Answered step by step

Verified Expert Solution

Question

1 Approved Answer

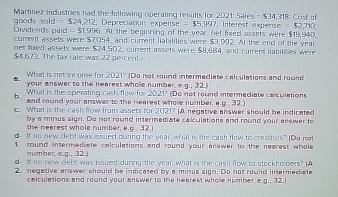

Martinez industrics had the following Operating results for 2 0 2 1 , haies - 5 3 4 , 3 4 8 , Cost of

Martinez industrics had the following Operating results for haies Cost of

goods sold $ Deprectation expense $ Interest experse $

Drvidends pald $ Al the beginnona of the year, net fixed assets were $

current assets were dnd current liabilities were At the end of the year,

net twoch assets were $ curnent assels were $ and current liabities wert

The tax Iate was percent.

o

What is net income for Do hat raund intermediate crilculations and round

your answer to the nenrest whole number, eg

b

What is the aperating cash, flow for Do not round intermediate colculstions

and raund your answer to the nearest whole number,

c What is the cash flow from assets tar A negative answer should be indicated

by a minus sign. Do not round intermediste caleulations and round your answer to

the nearest whole number, e

d If no new detil was ssued ruiring the year, what is the cash flow to crecitars? Do not

round intermediote colculations and round your answer to the nearest whole

number, eg

d If na new debl was issued during the year, what is the casit flow to stockholders? A

negative answer should be indicated by a minus sign. Do nas round intermediste

celculations and round your snswer to the neniest whole number, eI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started