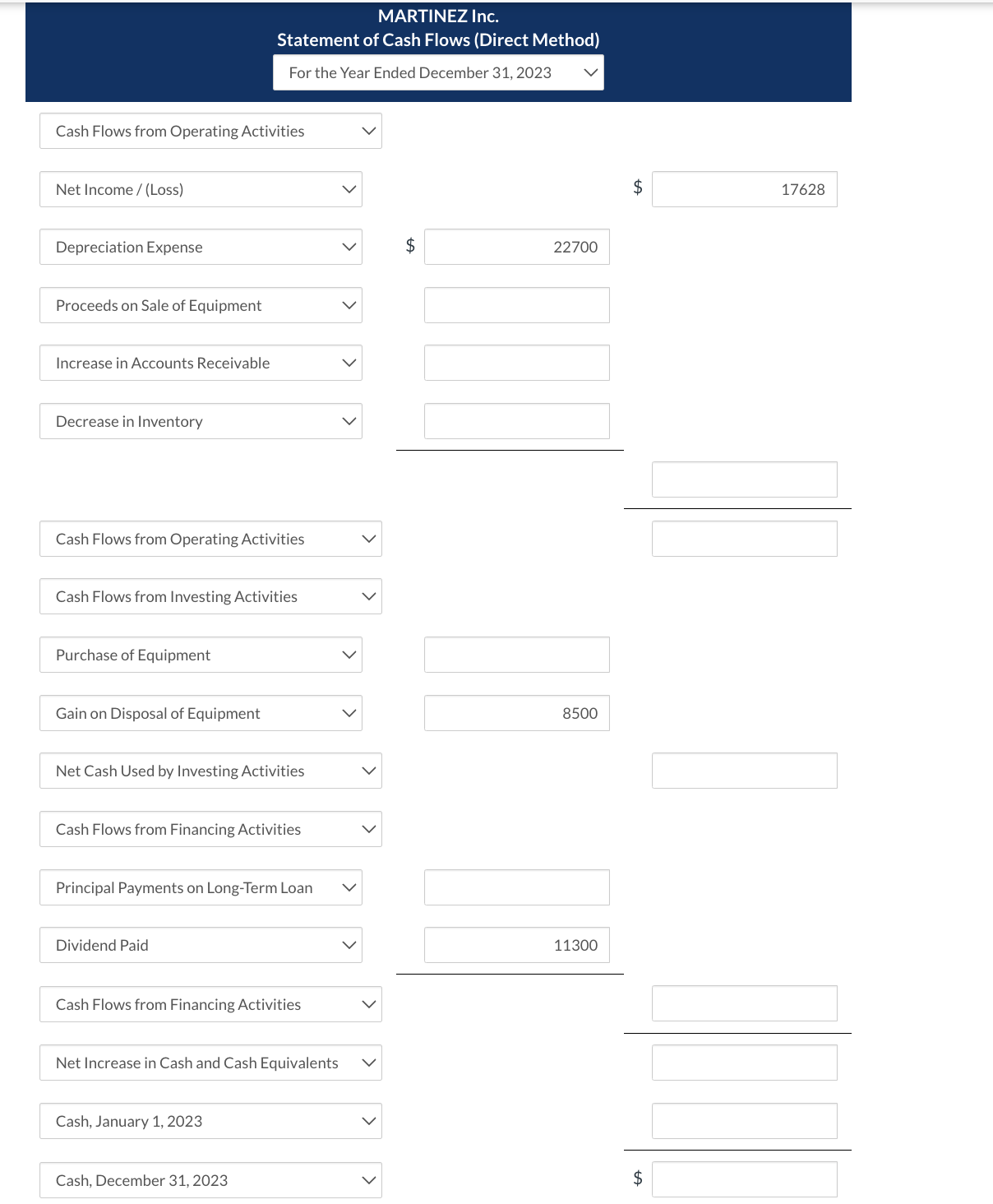

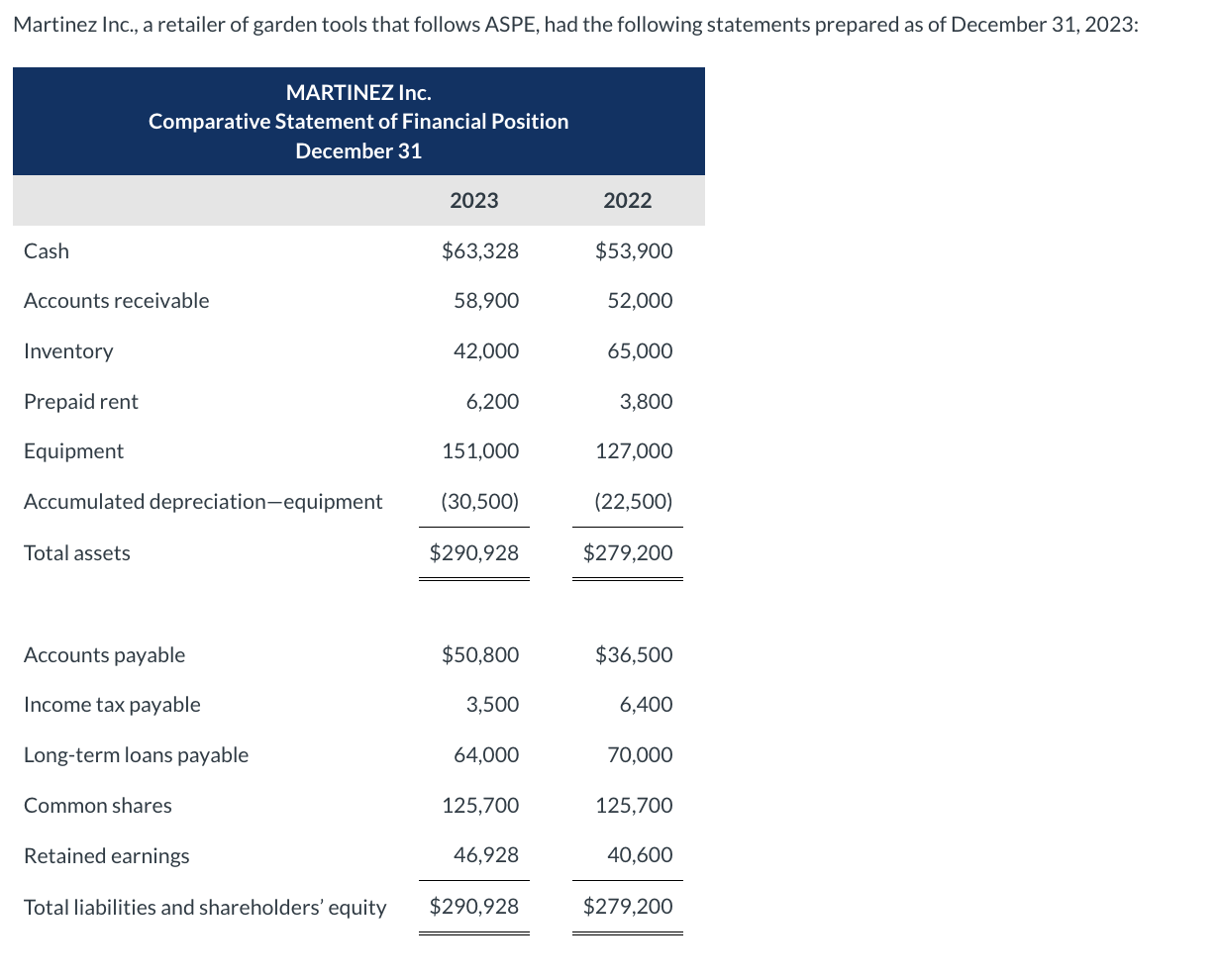

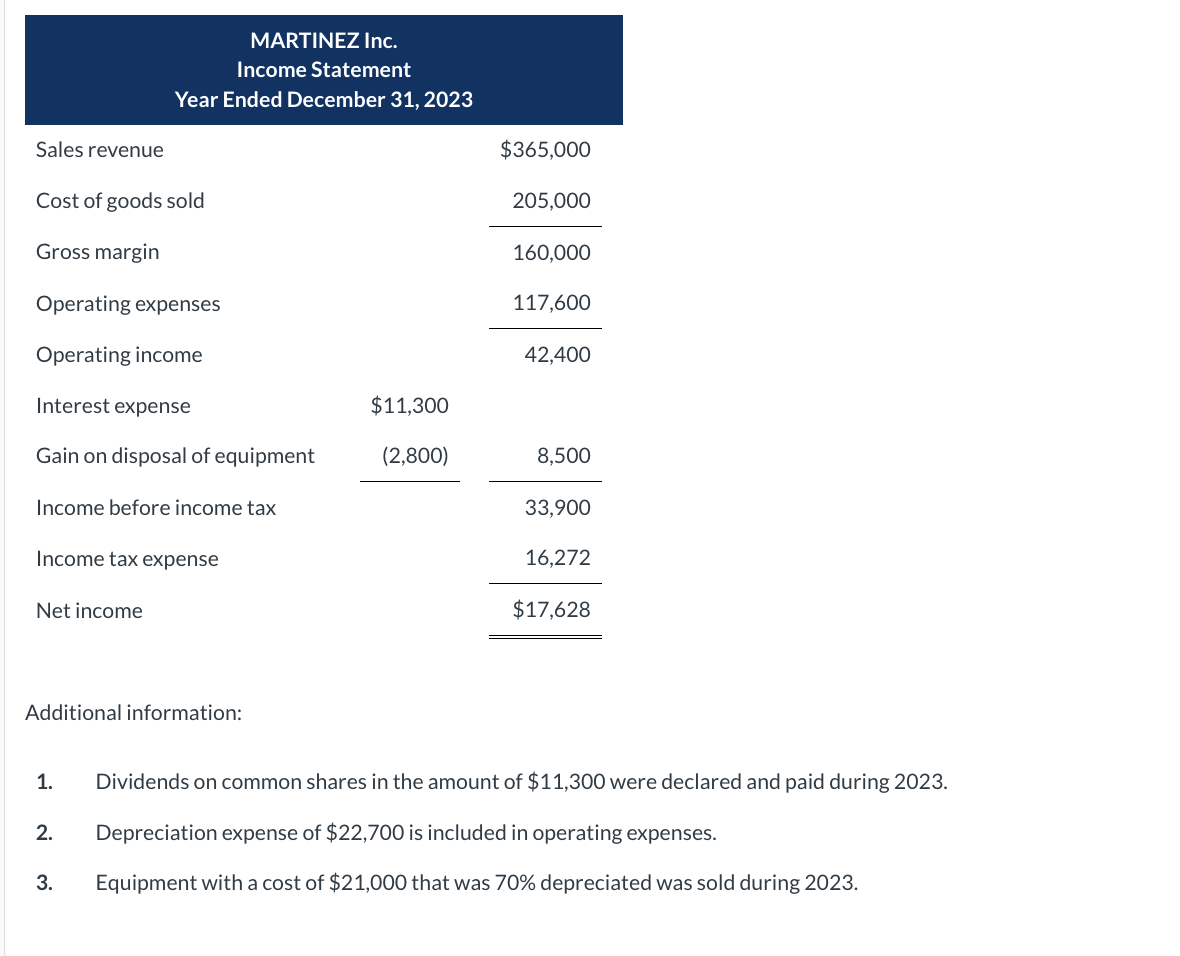

Martinez Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2023: MARTINEZ Inc. Comparative Statement of

Martinez Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2023: MARTINEZ Inc. Comparative Statement of Financial Position December 31 h 2023 Cash $63,328 Accounts receivable 58,900 Inventory 42,000 6.200 Prepaid rent 151 000 Equipment Accumulated depreciation-equipment (30.500) Total assets $290,928 $50.800 Accounts payable Income tax payable 3,500 64,000 Long-term loans payable 125.700 Common shares 2022 $53,900 52.000 65.000 3,800 127,000 (22,500) $279,200 $36,500 6,400 70.000 125,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started